I have some of the best readers and responders on the planet.

Sorry to all my fellow contributors here on Seeking Alpha and elsewhere, but I stand by that statement. So many of the investors who follow me are absolutely awesome.

They’re engaged. They’re engaging. They help keep me mentally sharp with their questions and comments.

Not to mention motivated and humble. I can’t forget about that.

It’s exceptionally important for a professional to maintain a healthy dose of humility. Especially when he has over 100,000 followers, as I do, it’s easy to get conceited. And once he starts thinking he’s all that and a bucket of buttered popcorn, he stops thinking as critically.

Which leads to mistakes.

We all make mistakes, of course. That’s inevitable. But the whole point of life – professional or otherwise – is to make as few as possible. Especially when something important is on the line.

In case I need to say it, you and your money are important to me. Therefore, I appreciate even the less-than-tactful responses I get.

So, yes, my readers and responders are amazing for all those reasons. But sometimes I get an extra perk as well. A bonus, if you will.

That was the case when I read “Harriho’s” comment on my recent “It’s Not Always Rainbows and Butterflies” article.

Because, as it turns out, he’s funny on top of everything else.

Harriho Goes for the REIT Gold

Despite the aforementioned article’s title, I did recommend some real estate investment trusts.

As I mentioned in the summary, “I believe we’re in the early stages of a REIT rally.” And “while investing can be difficult and challenging (not all rainbows and butterflies), I’m beginning to see the light at the end of the” tunnel.

As such, I talked up Alexandria Real Estate (ARE), Realty Income (O) – of course – and Mid-America Apartment (MAA).

That prompted quite a few comments, including this one from Harriho:

“It just seems to me that the slogan ‘don’t chase yield’ is a little too simplistic [which I also mentioned in the article]. Everything being equal, a 6% yield is better than a 5% yield. The trick, it seems, is to make sure that the higher yield is not predictive of a coming drop in share price.

“But I think the opposite might be true. A high yield usually represents an already-occurred drop in share price and, unless the underlying business has cratered, presages a regression to the mean. That is, a price appreciation.”

He went on to note that this notion is why he’s “stuck with REITs the last couple of years.” He faithfully took the dividends he got and put them right back into the dividend-payers, collecting up more and more dividends in the process – all while “waiting for price appreciation” to boost his gains further still.

“I don’t want to sound simplistic,” he added. “When picking the high-dividend stocks I selected, I did my best to understand the overall health of each business and the odds that its price would recover when REITs were back in fashion… although I can’t say that my nerves didn’t experience some significant challenges” as a result.

I appreciate that clarification, as I’ll explain below.

A Big Hurrah! For Harriho

Harriho seems to have a great investing approach:

- He assessed the companies.

- He assessed the markets.

- He assessed himself, correctly deeming himself tough enough to withstand short-term disappointments and frustrations.

For all those reasons, I salute him!

For any yield-chasing investors, please note that he overall stuck with the 6%-8% dividend-yielding range. As he went on to acknowledge, double-digit rates usually signify “something rotten.”

He wasn’t going overboard thinking he could make money from sucker yields. Which is good, because nobody can.

Even with this success, though, Harriho still has one problem, which he addressed with dry wit:

“But now I am 78 and am beginning to have to sell some stock to support our living expenses. So the prices of at least some of my investments matter. I have two choices – blow up every women’s clothing and/or every home decorating story on the planet or optimize the cash value of my investments.

“The optimizing investments choice is probably the easier path, although intellectually more challenging. Using the simple principle of selling high, I expect to have some good choices as REIT prices continue to increase.

“However, I am not sure what the correct strategy is for picking the right stock to sell. The one with the greatest appreciation? The one with the lowest dividend? The one whose business seems the least healthy? Perhaps just those tax lots that might still be at a loss so as to reduce taxes for as long as possible?

“Brad – you do a great job of telling us what to buy. How about a discussion about what to sell?”

If you’re in a similar situation where you’re considering a life of crime, keep reading. I think I have a solution. And it’s arson-free.

I promise.

When To Hold Them and When to Fold Them

Let me just start by making it perfectly clear that I am not trying to, nor am I qualified to, give direct financial advice on any investor’s portfolio or position within the portfolio. Furthermore, I am not trying to, nor am I qualified to, give tax advice.

I am only expressing my opinion, what I’ve learned through the years, to describe how I look at things. However, my situation and risk aversion could be very different than yours, so please do not misunderstand any of the following as personal financial advice on whether or not to sell a particular position.

So when to sell?

Harriho gave us some options to select from:

- The stock with the greatest appreciation

- The stock with the lowest dividend

- The stock whose business seems the least healthy

- The stock with losses that can offset taxes.

Now, it’s no secret that I’ve been influenced by some of the greatest investors of all time, including Benjamin Graham, Warren Buffett, and Peter Lynch.

One of greatest lessons I’ve learned is to look at the fundamentals of the underlying business rather than looking at a stock as a piece of paper that changes price each day.

Novel Investor

The reason I bring this up is because out of the 4 options listed, only one deals with the business fundamentals while the others revolve more around the stock:

- The stock whose business seems the least healthy.

This is the option I would personally chose in assessing whether or not to sell a business/stock.

One could argue that the stock with the lowest dividend yield is a fundamental metric, but I view this more as a function of market price.

For instance, a company could have a low yield because they cut the dividend (business fundamental), but typically the market price will suffer as a result, pushing the yield back higher.

Rather than focusing on the dividend yield, I might look at the company’s dividend history to see if they have ever cut the dividend, the average dividend growth rate, the current and forward / expected dividend payout ratio, etc.

Essentially, I’d rather own a stock yielding 2% if the dividend is on sound footing rather than a stock with an 8% yield and a very high payout ratio or any other deteriorating fundamentals.

I hold Prologis (PLD), which is now yields approximately 2.60%, but I would not sell it simply because my other stocks had a higher yield.

PLD’s dividend yield exceeded 3.00% not too long ago. The reason it is now lower is because the stock’s price has appreciated approximately 20% over the last month. Typically, most of the leading blue-chip REITs do not pay the highest dividend yield.

So my personal preference on whether or not to sell would not be based on the dividend yield.

Novel Investor

What about the stock with the greatest appreciation?

When to take profits is a tough one for many investors.

Do you sell just because the price ran up 10% in the last week?

What if the stock price is still under the businesses’ intrinsic value, do you still sell because of the rapid price appreciation?

To make matters more complicated, I really think the answer to this question is different, depending on what stage of life you are in.

If you’re retired or close to retirement, maybe you take the profit even if the price is still under the businesses’ intrinsic value.

For me and where I’m at in life, so long as the business is performing well fundamentally, I’m not looking to sell unless the price has gotten absurdly higher than the value of business, in which case I might trim, but I would not close out a position entirely just to capture the capital gain, since I’m still investing for the long haul and want to own my businesses for as long as they are profitable and providing dependable income.

An investor in a different stage of his or her life, or with different risk tolerances, may understandably have a completely different perspective.

Novel Investor Novel Investor

What about selling a stock at a loss to reduce taxes?

Again, I have to reiterate that I am not a Certified Public Accountant, and I am not giving tax advice, nor am I qualified to give tax advice. What I can say is that, personally, I look to the business fundamentals regardless of its tax implications.

Don’t get me wrong, I don’t want to pay more taxes than I have to, but a sell decision of mine would be based on the business fundamentals and not its impact on my taxes.

Now, if the business is deteriorating, I might sell at a loss and reap the benefits of tax loss harvesting, but my decision to sell would be based on the business fundamentals itself, rather than what capital gains could be offset.

Novel Investor

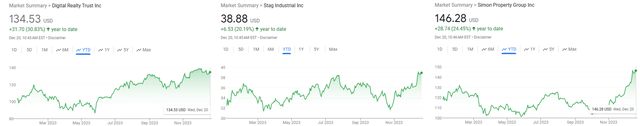

I thought it might be helpful to take a look at a couple stocks I’m up on year-to-date (“YTD”) to see how I might determine whether or not to sell.

- Digital Realty (DLR): YTD +30.83%

- STAG Industrial (STAG): YTD +20.19%

- Simon Property Group (SPG): YTD +24.45%.

Google

Digital Realty Trust, Inc. (DLR)

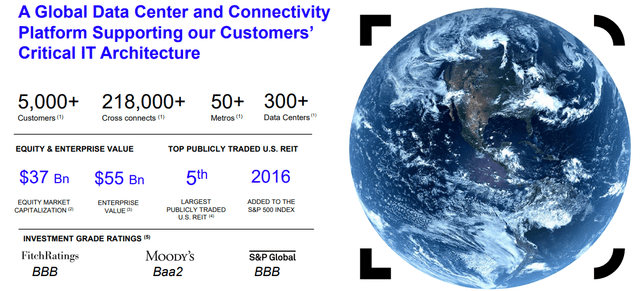

Digital Realty is a data center REIT that owns properties around the world with a portfolio of comprised of more than 300 data centers located in over 25 countries and across 6 continents.

Data centers are a critical component to everyday life, as they are part of what I like to call the “e-commerce trifecta.” Along with logistic properties and cell towers, data centers play a pivotal role in the interconnected world we live in.

Digital Realty’s data centers are used by world leading enterprises including Oracle, IBM, Meta, JP Morgan Chase, and AT&T and provide an array of technology solutions including interconnection, colocation, and dedicated server halls for hyperscale customers.

DLR – IR

Artificial Intelligence (“A.I.”) has really been a tailwind for certain tech companies and data centers throughout 2023.

The basic idea is that as companies rely more and more on A.I. solutions, their need for data storage, organization, and processing will only become greater.

This should increase demand for DLR’s server racks, which should ultimately translate into increased revenues, cash flow, and dividends. A.I.’s positive impact has already been priced in as DLR’s stock has gained over 30% YTD.

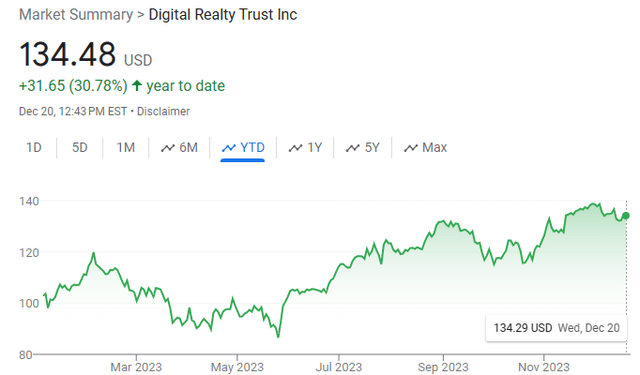

Google

So I’m up quite a bit on DLR this year, should I sell and capture the +30% gain? Well, in order for me to determine that, I will need to look at the company’s fundamentals.

A.I., the cloud, and all other things tech will only continue to grow in my opinion, which bodes well for technology REITs like Digital Realty.

The data center business is only gaining more relevance as more technologies are discovered and implemented. The point I’m trying to make is that I don’t see any issue with DLR’s basic business model of providing specialized space for computer servers.

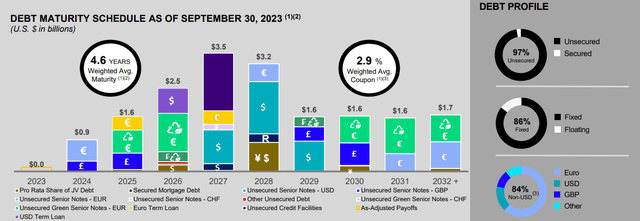

The next thing I want to look at is the financial strength of the company. DLR has an investment-grade balance sheet with a BBB credit rating and sound debt metrics including a net debt to adjusted EBITDA of 6.2x, a fixed charge coverage ratio of 4.1x, a long-term debt to capital ratio of 49.82%, and $2.1 billion in revolver capacity.

DLR is in a strong financial position and should have no issues making interest payments on their debt and addressing maturities as they come due.

DLR – IR

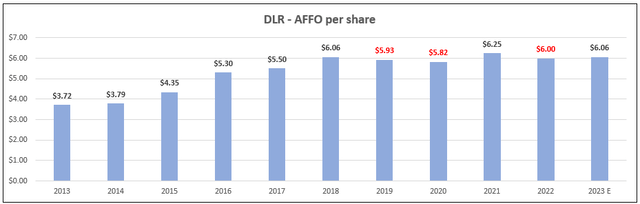

Over the last decade, DLR has had an average adjusted funds from operations (“AFFO”) growth rate of 5.31% and only had 3 years of negative AFFO growth since 2013.

Digital Realty generated $3.72 per share in AFFO in 2013 and analyst expect AFFO per share to increase to $6.06 by the end of 2023.

Since 2019, AFFO growth has slowed, but DLR is still growing albeit at a slower pace. It will be interesting to see what impact A.I. will ultimately have on DLR’s AFFO per share, but I expect it will help DLR return to growth. Analysts expect AFFO per share to increase by 3% in 2024, and then increase by 7% in 2025.

FAST Graphs (compiled by iREIT®)

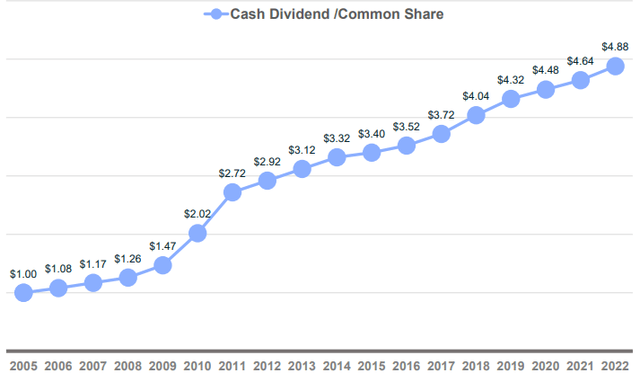

Digital Realty’s dividend has been very reliable for quite some time and has been increased each year since 2005.

From 2005 to 2022, DLR grew its dividend at a compound annual growth rate of 10%. The dividend is well covered with a 2022 year-end AFFO payout ratio of 81.33% and an expected 2023 AFFO payout ratio of 80.52%.

DLR – IR

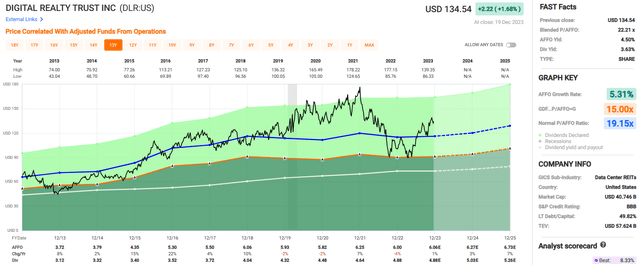

DLR pays a well-covered 3.63% dividend yield and is trading at a premium to its 10-year average AFFO multiple.

Currently shares of DLR are trading at a P/AFFO of 22.21x, compared to its 10-year average AFFO multiple of 19.15x. With AFFO growth moderating over the last several years I would be hesitant to pay too much of a premium for DLR, but at the same time I see the business prospering over the long term and think it’s a good business to own.

Even though I’m up quite a bit YTD, I plan to hold my DLR shares.

FAST Graphs

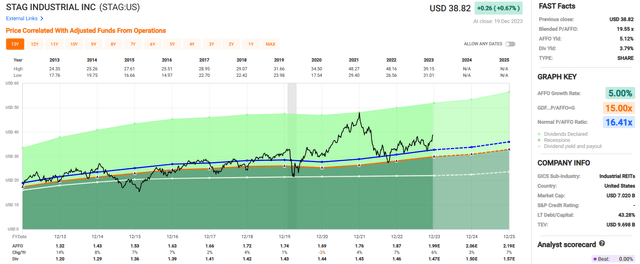

STAG Industrial, Inc. (STAG)

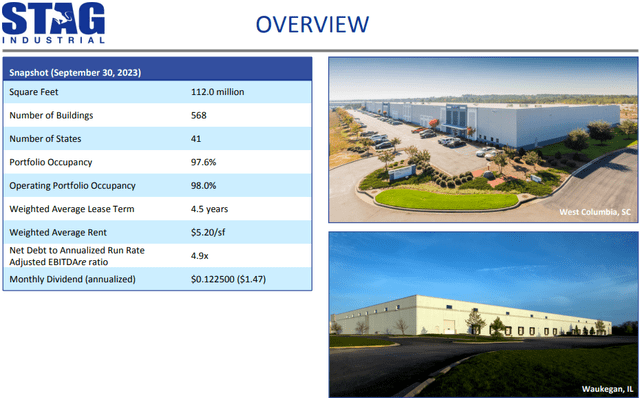

STAG is REIT that specializes in the acquisition and operation of single-tenant industrial properties with a portfolio totaling 112.0 million SF that is comprised of 568 industrial properties located across 41 states within the U.S.

STAG investment strategy revolves around 2 main principles:

- That single-tenant industrial properties have a binary risk in that the building either has a tenant or not, and that the market prices single-tenant industrial properties with a higher risk profile and consequently a lower value relative to its cash flow. STAG’s strategy is to own a portfolio of many single-tenant industrial properties which mitigates the binary risk associated with any one property.

- STAG’s not opposed to grabbing low-hanging fruit. Now wait a minute, I’m not saying that STAG acquires low quality or inferior properties, what I am saying is that STAG is not opposed to targeting properties that are in middle markets and does not exclusively target primary or gateway markets. STAG’s reasoning for this is that middle markets do not garner the same attention from institutional investors and are highly fragmented where the competition for acquisitions tends to be local investors without the same access to debt or equity capital. Essentially, STAG is not opposed to being the biggest fish in a small pond if the risk-adjusted returns warrant it.

At the end of the third quarter, STAG had a portfolio occupancy of 97.6% with a weighted average lease term (“WALT”) of 4.5 years.

STAG – IR

Okay, as a shareholder of STAG I’m up a little more than 20% YTD – should I sell?

Google

As an industrial REIT I don’t see any issues with STAGs business model, as industrial properties continue to be in high demand and should be for the foreseeable future given the rapid adoption of e-commerce.

Like data centers, industrial / logistics properties are part of the “e-commerce trifecta” and are necessary for online retail sales and fulfillment. I see a long-runway for growth for STAG and many other industrial REITs.

A thriving property sector is great, but what does STAG’s balance sheet look like?

STAG has an investment-grade balance sheet with a Baa3 credit rating from Moody’s and a BBB credit rating from Fitch.

They have solid debt metrics, including a net debt to adjusted EBITDAre of 4.9x, a long-term debt to capital ratio of 43.28%, and a fixed charge coverage ratio of 5.7x.

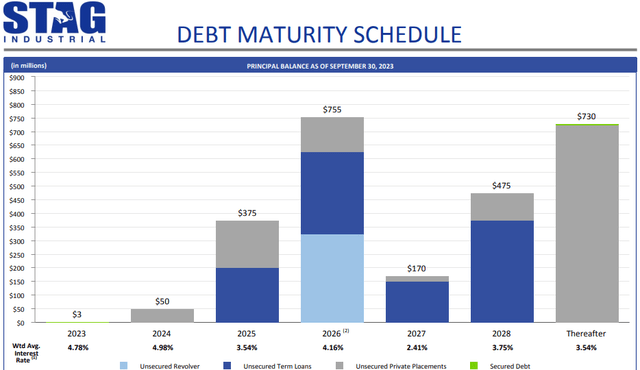

Additionally, STAG has $682.6 million of liquidity and no material debt maturities until 2025.

STAG – IR

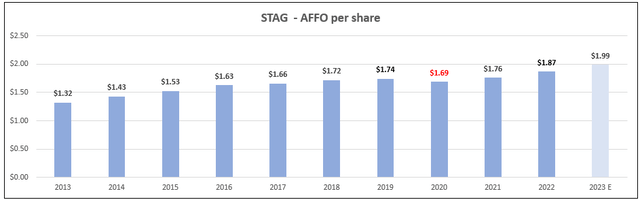

Over the last decade, STAG has had an average AFFO growth rate of 5.00% with only 1 year of negative AFFO growth since 2013.

Analysts expect AFFO per share to increase by 6% in 2023, and then increase by 3% and 7% in the years 2024 and 2025, respectively.

I don’t see anything in their earnings performance that would make me want to sell the stock.

FAST Graphs (compiled by iREIT®)

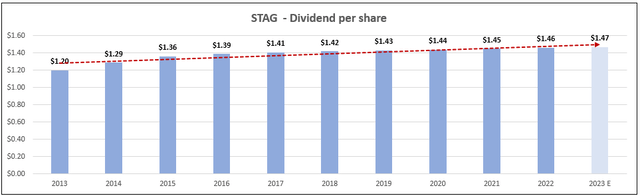

STAG increased its dividend each year since 2013 and has an average dividend growth of 3.22% over the past 10 years.

While the dividend growth has only been moderate, STAG has been very reliable with its monthly dividend, raising it each year over the last decade, even during the 2020 pandemic.

Furthermore, STAG’s dividend is secure, with a 2022 year-end AFFO payout ratio of 78.08%, and an expected 2023 AFFO payout ratio of 73.86%.

FAST Graphs (compiled by iREIT®)

STAG is a great way to add industrial exposure at a reasonable AFFO multiple.

Many other industrial REITs trade closer to a 30x AFFO multiple like Prologis (P/AFFO – 29.07x), or Rexford Industrial (REXR) (P/AFFO – 32.92x). Meanwhile, STAG is trading at a P/AFFO of 19.55x.

Granted, STAG does not deliver the same growth rates as the other industrial REITs I just mentioned, so a lower multiple is warranted, but not by 10 to 12 turns.

While STAG is trading at a discount compared to the majority of its peers, it is trading at a premium as it relates to their past earnings multiples.

Currently STAG pays a 3.79% dividend yield that is well covered and trades at a P/AFFO of 19.55x, compared to its 10-year average AFFO multiple of 16.41x.

I’m up quite a bit on STAG this year, but plan to hold on to my shares.

FAST Graphs

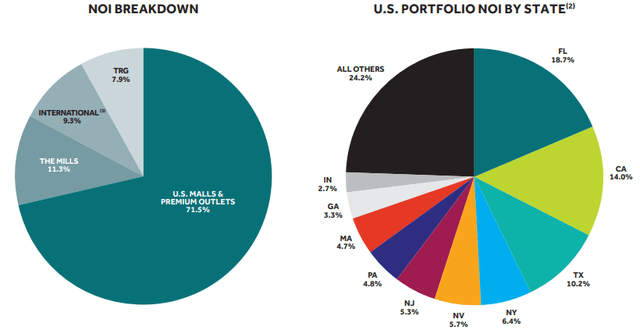

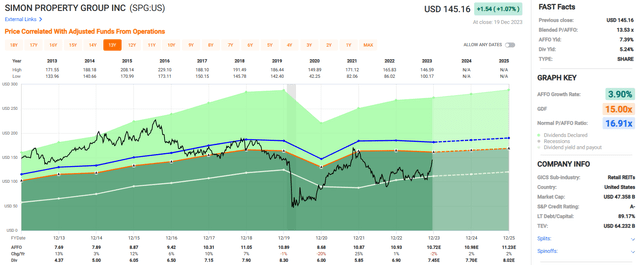

Simon Property Group, Inc. (SPG)

Simon Property is a mall REIT that develops, owns, and manages a portfolio of premier shopping, entertainment, and mixed-use destinations that primarily consist of malls, The Mills, and Premium Outlets.

At the end of the third quarter, SPG’s portfolio consisted of 195 properties across 37 states in the U.S., which includes 93 malls, 14 Mills, and 69 Premium Outlets.

Additionally, SPG has an interest in 24 super-regional and outlet malls in the United States and Asia through its 84% noncontrolling interest in the Taubman Realty Group (“TRG”).

Internationally, SPG owns 35 Premium Outlets which are located in Europe, Canada, and Asia.

And SPG owns a 22.4% equity stake in Klépierre, which is a real estate company based out of Paris that owns or has an ownership interest in shopping centers across 14 countries in Europe.

SPG – IR

So far this year, SPG is up approximately 22%, should I sell it?

Let’s see what the business fundamentals look like in order to decide.

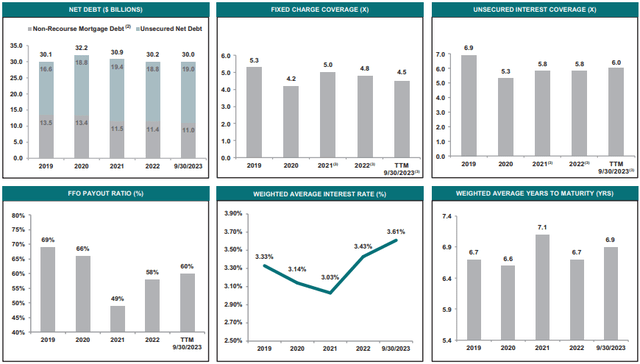

Google

Simon Properties has an investment-grade balance sheet with an A- credit rating from S&P Global and strong debt metrics including:

- total debt to total assets ratio of 42%

- net debt to EBITDA of 6.10x

- fixed charge coverage ratio of 4.5x.

- 3.61% W.A. interest rate

- W.A. term to maturity of 6.9 years

- $8.8 billion of liquidity.

Simon’s balance sheet and financial position look strong, so no worries on this front.

SPG – IR

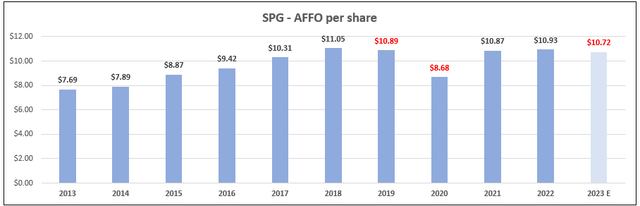

Since 2013, SPG has had an average AFFO growth rate of 3.90% and has only had 2 years of negative growth and 1 year of expected negative growth (2023).

The pandemic hit malls particularly hard, and in 2020 the company’s AFFO fell by approximately -20%, but then recovered the following year with AFFO increasing by 25% in 2021.

Since that time, AFFO growth has been muted, with AFFO per share increasing 1% in 2022, expected to fall by -2% in 2023, and then expected to increase by 2% in both 2024 and 2025.

FAST Graphs (compiled by iREIT®)

Unfortunately, as a result of the pandemic and forced closures, SPG’s AFFO fell by -20% in 2020 and forced the company to cut its dividend from $8.30 per share in 2019 to $6.00 per share in 2020, representing a dividend cut of approximately -27.71%.

I am not the type of person to make excuses, but in this case I can understand the blemish on their dividend record, as the pandemic was a black swan event and hopefully will not happen again in our lifetimes.

After the large dividend cut in 2020, SPG cut the dividend by -2.50% the following year, but then increased it by almost 18% in 2022.

One of the strongest features of SPG’s dividend is its conservative payout ratio. At 2022 year-end, SPG had an AFFO payout ratio of 63.13% and are expected to have an AFFO payout ratio of 69.49% in 2023.

Currently Simon Property pays a 5.24% dividend yield that is secure and trades at a P/AFFO of 13.53x, compared to their 10-year average AFFO multiple of 15.96x.

I’ll have to admit that malls are not my favorite property sector right now, and there are several indications that the future of brick & mortar retail will need to have an omni-channel component, which malls are not set up well to do.

However, at the same time, no one knows for sure what the future holds, and the Simon family has been making money off its real estate since 1960 and I believe they will continue to do so for the foreseeable future.

Well, I’m up over 20%, should I sell?

This one is probably the hardest for me to decide. The company’s management is top class, maybe the best in the retail space, and the company is in good financial health. They pay a high yield that is well-covered, so I don’t see any fundamental issues regarding SPG’s ability to make its dividend payments.

My only reservation is the future of malls and how they will fit in the post-covid world given consumers demand for omni-channel retailers. If the price was discounted enough, I would still add to my position in small batches, but given that the P/AFFO ratio is just several turns under its average –

I plan on holding my SPG shares for now.

FAST Graphs

In Closing

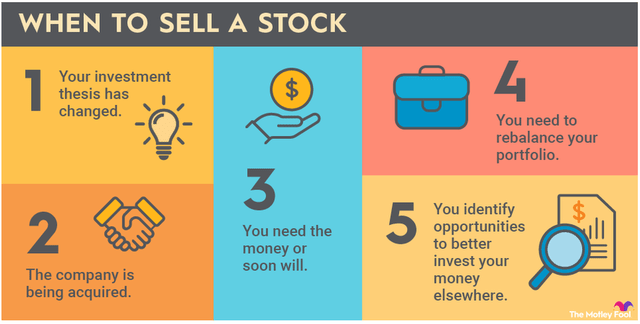

One of the biggest myths when it comes to stocks is the saying that,

No one ever went broke taking a profit.

That’s false, because selling simply due to the stock price going up is not a sound investment policy. According to Motley Fool, there are several good reasons for selling a stock:

The Motley Fool

I recently sold shares in OneMain Holdings (OMF) and Toll Brothers (TOL) in order to recycle the capital into REITs.

I also sold out of W.P. Carey (WPC) after the company cut its dividend.

I also sold my shares in Alpine Net Lease (PINE), CTO Realty (CTO), Global Medical (GMRE), and National Storage (NSA), and Postal Realty (PSTL) because I wanted to focus on blue-chip names like Agree Realty (ADC), Realty Income (O), and VICI Properties (VICI).

Inquiring minds want to know, what are you selling?

Read the full article here