Elevator Pitch

I assign a Hold investment rating to Nissan Motor Co., Ltd. (OTCPK:NSANY) [7201:JP]. Nissan Motor’s FY 2023 guidance is favorable, but it is a concern that the company is losing market share in the Chinese market. A key catalyst for Nissan Motor is the targeted increase in payout ratio to 30%, but this won’t happen in the short term. Therefore, I have a Neutral view of NSANY, and this translates into a Hold rating for the stock.

Readers can buy or sell Nissan Motor’s shares on the Tokyo Stock Exchange and the Over-The-Counter or OTC market. The company’s OTC shares with the NSANY ticker symbol has reasonably good trading liquidity considering its 10-day mean daily trading value of around $1 million (source: S&P Capital IQ). The 10-day average daily trading value of Nissan Motor’s Japan-listed shares is relatively higher at $120 million. The company’s shares listed on the Tokyo Stock Exchange with the 7201:JP ticker symbol can be traded with US stockbrokers like Interactive Brokers.

Company Overview

Nissan Motor is a leading Japanese automaker. According to the company’s most recent quarterly earnings report, Nissan Motor boasted a 10.2% market share in its home market, Japan, as of the end of Q2 FY 2023 (July 1, 2023 to September 30, 2023).

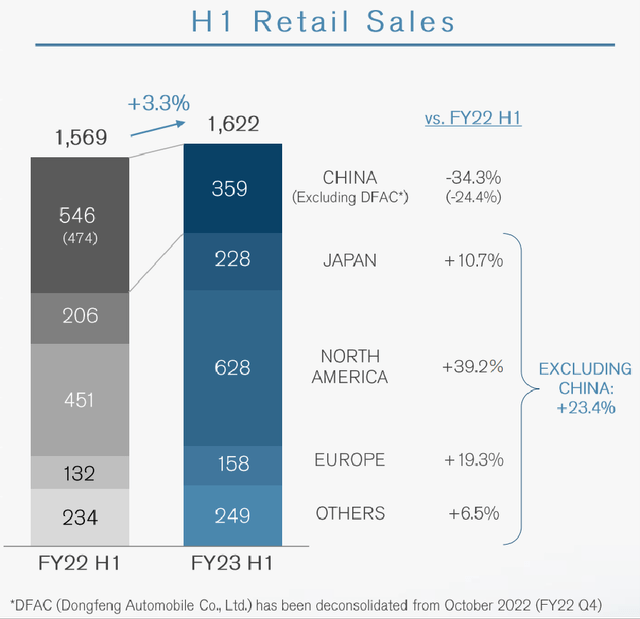

NSANY’s Retail Sales Breakdown By Geographic Market For 1H FY 2023

Nissan Motor’s Q2 FY 2023 Results Presentation Slides

NSANY’s market shares for the North American, Mainland Chinese, and European automotive markets were 5.7%, 2.8% and 1.9% (source: Q2 FY 2023 earnings report), respectively as of September 30, 2023. North America, China, Europe are the company’s key international markets in terms of retail sales contribution as highlighted in the chart presented above.

Upward Revision In Guidance Overshadowed By China Market Weakness

Nissan Motor raised the company’s FY 2023 (April 1, 2022 to March 31, 2023) top line and bottom line guidance by +3.2% and +14.7%, respectively when it released its Q2 FY 2023 results last month. The upward revision in NSANY’s full-year financial guidance isn’t surprising, as the company’s actual second quarter revenue and EBIT beat the market’s expectations by +2.2% and +27.3%, respectively as per S&P Capital IQ data.

NSANY’s updated guidance implies that its net revenue and net profit attributable to shareholders are expected to grow by +22.7% and +75.8%, respectively for FY 2023, respectively as indicated in its Q2 results presentation. At the company’s Q&A session for the Q2 FY 2023 results announcement, Nissan Motor attributed the guidance revision for FY 2023 to favorable expectations regarding foreign exchange effects, price increases, raw material cost reduction, and positive operating leverage.

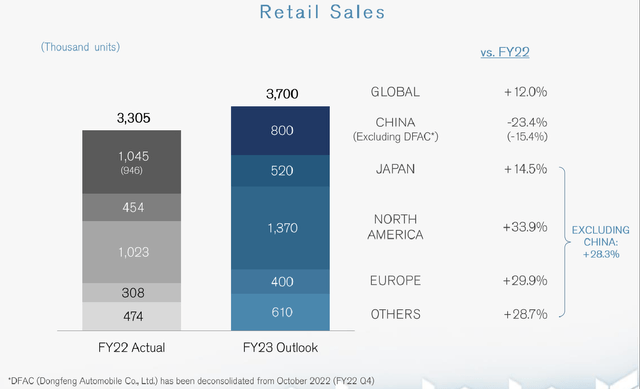

Nissan Motor’s FY 2023 Retail Sales Guidance By Geographic Market

Nissan Motor’s Q2 FY 2023 Results Presentation Slides

On the flip side, China, Nissan Motor’s largest market in terms of retail sales for FY 2022, is a weak spot for the company. NSANY expects to record positive retail sales growth for all of its markets in full-year FY 2023 with the exception of China as indicated in the chart presented above.

Nissan Motor revealed at its Q2 FY 2023 results Q&A session that the “average actual selling price of the entire Chinese market has dropped by nearly 20% in the past two years”, and it acknowledged that it is facing “fierce price competition in China.” NSANY’s market share in the Mainland Chinese market contracted by approximately -190 basis points YoY from 4.7% as of end-Q2 FY 2022 to 2.8% as of September 30, 2023, as disclosed in its Q2 FY 2023 earnings report.

Moving ahead, NSANY is unlikely to achieve a turnaround in the Chinese market anytime soon. At the company’s second quarter earnings Q&A session, Nissan Motor stressed that its business in China “may take time for growth” and it “cannot expect a short-term increase in profits” for this market.

There are different factors contributing to Nissan Motor’s market share loss in China. An October 5, 2023 Nikkei Asia article highlighted that NSANY has taken too much time to make the transition to EVs. An earlier Financial Times commentary published on August 1, 2023 mentioned that management attention has been diverted from the China market to other matters such as discussions with Renault SA (OTCPK:RNSDF) (OTCPK:RNLSY) on their “cross-shareholdings” and management transition (e.g. recent departure of COO in mid-2023).

In summary, NSANY’s prospects are mixed. It is encouraging that Nissan Motor has raised its FY 2023 financial guidance which translates into a positive outlook for the current fiscal year. On the other hand, it is worrying that NSANY is struggling in China, which Barron’s refers to as “the world’s largest automotive market.”

Targeted Dividend Payout Increase To 30% Will Be A Medium-Term Catalyst

Nissan Motor emphasized at its Q2 FY 2023 results Q&A session that it “will gradually increase the dividend per share and ultimately aim for a dividend payout ratio of 30%.”

It is natural to assume that a higher dividend payout ratio will be a potential re-rating catalyst for Nissan Motor stock, but this catalyst is less likely to be realized in the very near term.

Nissan Motor’s dividend payout ratio for the current fiscal year is expected to be 15%, or half of its targeted 30%, based on the company’s FY 2023 guidance of JPY390 billion in net profit and a minimum dividend distribution of JPY 15 per share.

There are good reasons for NSANY’s decision to grow its dividend payout ratio in phases. One reason is that Nissan Motor needs to set aside capital for repurchasing its own shares. Seeking Alpha News reported on December 12, 2023 that Renault plans to sell a 5% stake in Nissan” as part of “a planned rebalancing of the holdings the two companies have in each other.” The other reason is that NSANY has previously proposed to “invest 600 million euros in Ampere, Renault’s electric vehicle and software entity in Europe” as announced in a July 26, 2023 press release. This means that Nissan Motor has to reserve part of its cash for the Ampere investment when this deal is completed.

Nissan Motor’s JPY15 dividend per share guidance for FY 2023 is equivalent to a 2.7% dividend yield, which is decent but not particularly attractive. As such, I expect a positive re-rating of Nissan Motor’s stock to materialize when there is greater certainty about the timeline for the achievement of the 30% dividend payout ratio target.

Final Thoughts

Nissan Motor is fairly valued. The stock trades at a consensus forward FY 2023 P/E of 5.4 times (source: S&P Capital IQ), and this is roughly on par with the company’s consensus FY 2023-2027 EPS CAGR of +5.8%. This implies that Nissan Motor’s PEG (Price-to-Earnings Growth) ratio is 0.93 times or close to 1, which is indicative of fair valuation. Considering its valuations, outlook, and dividends, NSANY is deserving of a Hold rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here