VanEck Morningstar Wide Moat ETF (BATS:MOAT) is one my very favorite diversified US large cap ETFs. It invests in companies judged to have wide moats, which means they have, as Van Eck says, “sustainable competitive advantages” that distinguish them from other companies. The ability to maintain that status in good and bad markets alike is an excellent approach for long-term investors. But the question we have currently is this: at what price does that business advantage, that wide moat, become temporarily too expensive for a new buy. We think that is the predicament with MOAT, and thus as much as we like it, and would hold it if owned (I don’t, but have several times in the past), it does not get a buy from me. In a market selloff, it would be one of the first core equity positions I’d look to, as it has been throughout much of its nearly 12-year tenure.

MOAT has the same problem as the broader large cap stock market: its pricey

Despite teeter-tottering market sentiment, hawkish actions taken by the Fed, and growing concerns with the American consumer, the major indexes seemed to have shrugged off these concerns with strong performance. But can the party continue in 2024? As I’ve written recently, it could, but more likely in a year-2000 scenario, where the S&P 500 and Nasdaq 100 fly higher, then start a slow slide. In 2000, that slow slide lasted almost three years. But the last phase of the upswing, for the first nine weeks of 2000, were astonishing for bulls. They made money at a furious pace. But that was the last laugh, so to speak.

So, while I am not saying that’s exactly how it plays out in 2024, I am not willing to chase premium multiple stocks, individually or in a basket, even one as well-constructed as MOAT. The market might have already priced in events like interest rate hikes, but borrowing capital is, and remains, more expensive than it was a year ago. This may constrain expansion initiatives for many companies if demand from the US consumer persists as inflation cools. And while that doesn’t impact wide moat companies as much as small caps, after the market’s run in 2023, the odds that they all fall together, regardless of size, is now elevated. There are a lot of ETFs I trade tactically, but MOAT is not one of them. When I buy it, it’s for 1-3 years, hopefully. So it does not meet my criteria for entry now. Not with its portfolio trading at 24 times trailing earnings.

Why MOAT is always near the top of my watchlist

This post-pandemic stock market environment makes well-positioned companies a more vital addition to an investor’s portfolio. Or, in an all-weather format, a company whose competitive advantages are strong enough to guard against competition while earning high returns on capital for 20 years or more. This is how an economic moat is defined.

MOAT focuses on a large cap blend of stocks held by the Morningstar Wide Moat Focus Index. Closely replicating these factors, MOAT looks for companies with sustainable, competitive advantages and is currently most heavily concentrated in Financials, Health Care, Technology, and Industrials respectively across US equities.

With $13.3 billion in AUM, this 50-stock, equal-weighted equity ETF uses Morningstar’s forward-looking analysis that’s covered by 100 analysts globally, resulting a fund that combines two comprehensive teams conducting rigorous research (Morningstar and VanEck). MOAT will travel a bit down the capitalization spectrum, but its current weighted average market cap of $180 billion tells us that its main focus is on large cap stocks.

2024 may prove a tough environment for most companies to meet their growth targets, even with some of the best ones. But a portfolio with over 50 of those constituents can prove helpful in investing against that uncertainty. Where a Vanguard portfolio would provide you exposure to a broad market basket of securities through a strategic allocation style, MOAT takes a more dynamic approach with respect to businesses and sector rotation. The fund prioritizes single names in an equal weighted portfolio construction frame, but not the sectors themselves, strategically positioning the investor in higher performing industries within a given economic cycle.

Recent highlights

The fund has seen sizable net inflows year to date (around $4 billion), not surprising with MOAT up 32% for 2023. This is more impressive considering that the S&P 500 is more heavily weighted in technology, this year’s strongest performing sector at 28% versus MOAT’s 20% weighting. Performance attribution in this instance goes back to portfolio construction, where the fund takes a smart beta approach versus the S&P’s market cap weighted portfolio.

Despite the fund’s outperformance of the S&P 500 to date this year, MOAT still has relatively high correlation to the index at a 0.94 coefficient with a beta of 1.05. With a standard deviation of 19.8, there could be risks that the fund underperforms in an S&P 500 decline. It is not priced for perfection, but it is up there.

Price Trend Analysis

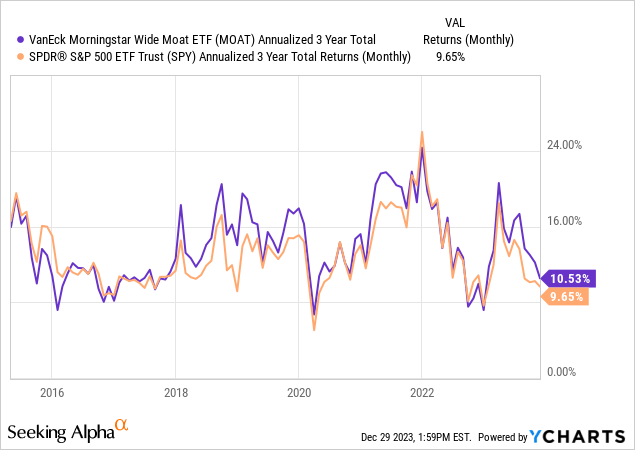

MOAT has just completed a 3-year period in which it outperformed SPY, though we see that advantage has narrowed more recently. But my bigger forward-looking concern is that barring another couple of years of sustained equity market bliss, that annualized 3-year return of both SPY and MOAT will not fluctuate in a range of 9% to 25%. Therein lies the issue for the equity ETFs I use for buy and hold purposes.

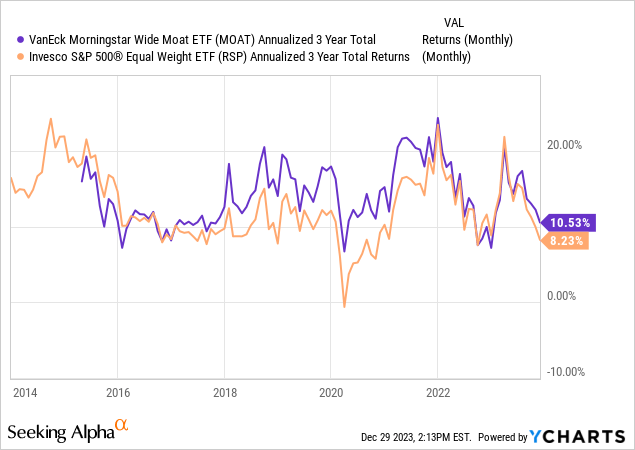

It might be difficult to see if you don’t read a zillion charts a week like I do, but here’s what I see below. When we replace SPY with RSP, the equal-weighted S&P 500 ETF, MOAT’s advantage widens. Translation: since I expect the market to lean more toward equal-weighted performance than continued mega-cap domination, MOAT will again be a place to center my core equity approach around, at a lower valuation level. This is how I’ve used it in the past.

MOAT would be a strong consideration, but currently there is not a single broad based core equity ETF I am willing to “own.” They are all “rentals” at this stage, I don’t use MOAT as a rental as I do with many other equity ETFs that target market segments, sectors, industries, etc.

Investors look to shake off the inflationary impacts that stemmed from the economic catalysts of the COVID-19 Pandemic in 2020. With inflation data cooling and the Federal Reserve signaling a possible end to their rate hiking campaign, inflation could continue lower. But I’m less an economist than I am an investor (30 years worth).

But rates will likely stay higher than many market participants are used to, so investors will need to confront lower growth rates and difficulties in companies meeting their forecasts and adjusting their annual guidance. That’s not an environment where I can jump to pay a premium earnings multiple, even for one of my favorite baskets of stocks that has been a nice winner for me in the past. I give it a hold rating because I cannot call it “broken” at this stage, just not a bargain.

Read the full article here