PennantPark Floating Rate Capital (NYSE:PFLT) is a rather conventional BDC, which seeks to generate high-yielding streams of current income and, to a lesser extent, NAV appreciation.

PFLT, as most BDCs, targets core middle market investment opportunities. The investments are made in companies, which are primarily backed by PE houses. In terms of the financing solutions, PFLT is theoretically flexible to provide capital across various segments such as senior secured debt, junior debt, subordinated debt, non-controlling equity etc.

According to PFLT’s investment policy, the Fund incorporates a couple of overarching principles in its investment decision-making:

- Focus on capital preservation.

- Identification and bias towards strong cash flows.

- Sponsor-backed.

In many cases BDCs tend to assume additional risk (on top of private credit factor) by allocating into riskier businesses with an attempt to capture incremental basis points in yield.

However, here it is worth underscoring PFLT’s attention to cash generating companies with relatively predictable and stable business models, which clearly implies reduced exposure to VC-type, speculative investments.

Let’s now explore PFLT’s underlying portfolio and try to determine whether PFLT looks attractive considering the risks and potential return profile.

Portfolio structure

As stated a bit earlier, there is nothing extraordinary with PFLT’s portfolio in the context of average BDC players.

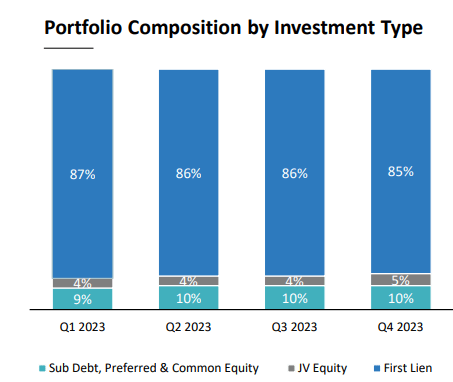

For example, the portfolio structure by investment type indicates stability and a huge skew towards first lien investments.

PFLT Investor Presentation

The fact that the lion’s share of PFLT’s portfolio is explained by first lien investments and only a relatively minor part is attributable to other and inherently more risky investment types confirms that on a fundamental level PFLT plays a conservative game.

Typically, among other BDCs the first lien bucket constitutes 70-80% of the total AuM, so from this perspective, we could argue that PFLT is positioned its business in a slightly more defensive manner than average BDC name.

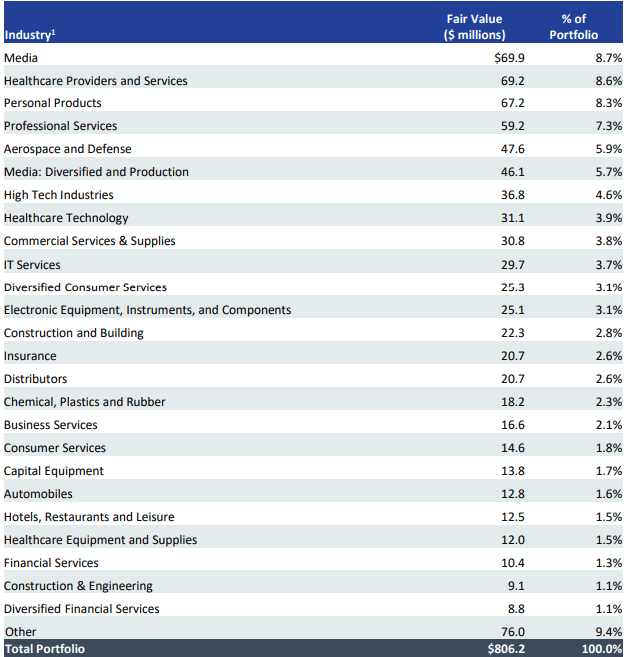

PFLT Investor Presentation

Moreover, if we express PFLT’s portfolio in industry-level, we will notice a very diversified picture with no significant concentration risks in specific industries or economic segments.

The most important takeaway from the table above is that there is no material exposure towards inherently speculative industries such as high-tech, construction and life sciences.

Finally, as PFLT’s name already implies, all of the fixed income based investments are structured with variable rate component allowing PFLT to perfectly capture the benefits of higher interest rate environment.

Thesis

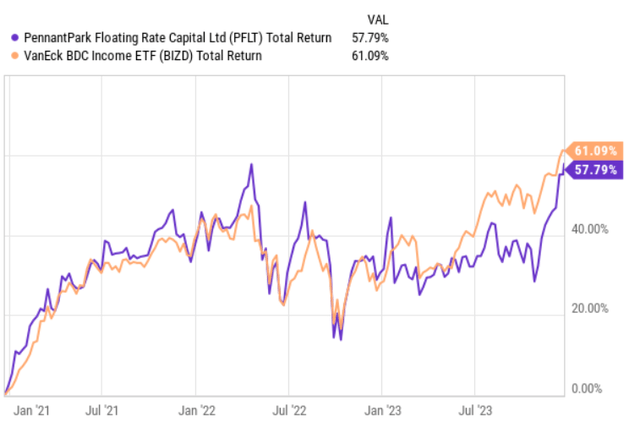

In the past 3-year period, PFLT has performed in line with the overall BDC market benefiting from the favorable environment that is associated with higher interest rates and stronger demand for private credit solutions.

YCharts

It is interesting that PFLT has not managed to capture an alpha considering that the entire portfolio is based on floating instruments, which has not been the case for other BDCs. In other words, theoretically, PFLT should have registered a bit better returns since there was no element of fixed rate investment, which has imposed difficulties for most BDCs to fully benefit from more attractive SOFR.

The offsetting factor, in my view, has been the defensive focus of PFLT to avoid overly risky investments, which have lately performed quite well (e.g., life science businesses, high tech etc.). Namely, up until now we have not noticed a major uptick in bankruptcies of cash burning or speculative businesses that has helped more risk-seeking BDCs to keep collecting higher yielding coupons.

With that being said, I think that there are two additional reasons on top of the defensive portfolio structure that make PFLT an interesting BDC.

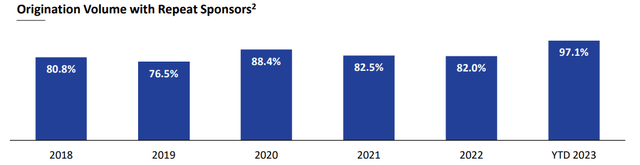

First is the historical track record of repeat sponsor transactions.

PFLT Investor Presentation

Since 2018, over 75% of PFLT’s deals have been with repeat sponsors, which introduce efficiencies and overall predictability of the further investments. The fact that PFLT can to a large extent rely on the same sponsors is critical, especially given that PFLT is known for its portfolio quality (i.e., with very minimal write-downs).

In the most recent earnings call, Art Penn – Founder, Chairman & CEO, captured this fact nicely:

Our credit quality since inception over 10 years ago has been excellent. PFLT has invested $5.3 billion in 468 companies and we have experienced only 18 non-accruals. Since inception, PFLT’s loss ratio was only 15 basis points annually.

Plus, in the Q4, 2023, PFLT did record any write-down at all.

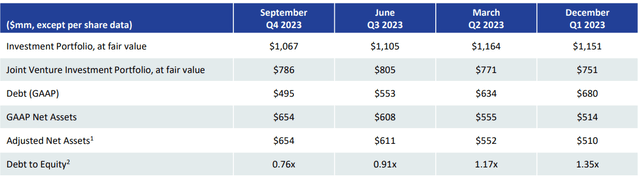

Second element, which renders PFLT’s investment case quite appealing is the level of external leverage.

PFLT Investor Presentation

Since Q1, 2023, PFLT has consistently reduced its reliance on external debt, while maintaining its commitment to dividends and also managing to increase its net asset base.

A debt to equity below 1x could commonly be deemed as a safe level compared to average indebtedness in the BDC sector. In PFLT’s case, the leverage is significantly below that signaling greater safety and lower risk of experiencing notable write downs during recessionary market conditions.

Now, even though PFLT looks more protected and resilient from the key aspects such as investment type, industry focus and leverage, the current yield is actually not that low.

Currently, PFLT distributes 10.4% in yield, which is perfectly in line with the BDC average that could be achieved via passive strategy.

The only caveat in terms of the dividend yield is the ratio between NII and dividend per share. The dividend coverage in the last two quarters stood at ~96%, which clearly indicates a low margin of safety.

However, it is highly unlikely that PFLT would have to revisit its current dividend. I would expect PFLT to go up a bit in the leverage in order to accommodate new investments, which, in turn, should provide a boost to the NII component. In fact, in the past conference call Art Penn gave unambiguous signals on increasing deal activity going forward:

We are seeing an increase in deal flow compared to the first half of 2023 and have a growing pipeline of interesting and attractive investment opportunities. Since quarter-end, we’ve continued to be active from September 30 through November 10, we’ve invested $76 million into new and existing investments and are continuing to see strong deal flow going into year-end.

The bottom line

In my opinion, PFLT offers an appealing opportunity for BDC investors to capture above 10% yield in combination with solid and resilient underlying fundamentals.

Currently, PFLT’s yield is at the same level as for the overall BDC sector. Yet, if we take a deeper look at the portfolio and financials, it is evident how PFLT is a way more safer BDC vehicle than average player in this sector. For example, PFLT carries much lower external debt load, there is no huge exposure to speculative industries and the situation of no write downs speaks for itself.

In a nutshell, PFLT offers a great risk and return profile through which I would go long on the BDC factor.

Read the full article here