Introduction

Silvercrest Metals (NYSE:SILV) is a new mid-tier silver producer. Previously, they focused on exploration. However, they pivoted to production after the discovery of the Las Chispas deposit in Mexico.

Silvercrest is unique in that they have a clean balance sheet, low costs, and are generating solid FCF (free cash flow). Silver miners are rare, and silver miners with these characteristics are even rarer. In fact, Silvercrest is currently in a league of its own. I think these characteristics set it up to be a high-flyer as silver prices rise.

Nearly all of its peers have significant debt, high costs, or both. Silvercorp is perhaps the one silver miner that can match up with Silvercrest; however, who wants China exposure? That risk removes Silvercorp as a true peer.

From a risk-reward standpoint, Silvercrest stands out. It’s the highest-rated silver miner in my database for that reason. Best in class.

I suppose you can compare Silvercrest to the two silver miner ETFs, which are SIL and SILJ. The question you have to ask yourself is will these ETFs match Silvercrest’s performance? I would say no, but they do offer less risk. If you are more on the conservative side, then ETFs might be your go-to stocks.

Buying a silver miner is really a bet on higher silver prices. If you don’t expect silver to rise substantially, then they don’t make sense from a risk-reward perspective. These are highly volatile stocks that can easily lose money. Conversely, if silver rises, the leverage can give you 100% returns in a single year.

If you look at the silver chart (see below), it has been in a 3+ year correction, after running from $18 to $29 in 2020. It is my belief that we are on the verge of a breakout, and I will state my reasons why. If silver does break out, then Silvercrest is an ideal place to participate.

Monthly Silver Chart (Trading View)

While silver has been in 3-year correction since it’s last run from April 2020 to July 2020, it also had an 8-year basing from 2013 to 2020. Technically, this is a powerful setup, and one that should not be ignored.

If silver can get above $27, there is a very good chance it could make a run at $30. And if it can get above $30, there is very little resistance above that level. There is a little bit of resistance at $35/$36, but that’s it. In fact, I expect silver to run from $30 to $50 within 6 months after $30 is breached. Will that happen in 2024? My guess is yes, and here is why.

The US economy is wobbling. If you have paid any attention to the economy since 2000, then you know that what has been occurring is disconcerting. Let’s use some bullets to look at the last 24 years.

- The dot-com bubble popped in 1999-2000.

- In 2001, we had the 9/11 recession.

- From 2002 to 2007, we had the housing bubble, which popped in 2008.

- In 2008, we had the GFC (Great Financial Recession).

- From 2009 until 2020, the Fed used artificially low interest rates (free money) and money printing (debt expansion) to keep the economy growing.

- In 2020, we had COVID, and both the US Government and the Fed expanded their balance sheets substantially.

- From 2000 until 2023, the national debt expanded from around $5.5T to $33T. The Fed’s assets increased from less than $1T to around $8T (via printed digital keystroke dollars).

- Annual interest on the national debt has reached more than $800B, and is rising because we have to roll over about $4T in debt in 2024 (pay off the principal with new loans).

- The government will have a deficit of around $2T in 2024, and it could be much higher if we have a recession.

- The Ukraine War has created an economic alliance between Russia, China, Iran, and Saudi Arabia. This has had the effect of a movement toward de-dollarization. It has also expanded the BRICS alliance and created a Global South multi-polar economic world.

- Inflation has raged and the consumer has been squeezed. It is estimated that more than 50% of households are living paycheck to paycheck. While the rate of inflation has come down, costs have not.

- The economy is slowing, with both PMIs (manufacturing purchasing managers index) and LEIs (leading economic indicators) that are indicative of a looming recession.

- An extended inverted interest rate yield curve points to a recession. We have not had an inverted curve of this length since the 1950s that did not result in a recession.

- All of the macro gurus (a long list) that I follow expect a recession. Not a single one expects a soft landing. I will name two who are saying they have never in their lifetime seen this big of an economic bubble: Jeremy Grantham and Stanley Druckenmiller.

- Many are calling this the everything bubble. I call it the debt bubble.

- Historically, stock markets drop when you have a recession.

- Historically, stock markets drop when the Fed lowers rates.

I hope that is enough evidence for you. I will also list myself. I have followed the economy since 1980, and I have never been this bullish for silver.

Why am I bullish for silver? Well, like Jim Rogers likes to say, it’s 50% off its all-time high of $49. It’s perhaps the cheapest commodity. But that’s not the reason. I’m bullish on silver because of the GSR (gold-silver ratio). It’s currently over 80. In 1980, it dropped to 17. In 2011, it dropped to 39. Those were the last two gold bull market tops. This time, I expect it to reach around 30. Thus, silver miners will have 2x the leverage as gold miners.

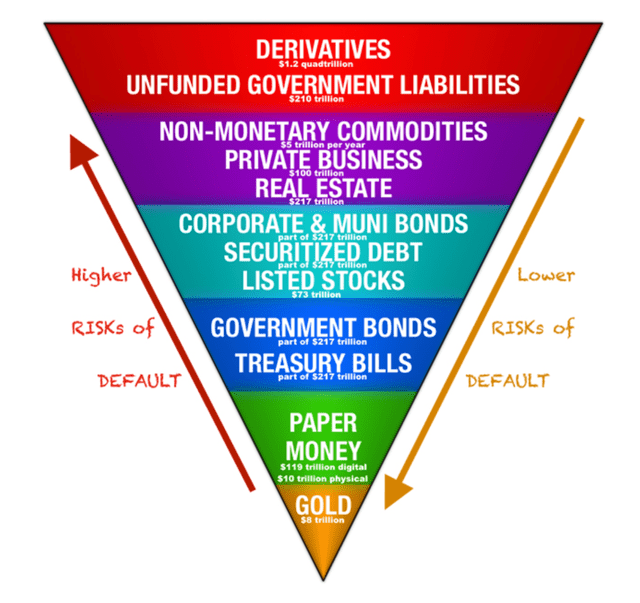

But the real reason I like silver is because of gold. If the debt bubble begins to pop, then the one asset that will benefit the most is gold. Why? Because gold does not have any counterparty risk. Exter’s Pyramid clearly shows this correlation of where investors run when risk increases (see below).

Exter’s Pyramid (wikipedia.org/wiki/John_Exter)

It is obvious to me that the debt bubble is reaching a breaking point, and gold will benefit from that event. Those who ignore this outcome will miss out on the stocks that will benefit.

Holding Silvercrest Metals seems like a no-brainer to me, both from an alpha standpoint and a hedge standpoint. I expect it to rise 100% or more in 2024, 2025, and 2026. Over that 3-year period, if it does not rise 500%, I will be surprised. It is perhaps one of the most asymmetrical bets (the probability or outcome of a trade has more profit than loss or risk taken to achieve the profit) you can place today.

Why do I expect such large returns? Simply put, I see the debt bubble beginning to pop in 2024 when the recession transpires (my expectation, which has historical odds in its favor). That popping sound will lead investors to gold as both a hedge and alpha play. Then, as gold rises, silver will come along for the ride (it always does). Why will silver rise with gold? Because most investors cannot afford gold, so they buy silver instead.

I expect the recession to begin in either Q1 or Q2 2024. Once the selling begins on Wall St, gold (and silver) will initially fall. However, at some point (S&P 3800 to 4000?), the fear trade will ignite, and gold (and silver) will decouple from the stock market and begin to trend higher.

One final point. We have not experienced the fear levels that existed in 2008 since that time. Note that it was these fear levels that pushed gold from below $1000 to $1935 from 2009 to 2012. It is my belief that those fear levels will return with this recession. That will be the trigger for gold (and silver).

|

Stock Name |

Symbol (US) |

Type |

Category |

Share Price (US) |

FD Shares |

FD Mkt Cap (12/20/2024) |

|

Silvercrest Metals |

SILV |

Silver |

Mid-Tier Producer |

$6.46 |

152M |

$1B |

Company Overview

Silvercrest Metals is a silver miner in Mexico. In 2022, they began production at their large silver/gold mine in Mexico. Las Chispas is a monster project. It has 6 miles of underground workings and 14 known veins. The resource size is 130 million oz (550 gpt silver equivalent including gold) and growing in size. They now have an FD market cap of $1 billion. Amazingly, it’s still cheap. They don’t have a second mine to build, but Las Chispas is growing in size and should extend the 8-year mine life. They already have solid drill targets to add two years to the mine (converting M&I resources into reserves). I expect this to be at least a 12-year mine and perhaps much more.

Amazingly, they already paid off the capex. It took less than a 1 year. They have $80 million in cash and bullion and no debt. Plus, they are generating sold FCF (free cash flow) with break-even costs of around $17 per oz (AISC of $11.45 last Qtr). They are producing 10M oz’s annually, so at current silver prices of $24, that is 10M x $7 = $70M a year. But consider how much leverage they have for each dollar that silver rises.

They only mine gold and silver, which decreases their risk for base metal prices. The head grade is currently around 700 gpt AGEQ (including gold). The overall resource, including inferred, is 550 gpt AGEQ (including gold). That is an excellent grade. This is a strong company with very good management, with keen exploration skills. Their strategy now is to find and develop mines. The only red flag for this stock (other than location risk in Mexico) is they don’t have a large number of insiders, thus making them a takeover target. We don’t want a major or large mid-tier to acquire it for a small premium.

Ideally, I would like to see a company of the same size merge as equals, and one with strong insiders. Aya or Gogold seem like good fits.

They are shareholder-friendly and are currently buying back shares.

Company Info

Cash: $80 million.

Debt: None.

Current Silver Resources: 130 million oz. AGEQ (including gold)

Current FCF Multiple: 14

Estimated Future Silver Reserves: 150 million oz.

Estimated Future Silver Production: 10 million oz.

Estimated Future Silver All-in Costs (breakeven): $20 per oz.

Estimated Future FCF Multiple: 18.

Scorecard (1 to 10)

Properties/Projects: 8

Costs/Grade/Economics: 8

People/Management: 8

Cash/Debt: 8

Location Risk: 7

Risk-Reward: 9

Upside Potential: 8

Production Growth Potential/Exploration: 8

Overall Rating: 8

Strengths/Positives

Significant upside potential.

Significant exploration potential.

Strong management team.

Strong balance sheet.

Excellent grade/costs.

Silver production exposure (these are rare).

Risks/Red Flags

Dependence on higher PM prices (for large returns).

Location risk (Mexico).

Speculation stock (high risk).

Takeover target.

Short mine life.

Estimated Future Valuation ($50 Silver)

Silver production estimate for the long term: 10 million oz.

Silver All-In Costs (break-even): $20 per oz.

10M oz. x ($50 – $20) = $300 million annual FCF (free cash flow).

$300 million x 18 (FCF multiplier) = $5.4 billion.

Current FD market cap: 1 million.

Upside potential: 440%.

Future Valuation Explained (recurring paragraph in my articles)

First of all, this expected upside potential is not necessarily for the next 12 months, although that is a strong possibility! This is a long-term view in 2-5 years. I don’t believe in investing for the short term. I invest for future gold and silver prices at much higher levels.

I used a future PM price of $50 silver and $3,000 gold because I am a long-term investor who plans to wait for higher silver prices. I expect to see this level reached within 2-5 years. In fact, I use $100 silver for valuations on my website since that is my expected future price.

I believe that gold drives the silver price and that macroeconomics drives the gold price. The only reason I expect to see $100 in silver is that I expect to see at least $3,000 in gold. Using a GSR (gold-silver ratio) of 30 might seem aggressive, but I think it is realistic. The GSR was 17 in 1980 and 39 in 2011.

My estimated return (440%) will only occur if all assumptions are correct. A more likely outcome will be something less than this amount, although it is not crazy talk to expect a much higher return in the long term. In fact, my expectations are much higher.

One key assumption is that costs will not explode higher. I have padded the current costs, but it’s possible that I did not pad them enough. We do not know what the future costs will be. Using $20 per oz break even costs should be conservative for the next two years. Once we get three years out, it could be an aggressive estimate.

I’m using an FCF multiple of 18 for my future valuation, and they are currently valued at an FCF multiple of 14. If silver explodes higher, then I expect them to easily reach 18 or higher (from much higher margins, an expected clean balance sheet, and a mania into silver miners).

My future All-In Costs are the expected breakeven costs per oz that will generate FCF.

Balance Sheet/Share Dilution

They have $80 million in cash and bullion and no debt. My take is they are cash-focused (watching how they quickly paid off their capex debt) and will not be a typical mid-tier producer that likes to use debt on their balance sheet. This is my favorite balance sheet strategy (debt aversion), and I wish more gold/silver mining companies would utilize it.

I do not expect them to require any more share dilution unless they acquire a project that requires a high capex.

Risk/Reward

This risk/reward looks outstanding, but it does have some risk issues. The first is they are a takeover target. I’m shocked they haven’t been acquired. The second risk is Mexico. It used to be considered mining-friendly, but it isn’t anymore. The current President and his mining regulators have been ambivalent at best with regard to allowing new permits for open-pit mining.

Everyone in the mining industry has an opinion regarding the path forward in Mexico for new open-pit mines. Some people are bullish, whereas others are bearish. I tend to lean in the bullish camp since mining provides many well-paying jobs, and the majority of mines in Mexico are open pits.

Silvercrest’s mine is underground, but if new open pits become difficult to permit, that will move many investors away from Mexico and will impact all silver miners in Mexico.

Also, permitting is just one area where Mexico has turned away from its historical mining-friendliness. As a country that was primarily controlled by the conservative PAN party, that is no longer the case. The country is now strongly influenced by a pro-union political party that is somewhat antagonistic toward business and more pro-labor.

Another risk factor is the potential for a soft landing or no landing. The longer the economy remains strong, the less likely for silver to break out. This is not my expectation, but it is a possibility.

Some would say the short mine life (7 years) is an issue. But I think it is really 9 years, after converting M&I and inferred into reserves. And with their exploration expertise and a plethora of drill targets (12-mile potential vein strike), I don’t see the mine life as a risk.

The returns for this stock should be solid if silver prices soar and they don’t have any issues at their mines. Plus, I would expect them to find a way to grow production.

Investment Thesis

I see Silvercrest as a strong silver miner that checks all of the boxes except strong insiders and a safe location. It is one of the best choices to hold while we wait for silver to break out. That could be in 2024, but if not, then 2025 or 2026 seems highly likely. My gut says we won’t have to wait until 2025. Of course, I’m just guessing.

I recognize that this isn’t a slam dunk and is a speculation bet (as are all silver mining stocks). I like to bet on many mid-tier producers (I own a lot of them), and then wait to see which ones are the winners. I don’t believe you can pick PM winners, and it is foolish to do so. Instead, I try to pick potential winners and then let the winners appear.

I keep my allocations low and never make big bets. Many investors will make big bets on stocks like Silvercrest, but I think that is a mistake. For any speculation stock, only invest what you can afford to lose. I like to say that if you worry about a stock, then your allocation is too high. It is rare for me to invest more than 1% of my total cost basis in a single stock (unless it is an ETF or mutual fund).

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2024 Long/Short Pick investment competition, which runs through December 31. With cash prizes, this competition — open to all contributors — is one you don’t want to miss. If you are interested in becoming a contributor and taking part in the competition, click here to find out more and submit your article today!

Read the full article here