The iShares Fallen Angels USD Bond ETF (NASDAQ:FALN) invests in fallen angels, or bonds recently downgraded from investment-grade to non-investment grade. Fallen angels have outperformed high-yield corporate bond benchmarks for decades, as forced selling from institutional investors causes these securities to trade at comparatively low prices, leading to outsized capital gains once conditions settle. FALN has performed exceedingly well too, outperforming most of its peers since inception, and for most relevant time periods. FALN’s strong investment strategy and performance track-record make the fund a buy. Its growing 5.4% yield is reasonably good too, but lower than that of its peers.

Fallen Angels – Overview And Analysis

FALN’s performance and investment thesis are both dependent on peculiarities of bonds and bond markets. Let’s have a look at these before tackling the fund itself.

Bonds can be divided into two groups: investment-grade and non-investment grade.

Investment-grade bonds are issued by comparatively strong corporations, with credit ratings of at least BBB- or higher. Default rates and yields are both low.

Non-investment grade bonds are issued by comparatively weak corporations, with credit ratings of BB+ and below. Default rates and yields are both high.

Some institutional investors and index funds are constrained from investing in non-investment grade securities, due to their comparatively high default rates. As an example, most of the larger bond ETFs exclusively invest in investment-grade bonds, including the two largest ones, the Vanguard Total Bond Market ETF (BND), with $300B in AUM, and the iShares Core U.S. Aggregate Bond ETF (AGG), with $100B.

When bonds are downgraded from investment-grade to non-investment grade, some institutional investors are forced into selling, including BND and AGG. Forced selling almost always leads to materially lower prices and higher yields: a $300B behemoth like BND can’t sell without moving the market, especially not when others are selling too. As market conditions settle and forced selling ceases, prices tend to improve, and buyers tend to benefit. Investors christened these bonds fallen angels, a very evocative, self-explanatory name.

As an example of the above, we have Carnival Corporation (CCL) bonds, one of the larger FALN holdings in prior years. CCL is one of the largest cruise ship companies in the world, and was significantly impacted by the coronavirus pandemic. Revenues dropped to around zero in 2022, and it was unclear when, or if, the company would ever recover.

A few months into the pandemic, CCL’s credit rating was slashed by all agencies, from around A to B, with the company becoming a fallen angel. CCL needed cash to survive, and was able to raise $3 billion at a 11.5-12.0% rate for three years in April 2020. This was an exceedingly high rate, but it was the pandemic, and CCL is a cruise ship company. FALN invested quite heavily in that bond and profited as the pandemic subsided and bond prices rose.

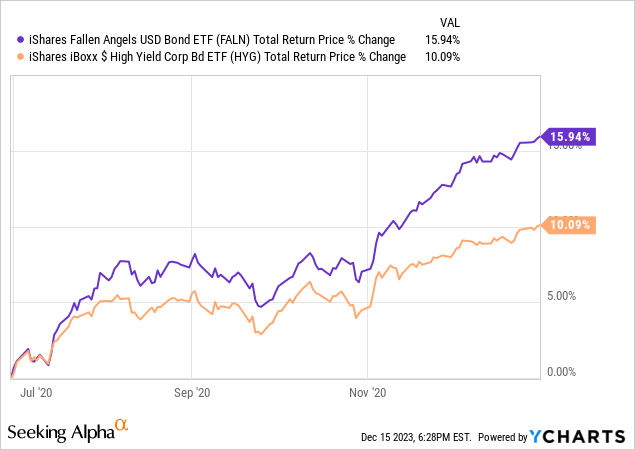

Data by YCharts

Although those CCL bonds were not guaranteed to outperform, there were reasons to believe that they would. Their yields were high, as they were from a risky, non-investment grade issuer. The company was going through a rough patch, but it could prove temporary, and long-term fundamentals remained strong. Investing in these bonds did, in fact, lead to strong, market-beating returns, as expected.

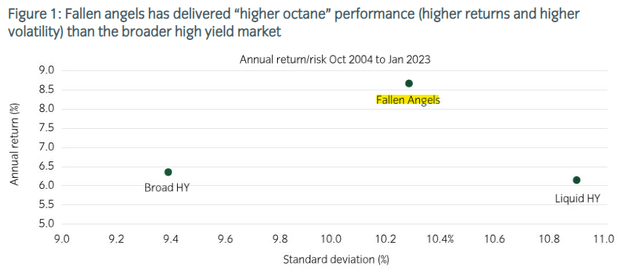

Investing in fallen angels as a whole generally leads to the same, with these securities outperforming broader high-yield bond indexes for the past two decades or so. Volatility tends to be about average.

Insight Investment

As fallen angels tend to outperform due to structural reasons inherent to bond market and market participants, outperformance is likely to continue long-term. In my opinion at least.

With this in mind, let’s have a look at FALN itself.

FALN – Fallen Angel Index ETF

Performance Analysis

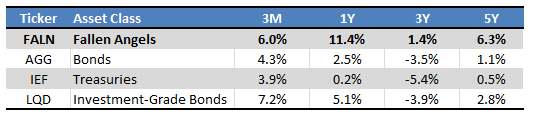

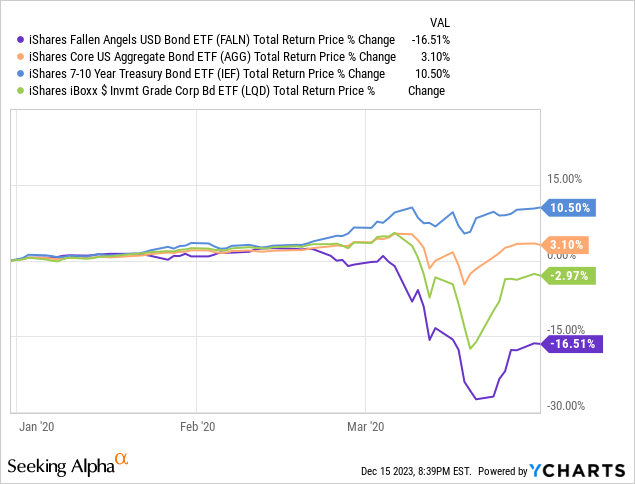

FALN is a simple-fallen angel index ETF, with the same strong performance track-record of its underlying securities. Returns are high, since inception and for most relevant time periods. The fund tends to outperform most other bonds and bond sub-asset classes, since inception and for most relevant time periods.

Seeking Alpha – Chart by Author

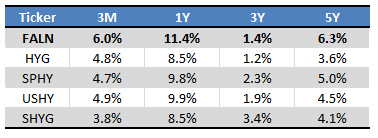

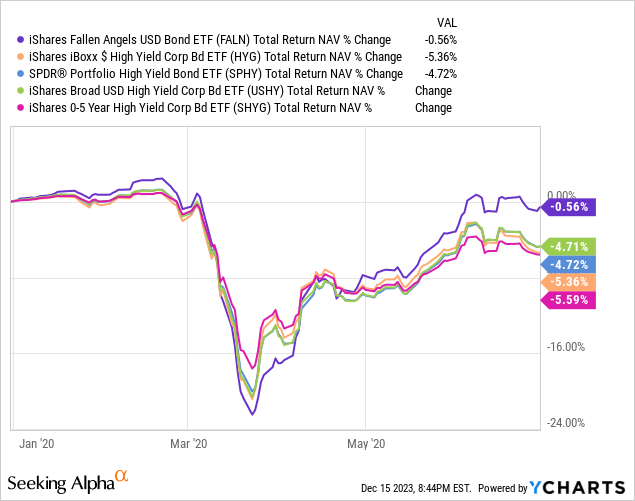

FALN also tends to outperform most of its high-yield corporate bond peers, since inception, and for most relevant time periods.

Seeking Alpha – Chart by Author

FALN’s strong performance track-record, underpinned by a proven investment strategy, is its most significant benefit, and core investment thesis. FALN is the best choice for long-term high-yield bond investors, in my opinion at least.

Dividend Analysis

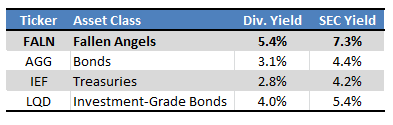

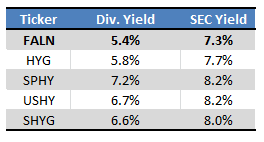

FALN focuses on non-investment grade bonds, and so sports a higher yield than most bonds and bond sub-asset classes.

Fund Filings – Chart by Author

On the other hand, the fund yields somewhat less than most of its peers, and is one of the lowest-yielding non-investment grade ETFs in the market. This is because most other high-yield ETFs include sizable investments in the more speculative, riskier issuers with B-CCC credit ratings, and sky-high yields. Fallen angels rarely fall so low, so FALN includes fewer such investments, somewhat lowering its yield.

Fund Filings – Chart by Author

In my opinion, FALN’s yield is good enough, and makes the fund a reasonably effective income vehicle. Still, the fund’s total returns are its key advantage and benefit, and its core investment thesis. Investors looking for income exclusively have much better choices than FALN, but I don’t think it is wise to disregard capital gains and total returns.

Credit Risk

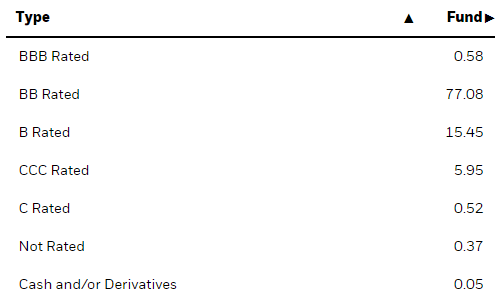

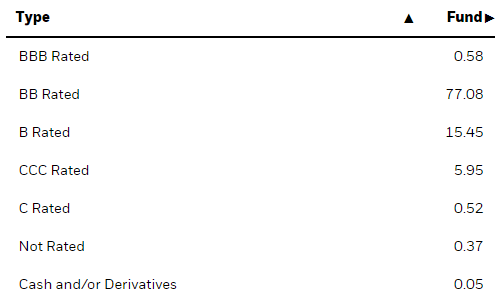

FALN focuses on non-investment grade bonds, with an average credit rating of BB. This is the highest credit rating within these bonds, which makes sense for a fund focusing on fallen angels.

FALN

Although FALN’s credit quality is not particularly low, it is lower than that of most bonds and bond sub-asset classes. Expect above-average losses during downturns and recessions, as was the case in 1Q2020, the onset of the coronavirus pandemic.

Data by YCharts

FALN’s credit quality is a bit higher than that of most high-yield bond ETFs, as these include a greater proportion of very low quality junk bonds. Compare FALN’s credit quality:

FALN

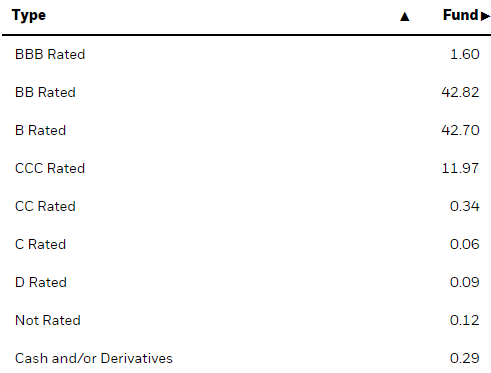

With that of the iShares 0-5 Year High Yield Corporate Bond ETF (HYG), the largest high-yield bond ETF:

FALN

Considering the above, FALN should outperform its high-yield peers during downturns and recessions. The situation was a bit more complicated during early 2020, with the fund seeing above-average losses during 1Q2020, but recovering faster from these in 2Q2020. Results seem broadly positive, but not quite what I expected.

Data by YCharts

In any case, FALN’s credit risk is something of a negative for investors, but I don’t find these risks excessive, nor do I think that they detract from the funds strong performance track-record and investment thesis. More risk-averse investors might disagree.

Interest Rate Risk

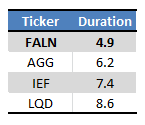

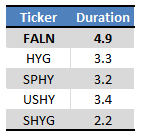

FALN’s duration is somewhat above-average, as the highest-quality issuers tend to issue long-term debt, and these rarely become fallen angels.

Fund Filings – Chart by Author

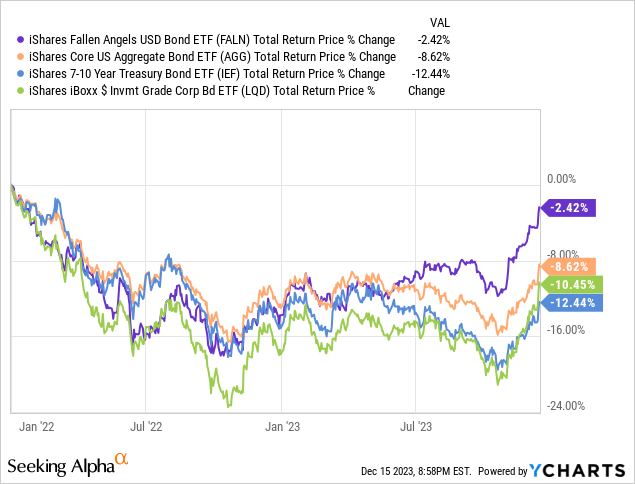

Due to the above, expect below-average losses when interest rates increase, as has been the case since early 2022.

Data by YCharts

On the other hand, FALN’s duration is a bit higher than that of its high-yield peers, as the fund’s holdings were all originally investment-grade, and these tend to be of longer maturities.

Fund Filings – Chart by Author

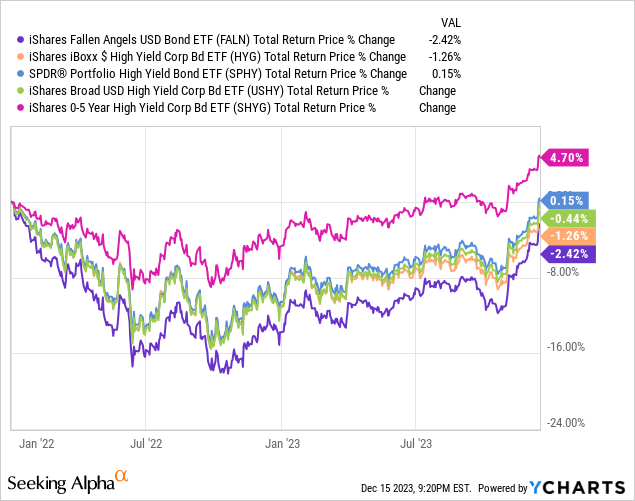

Due to the above, FALN should underperform its high-yield peers when rates rise, as has been the case since early 2022. Underperformance was not all that significant, however.

Data by YCharts

FALN has some interest rate risk, but not significant or low enough so as to merit any special mention or consideration.

Conclusion

FALN’s strong investment strategy and performance track-record make the fund a buy.

Read the full article here