Investment Rundown

Back in July, I covered Fortive Corporation (NYSE:FTV) and the stock price has been quite volatile during that time, but is not far off from when I initiated coverage of the company. I figured that since we have gotten some more earnings reports from the company during this period it would be worthwhile to do an updated view on FTV. I am happy to say that I am staying with my previous rating, which is a buy. The company released strong third-quarter results on October 26 and reaffirmed the guidance for the year.

FTV is a large company that doesn’t get too much consistent coverage here on Seeking Alpha, a bit of a shame I think as it’s a very solid business that is growing its earnings at a good rate. The revenue profile of FTV is quite diversified and growth has come a lot from successful acquisitions in the last decade. Most recently FTV announced the acquisition of German company EA Elektro-Automatik with a deal valued at $1.2 billion. The margins are still growing despite there being higher interest rates than a year ago, which I think goes to show some of the resilience that FTV has as a business. I was a buyer at the $74 range per share and with the price falling slightly from that I continue to be a buyer and bullish on FTV. It trades below its historical p/e by around 5% providing some margin of safety I think. Concluding this I am reiterating my buy for FTV.

Company Segments

FTV is a global entity specializing in the design, development, manufacturing, marketing, and servicing of professional and engineered products, software, and services. Operating on a worldwide scale, the Intelligent Operating Solutions segment of FTV is a key driver of its offerings. This segment delivers cutting-edge instrumentation, software, and services, encompassing electrical test and measurement, facility and asset lifecycle software applications, as well as worker safety and compliance solutions.

Company Strategy (Investor Presentation)

With a diverse portfolio catering to manufacturing, process industries, healthcare, utilities and power, communications and electronics, and other sectors, FTV stands as a comprehensive provider of intelligent solutions. One of the rapidly growing markets that FTV works in is the grid and energy storage one, which is expanding quickly in terms of capacity. Energy storage is a particularly interesting market as it could be very lucrative for companies seeing as generating as much energy as possible in the coming decades is a priority and then being able to store that could be revolutionary for many nations. Up until 2030, it seems this market is going to grow at a very robust 8.4% annually and then be valued at over $430 billion in total.

Earnings Highlights

Since the last coverage I had on FTV, we have gotten another earnings report which was reloaded on October 25, 2023. The revenue growth for the company was 2.6% YoY which was visible across all segments of the business. I think the broad resilience that was visible was a bullish sign and something that resulted in the quick share price appreciation since the report was published.

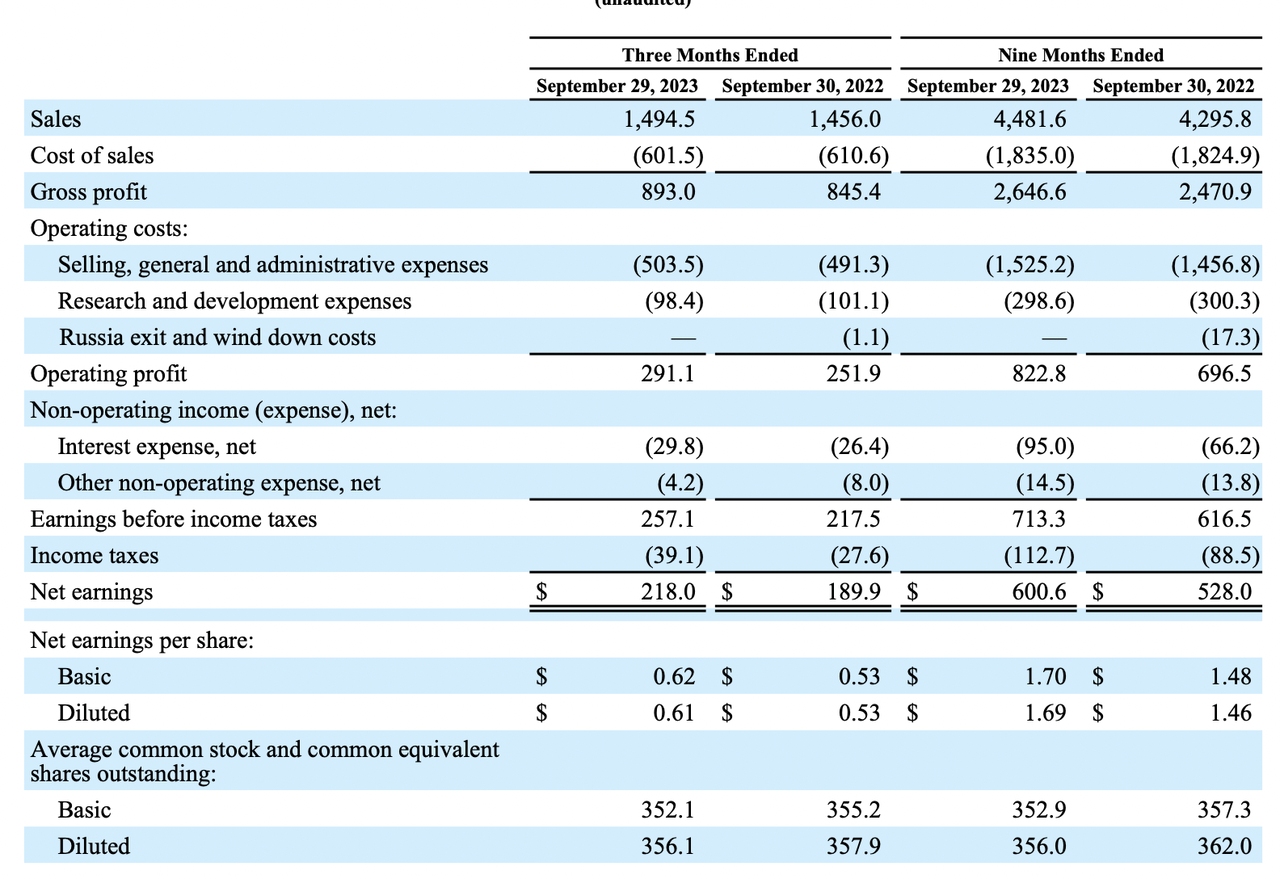

Income Statement (Earnings Report)

The company sales came in just shy of $1.5 billion and the cost of sales declined which resulted in a solid EPS YoY growth rate of 16.9%. This growth was further supported by the fact that FTV has continued to buy back shares and benefit shareholders in a good way. YoY shares outstanding decreased by 3 million as $274 million has been spent on this.

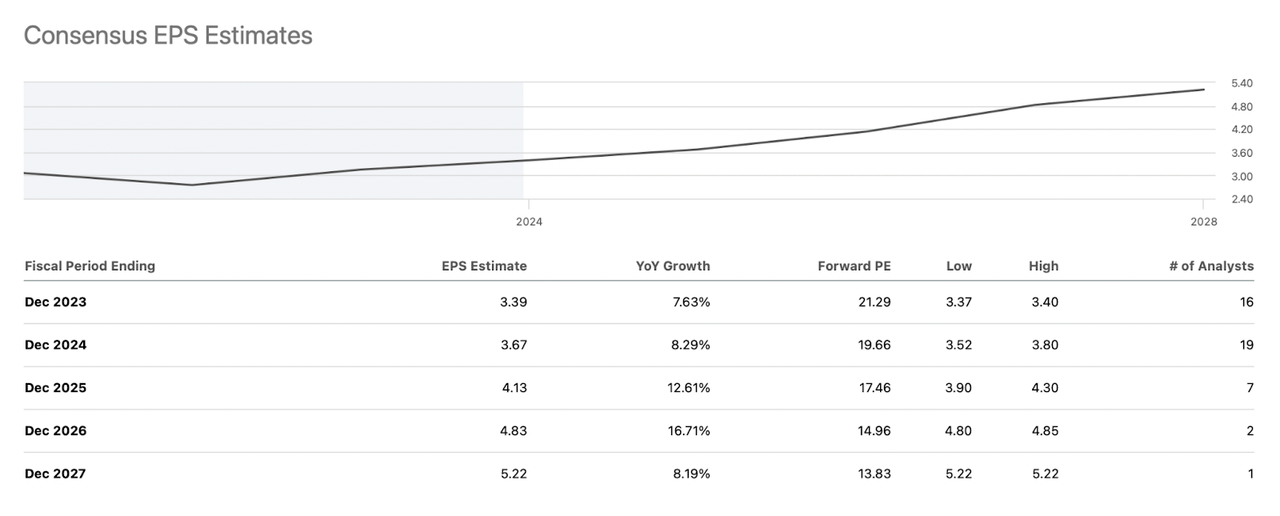

EPS Estimates (Seeking Alpha)

The future EPS estimates for the company are quite positive right now, with most anticipating a double-digit YoY growth rate until 2027. I think the first hurdle to get over will be the higher interest rates, but with them set to be decreased sometime next it seems FTV has the opportunity to continue its steady top and bottom-line growth path. What I will be looking particularly at the next few reports will be how the cost of sales expands and develops.

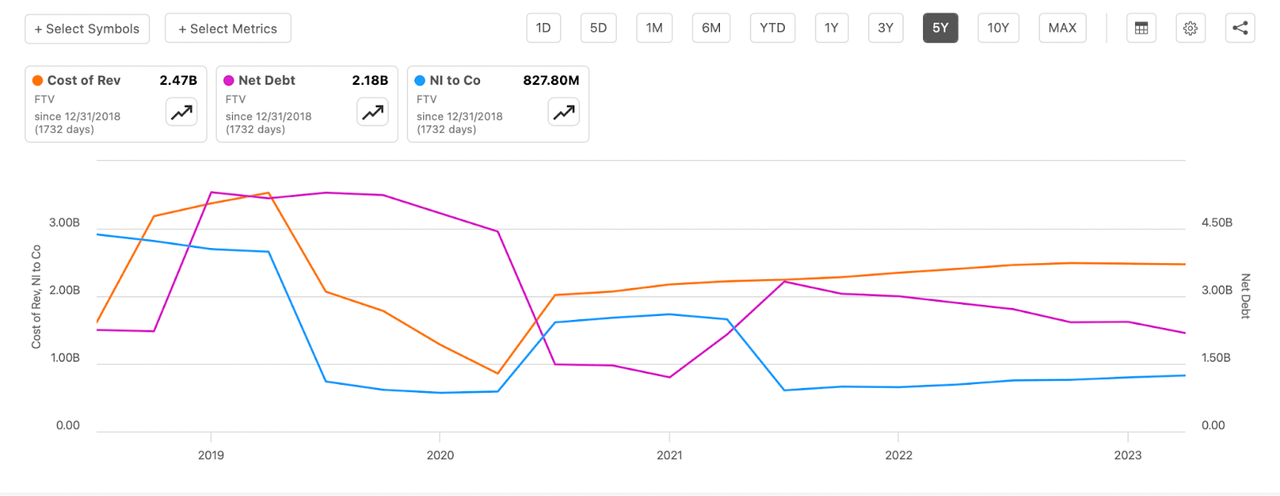

Company Numbers (Seeking Alpha)

The cost of sales has been steadily declining from its high back in 2019 which also resulted in a steady climb in the net income as well. In 2018 the company managed to achieve a record net income of nearly $3 billion, where $2.4 billion of that coming from “earnings of discontinued operations”. When we take that away from the net income we get a result around $600 million instead, which FTV has beaten in the last 12 months, as it’s over $800 million. Over that period that is a NI CAGR of 6.66%.

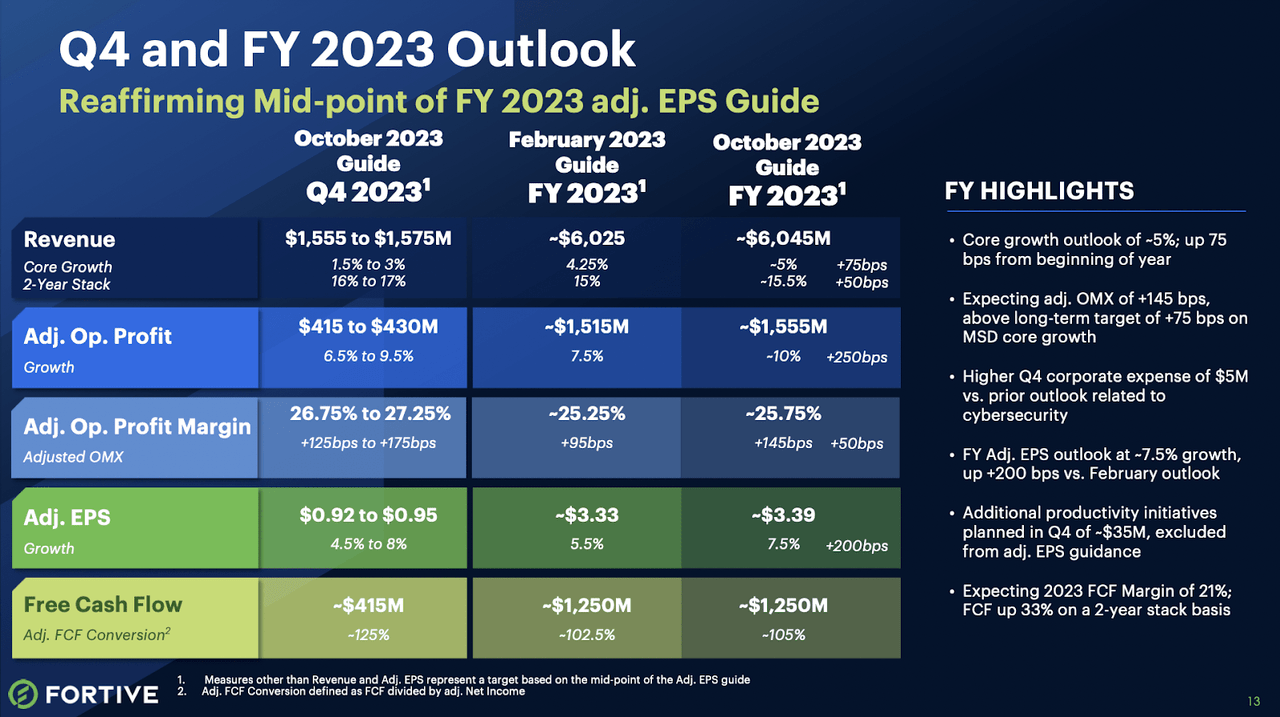

2023 Outlook (Investor Presentation)

The guidance that FTV has provided is reaffirming their mid-point adj EPS guidance right now. The company sees the adj EPS at $3.39, a 7.5% YoY growth rate. With the average 5-year p/e for FTV sitting at 22, we get a 2023 price target of $74.5. That indicates an immediate upside of 3.5% from today’s price levels. With a yield of 0.44% right now we get something closer to 4% instead. I think growth will accelerate next year and we should see a CAGR for the EPS being closer to 8% instead until 2030 I think. In 2030 if the shares outstanding remain the same get us an EPS of $5.8. A 22x multiple translates to a price target of $127, a 77% upside potential. During those 7 years, we also have dividend payouts, which would add a 3% gain should the yield remain the same. In total that is a 80% upside in 7 years, or 11% annually. I am happy to be a buyer when the outlook is so favorable and is therefore reiterating my buy here for FTV.

Risks

FTV’s performance is intricately tied to the broader state of the global economy. A sustained recession or economic slowdown has the potential to present significant challenges for the company, influencing both its revenue and profitability. In such adverse economic conditions, FTV may face obstacles in generating the necessary Free Cash Flow (FCF) essential for pivotal acquisitions and strategic business enhancements. The financial strain imposed by economic downturns could limit FTV’s capacity to invest in innovation and expansion.

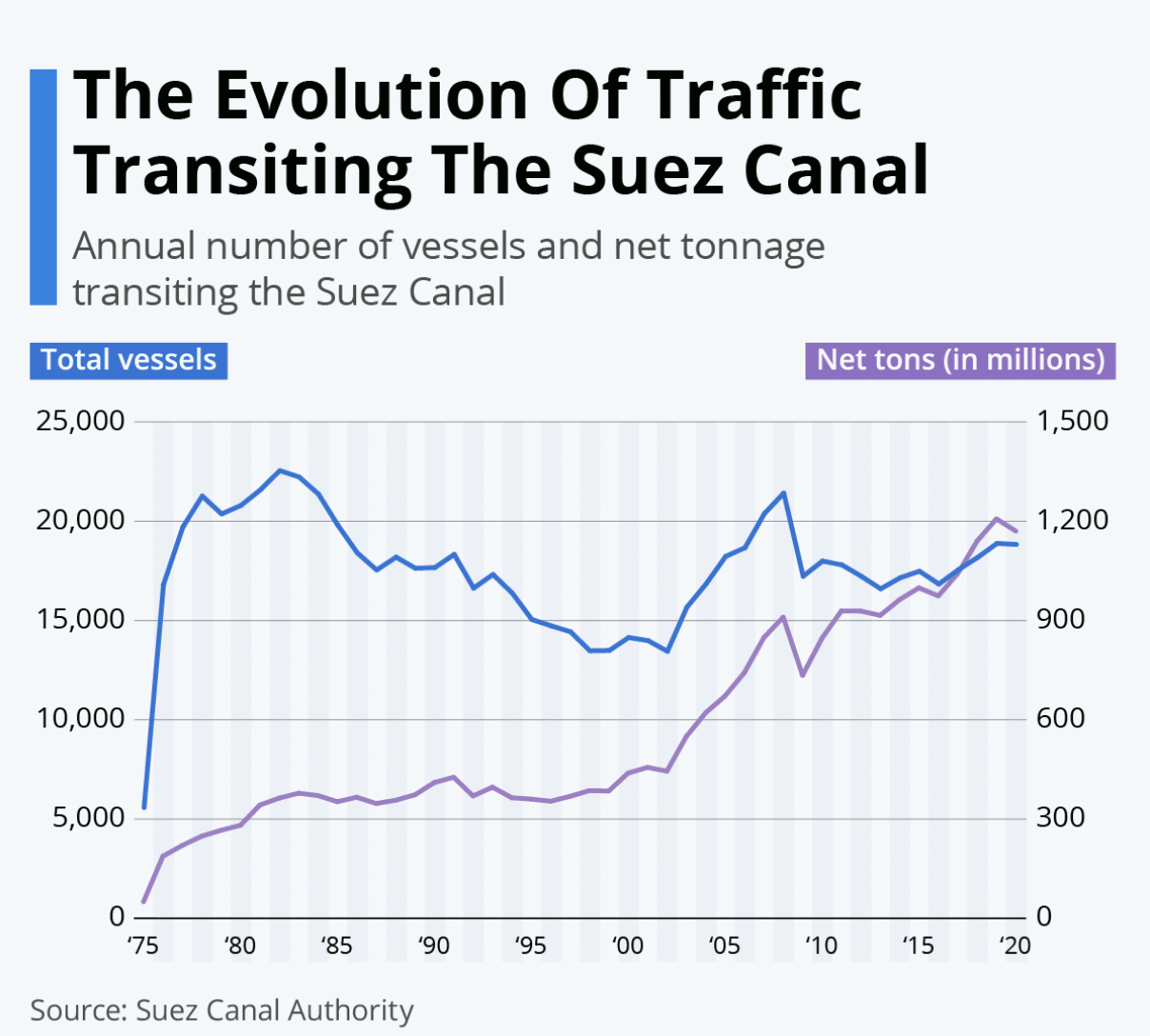

Suez Canal (Statista)

Given FTV’s status as a global business, recent disruptions in the Suez Canal have raised concerns about potential escalations in shipping rates in the short term. Such a scenario could translate into heightened costs for FTV, exerting downward pressure on its earnings. Moreover, the ripple effect of increased shipping costs may contribute to an uptick in inflation, influencing the trajectory of interest rates in the coming year. This shift could potentially thwart expectations of interest rate cuts, introducing an additional layer of financial considerations for FTV.

Final Words

I have covered FTV before and the company continues to be a solid business I think. It has proven to have resilient margins in the face of higher interest rates. The top line continued to expand, although, at lower rates than in previous years, it has been in a particularly difficult market environment. Going forward I think FTV can provide investors with a solid double-digit return annually until 2030. The stock price is slightly lower since when I initiated coverage on the business, and I am now even more eager to rate it a buy I have to say. The service and product portfolio is well diversified and the management has proven to be very capable of making efficient and profitable acquisitions without overextending themselves too much. FTV was a buy in July for me and continues to be going into the end of 2023.

Read the full article here