For decades, Doctor Copper has diagnosed the overall health and well-being of the global economy. While copper is an infrastructure building block, the metal has increasingly become an energy commodity as green energy initiatives require increasing copper supplies. In 2021, Goldman Sachs called copper the “new oil.” Meanwhile, China is the world’s leading copper consumer, with requirements at over 50% of annual refined copper supplies.

COMEX copper futures prices (HG1:COM) rose to a record $5.01 per pound high in March 2022, when they ran out of upside steam, falling below the $4 per pound level. However, the red industrial metal has been in a bullish trend throughout this century.

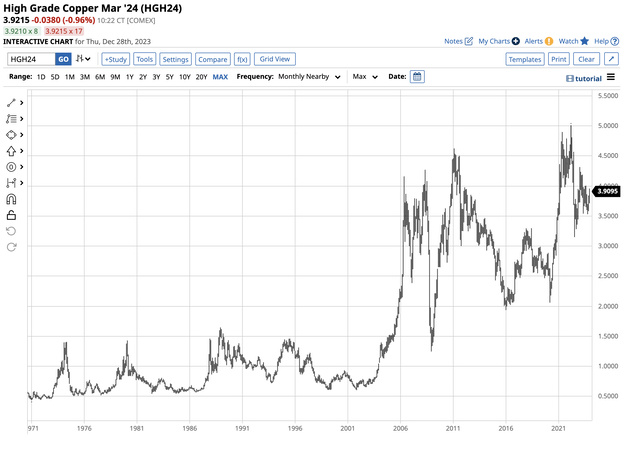

Long-Term COMEX Copper Futures Chart (Barchart)

As the COMEX copper futures chart from 1970 highlights, copper has made higher lows and higher highs since 2001. Moreover, before 2005, the price never traded above the $1.70 per pound level. The last time copper futures were under $2 was in 2016; the base metal has not been below $1.70 since 2009.

At below $4 per pound in late 2023, copper could offer significant upside potential in 2024. The United States Copper Index Fund, LP ETF (NYSEARCA:CPER) moves higher and lower with copper prices.

Copper is the bellwether industrial commodity – The price corrected from a record high and sits below $4 per pound

Copper reached its record high in March 2022, when the price moved over $5.00 per pound for the first time.

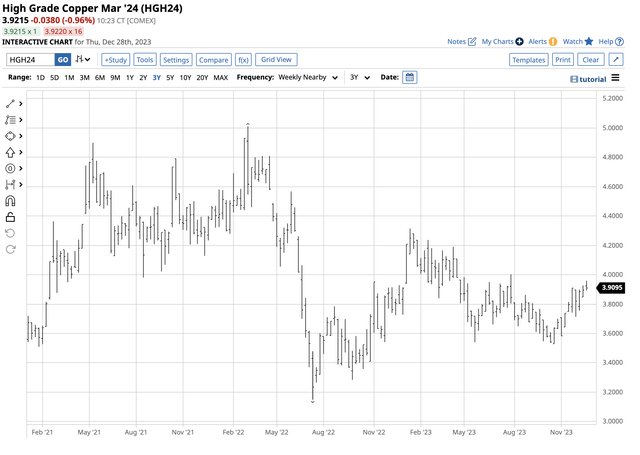

Three-Year Copper Futures Chart (Barchart)

The three-year chart highlights copper’s rise to $5.01 in March 2022 and the subsequent correction of over 37% plunge to $3.15 per pound four months later in July 2022. Copper recovered to $4.3145 in early 2023 before falling to a higher $3.54 low in May 2023. After briefly probing above the $4 level in July 2023, the red metal fell to a marginally lower $3.53 low in October as the U.S. dollar rallied, and interest rates rose to the highest level since 2007. Since late October, copper has made higher lows and higher highs, and was approaching the $4 per pound level again in late December.

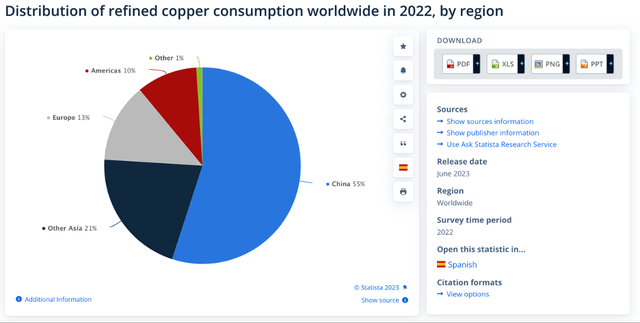

China is the leading consumer

China is the world’s second-leading economy, the most populous country, and the leading copper consumer.

Global Copper Consumption in 2022 (Statista)

The chart illustrates China’s 55% share of 2022 worldwide refined copper consumption. Economic weakness in China weighed on copper demand and prices throughout 2023.

A mining legend says new production is not possible until prices reach $15,000 per ton

Robert Friedland is the founder and executive co-chairman of Ivanhoe Mines Ltd., a Canadian copper mining company with properties in Southern Africa.

Ivanhoe is not Friedland’s first mining rodeo. Since the early 1980s, he has secured funding for the exploration and development of commodity resources, making him a billionaire.

Friedland recently forecasted that significant new copper supplies would only be available once the price reached the $15,000 per ton level. In a Bloomberg TV interview, he said:

“We probably need about $15,000 a ton, stable for a long period of time, before the industry can really gear up and build those giant mines.”

On December 27, three-month LME copper was at the $8,690.50 per ton level. Therefore, a 72.6% rally with prices remaining at that level is necessary for new supplies to come online. Moreover, it takes the better part of a decade to build new copper mines, and many reserves are in politically challenging parts of the world, like the Democratic Republic of Congo. Nearby March COMEX copper futures were at the $3.9550 per pound level on December 27. A 72.6% rally would propel the base metal over $6.80 per pound.

The four reasons to buy copper below $4

The four compelling reasons to buy copper under the $4 per pound level as 2024 approaches are:

- Interest rates: The U.S. Fed is the world’s leading central bank. At the early December FOMC meeting, the Fed continued to pause rate hikes, leaving the Fed Funds Rate at 5.375%. Moreover, the central bank forecasted rate cuts for 2024 after the November CPI and PPI data showed declining inflationary pressures. Since the December meeting, the closely watched PCE indicator showed lower inflation. Falling rates are bullish for commodity prices as they lower the cost of inventory financing. Copper is a leading bellwether raw material.

- Currencies: The prospects for falling interest rates and a soft landing in the U.S. and global economies have caused the U.S. dollar to move lower, with the dollar index heading for a test of the 100 level. While London is the hub of international copper and base metals trading, the LME prices the metals in dollars per ton. A weaker dollar tends to be bullish for copper prices, making copper less expensive in foreign currency terms.

- Supply and Demand: Green energy initiatives increase copper’s demand side. Several analysts believe copper demand could double by 2035, with miners struggling to keep pace. Electric vehicles, wind turbines, and other alternative energy sources require increasing amounts of copper. Meanwhile, the weak Chinese economy weighed on the demand side of copper’s fundamental equation in 2023. There are no guarantees that the economic malaise will continue in 2024. If China’s economy improves, the demand for copper could suddenly increase, perhaps dramatically.

- The long-term trend: Before 2005, COMEX copper futures never traded above $1.70 per pound. They have not traded below $1.20 since December 2008, below $2 since January 2016, and made a marginally higher low at the $2.0595 level as the global pandemic gripped markets in March 2020. Copper has not been below $3 per pound since October 2020. The bullish long-term trend in copper has been intact since the turn of this century, with copper making higher lows and higher highs.

Copper prices consolidated in 2023 and could be ready for another significant rally, challenging the March 2022 $5.01 per pound high in 2024.

CPER tracks COMEX copper futures

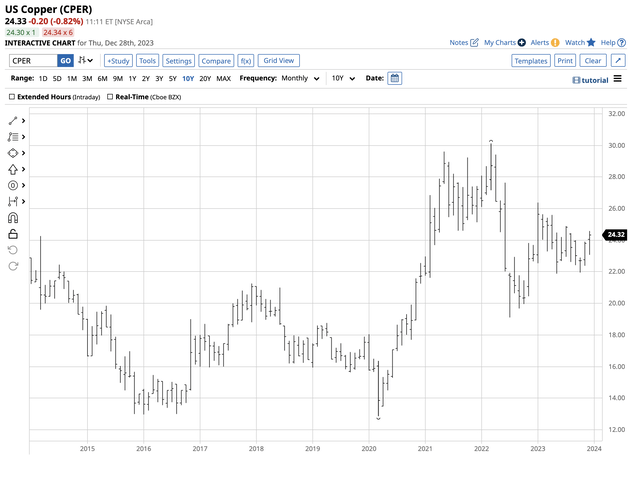

The most direct route for a risk position in copper is via the COMEX futures and futures options or the LME copper forwards and options. Copper mining stocks offer exposure, but tend to be more volatile than the metal, outperforming on the upside but underperforming when copper prices decline. The United States Copper Index Fund, LP ETF trades on NYSE Arca. At $24.33 per share, CPER had over $133.5 million in assets under management. The liquid ETF trades an average of 91,303 shares daily and charges a 0.97 management fee.

COMEX copper futures fell 37% from the March 2022 high to the July 2022 low. Since then, they recovered 24.5% to $3.9215 on December 28.

Chart of the CPER ETF Product (Barchart)

The chart shows the CPER ETF fell 36.6% from $30.12 to $19.11 per share from March to July 2022. The recovery to the $3.9215 level in December 2023 took CPER 27.3% higher to $24.33 per share.

CPER is not a leveraged ETF, so it does not suffer from time decay. It trades on the stock market and is available for standard equity accounts.

In 2023, copper prices consolidated and were up under 4% as of December 28. If China’s economy recovers, U.S. rates fall, and the U.S. dollar declines, it could create a perfect bullish storm for the infrastructure-building metal that is also a critical emerging energy commodity.

Read the full article here