Horizon Technology Finance (NASDAQ:HRZN) is a relatively small-size BDC with a heavy focus on VC-profile company lending activities.

According to HRZN’s investment policy, the following criteria are applied when considering new investments:

- Deal size up to $50 million

- Deal term based on a 3-5 year period with a meaningful interest-only period

- Priority interest over equity and unsecured debt

What comes immediately in mind when looking at the aforementioned investing criteria is that it seems that HRZN does not follow a conservative investment underwriting process.

For example, we do not see a focus on predictable cash generation, non-cyclical industries, or any other aspect that would be associated with prudent fundamental conditions.

Yet, this should not be a major surprise either as the key target segment of HRZN lies in early-stage growth companies, which are mostly backed by VC players.

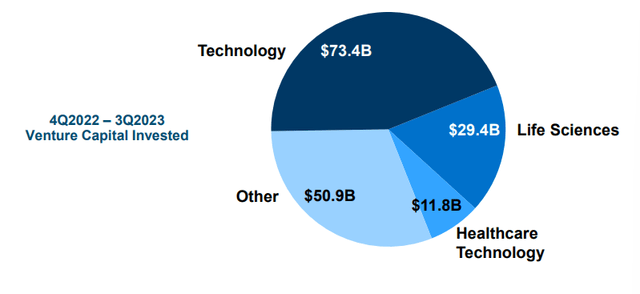

HRZN Investor Presentation

The current split of HRZN’s portfolio illustrates this situation quite nicely. Namely, the lion’s share of HRZN’s AuM lies in inherently speculative sectors such as life sciences, technology, healthcare technology, etc. The speculative nature is further boosted by the fact that the underlying companies are still in the early development stage, oftentimes requiring cash injections or loans to close the gaps in the cash generation until a new breakthrough is achieved.

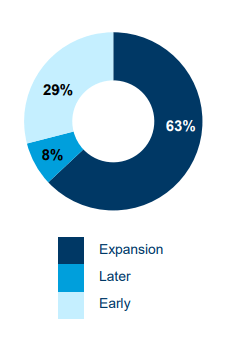

HRZN Investor Presentation

As of Q3, 2023, only 8% of the businesses that had received financing from HRZN were classified under “later stage” profile, where typically you see some patterns of cash flow neutrality.

Almost one-third of the portfolio is still in a stage which requires significant funding and where there is no certainty around whether the businesses will manage to realize a successful go-to-market strategy. In other words, roughly one-third of HRZN’s portfolio is per definition speculative.

The remaining 63% of the exposure is constituted of businesses which need capital to accommodate growth. Here it is critical to note that in most instances growth is necessary to achieve the benefits of economy of scale so that the fixed cost base could be offset by a sufficient level of top-line, thereby securing positive underlying cash flows. What this means is that these companies embody a tiny margin of error, where minor deviations from the projected growth plan could lead to an additional need for equity injection or more expensive debt financing to keep the business afloat until cash flow (or margin) targets are achieved.

In terms of external leverage, which is an important part of the business for every BDC, HRZN carries a relatively debt-saturated balance sheet. As of Q2, 2023, HRZN’s leverage profile landed at 1.2x, which could be classified more towards the aggressive end of the typical BDC player.

As a result of the elevated risk exposures, HRZN has one of the highest debt portfolio yields in the industry (as per Rob Pomeroy, CEO, in the most recent earnings call):

Our debt portfolio yield of 17.1% continues to validate structuring our investments with floating interest rates in a rising interest rate environment, we again generated one of the highest debt portfolio yields in the BDC industry.

Thesis

In my opinion, because of the additional riskiness that is associated with the nature of businesses to which HRZN provides financing, this BDC is not an attractive BDC to consider. The risk and reward ratio is off, where the return potential does not seem to justify the risk.

Let me explain.

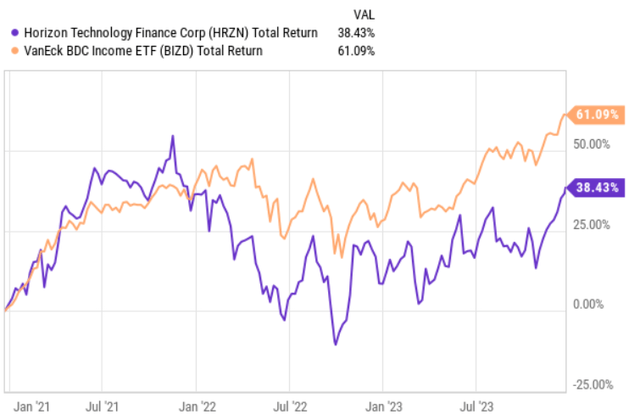

YCharts

First, HRZN has significantly lagged behind the overall BDC space even though the market conditions have been extremely favorable for BDCs. So, even during the period of strong industry-level tailwinds, where more “risk-on” BDCs should do better relative to conservative ones, HRZN has underperformed.

Looking at the prevailing dividend yield of HRZN, we can also see that it is rather difficult for the Fund to pass through the ~17% yield to investors. Currently, HRZN yields just 10%, which is even below the sector average (~11.5%).

A major reason for this is the subpar quality of investment portfolio, where, as elaborated above, a notable bias is shifted towards rather speculative and in most cases, cash burning companies.

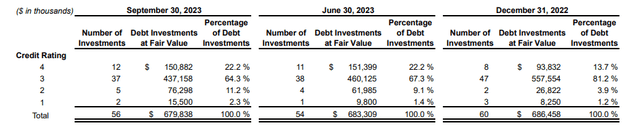

Third Quarter 2023 Financial Results

The table above is a perfect example of that.

HRZN’s portfolio quality has been consistently deteriorating since the end of 2022. For instance, while as of year-end 2022, HRZN had only 5.1% of the investments labeled as in financial difficulties with a great probability of capital impairment, now in Q3, 2023, the corresponding figure has increased to 13.5%.

This is not only material in the rate of change terms, but also in the context of the overall portfolio.

Even Jerry Michaud, company’s president, in the Q3, earnings call admitted the structural difficulties of HRZN investments:

VC activity levels remain under considerable stress as VC investments in new portfolio companies made in 2021 and the first half of 2022 are significantly overvalued in the current economic market. As a result, the ability of VC backed companies to raise new capital is challenging. Combined with a virtually closed IPO market and a muted M&A market, VC backed technology and life science companies are finding it increasingly difficult to raise much needed capital to fund operations and growth.

The bottom line

All in all, HRZN is exposed to some unfavourable risk factors beyond the ones, which are typical and already somewhat high for standard BDCs.

In HRZN’s case, there is a huge concentration in the VC-profile companies, where the majority of them are not in a position to generate cash flows in a sustainable manner and thus rely on private external financing. Such a strategy works in a low interest rate world and when the M&A and IPO markets are active. Now, when the overall financing conditions have tightened, the prospects of many early-stage, cash-burning companies have significantly weakened, rendering their financial prospects even more speculative.

Given the relatively unattractive yield of HRZN (especially in the context of the underlying risk level) and a very unfavorable trend in the portfolio quality, I would avoid investing in HRZN.

Read the full article here