Introduction

Brookfield Corporation (BN) spun off shares of Brookfield Asset Management (NYSE:BAM) in December 2022. My thesis is that there is logic in holding onto BAM shares.

The Numbers

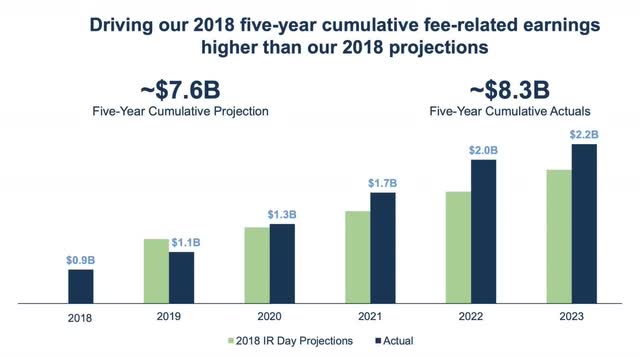

Looking back at the earnings call transcripts, it seems the BAM dividend has remained 32 cents per share per quarter or $1.28 per year since the first independent call from 4Q22. The September 2023 Investor Day presentation reminds us that back in 2018, management told us they planned to double fee-bearing capital by 2023. They have done much better than this by tripling it from $129 billion to $440 billion for a 27% CAGR. This has resulted in prodigious fee-related earnings (“FRE”) increases:

BAM fee-related-earnings (September 2023 Investor Day)

Given the above track record from 2018 to 2023, I am optimistic about FRE going up substantially in the next few years. This means dividends should go up in a meaningful way as well.

I’ve owned Brookfield for many years such that my cost basis for the BAM spinoff shares is well below today’s levels (I have a cost basis of a little over $14 in one account and a cost basis between $18 and $19 in another). When thinking about the investment today, I don’t just look at the forward dividend yield against the current share price which is over 3%. I also look at the higher dividend yield derived from my lower purchase price. Said another way, I’m expecting to get a forward dividend of about $1.28 for each share that cost me less than half of today’s share price of $39.80. If I sell shares then the capital gains taxes will be high such that my capital will shrink. Also, the number of dividend growth stocks where the tax-reduced capital could be redeployed is limited.

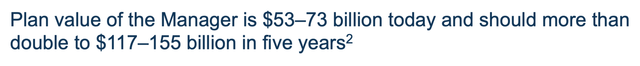

BN’s September 2022 Investor Day presentation showed a plan value of $53 to $73 billion for BAM:

BAM plan value (BN 2022 Investor Day)

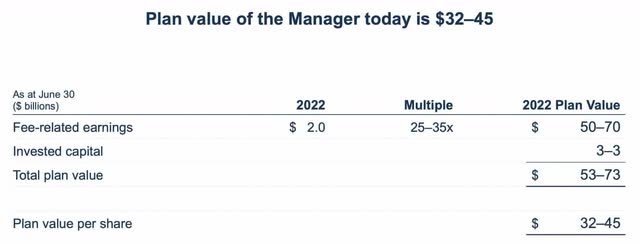

The above presentation says the $53 to $73 billion comes out to $32 to $45 per share:

BAM plan value breakdown (BN 2022 Investor Day)

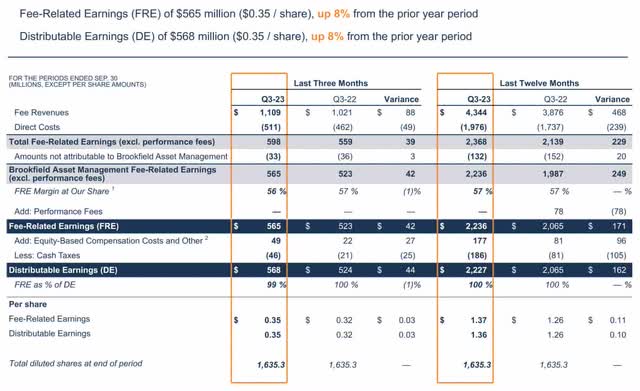

It has been more than a year since the above presentation and the fee-related earnings (“FRE”) have gone up. Looking at the 3Q23 supplemental, we have $2,236 million in trailing twelve month (“TTM”) FRE:

BAM earnings (3Q23 supplemental)

In the past, management valued the FRE component at 25 to 35x the TTM amount, which implies a range of $56 to $78 billion for this component with today’s numbers.

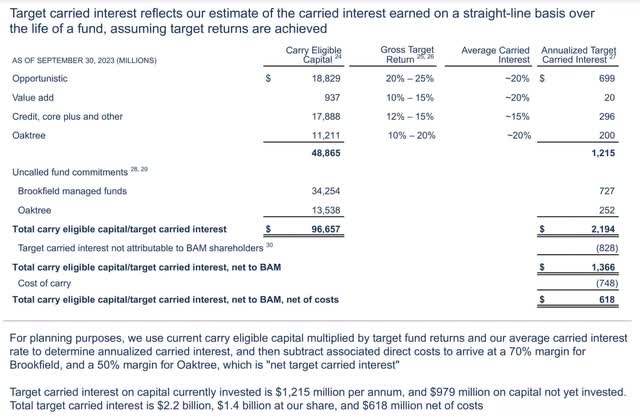

Looking at the 3Q23 supplemental again, we have $618 million in target carry:

BAM target carry (3Q23 supplemental)

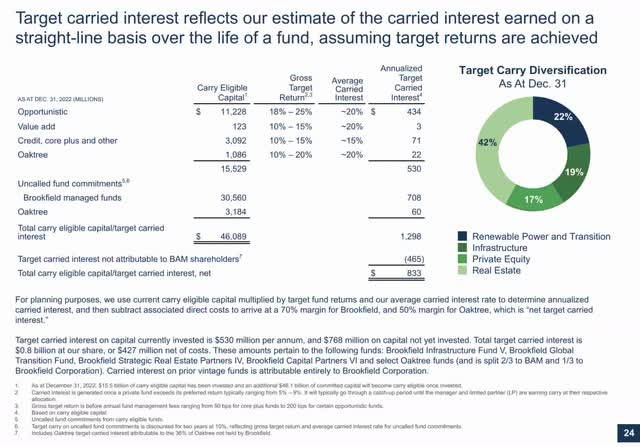

I believe the valuation of BAM’s target carry is about $6 billion, which is 10x higher than the TTM figure of $618 million. This target carry is up substantially from the $427 million we saw in the 4Q22 supplemental:

BAM previous target carry (4Q22 supplemental)

Target carry has gone up largely because the carry eligible capital for Opportunistic went up from $11.2 billion to $18.8 billion. Other laudable increases were Credit, going from $3.1 billion to $17.9 billion, along with Oaktree, going from $3.2 billion to $11.2 billion.

Summing up FRE and target carry, I think management would say the plan value is roughly $62 to $84 billion. Management may be a bit optimistic so I think the low end of the valuation range could be closer to $50 billion. Dividing the overall range of $50 to $84 billion by 1,635.3 million shares gives us a range of $31 to $51 per share. The share price as of December 22nd was $39.80 which is inside this range.

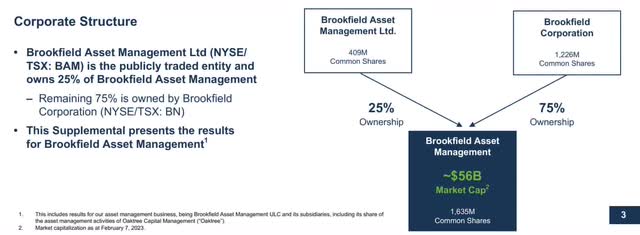

One confusing consideration when looking at BAM’s market cap is the interest held by BN. The 4Q22 supplemental shows there are only 409 million shares used in the calculation when we look at the market cap on sites like Yahoo Finance. As such, Yahoo Finance showed something close to 1/4th of the $56 billion below in February, which was about $14 billion:

BAM market cap (4Q22 supplemental)

Closing Thoughts

Forward-looking investors need to keep tabs on the corporate structure above. For example, BAM’s 2Q23 letter says BN’s ownership of BAM will soon drop from 75% to about 73% because of Brookfield Reinsurance’s (BNRE) agreement to acquire American Equity Investment Life Holding Company (AEL).

The dividend yield of the S&P 500 was about 2% from 2010 to the later part of 2020 but now it is closer to 1.5%. There aren’t many companies out there like BAM that have tremendous growth prospects while also offering a dividend yield that is about double that of the S&P 500.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Read the full article here