The BlackRock Energy and Resources Trust (NYSE:BGR) is a CEF which provides investors exposure to an energy sector buy-write strategy.

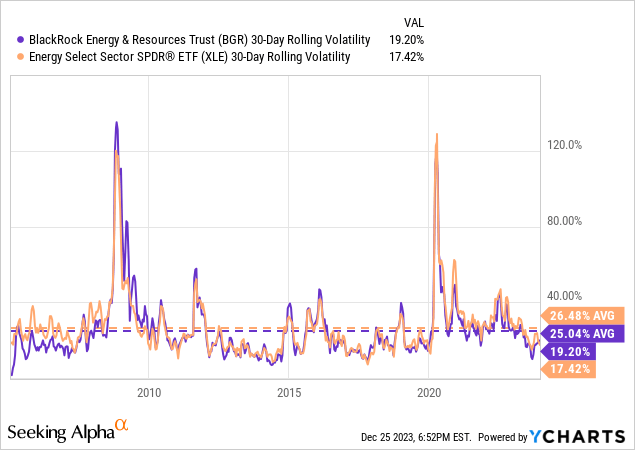

Since its inception in December 2004, BGR has delivered a substantially lower total return than comparable passive ETFs while at the same time exhibiting roughly the same level of volatility.

I believe this dynamic is set to continue going forward and thus I believe investors should sell BGR as passive low fee energy funds offer much better risk adjusted return potential.

Lower Returns But Similar Volatility To Comparable Passive Products

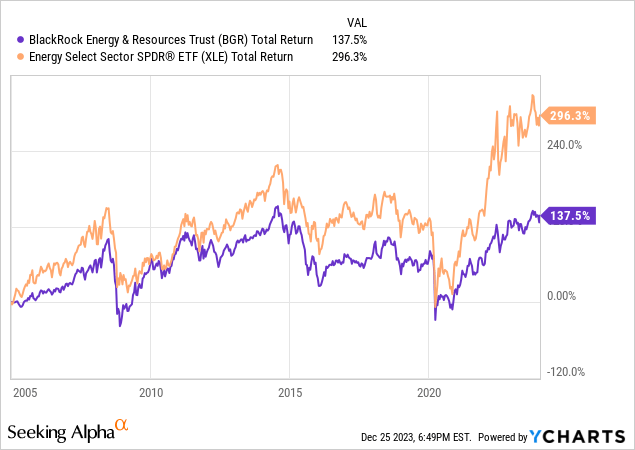

Since inception in late 2004, BGR has delivered a total return of 137.5%. Over the same time period, the Energy Select Sector SPDR ETF (XLE) has delivered a total return of 296.3%.

Despite delivering just 46.4% of the total return delivered by XLE, BGR has realized nearly the same amount of volatility. Thus, BGR has delivered worse risk adjusted returns than XLE in addition to delivering worse performance on an absolute basis.

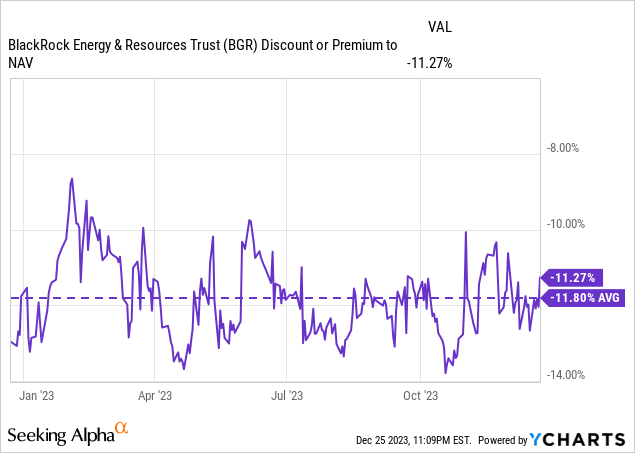

Discount/Premium to NAV Creates Additional Unwanted Volatility

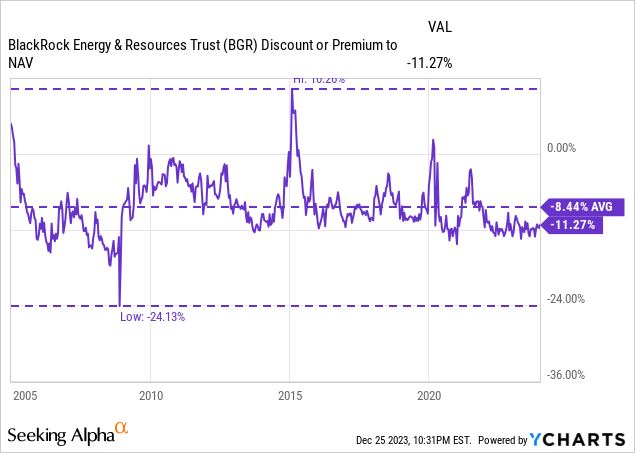

Since inception, BGR has traded at a wide range relative to its NAV. At one point BGR traded at as much as a 24.13% discount to NAV and at another point at a 10.2% premium to NAV.

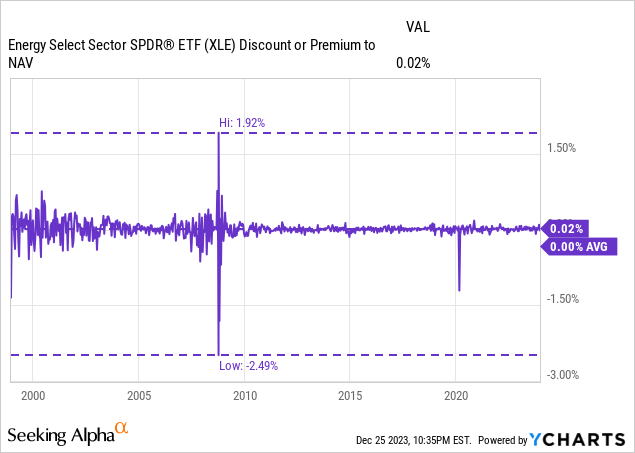

The volatility in terms of BGR’s price relative to NAV has created additional volatility for BGR shareholders. Contrastingly, ETFs tend to trade right in line with NAV and generally do not experience significant premiums or discounts to NAV.

For example, XLE has traded at an average discount to NAV of 0.00% while its most significant discount to NAV was 2.49%.

Due to this dichotomy, BGR has experienced more price to NAV volatility historically than XLE. I expect this to continue to be the case going forward.

One might argue that this additional driver of volatility is not important as BGR’s price relative to NAV tends to be mean reverting over time. However, I think this viewpoint fails to take into consideration the fact that BGR tends to exhibit wider discounts to NAV during times of equity market stress. This means that BGR is likely to perform worse on a relative basis at the worst possible time for investors who may be experiencing losses in other parts of their portfolio.

For example, consider the fact that BGR’s maximum discount to NAV of 24.13% occurred in late 2008 which was a period of sharp equity market declines. BGR’s discount to NAV also widen rapidly in early 2020 as equity markets sold off due to covid-19 fears.

Current Discount to NAV Is Roughly Inline With Historical Norms

While the fluctuation in the level of discount or premium to NAV creates additional volatility, it also has the potential to create an attractive short-term trading opportunity when levels reach extremes.

Currently, BGR is trading at a 11.27% discount to NAV. Historically, BGR has traded at an average discount to NAV of 8.44%. Thus, I do not find BGR to be trading at a highly attractive discount to NAV as a reversion to the historical mean implies just a 2.8% gain from current levels. Moreover, the timing of such a reversion to the mean is difficult to predict and BGR’s discount to NAV may widen in the event of a market stress event.

On November 15, 2023 BlackRock announced the renewal of an open market share repurchase program for CEFs including BGR. Under the program, BGR may repurchase up to 5% of outstanding common shares. However, the amount and timing of repurchases are determined by BGR’s management. During the quarter ending September 30, 2023 BGR repurchased 214,134 shares at an average discount to NAV of 12.1%. This repurchase amount is very small relative to the 27,464,975 shares currently outstanding. Given the tepid nature of repurchases during the prior quarter at a discount to NAV similar to where BGR is currently trading I do not expect the fund to get much more aggressive in terms of its repurchase program.

The fund is trading roughly inline with its average discount to NAV over the past year and thus I view it as unlikely that management decides the current level of discount is much more attractive than any point over the past year. If the management team viewed the current level of discount as highly attractive, I believe they would have already gotten more aggressive in terms of repurchases.

High Management Fee is A Headwind

Another headwind for BGR in terms of driving solid relative risk adjusted performance is its high management fee. BGR charges a management fee of 1.2% and has other expenses of 0.06%. Thus, the total expense ratio for the fund is 1.26%. Comparably, the average equity mutual fund charges an expense ratio of 0.44%. XLE has a gross expense ratio of just 0.10% while the Vanguard Energy ETF (VDE) also has an expense ratio of 0.10%.

Call Selling Limits Upside Participation

BGR attempts to generate additional income and reduce volatility through a targeted covered call selling program. This strategy has driven substantial underperformance vs products such as XLE as BGR has not fully participated in upside moves. Moreover, the strategy has failed to provide much in the way of volatility reduction.

As of November 30, 2023 BGR had written calls on 32.5% of total portfolio holdings.

Oil prices and energy equities have recently fallen but I believe this trend could reverse if the geopolitical picture in Ukraine or the Middle East were to worsen from or global growth prospects improve. Thus, from a portfolio management perspective, I do not believe it is prudent to sell calls which may limit upside participation related to energy exposure. Furthermore, energy equities trade at among the cheapest valuation (~11x forward earnings) of any sector and thus could be a coiled spring in the event that oil prices move higher from here.

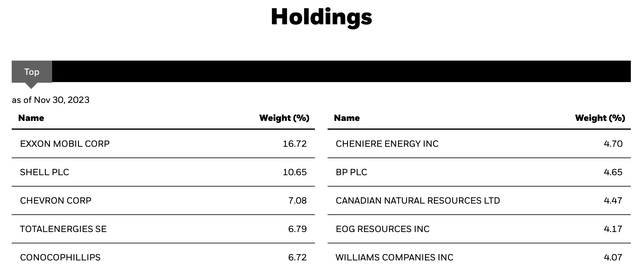

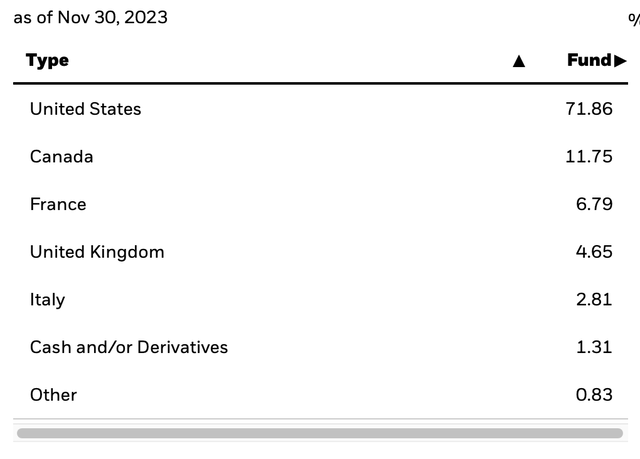

Holdings Analysis

BGR is fairly concentrated with the top 5 holdings accounting for ~48% of the fund. One notable difference between BGR and the aforementioned XLE is that BGR has ~28% exposure to energy equities outside the U.S. while XLE holds only U.S. energy equities. Another comparable products is the iShares Global Energy ETF (IXC) which has ~41% exposure to energy equities outside the U.S.

Thus, based on these facts I consider BGR to be a middle ground between U.S. focused funds such as XLE and global funds such as IXC.

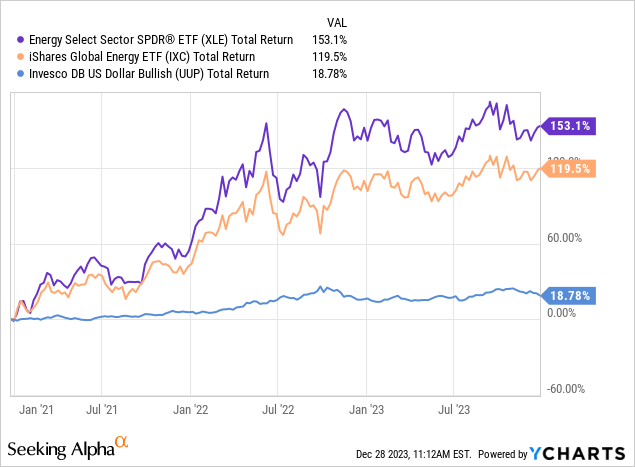

One reason why I am not a huge fan of international diversification in terms of sector exposure is that it introduces the additional impact of foreign exchange movements. For example, over the past 3 years XLE has delivered a total return of 153% while IXC has delivered a total return of 119%. During this same time period, the U.S. dollar as proxied by the Invesco DB US Dollar Index Bullish Fund (UUP) has delivered a total return of 19%. Thus, a strong dollar has negatively impacted IXC on a relative basis.

BlackRock BlackRock

What Would Make Me More Positive on BGR

In order to get more positive on BGR, I would need to see the fund trade at a much wider discount to NAV than is currently the case. By buying BGR at historically cheap levels relative to NAV (e.g. 20% discount or more) I believe the potential gains related to mean reversion would make the potential added volatility more acceptable.

Additionally, on a relative basis I would become more positive on BGR in the event that my energy market view changes such that I see more limited upside potential in oil prices.

Conclusion

Historically BGR has delivered substantially lower total returns than low fee energy sector index funds such as XLE. Despite delivering lower total returns, BGR has delivered historical volatility which is roughly the same as XLE.

A major driver of added volatility for BGR historically has been changes in its level of discount or premium to NAV. The fund tends to experience significant widening of its discount to NAV during market stress events.

In order to receive adequate compensation for the additional volatility related to BGR’s CEF structure, I believe investors should only consider buying BGR when the discount to NAV is historically wide and is likely to narrow substantially in the near-term.

I do not view the fund’s current discount to NAV as highly attractive relative to the added level of volatility due to the CEF structure. Moreover, I do not view the fund’s covered call selling strategy as a good bet in the current environment. Oil prices are low and energy stock price valuations are fairly low. Thus, energy stocks could be a coiled spring in the event of positive news for the sector.

I am initiating BGR with a sell rating as I prefer to get energy exposure via low fee ETFs such as XLE. I would consider upgrading the fund to hold if the discount to NAV were to widen considerably from current levels.

Read the full article here