The ALPS Sector Dividend Dogs ETF (NYSEARCA:SDOG) is an interesting fund to consider entering 2024. This fund has caught the attention of many with its innovative approach to portfolio construction, and could be a big winner next year (at least on a relative basis).

SDOG is an exchange-traded fund, or ETF, that aims to provide investors with a high dividend yield coupled with consistent dividend growth. It employs a unique investment strategy known as the “Dogs of the Dow Theory.” The Dogs of the Dow theory is an investment strategy developed by Michael B. O’Higgins that involves selecting the top 10 dividend-yielding stocks listed in the Dow Jones Industrial Average. The strategy suggests investing in these stocks with the belief that they will eventually rebound in price.

Unlike traditional applications of this theory, SDOG selects its holdings from the S&P 500 Index (SP500) instead of the Dow Jones Industrial Average (DJI). The fund was established on June 29, 2012, and has since striven to maintain a balanced portfolio comprising the highest-yielding stocks from each sector within the S&P 500, with the exception of real estate. It currently manages assets worth approximately $1.15 billion and has a total expense ratio of 0.36%.

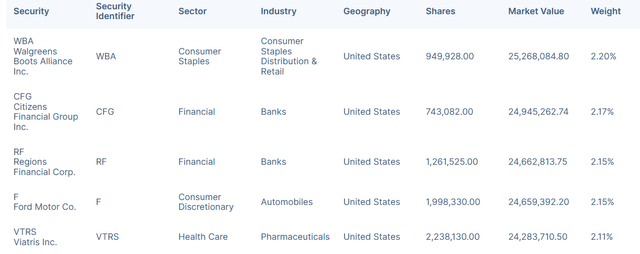

SDOG Holdings: A Closer Look

SDOG’s portfolio is equally weighted, which reduces the risk of overexposure to a single stock or sector, thereby promoting portfolio diversification. The five highest yielding stocks from each of 10 sectors (excluding real estate) are selected, creating a robust and diversified portfolio.

alpsfunds.com

However, as the fund rebalances its portfolio annually, these holdings may change over time.

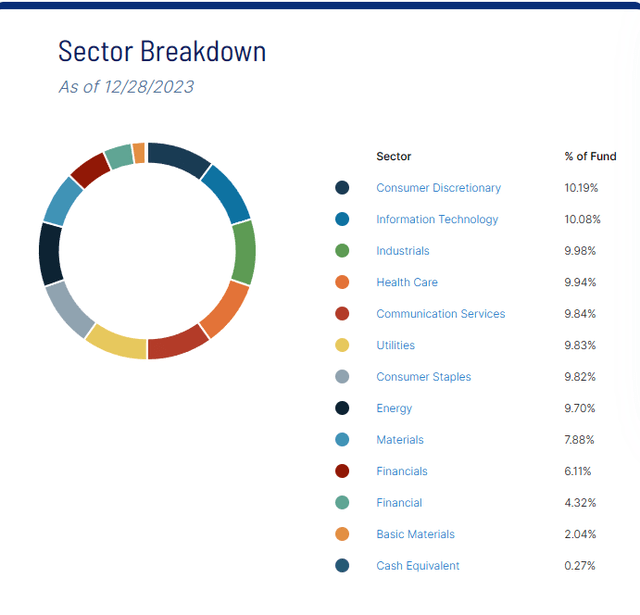

Sector Composition and Weightings

SDOG follows an equal sector weighting strategy, ensuring no single sector dominates the portfolio. This approach provides a balanced exposure to all sectors, thereby reducing sector-specific risks.

alpsfunds.com

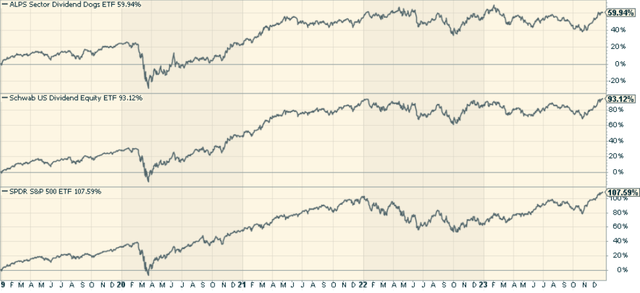

Peer Comparison: SDOG vs Similar ETFs

When investing in a specific ETF, it’s important to compare it with similar funds to evaluate its relative performance. Two notable funds often compared to SDOG are the Schwab U.S. Dividend Equity ETF™ (SCHD) and the SPDR® S&P 500 ETF Trust (SPY).

Over the past three years, SDOG has underperformed both, primarily because of the sector allocation being low for Technology, which has been the clearest winner over the last three years. Not a bad thing, just something to consider.

stockcharts.com

Pros and Cons of Investing in SDOG

Pros

- High Dividend Yield: SDOG offers a high dividend yield (4.28%), which is attractive to income-focused investors.

- Diversification: The fund’s equal-sector, equal-weight strategy promotes portfolio diversification, reducing the risk of overexposure to a single stock or sector.

- Dividend Growth: SDOG has a consistent track record of dividend growth.

Cons

- Underperformance: SDOG has underperformed the broader market (as represented by SPY) and other similar ETFs like SCHD.

- Sector Exclusion: The fund excludes the real estate sector, which can be a significant source of dividends.

- Volatility: SDOG has a beta close to 1, indicating it’s almost as volatile as the overall market.

Conclusion: Should You Invest in SDOG?

Investing in SDOG can be a viable strategy for investors seeking high dividend yields and consistent dividend growth. However, potential investors should be aware of the fund’s relative underperformance and market-like volatility. It’s also worth noting that the fund’s equal-weight strategy can limit its exposure to high-performing sectors or stocks.

SDOG offers a unique way to invest in high-dividend-yielding stocks across various sectors of the S&P 500. If you believe in mean reversion, the dogs of the S&P 500 may be worth playing through the fund as a catch-up trade in 2024.

Markets aren’t as efficient as conventional wisdom would have you believe. Gaps often appear between market signals and investor reactions that help give an indication of whether we are in a “risk-on” or “risk-off” environment.

The Lead-Lag Report can give you an edge in reading the market so you can make asset allocation decisions based on award winning research. I’ll give you the signals–it’s up to you to decide whether to go on offense (i.e., add exposure to risky assets such as stocks when risk is “on”) or play defense (i.e., lean toward more conservative assets such as bonds/cash when risk is “off”).

Read the full article here