Introduction

Let’s discuss Dominion Energy (NYSE:D), one of the worst utility stocks of the past few years.

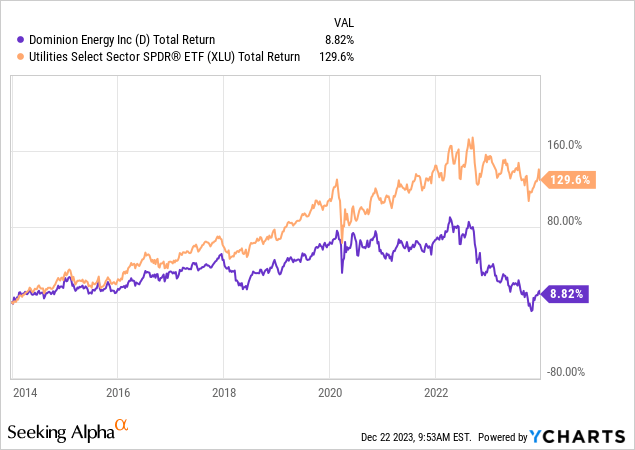

Over the past ten years, Dominion Energy returned just 9%, including dividends. This underperformed the already underwhelming 130% return of the Utilities Select Sector ETF (XLU).

On July 10, I wrote an article on the company titled “Dominion’s 5% Yield: Is The Juice Worth The Squeeze?” In that article, I discussed the company’s business transition toward more sustainable growth, a healthier balance sheet, and consistent shareholder distributions.

Here’s a part of my takeaway (emphasis added):

Dominion Energy may seem like a tempting investment with its current 5.1% yield, but the risks associated with the company should not be ignored. As a struggling utility giant facing regulatory issues, potential debt downgrades, and the challenges of the utility sector, Dominion Energy’s future is uncertain.

While the company has taken steps to improve its business and reduce costs, such as cutting its dividend and reviewing its operations, there are still concerns about its credit rating and overall financial health. The recent negative outlook from S&P suggests that countermeasures may be needed to strengthen Dominion’s credit metrics.

In this article, I’m revisiting the company with a focus on its turnaround potential.

The company is working on divestitures, debt reduction, and other measures to provide a path to sustainable growth.

So, let’s get to it!

Has Dominion Turned Into A Turnaround Play?

One of the most interesting energy/utility-related headlines I’ve read this year was the one below:

Dominion Energy

On September 5, the company announced that it had concluded a sales process of its three natural gas distribution companies to Enbridge (ENB), the largest midstream company in North America.

According to the company (emphasis added):

The transactions announcement also represents another significant step in our business review, which is focused on repositioning the company to create maximum long-term value for shareholders, employees, customers, and other stakeholders. However, our work is not complete.

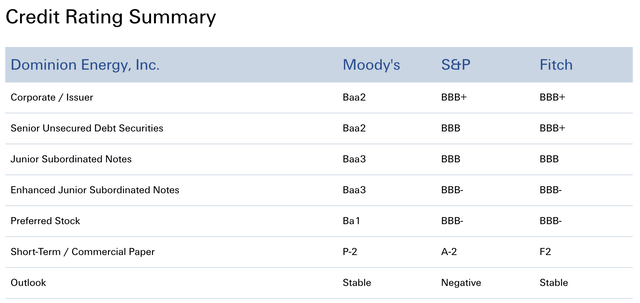

Consistent with prior communications, we are focused on strengthening the company’s credit position within its existing consolidated rating categories of Baa2 (Moody’s issuer rating), BBB+ (S&P issuer rating) and BBB+ (Fitch issuer rating). We want to emerge from the review with a sustainable credit foundation that, over time, will consistently meet and exceed our current downgrade thresholds even during temporary periods of cost or regulatory pressure.

Last month, the company elaborated on these plans when it reported its third-quarter earnings and recognized that a big part of its problems comes from the loss of investor confidence.

A critical aspect of the transformation involves fortifying the company’s financial position, which goes a long way in an environment of elevated rates.

Dominion Energy has undertaken strategic asset sales, including the sale of interests in Cove Point and the aforementioned gas utilities to Enbridge.

The proceeds from these transactions are directed towards reducing debt, contributing to a stronger and more resilient balance sheet.

This, in turn, enhances the company’s creditworthiness and financial flexibility.

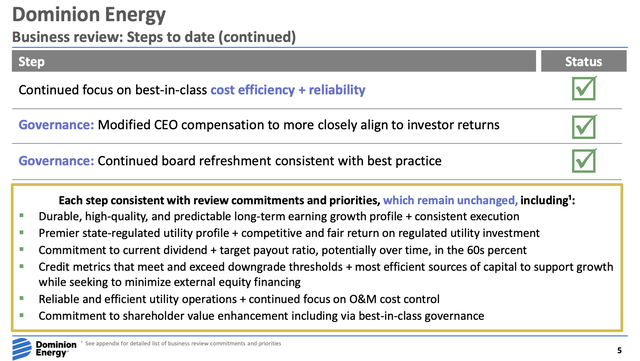

Dominion Energy

Despite the focus on debt reduction, one of the cornerstones of the business transformation is the company’s commitment to maintaining the current dividend.

During its earnings call, the company emphasized the importance of consistent dividend payouts and their role in restoring the payout ratio to a peer-appropriate range over time.

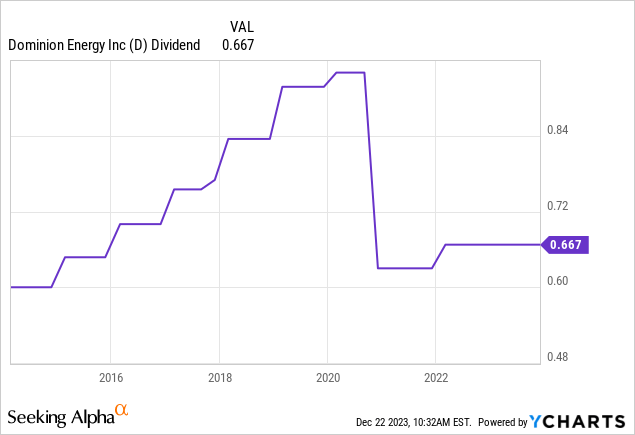

Bear in mind that in 2020, the company cut its dividend by 33%. Almost exactly two years ago, the company hiked its dividend by 6% to $0.6675. This currently implies a 5.6% yield, which is quite attractive (ignoring everything else).

The reason why dividend growth has been flat since December 2021 is the focus on earnings growth, which is now more important than dividend growth.

After all, investor confidence needs to be regained, which relies on smart investments.

Hence, as part of the transformation, Dominion Energy is proactively addressing concerns about the quality of earnings.

During its earnings call, the company mentioned the elimination of future operating earnings from sources considered to be of low quality, such as the upfront recognition of unregulated solar investment tax credits and certain gains from asset sales.

This commitment to higher-quality earnings is a strategic move to align the company’s financial performance with shareholder expectations.

As a result, the company views 2023 as a transition year due to the pending results of these actions. The retroactive reclassification of assets being sold as discontinued operations and other nonrecurring items contributes to the complexity of modeling for the year.

This makes sense, as even the smallest utility it sold (Public Service Company of North Carolina) had a deal value of more than $3 billion, including debt.

When it comes to measures to enhance growth, opportunities arise from near-term regulated rate-base investments driven by demand growth, policy directives for zero-carbon energy resources, and reliability investments in grid transformation, electric transmission, and nuclear relicense renewals.

Dominion Energy

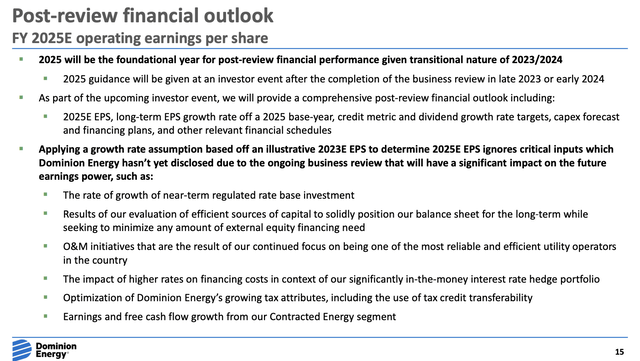

The transition is expected to continue into 2024, with 2025 viewed as the foundational year for the company’s post-review financial performance. A comprehensive post-review financial outlook, including 2025 earnings expectations, will be provided in the coming months, enhancing transparency and simplifying financial presentation.

So, what does this mean for its balance sheet? According to the company, rating agencies expect Dominion Energy’s consolidated FFO (funds from operations)-to-debt ratio to be in the high teens percent range, exceeding current downgrade thresholds.

For example, adjusting for the announced transactions, Moody’s published, they would expect Dominion Energy’s consolidated FFO to debt to be in the high teens percent range, exceeding our current downgrade threshold of 14%. But as the agencies pointed out, we expect the financing of our significant near-term customer-driven growth to put downward pressure on that metric. We want to emerge from the review with a sustainable credit foundation that over time, will consistently meet and exceed our downgrade thresholds even during temporary periods of cost, regulatory or interest rate pressure. – D 3Q23 Earnings Call

The company currently has a BBB+ (or equivalent) rating from all three major rating agencies. Only S&P has a negative outlook.

Dominion Energy

BBB+ is just one step below the A-range. Analysts expect the company to maintain a net debt level of roughly $46 to $47 billion through 2025, which translates to a net leverage ratio of roughly 6.5x expected EBITDA.

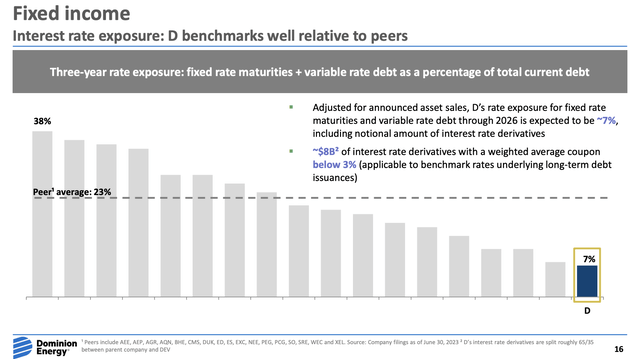

Related to this, The company acknowledged the impact of interest rates on its debt and is employing strategies such as pre-issuance interest rate hedges to manage exposure and dampen volatility.

The focus on managing interest rate risk is evident in the comparison of floating-rate debt and fixed-rate debt maturities over the next three years, benchmarking well against peers (as seen in the chart below).

This buys the company a lot of valuable time!

Dominion Energy

So, what does this mean for its valuation?

Valuation

Although the company is not yet willing to give us guidance, analysts are upbeat about its earnings per share growth potential.

Using the data in the chart below:

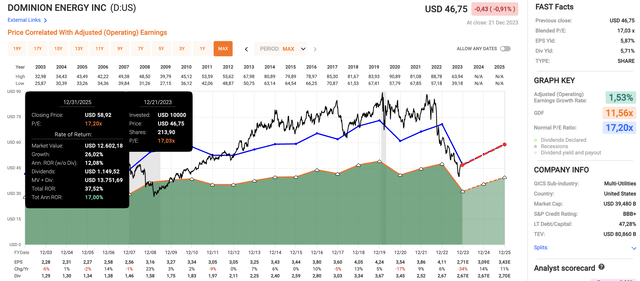

- The EPS slump is expected to be over. Although EPS is expected to decline by 23% in 2023, 2024 is expected to see 14% growth, followed by 11% expected growth in 2025.

- Dominion shares are trading at a blended P/E ratio of 17.0x. The long-term normalized valuation is 17.2x. Before the pandemic, the stock traded above that on a very consistent basis. Low expectations have pushed this number lower.

- If we assume that a 17.2x multiple is fair for the time being, the stock has a fair price target of roughly $60, which is roughly 28% above the current price.

- The current consensus price target is $48.

FAST Graphs

All things considered, I believe that Dominion is undervalued.

Hence, I’m changing my rating to Bullish/Buy.

A lot of weakness has been priced in, and although I do not expect investors to fall in love with this company anytime soon, even a fragile growth recovery warrants a higher stock price.

That said, this is not a high conviction Buy thesis. Dominion Energy remains a shaky turnaround play.

Also, if I wanted a high yield with lower risks, I would buy a midstream company like Enbridge, Energy Transfer (ET), or Antero Midstream (AM), to give you a few examples.

While I’m bullish, Dominion needs to be handled with care, especially if interest rates remain elevated on a prolonged basis. This could force S&P to cut the debt rating to BBB, likely followed by its two peers.

If I were a buyer, I would keep a small position to incorporate elevated risks.

Takeaway

Dominion Energy, once a laggard in the utility sector, is undergoing a significant transformation.

Recent strategic moves, including divestitures and debt reduction, aim to fortify the company’s financial position.

Despite a dividend cut in 2020, Dominion remains committed to shareholder distributions, emphasizing the importance of consistent payouts.

Meanwhile, the focus on higher-quality earnings and managing interest rate risk demonstrates a proactive approach to regain investor confidence.

Analysts project a rebound in earnings per share, and with a current undervaluation, a fair price target of $60 suggests potential for a 28% increase.

While the outlook is cautiously optimistic, Dominion Energy is still navigating a shaky turnaround, warranting careful consideration in light of lingering risks.

Read the full article here