Introduction

At our Conservative Income Portfolio service, we look for under-the-radar bargains. KMPB is one example, and I am the only Seeking Alpha analyst covering this very interesting and undervalued baby bond.

Kemper Corporation

Kemper Corp. (NYSE:KMPR) is a well-known insurance company, actually a family of insurance companies. The fact that their name is well known may be in part due to the Kemper Open golf tournament which they sponsor. KMPR is a diversified insurance company that issues not only property/casualty insurance policies but also health and life insurance policies. They have over $13 billion in assets, have issued 5.3 million policies, and are represented by 26,000 brokers and agents. A.M Best rates KMPR as A- (excellent).

Their auto insurance segment was suffering like other auto insurers, and they were planning on raising prices to fix this situation. But recently, they made the decision to simply exit the auto insurance business. According to the 3 analysts on Yahoo Finance, earnings are expected to jump to $3.88 per share in 2024 as a result. Just a couple of days ago, broker Piper Sandler announced that they were maintaining their overweight rating on KMPR and boosted their price target from $47 to $56 per share.

These earnings estimates are a bit stale and given the huge rally that we have had in bonds over the last several weeks, I would expect KMPR to beat these estimates as, like almost all insurance companies, they hold a large portfolio of bonds. So they are seeing big gains in their portfolio now.

Kemper carries an investment grade credit rating of Baa3 from Moody’s and BBB- from S&P.

Kemper Baby Bond

KMPB has issued only one baby bond, and it is an unusual one. That is because, on its call date, the yield will reset based on the U.S. 5-year Treasury note yield. Let’s look at some of the numbers regarding this bond.

Last Price $19.45

YTM – unknown due to the reset rate

Call Date 3/15/2027

Maturity Date 3/15/2062

Yield to Call 15.19%

Reset Rate On Call Date – 5-Year T-note yield plus 4.14%

10.36% Yield to Maturity If It Resets At Today’s 5-Year Note Yield of 3.88%

Junior Bond

Credit Rating Ba1 From Moody’s and BB+ from S&P

The most important thing to note is that despite the 5-year note yield recently falling from nearly 5% to today’s 3.88%, on 3/15/2027 the yield on KMPB will still soar to 10.36% if we are at today’s 5-year note yield. That is an incredible yield for a bond from an investment grade company in what is now a lower interest rate environment for long bonds. So although the maturity on the bond is very long at 2062, this is really a play on this bond for the next 3.25 years until its call date.

With that kind of reset rate, KMPB has a very high likelihood of rising significantly in price over time as we move toward 2027. In fact, it was trading over $25.00 prior to the Fed rate increases. Although I think it unlikely that KMPB will be called, which would provide a 15.19% yield to call, I believe capital gains plus the current yield can provide a 12% annual return or better between now and its call date. And even at its current yield, pre-reset, it is attractive relative to other bonds with the same credit rating, which I will show later.

One thing to note is that KMPB is a junior bond, which is why it is rated one notch lower than KMPR’s standard BBB-/Baa3 rated bonds. A junior bond allows interest payments to be deferred for up to 60 months, but in the decades I have been investing in fixed-income, I have never seen a company defer payments on a junior bond and any deferred payments are cumulative. The credit rating already takes the fact that this is a junior bond into consideration, so it can be compared to other bonds with the same rating.

KMPB’s Undervaluation Compared With Similarly Rated Bonds

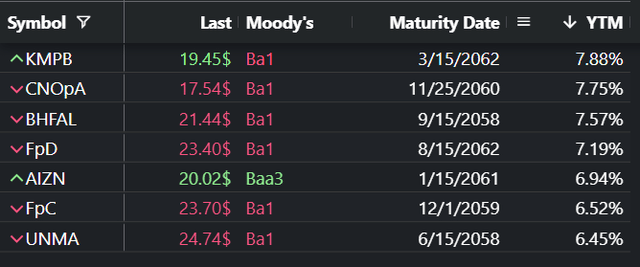

Author

Above is a list of all the Ba1 rated baby bonds with long maturity dates like KMPB. AIZN shows a Baa3 rating, but QuantumOnline.com shows that it is a Ba1 rated bond, and S&P gives AIZN the same rating as KMPB. As a side note, BHFAL is also a junior bond like KMPB.

So even without factoring in KMPB’s excellent reset rate, which is likely to move its yield way above its peers, KMPB is undervalued. And on top of that, KMPB is a much shorter play than these other bonds as we are really looking at KMPB as a 3.25-year investment or shorter where we expect to achieve a large total return. I don’t think of this as a 39-year bond and don’t expect to hold it beyond its call date unless it is still undervalued and yielding above its peers.

Although the above list shows that KMPB is somewhat undervalued, it leaves out the fact that KMPB is the only one of these that has a reset-rate which will likely significantly boost its YTM in the future, making it very undervalued. So the market seems to be totally ignoring the valuable reset rate when pricing KMPB. The reset-rate also provides great interest rate protection, which the others don’t have.

Interactive Brokers

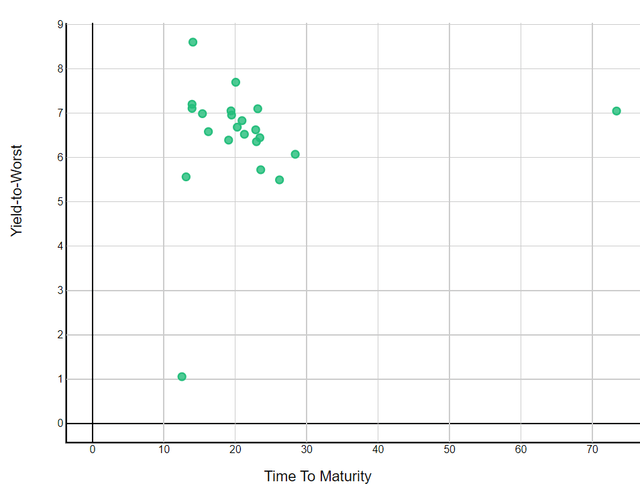

This is a scatter plot of all long-term Ba1 rated traditional bonds. As you can see, the average YTM is actually closer to 6.5% making KMPB’s current yield more than 1% higher than its Ba1 rated peer bonds, and again, this gives no value to KMPB’s reset-rate. It is surprising how the market is totally overlooking its reset-rate, but the market’s blindness is our gain.

KMPB’s Excellent Interest Rate Protection And Spread Over Treasuries

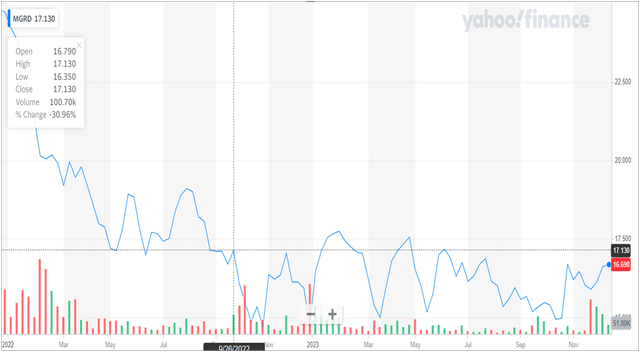

The beauty of KMPB is that it works well if interest rates rise and also if they fall. This is very important in this uncertain environment, and especially for very long-term bonds, which can be crushed by higher interest rates. We saw banks that own long-term treasury bonds and other long-term instruments get crushed as the value of their bond holdings crashed when rates rose. Below is a chart of an investment grade bond symbol MGRD to show you what has happened to its price as a result of higher interest rates.

Yahoo Finance

As you can see, it fell in price from $25 to $15 and has only gained a bit of that back due to the large drop in long-term rates we have seen in recent weeks.

Unlike other long-term bonds, the reason KMPB will do great if rates rise is that the reset rate at current rates is already 10.36% and that yield will rise in tandem with any rise in the 5-year note yield. If the 5-year note is yielding 6%, the reset yield on KMPB at its current price will become 13.33%. So absolutely no worries here if rates rise. In fact, this bond will do great if rates rise and is a good defensive play for your portfolio to offset your other bonds that will do poorly if rates rise.

And because the current reset yield of 10.36% provides a spread of 6.48% over the current 3.88% 5-year note yield, wherever rates go, even if they go lower, that is an enormous spread over treasury yields for a bond from an investment grade company. If the 5-year note drops to 2.25% by the reset date, the yield on KMPB will adjust to 8.4%. That will be an enormous yield in a 2.25% interest rate environment, and the price of KMPB should still see a good size rise in price. In fact, this security was issued at $25 with a mere 5.875% yield, so this reset yield will be very attractive in a significantly lower interest rate environment. So we really have a win/win situation here.

Summary

It looks to me that the market is totally missing that this bond (NYSE:KMPB) has a reset rate, which is why it trades so cheaply. As I wrote earlier, KMPB flies totally under the radar and I am the only Seeking Alpha analyst covering this baby bond. Even without the reset rate, KMPB trades cheaply so when the reset rate is factored in, KMPB is extraordinarily cheap/undervalued.

In the article, we showed that KMPB currently has the highest yield of all Ba1 rated baby bonds, and we looked at the typical Ba1 rated traditional bond yields and found that KMPB’s yield is more than 1% higher in yield.

But most importantly, KMPB is really a 3.25-year investment and not the long bond investment that investors seem to be focused on. On its call date, it will reset to a yield of 10.36% at today’s 3.88% yielding 5-year Treasury note. And we noted that the 10.36% reset rate is a huge spread over the current 3.88% 5-year Treasury note yield.

So we have a huge winner if rates rise. If the 5-year note is 6% on its reset date, the yield on KMPB will skyrocket to 13.33% and will certainly see a large rise in its price with such a huge spread over treasuries. It could well be called at $25 for a 15.19% annual return. If rates fall, the reset yield will also fall from 10.36%, but it will always be way above the current treasury yield, which should also lead to a nice price rise. Having a fixed-income security which will likely go up whether rates go up or down is a valuable security.

KMPB was originally issued at a 5.875% yield at $25. It is very hard to see an interest rate scenario that won’t send KMPB significantly higher over time as we head toward its call date in early 2027.

Read the full article here