Roughly eight months ago, Anheuser-Busch InBev SA/NV (BUD) found itself in a whirlwind of trouble amid backlash and boycotts surrounding its advertisement campaign. Of course, the boycott was limited mainly to Bud Light sales in North America, causing its overall revenue to decline by only around 3%, generally in line with normal seasonal patterns. Since then, its sales have popped up to all-time highs, indicating the fiasco had no clear negative impact on the company, primarily due to its vast size in both brands and global span.

That said, the backlash likely had an impact on its valuation. The stock lost nearly 20% of its value from April to June of this year but has since recovered most of those losses because its fundamentals did not change materially. To me, this is a potential lesson for investors as it is not always wise to make bets based on personal biases if the aim is to earn a profit; some bias rationality is paramount.

That said, I believe the more significant issue remains the company’s reasoning behind the advertising campaign, a desperate effort to expand its market share amongst younger adults. In recent years, there has been a growing skew toward lower alcohol consumption in the youngest generation, both in the US and in most other high-income countries. While Millenials drink the most, Generation Z (excluding those not of age) drinks the least, even less than Baby Boomers; an astonishing figure given this demographic is generally around college-age through 28 years. Unfortunately for Anheuser-Busch, it is not in the cannabis industry, which is trending to replace alcohol usage for many younger people.

In my view, the advertising campaign woes have much to do with the company’s long-term struggle to cater to a changing market and demographic environment. While some may see that it is “alienating” its core demographic, the fact is that its long-term performance requires it to cater to the most significant economic groups as opposed to niches. There is much online debate, but it is an economic fact, given the company’s vast size and scope.

Fundamentally, while Anheuser-Busch is keen on acquiring craft beer and spirit brands more popular amongst younger people, the company is likely unable to spur a renaissance in alcohol consumption amid the rise of more sober generations, with a significant reason being higher perceived negative health impacts. Notably, this generation comes amid a 3X increase in total deaths from alcoholic cirrhosis over the past two decades (much of Gen Z’s lifespan), with that figure rising to 7X amongst younger people. In my opinion, as many young people may know someone who has faced this, the allure of alcohol is notably lower – although that is my personal, subjective view.

I covered the company last with a bearish outlook in 2021 in “Anheuser-Busch: Risk Profile Worsening Due To Competitive Pressures.” Since then, BUD has lost around 14% of its value, with that article being published around the peak of its current trading channel. Despite tremendous social turbulence surrounding the company, its overall change since its 2020 lows is minimal. As such, I believe it is an excellent time to look at its financials to see how these long-term demographic issues may impact its fair value today.

A Closer Look at Anheuser’s Financial Trends

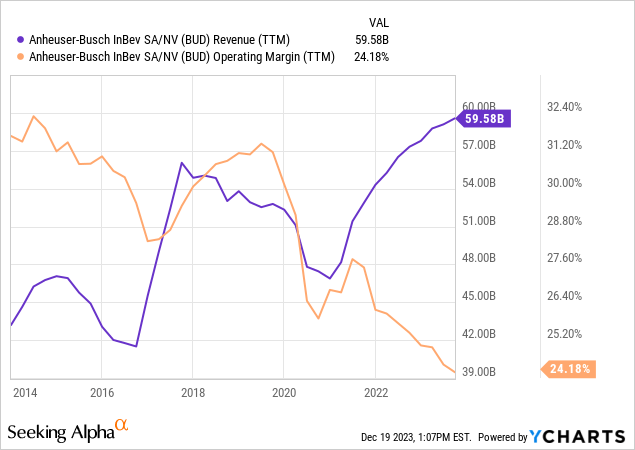

The most alarming trend facing Busch is not the tiny temporary decline in sales it had earlier this year but the long-term decline in its operating margins. Over the past decade, the company has seen a consistent decrease in operating margins. Each year, the figure has declined by about 70 bps with relative consistency, indicating the company is struggling to keep up with the competition and maintain its market power. That said, it has expanded sales over this period. See below:

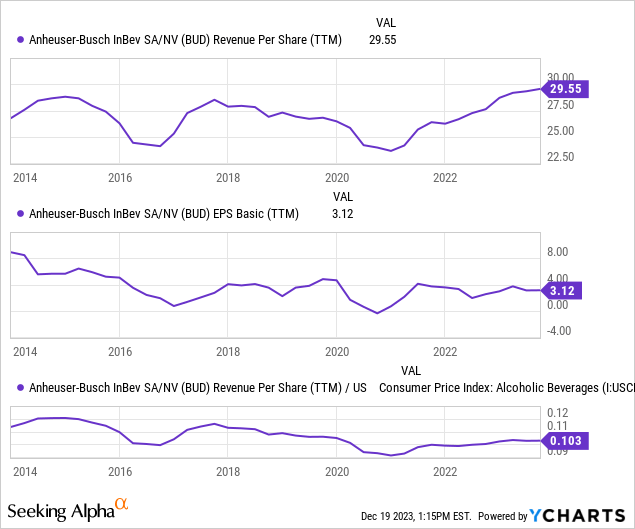

These figures are a bit more telling per share as the company’s sales have benefited from dilutive acquisitions over the past decade. If we account for the change in its total shares outstanding, we can see its revenue per share is roughly stagnant over time. Indeed, if we account for the moderate rise in alcohol prices in recent years, we can see that its inflation-adjusted sales per share has been trending down over time. See below:

Over the past decade, the company’s alcohol inflation-adjusted sales per share has slipped by around 17%. That is not particularly alarming, but it points toward a long-term negative trend facing the company as it struggles to maintain a competitive edge in a slowing market.

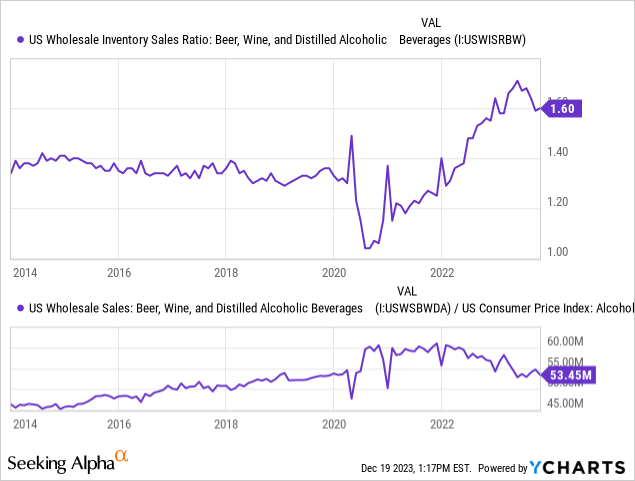

Interestingly, there are also negative broader headwinds in the US alcohol market. Since the “COVID drinking boom” of late 2020 through 2022, alcohol sales have declined moderately when compared to alcohol prices. At the same time, we’ve seen a significant buildup of alcohol inventories compared to sales, pointing toward impending price reductions. See below:

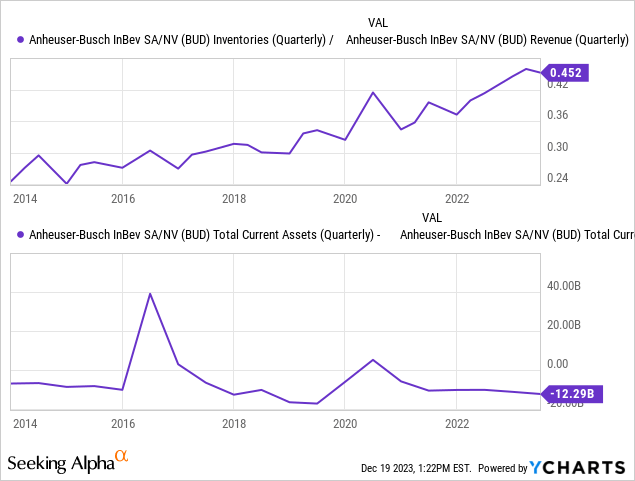

As alcohol prices rise, many Americans are drinking less. Of course, total real wholesale alcohol sales in the US are about where they were before COVID, so it may be that people are not consuming so much as aspects of their lives normalize. Even then, we see a vast inventory buildup, often leading to price reductions and discounts as sellers look to offload inventories. Anheuser-Busch is no exception to that trend, as it also faces chronically negative working capital. See below:

The company has had a relatively significant and prolonged increase in its inventory ratio, pointing toward potential overproduction, with a steeper rise since 2020. At the same time, the company has $12.3B more in current liabilities than current assets, with that deficit rising to ~$26B if we exclude inventories. Given the company is enormous and can quickly achieve external financing, this does not point toward a liquidity or solvency issue. That said, the company does have $76B in total financial debt ($127B in total liabilities) and just ~$56B in tangible assets (~$89B adding back depreciation). Accordingly, I believe the firm is at risk of financial issues if it continues to face deteriorating income levels and profit margins.

There are other issues facing Anheuser-Busch. On Monday, its Teamsters union overwhelmingly voted to authorize a strike if the company fails to agree to contract terms. This union represents 5K employees, of which the company has around 167K, so it is mainly limited to its 12 US breweries. That said, this issue points toward the trend of employees gaining superior market power, which generally results in lowering profit margins in the long term as wages rise disproportionately to sales.

Overall, I do not believe we should expect the firm to see improved sales or profits in 2024. The analyst consensus looks toward $3 in EPS this year, rising to $3.57 in 2024 with a 5% sales growth outlook. That is not very likely to me, given its inventory buildup and that of the US market at large. On top of that, many people in higher-income countries (and particularly the US) are facing growing consumer strains due to cost pressures, resulting in lower free spending capacity, which is likely lowering demand for alcohol, given it is becoming more expensive.

The Bottom Line

Since Anheuser-Busch is such a large and old company, it is best to consider it in light of long-term trends and potential. To that extent, I think two factors which point toward a long-term decline in total demand for alcohol. For one, the portion of people with fatty liver disease is very high today at around 39%, up over 43% since 1990. This figure is relatively high for all demographics around middle age and above, and while not necessarily alcohol-related, it could discourage consumption levels over the long run. Secondarily, younger demographics are far less interested in alcohol than what was typical in decades prior. Both factors are global phenomena seen in nearly all major developed countries.

While this opinion is speculative, I believe that alcohol companies today may be akin to tobacco companies in 1990. The culture eventually shifted as people became more aware of related issues, making cigarette consumption less regular. This issue may seem far off to many investors with a short-term horizon, but the fact that BUD has not gone anywhere in over a decade and has seen its EPS and inflation-adjusted sales decline points to its significance, particularly if the trend away from alcohol continues to accelerate with demographic changes.

Of course, the firm’s short-term horizon is not great either. The company’s inventory ratio is high today and that of the US market at large, as total inflation-adjusted sales decline. This may be due to the demographic issue and a decline in consumer economic power that directly discourages consumption. Assuming these issues will remain in 2024, I expect BUD to face even lower EPS. Indeed, its marketing issues this year may also be a negative factor as some may have permanently shifted toward other brands, though the data around that point is unclear.

Personally, due to these numerous issues, I believe BUD should be valued more similarly to tobacco companies like Altria Group, Inc. (MO) and British American Tobacco p.l.c. (BTI), which trade at forward “P/E” ratios of 8.5X and 6.4X, respectively. Assuming the consensus 2024 EPS of $3.57 proves accurate, that would value BUD at ~$28.50 per share at an 8X “P/E.” Altria and BUD have very similar leverage levels, so a similar valuation would be found if I used “EV/EBITDA” instead.

I am bearish on BUD and believe it will decline in value in 2024. That said, I would not short-sell the stock today because my thesis is partially based on the widespread understanding of the issues facing large alcohol companies. Today, I expect very few investors would agree with my sentiment that alcohol consumption is headed into long-term decline. Further, I expect this trend to continue to weigh on the most prominent companies as they’re less nimble in adapting to consumer preference changes due to larger capital investments. Still, once investors begin to expect BUD to continue to lose sales and EPS per share (compared to inflation), I believe “P/E” will decline dramatically as its long-term cash-flow expectations are dramatically downshifted.

Read the full article here