Note:

I have covered Pyxis Tankers Inc. (NASDAQ:PXS), (NASDAQ:PXSAP), (PXSAW) previously, so investors should view this as an update to my earlier articles on the company.

Solid Third Quarter Results

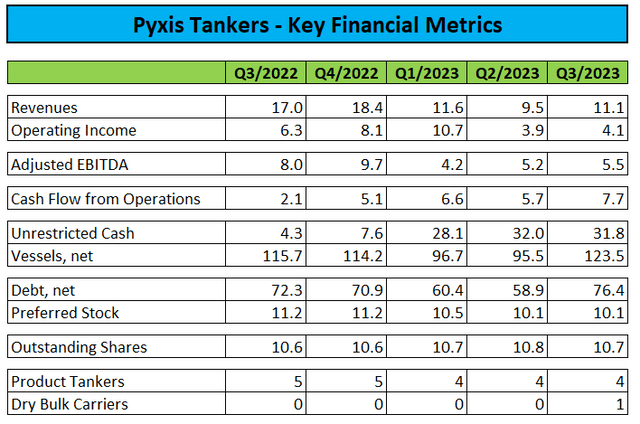

Last month, small, Greece-based product tanker and dry bulk carrier operator Pyxis Tankers or “Pyxis” reported decent Q3/2023 results with solid profitability and strong cash flow generation.

Company Press Releases

The company’s average daily time charter equivalent (“TCE”) rate of $28,024 was up by 12% quarter-over-quarter. At the time of the earnings report, 84% of available product tanker days for Q4 had been fixed at a TCE rate of $29,600 per day.

Strong Product Tanker Prospects

Strong projected demand for jet fuel should support product tanker markets going into 2024, with growing deliveries of petrochemical feedstocks to China and longer predicted sailing distances also contributing to a healthy industry outlook.

Increased Share Repurchases

In addition, the company has started to utilize its $2 million share repurchase program more aggressively. During the quarter, the company bought back 162,904 shares at an average price of $3.61 per share. As of November 14, Pyxis had repurchased an additional 107,933 shares with approximately $0.9 million remaining under the current buyback authorization at that time.

Foray Into Dry Bulk Shipping Continues

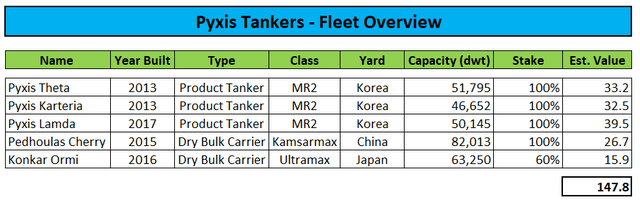

In mid-September, the company took delivery of its first dry bulk carrier, the 2016 Japanese-built Ultramax vessel Konkar Ormi.

Please note that the vessel is jointly owned by Pyxis Tankers (60%) and CEO and controlling shareholder Valentios “Eddie” Valentis (40%) with the joint venture being consolidated in the company’s results.

Pyxis also announced the sale of the 2015 Korean-built MR2 product tanker Pyxis Epsilon for $40.75 million in cash. The vessel has been delivered to its new owners earlier this week. After transaction costs and repayment of related debt, the company received net proceeds of $26.8 million.

The sale will result in the recognition of a $17.1 million one-time gain or approximately $1.62 per share in the current quarter.

However, most of the sales proceeds will be used to acquire the Pedhoulas Cherry, a 2015 Chinese-built Kamsarmax dry bulk carrier from Safe Bulkers, Inc. (SB) with delivery scheduled for February 2024.

Following the sale of the Pyxis Epsilon and the purchase of the Pedhoulas Cherry, the company’s fleet will look as follows:

Company Press Releases / MarineTraffic.com

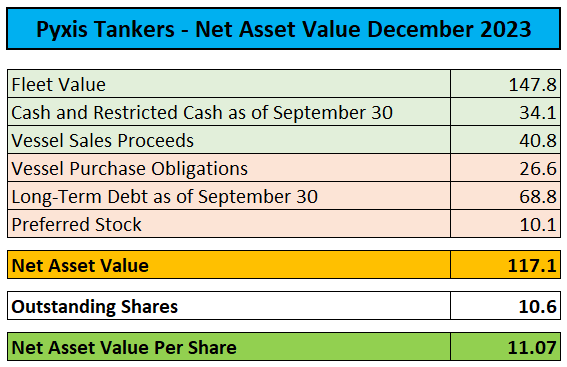

Discounted Valuation Due To Lack Of Dividends

Despite the company having stepped up its share repurchase efforts, Pyxis Tankers still trades at a large discount to estimated net asset value (“NAV”) per share which is likely attributable to a number of factors:

- lack of scale.

- lack of trading volume.

- corporate governance concerns.

- recent expansion into dry bulk shipping.

- lack of dividends.

Company Press Releases / MarineTraffic.com

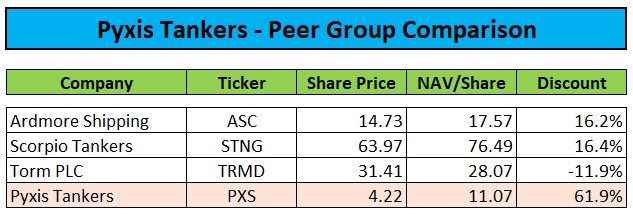

As a result, the company’s common shares are currently changing hands at a 60%+ discount to NAV, substantially higher than its much larger U.S. exchange-listed peers:

Value Investors Edge / Company Press Releases / MarineTraffic.com

With the most generous dividend payer TORM plc (TRMD) even trading at a substantial premium to NAV, it seems quite clear that many market participants are basing their industry investments mostly on dividend payments.

However, given management’s stated focus on balance sheet improvement, measured share repurchases, and particularly investments in other shipping segments, Pyxis Tankers is not likely to initiate a dividend anytime soon.

PXSAP – Solid Income And Potential Capital Gains

That said, income-oriented investors might consider an investment in the company’s Series A 7.75% Convertible Preferred Shares, Pyxis Tankers Inc. 7.75% CNV PFD A (PXSAP).

While daily trading volume remains low and the current dividend yield of approximately 8% isn’t exactly mind-blowing in the current interest environment, the preferred stock carries a conversion option at a price of $5.60 per common share which might very well come into play again should product tanker markets remain firm.

Please note that Pyxis Tankers has the option to redeem the Preferred Stock at a price of $25 per share, but given the interest environment, I firmly expect the company to abstain from calling the preferred shares anytime soon.

Bottom Line

Pyxis Tankers reported decent third quarter results and continued its recent foray into dry bulk shipping with the acquisition of a Kamsarmax vessel from Safe Bulkers.

The company also stepped up the pace of share repurchases, but the ongoing lack of dividends is likely to result in the company trading at a material discount to its much larger U.S. exchange-listed peers for the time being.

However, with dry bulk charter rates having recovered significantly in recent weeks and prospects for the product tanker market remaining decent going into 2024, the company’s net asset value per share should increase further, particularly when assuming additional share repurchases.

Consequently, I am reiterating my “Buy” rating on the company’s common shares.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here