Investment Thesis

Fiverr International Ltd.’s (NYSE:FVRR) Q3 2023 results reflect the thesis that I continue to have on the stock: that this stock is simply not compelling enough for me to reward it with a buy rating.

And what I find ironic is that I’m one of the only voices on Seeking Alpha that hasn’t got a buy rating on this stock. But I believe that, sooner or later, more analysts will come around to my side of the boat where it’s lonely and cold. At least for now.

Ultimately, the stock is very cheaply valued at 8x forward free cash flows. Few investors would argue the contrary. But I contend that a cheap stock isn’t good enough in and of itself. It needs to be able to grow its intrinsic value sustainably. And it’s on that latter aspect that I have an issue with this company’s stock, and I’m neutral on this name.

Rapid Recap

Back in September, I wrote a neutral analysis on Fiverr where I said:

According to my updated estimates, Fiverr is priced at 11x next year’s EBITDA. The business is clearly a lot cheaper than it once was. But at the same time, it’s not thriving to the same extent that it once was.

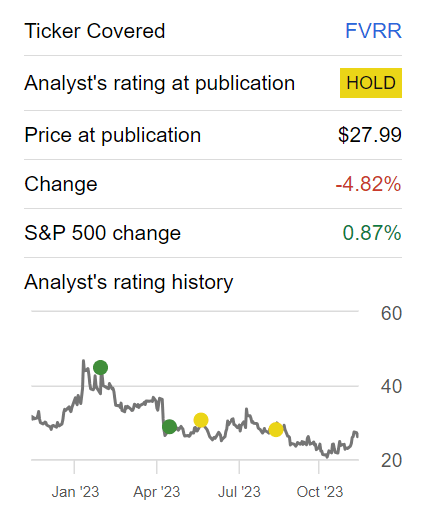

This is the stock’s performance since then.

Author’s work on FVRR

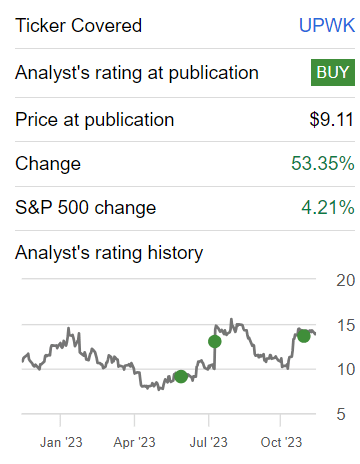

At the same time, I’ve been outspoken throughout SA that I’m bullish on its peer Upwork Inc. (UPWK).

Author’s work on FVRR

The point I’m making here is that in investing, it’s not enough to have a good story or a growing total addressable market, or TAM. You need to buy a mispriced stock. That is, where expectations are lower than where the company is headed.

Fiverr’s Near-Term Prospects

Fiverr is an online marketplace that connects freelancers with clients seeking various digital services. The platform offers a diverse range of services, from graphic design and writing to programming and marketing.

Fiverr’s unique proposition lies in its gig-based structure, where freelancers, referred to as sellers, showcase their skills by offering services, or “gigs,” at different price points. Clients, or buyers, can browse these services, engage freelancers, and collaborate on projects ranging from small tasks to more extensive undertakings.

Fiverr’s user-friendly interface and global reach have positioned it as a popular hub for businesses and individuals seeking cost-effective and specialized freelance expertise.

In the near term, Fiverr confronts challenges related to the ongoing evolution of its business model and the dynamics of the freelancing marketplace.

One notable challenge revolves around the scalability and optimization of its recently launched product, Fiverr Neo. While Fiverr Neo envisions serving as a personalized recruiting expert, helping clients accurately scope their projects and connect with freelance talent efficiently, the platform is in its early stages. The company acknowledges that the technology, including leveraging existing Large Language Model engines, is still undergoing optimization for large-scale and high-performance usage. Enhancing the algorithm and processing speed while ensuring a seamless customer experience poses a challenge as Fiverr seeks to expand the user base and increase the impact on match quality and delivery.

Another challenge lies in the effective implementation and adoption of Fiverr Business Solutions, particularly the Fiverr Enterprise offering. Targeting higher-end customers with more complex project requirements, Fiverr Enterprise aims to provide ongoing engagement with a pool of freelance talent, continuous task and project management, and budget tools.

The challenge here is twofold: first, convincing larger businesses to embrace the platform for extended engagements, and second, ensuring that the platform’s features adequately address the nuanced needs of businesses with evolving project scopes. Achieving widespread adoption and demonstrating tangible value to larger enterprises can be a gradual process, and Fiverr needs to navigate these challenges to establish Fiverr Enterprise as a go-to solution for businesses seeking extended freelancing support.

Revenue Growth Rates Are Uninspiring

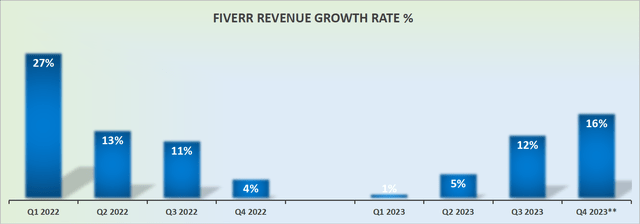

FVRR revenue growth rates

The problem with investing is that investors demand certainty. Investors never like bad news, that’s obvious. But the second thing that investors dislike is uncertainty. What do I mean by that?

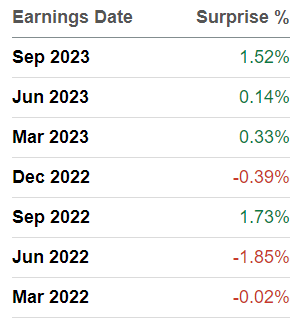

Previously, Fiverr could be counted on to deliver solid mid-20s% CAGR. Today, despite its very easy comparables with the prior year, its growth is categorically below 20% CAGR. What’s more, I’ll underscore that Fiverr is not the sort of company that under-promises and overdelivers, as you can see below.

SA Premium

As you can see here, Fiverr is just as likely to beat analysts estimates as it is to miss analysts’ estimates. Put more concretely, Fiverr is no longer classed as a high-growth business. This is a business that now operates in the shadow of its former self.

FVRR Stock Valuation — 8x Forward Free Cash Flow

To be clear, there are good aspects to Fiverr’s investment thesis. After all, the business is clearly highly free cash flow generative. Case in point, I can easily see a path over the next twelve months where Fiverr delivers $130 million of free cash flow.

This puts Fiverr priced at just 8x forward free cash flow. No rational investors would make the case that this is a rich valuation. What’s more, the business is very well capitalized, with more than $130 million of net cash on its balance sheet.

So, not only is the business producing about $130 million of free cash flow over the next twelve months and growing, but it also has more than 10% of its market cap made up of cash.

So, again, the valuation is not the issue with this stock. The issue, rather, is that its growth prospects have fizzled out. And it’s difficult to get a large multiple on a stock when this once robustly growing business has sputtered and stalled.

The Bottom Line

In summary, my examination of Fiverr’s prospects solidifies my reservations about the stock, leading me to withhold a buy rating.

While the current valuation at 8x forward free cash flow appears enticing and underscores Fiverr’s strong free cash flow generation, the pivotal concern lies in the company’s faltering growth rates.

Formerly, Fiverr was a stalwart. It could be counted on for a solid mid-20s% CAGR. But now, Fiverr International Ltd.’s growth has now dipped well below 20%, and perhaps it will stabilize around 15% CAGR, signaling a departure from its high-growth trajectory.

The challenge lies not in the valuation, which is seemingly reasonable, but in the company’s ability to reignite its growth engine. Despite the appealing free cash flow metrics, the stagnant growth prospects are a significant hurdle, prompting me to remain cautious and neutral on Fiverr until a more convincing growth story emerges.

Read the full article here