Investment Thesis

Stellantis N.V. (NYSE:STLA) is a genuine deep-value situation. In this instance, it appears to be highly undervalued without presenting any specific reasons to doubt its quality and warrant a lower valuation.

In this article, I will review key aspects to determine why I don’t see any grounds for valuing it so cheaply. From the transition to electric vehicles to assessing its quality compared to competitors and exploring potential catalysts for the market to adjust the valuation in the short term. Additionally, I will conduct a valuation to justify why I believe the company is a clear ‘buy‘ at the current price.

Business Overview

Stellantis N.V. is a global automotive company formed from the merger of Fiat Chrysler Automobiles and PSA Group. The merger was completed in January 2021, resulting in the creation of Stellantis as the fourth-largest automotive manufacturer in the world by volume.

Stellantis is home to several well-known automotive brands, including Fiat, Chrysler, Jeep, Dodge, Ram, Peugeot, Citroën, Opel, and others. The company operates in various markets globally and has a diverse range of vehicles, from passenger cars to trucks and commercial vehicles.

Stellantis Brands (Stellantis)

As you can see, Stellantis brands are not inherently inferior or in a less competitive position compared to other competitors such as Ford Motor Company (F), General Motors Company (GM), or Volkswagen AG (OTCPK:VWAGY). In fact, the company estimates that it holds a 10% market share in North America, thanks to the strong brand presence of Jeep and Ram, as well as approximately 20% of the market share in Europe.

Therefore, based on this aspect, we cannot consider that the company deserves to be quoted at such a low valuation.

Electric Vehicles

On the other hand, the greatest risk facing all these vehicle manufacturing companies is the transition toward electric vehicles. This shift will necessitate substantial investments in developing their own electric vehicles to remain sufficiently competitive compared to the current market leader, Tesla, Inc. (TSLA), which is significantly ahead in terms of technology and manufacturing capability. All this while striving to make their electric vehicles profitable enough to avoid financial losses during this transformative process.

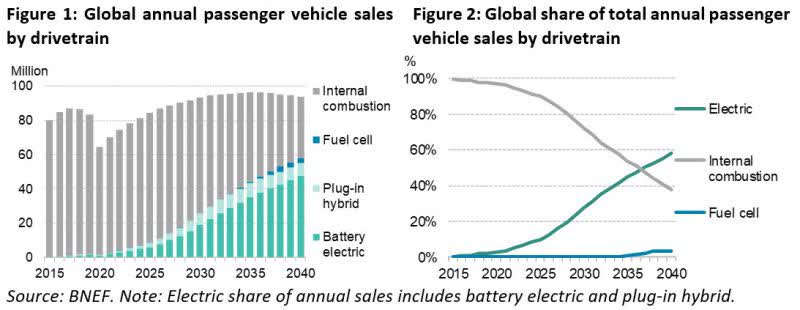

It is worth noting that the transition to electric vehicles is not expected to happen anytime soon. According to BloombergNEF’s latest research, titled ‘Long-Term Electric Vehicle Outlook,’ electric models are projected to comprise 58% of new passenger car sales globally by 2040 and 31% of the entire global car fleet. In other words, even within the next 20-25 years, it is not anticipated that 100% of sales will be entirely electric vehicles.

Electric Vehicle Outlook (BloombergNEF Report)

Thanks to this expectation, the Internal Combustion Engine vehicle market anticipates significant growth in this decade. In the United States alone, nearly 10% growth is expected, and emerging economies will also play a crucial role in the sector’s expansion. This is due to the global lack of EV infrastructure, leading users to continue opting for traditional vehicles, which are often more affordable in certain models, despite Tesla’s efforts to substantially reduce its prices.

In conclusion, I also do not believe that electric vehicles pose an imminent risk of extinction for traditional vehicle manufacturers and would not justify such a low valuation.

Key Ratios

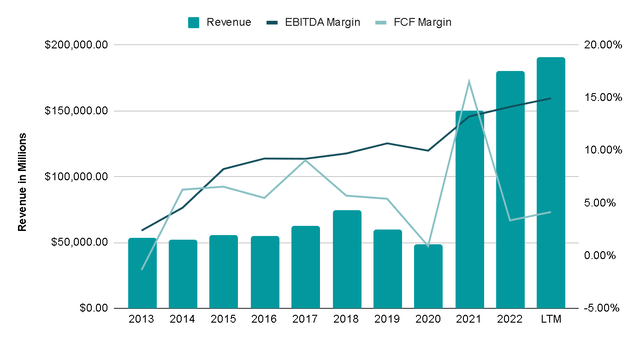

As mentioned, the merger between Fiat Chrysler and PSA Group occurred in 2021. When analyzing the pre- and post-merger numbers, we observe not only a significant increase in revenue, rising from $47 billion in 2020 to $149 billion in 2021, but also an improvement in margins. This indicates that the merger notably enhanced the overall quality of the business.

In fact, from 2013 to 2020, revenue experienced an annual decrease of -1.5%, maintaining average EBITDA margins of 8%. However, between 2021 and the last twelve months, revenue has grown by 12.75%, with average EBITDA margins of 14%, reaching almost 15% in the last twelve months. This confirms that the merger created a stronger company, and the increased scale and cost efficiency ultimately benefited profits.

Author’s Representation

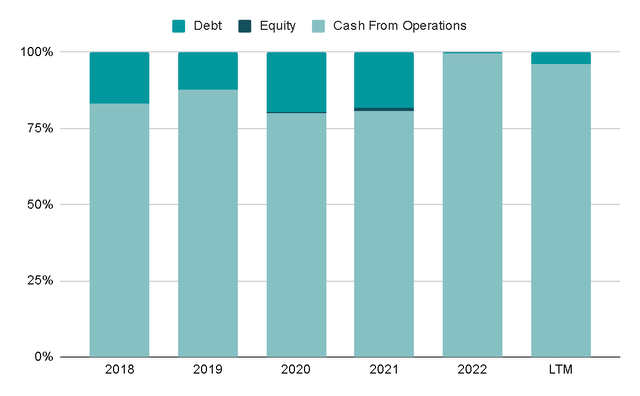

Between 2018 and 2020, the company was primarily financed through Cash From Operations, with a smaller portion, approximately 15%, coming from Debt. However, since 2021, there has been a radical shift, and in the last two years, not even 5% of the financing has originated from Debt.

Author’s Representation

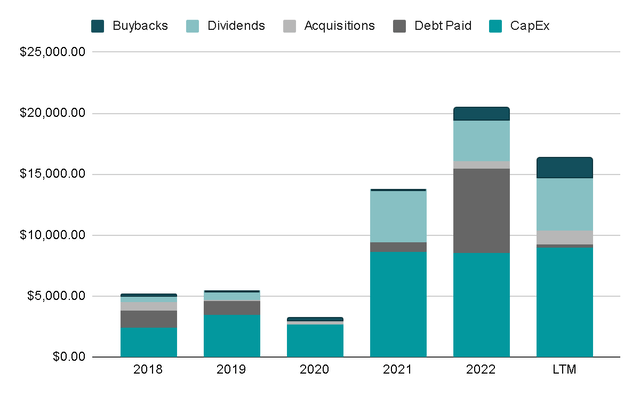

Over the past five years, half of this capital has been allocated to CapEx for business reinvestment, another 20% to pay down debt, and 20% to reward shareholders through dividends and buybacks. In fact, €8.6 billion in dividends and €1.1 billion in buybacks have been distributed, and there is an active €1.5 billion buyback plan. This is possible because the company is a rare case in the automobile sector, having no debt, and its net debt is -€23 billion. In other words, with the cash on the balance sheet, they could pay off all their debt and still have 23 billion euros remaining.

Author’s Representation

Are Competitors Better?

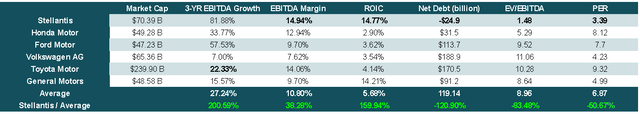

Now, to contextualize this data in comparison to its competitors, I have created a table comparing key ratios such as EBITDA margins, return on invested capital, net debt (in billion), and crucial valuation metrics like EV/EBITDA and P/E ratios.

In this regard, Stellantis stands out as the company with the highest EBITDA margins, the only one with negative net debt, and the highest returns on capital. Moreover, it is also the most attractively valued. The EV/EBITDA ratio is 80% lower than the average of other competitors, and the P/E ratio is 50% lower.

Author’s Representation

There is undoubtedly a significant gap in both important aspects-Stellantis excels in terms of quality, while also being one of the most attractively valued companies in the market. Therefore, we cannot conclude that the company is cheaper due to a poorer quality business model.

Valuation

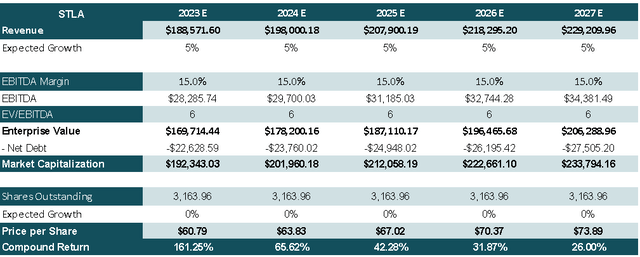

At this point, it appears that Stellantis’s valuation enhances this deep value situation, but, if we conduct a valuation with the assumption of a 5% annual revenue growth over the next five years, maintaining EBITDA margins similar to the current 15%, and applying an EV/EBITDA multiple of 6x-lower than the average of 8x for its competitors-without considering buybacks in the next few years, we could anticipate an annual return of 26% over the next five years at the current price.

This represents an exceptionally attractive performance at a conservative valuation. The analysis assumes that the company will grow less than market expectations, will not engage in share repurchases, and the multiple will remain below the average of its competitors.

Author’s Representation

Why Is So Cheap?

At this point, there is no doubt that Stellantis is a deep-value opportunity and is highly undervalued without a clear reason. In my opinion, it is a mix of distrust regarding the company’s continued relevance in an electric vehicle environment, which we have already seen is unlikely to happen anytime soon, and fears about the macroeconomic situation. The outlook for 2024 suggests there will be no further interest rate hikes, while inflation is declining, and the economy appears to remain solid.

Additionally, I must mention the risks that the company faces. Although its valuation relative to its peers is very cheap, this sector does not usually trade at high multiples because it is structurally difficult to succeed here. Among some of the risks I want to highlight are the following:

- Economic Downturns: The automotive industry is sensitive to economic cycles. Economic downturns can lead to decreased consumer spending, lower demand for new vehicles, and financial challenges for automotive manufacturers. This is one of the main reasons why the market is distrustful of the sector right now.

- Technological Changes: Rapid advancements in technology, particularly in electric vehicles, autonomous driving, and connectivity, pose both opportunities and challenges. Stellantis needs to adapt to these changes to remain competitive, but the pace of technological evolution can be a risk.

- Competition: Intense competition in the automotive industry can affect market share, pricing, and profitability. Stellantis needs to continually innovate and differentiate its products to stay ahead of competitors.

Final Thoughts

Having considered the risks, the quality of the business, and the current valuation, it seems to me that the company is a clear ‘buy‘, and I see no compelling reason for it to be trading at such a low valuation. Although I also understand the factors contributing to this mistrust.

Currently, many of the fears are fading, especially those related to the macroeconomic situation and the recent issues with strikes in the automotive sector. While it is still too early to claim victory, if the economy continues to improve, discretionary consumption could strengthen, and Stellantis might be seen as one of the main beneficiaries. Even if this scenario does not unfold, the valuation provides enough margin of safety to offer potential upside, even if things do not go according to expectations.

Read the full article here