Raiffeisen Bank International AG (OTCPK:RAIFF) trades at a very low valuation due to negative investor sentiment related to its Russian exposure, making it an interesting value play within the European banking sector.

Business Overview

Raiffeisen is an Austrian bank, but its operations are spread across several Central and Eastern Europe countries, serving some 18 million customers across 13 markets. In Austria, Raiffeisen operates mainly in the corporate and investment banking (CIB) segment, while in other countries it has more sizable retail operations beyond CIB.

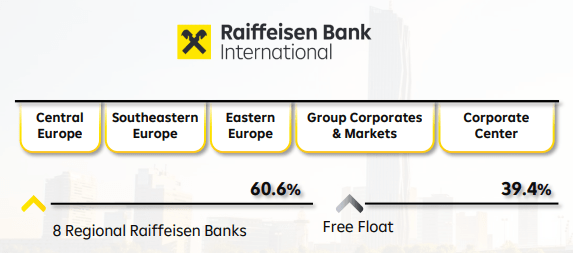

Its main shareholders are a group of co-operative Regional Banks, which together own around 60.6% of Raiffeisen’s shares, while the rest trade as free-float. The bank has been listed since 2005 and has nowadays a market value of about $6.7 billion, being traded in the U.S. on the over-the-counter market.

Shareholder structure (Raiffeisen)

At the end of last September, its loan book was above €103 billion, making it a relatively small bank in Europe, with its most important markets being Austria, Czech Republic, Slovakia, and Russia, which together account for some 75% of Raiffeisen’s loan book.

Despite this relatively good geographical diversification, Raiffeisen is quite exposed to Russia, being the Western European bank more exposed to this country. While Russia’s weight on total loans is not much large, its Russian unit has a much higher weight on revenues and profits due to high interest rates in this country and very good lending margins. Indeed, Russia has contributed to some 30-40% of Raiffeisen’s net income over the past few years, showing that is Russian unit is quite important within the group.

While Russia has been a profitable country for the bank in the past, it’s also a risky exposure due to political and economic instability. Moreover, Raiffeisen also has some exposure to Ukraine, amounting to some 1.4% of its loan book.

This risky exposure has backfired in the past, namely in 2014, when the oil price collapsed, which led to some losses in Russia plus Ukraine entered into a civil war and Raiffeisen’s exposure to the country also performed badly, leading to a turnaround program to reduce risk and boost its capital position.

More recently, the bank found itself in a tough spot when Russia attacked Ukraine in 2022, showing that its Russian exposure was questionable for its business sustainability over the long-term, despite being quite profitable for the bank. Indeed, most Western banks have decided to stop doing more business in Russia, and its peer Societe Generale (OTCPK:SCGLY) was able to rapidly sell its Russian unit during the past year. Moreover, there has been pressure from the European banking regulator, the European Central Bank, for European banks to exit Russia.

However, Raiffeisen has a long tradition in the country and has defended its ties with Russia, and so far has not yet disposed the unit or performed a spinoff, as it was planning to do some months ago.

Nevertheless, the bank announced last week a “creative” deal to extract some capital from its Russian unit, by acquiring a 28% in an Austrian construction group called Strabag (OTCPK:STBBF), through a deal with Russian sanctioned oligarch Oleg Deripaska. This stake is valued at some €1.51 billion and is planned to be transferred to Raiffeisen as a “dividend in kind,” allowing the bank to extract some capital from its Russian unit, something that currently is not able to do.

This transaction is still subject to regulatory approvals, but if approved it would be positive for the bank, by making it possible to extract capital from Russia.

Beyond this potential deal, Raiffeisen says that is still working on potential transactions to deconsolidate Raiffeisen Russia from the group, including a sale or a spinoff, and in the meantime is reducing business activity in the country to gradually reduce its exposure to Russia.

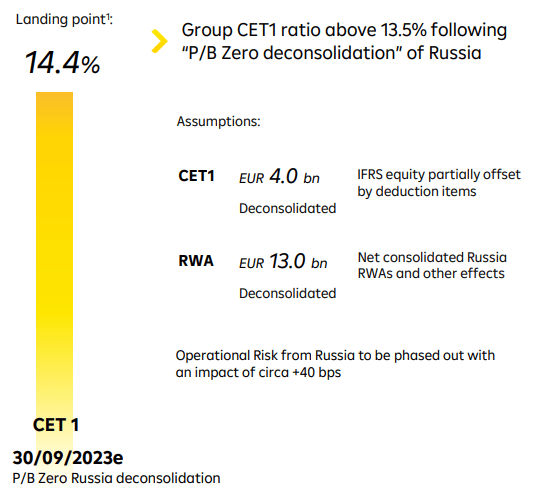

In an extreme scenario, there is some possibility that Raiffeisen’s Russian unit may be nationalized, if Russia eventually retaliates against economic sanctions from Western countries. This would be the worst case for Raiffeisen, and most likely would receive little or no value for its stake in its Russian business. In this case, Raiffeisen would lose some €4 billion of CET1 capital and reduce its risk-weighted assets by some €13 billion, having a negative impact of about 200 basis points (bps) in its CET1 ratio.

Nevertheless, its CET1 ratio would be about 14.4%, still well above its 13.5% capital requirement, thus Raiffeisen seems to be in a comfortable position even in an extreme scenario regarding its exit from Russia.

Russia deconsolidation (Raiffeisen)

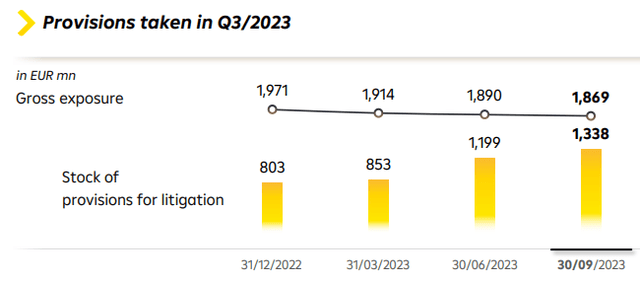

Beyond Russia, another country that has been problematic for Raiffeisen is Poland, due to an issue that was raised before the global financial crisis of 2008-09, namely Polish mortgage loans tied to foreign currencies, of which the vast majority was linked to the Swiss Franc.

This was not specific to Raiffeisen, being an issue across the Polish banking industry, and customers are still raising litigation cases against the banks. During 2023, Raiffeisen booked more than 500 million in provisions, raising its total provisions to more than €1.3 billion. Its total exposure to this issue is about €1.87 billion, thus most of this risk is already reflected in its accounts and the financial impact going forward is not expected to be a significant issue.

CHF provisions (Raiffeisen)

Financial Overview

Regarding its financial performance, Raiffeisen has reported a very good operating performance despite its risky geographical profile, as the bank benefited from higher interest rates and the fact that is one of the few Western banks that still operate in Russia, which led to increased transaction volumes from corporate customers over the past eighteen months.

Indeed, Raiffeisen reported very strong revenue and earnings growth in 2022, given that net interest income increased by 52% YoY to more than €5 billion and commissions increased by 95% YoY to nearly €3.9 billion. While its expenses also increased at double-digit figures (+19% YoY), its strong revenue growth led to an operating result of €6.1 billion, up by 137% YoY. Its reported profit amounted to €3.6 billion (+164% YoY), but excluding Russia and its gain from the sale of the Bulgarian unit, its adjusted profit was €982 million (+35% YoY).

During the first nine months of 2023, Raiffeisen maintained a very strong operating momentum, particularly when excluding Russia. Due to higher interest rates in Europe, its net interest income increased by 32% YoY to €3.16 billion, while commissions were practically flat after a very strong year.

Expenses increased at 10% YoY to €2.26 billion, leading to a cost-to-income ratio of 48% in 9M 2023, a relatively good level of efficiency within the European banking sector. Excluding its increased provisions related to CHF mortgages in Poland, the bank’s risk costs were close to zero, showing that credit quality remained quite good during a tough period of inflationary pressures and higher interest rates.

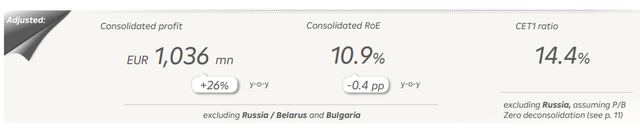

Due to the combination of positive operating jaws (revenue growth higher than cost growth) and stable credit costs, Raiffeisen’s adjusted profit (excluding Russia) increased to more than €1 billion in 9M 2023, and its return on equity (ROE) ratio was 10.9%, which is a good level of profitability compared to its closest peers.

Adjusted profits (Raiffeisen)

As shown in the previous graph, its capital ratio was 14.4% when excluding Russia at a total loss, while its reported CET1 ratio was 16.5% at the end of last September. This means that Raiffeisen is well capitalized despite the outcome of its exit from Russia, boding well for its shareholder remuneration policy in the coming years.

While Raiffeisen’s dividend history is not particularly good, given that its dividend was suspended several times over the past few years due to its exposure to risky geographies, it has recently resumed a dividend payment which is a positive signal regarding more frequent dividend distributions in the future.

Indeed, Raiffeisen suspended its dividend payments in 2022 due to its exposure to Russia and the uncertainty created by the war and restrictions to capital flows, but has resumed its dividend payments last November. Its dividend was set at €0.80 per share, which at its current share price leads to a dividend yield of about 4.3%. While this dividend yield is below the European banking sector average, it’s a good sign that Raiffeisen has a strong capital position and is positive regarding its operations in the near future. Moreover, the bank says that dividends will be decided based on the bank’s capital position excluding Russia, thus Raiffeisen seems to be in a good position to deliver a sustainable dividend even if it’s not able to extract capital or exit its Russian unit over the next few years.

The street seems to agree with this view, considering that the current consensus is for Raiffeisen to increase its annual dividend over the next three years, to about €1.20 related to 2025 earnings, thus Raiffeisen has good dividend growth prospects ahead.

Conclusion

Raiffeisen is one of the European banks with higher exposure to risky geographies, of which Russia clearly stands out. Its recent agreement to take a stake in Strabag may be a positive step in the right direction, but Raiffeisen needs to exit the country to regain investor confidence in its investment case.

Due to this background, Raiffeisen’s current valuation is among the lowest in the European banking sector, trading at only 0.36x book value. This clearly does not reflect the bank’s fundamentals and positive operating performance in recent quarters, being justified by negative investor sentiment related to its Russian and Polish operations.

However, the Polish issue is almost fixed and even excluding the Russian unit, Raiffeisen is trading at an adjusted price-to-book value of only 0.47x. This is much lower than the sector’s average of 0.88x book value, thus Raiffeisen seems to be an interesting value play in the European banking sector for contrarian investors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here