Introduction

I initiated coverage of Verizon Communications Inc. (NYSE:VZ) stock in July 2023 with a ‘Buy’ rating, when one share cost $34. Since then, probably against the backdrop of heightened market expectations about the imminent Fed rate cut, the stock has followed the market rally and outperformed it by almost three times, taking into account the dividend yield.

SA, author’s previous article on VZ

Since almost six months have passed and a lot has happened in that time, both in the market and at Verizon in particular, I have decided to re-evaluate my thesis and test its strength.

Recent Financials And Developments

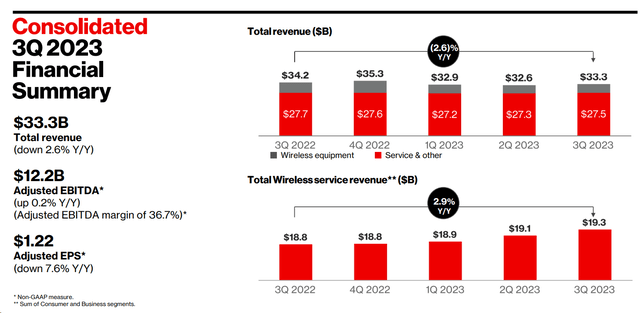

In Q3 FY2023, Verizon reported robust results with wireless service revenue up 3.9% YoY and adjusted EBITDA reaching $12.2 billion, exceeding Q3 and sequential figures.

VZ’s IR materials

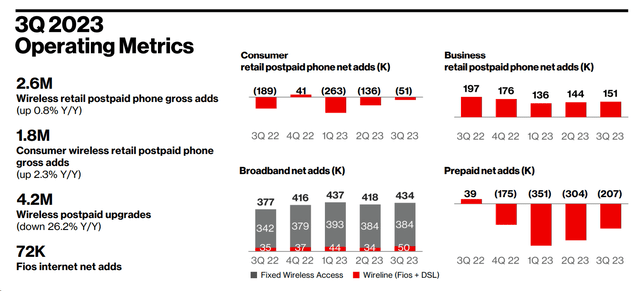

Consumer mobility showcased improved postpaid phone net additions, emphasizing flexibility. Business mobility saw 151,000 phone net additions, maintaining strength. Broadband achieved over 400,000 new subscribers for the 4th consecutive quarter, totaling 10.3 million, with fixed wireless access net adds of 384,000. The Fios side reported 72,000 internet net adds, a notable performance.

VZ’s IR materials

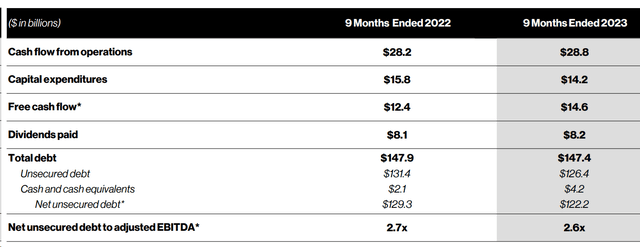

Verizon’s year-to-date free cash flow of $14.6 billion surpassed 2022’s full-year total, while debt-to-EBITDA ratio decreased slightly from 2.7x to 2.6x, which is a good sign. The firm also increased dividends for the 17th consecutive year.

VZ’s IR materials

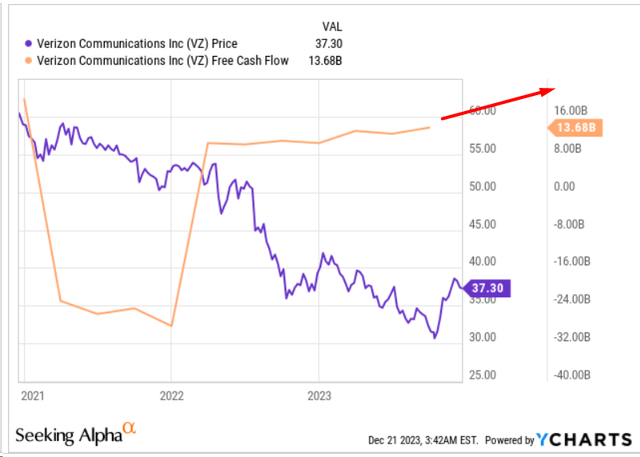

The company raised its FY2023 free cash flow guidance by $1 billion to over $18 billion, thereby predicting a continuation of the rapid recovery after the COVID period:

YCharts, author’s notes

Based on what I read from Goldman Sachs’s September takeaways [Communacopia & Technology Conference], Verizon expects the pace of ~400,000 fixed wireless net additions to continue, citing the simplicity and service appeal of the product to consumers. The deployment of C-band is anticipated to increase fixed wireless distribution in urban, suburban, and rural areas. Management remains confident in reaching 4-5 million fixed wireless subscribers by FY2025.

Also, the company aims to achieve a ~2x net leverage target by FY2025, signaling a commitment to financial discipline. Share repurchases are anticipated once this target is reached, so it’s not really far from us considering that we stand at 2.6x today.

In general, I like the changes and initiatives that the company is taking for its development. The most important thing for a value stock like VZ is the stability of the FCF, and if we expect a further decrease in CAPEX and a reduction of the debt burden in the future, this is the most important argument for a ‘Buy’ rating. But only if the valuation of the stock is reasonable.

Verizon’s Valuation Analysis

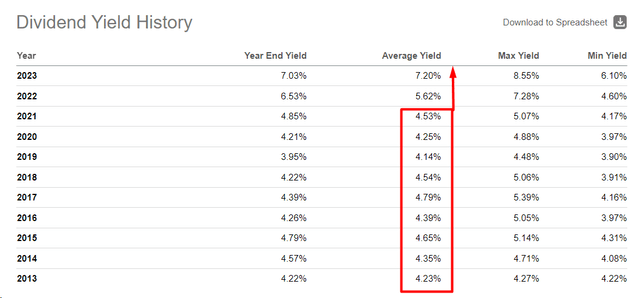

A large part of Verizon’s valuation depends on the interest rate in the economy: the lower it is, the more attractive it is to buy VZ in order to achieve a yield above that of government bonds. Before the current rate hike cycle, the average dividend yield of VZ was between 4.14% and 4.79% for several years, while now it is rising to 7.2%:

Seeking Alpha, author’s note

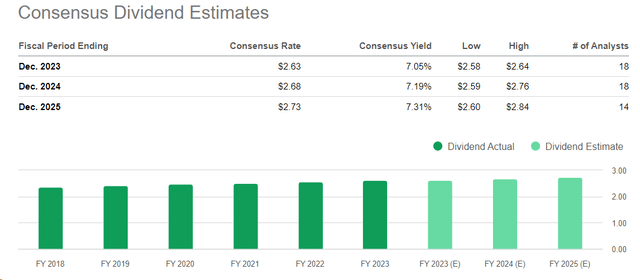

Moreover, this is only due to interest, because dividend payments continue to grow, as I wrote above. Furthermore, VZ’s dividend yield is projected to rise to as much as 7.31% by the end of FY2025, based on the same share price as today:

Seeking Alpha, VZ’s Dividend Estimates

What if today’s consensus on a rate cut in 2024 is correct? Then VZ shares should rise to such a level that they return the usual yield. However, I don’t think we’ll be back to the middle of that 4-5% range anytime soon because the risk of another round of inflation means the Fed is highly unlikely to cut rates to radically low levels like they have been. Let’s say 6% would be a very good yield for VZ stock considering all its idiosyncratic risks.

FY2024 Dividend payment / Stock Price = FWD Dividend Yield

$2.68 / X = 6%

X = $44.7 [an upside potential = 19.75%]

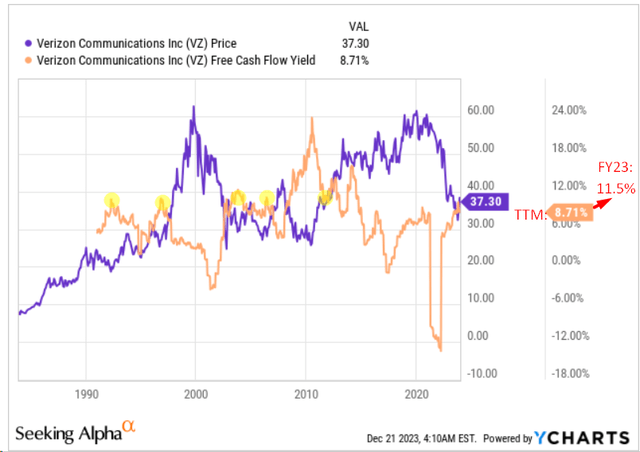

The conclusion that the company is undervalued, which results from the above reverse engineering, is confirmed when we look at the FCF yield, another very important metric for any value stock. If we take the FY2023 guidance of ~$18 billion FCF as a basis, we get an FCF yield of ~11.5%, which is significantly higher than VZ’s TTM figure of 8.71%.

YCharts, author’s notes

Yes, VZ has traded at a higher ratio in the past, but at those times the stock was at or heading towards its critical bottom (as in 2011). Now the company continues to perform like a classic cash cow, with “milk yields” becoming more and more predictable.

The Bottom Line

Of course, investing in Verizon stock comes with inherent risks, including susceptibility to disruptive technological changes, regulatory dependencies, and intensified competition in the telecom sector. T-Mobile’s (TMUS) resurgence, particularly after the Sprint merger, poses a notable threat to Verizon’s industry dominance. The sector’s full penetration in the U.S. and the uncertainty surrounding potential health and environmental impacts of historical lead-sheathed cables, as reported by The Wall Street Journal, add additional layers of risk. While Verizon has been proactive in adopting new cable technologies since the 1950s, the extent of exposure remains uncertain, requiring ongoing research by management to quantify potential liabilities and determine necessary mitigation measures.

However, despite all the risks, I believe that Verizon’s dividend yield cannot remain at current levels if the market is confident that the Fed will cut interest rates soon. Especially so if Verizon’s FCF stability is maintained, its debt continues to be systematically reduced and service revenue growth increases – that’s what I expect. In my opinion, VZ will remain undervalued until the dividend yield reaches 6%. For this to be the case in FY2024, the share price would need to rise to $44.7, which, according to my calculations and based on the consensus dividend payout for next year, represents an upside potential of 19.75%. I therefore reiterate my previous ‘Buy’ rating.

Thanks for reading!

Read the full article here