As a recent retiree now entering the “decumulation phase” of my investing life, I am interested in collecting high yield income from stocks such as BDCs, as I have previously written about. I most recently reviewed a BDC that I added to my Income Compounder portfolio back in September, when I covered Crescent Capital (CCAP) – Crescent Capital: Joining The Ranks Of High Yield BDCs In My Portfolio (NASDAQ:CCAP) | Seeking Alpha.

Recently, there have been a number of articles discussing other popular BDCs such as Ares Capital (ARCC), FS KKR Capital (FSK), Blackstone Lending (BXSL), Main Street Capital (MAIN), and Blue Owl Capital (OBDC), which are the five largest by market cap.

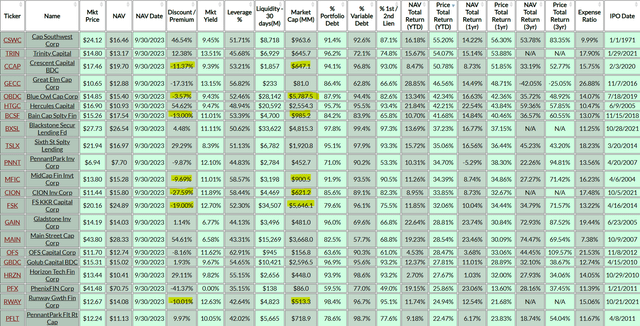

As we approach the end of the year I wanted to review the BDC performance of all the publicly traded BDCs in the BDC Universe and specifically, the ones that have a market cap of more than $100M with better expected performance from the larger (as measured by market cap) BDCs. However, that has not turned out to be the case, at least in 2023, as shown in the table below. For example, ARCC is not even in the top 20. MAIN due to its very high premium of greater than 54% does make the top 20 but is in danger (in my opinion) of a drastic drop in price whenever the next market correction occurs.

In my opinion, the BDCs that have performed well this year yet still trade at a substantial discount to NAV represent the best ones to consider in 2024 if we do see a market correction and better entry prices. Of course, credit quality is a consideration, and some believe that the discounts represent higher credit risk in the portfolios of those BDCs. That is indeed something that should be considered prior to making any investment decision.

cefdata.com

Top 20 BDCs with market cap > $100M ranked by Price Total Return in 2023. The ones with market cap greater than $500M and trading at a discount to NAV (as of 9/30/23) are highlighted in yellow.

In my personal portfolio I currently hold TRIN (which does trade at a slight premium and which I wrote about back in March), CCAP, CION (which I suggested in April should outperform in 2023), FSK (which I also reviewed in March), and RWAY on this list. I have not yet done an in-depth review of RWAY but there have been at least 6 recent Buy recommendations from other SA analysts.

Seeking Alpha

I previously held CSWC and ARCC but sold them as the premiums increased, believing that the discounts on the others would narrow as outperformance continues. I was probably wrong to sell CSWC but again with my belief that a market correction is due probably in Q1 2024, there is a good chance that there will be an opportunity to start a new position at a much better price.

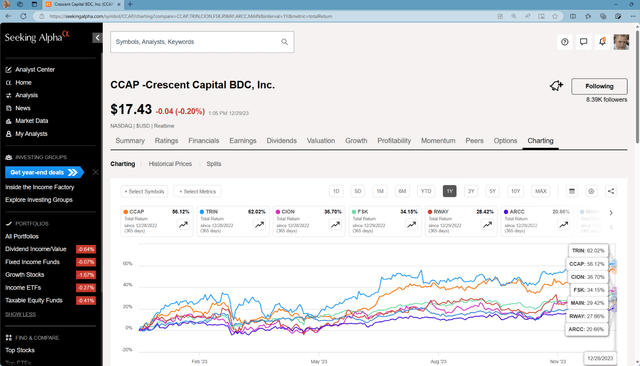

The 1-year total return performance as show in the SA charting tool shows that only MAIN performed slightly better than RWAY but the other 4 BDCs that I own all performed better than MAIN and ARCC this year (as of 12/28/23).

Seeking Alpha

While researching this article I also observed that Bain Capital Specialty Finance (BCSF) also trades at a discount of -13%, has a market cap of $985M, yields over 11% and is in the top 10 of 2023 outperformers. Several SA analysts have rated BCSF a Buy in the past few months. I am not very familiar with this BDC so if anyone has more to add please comment below.

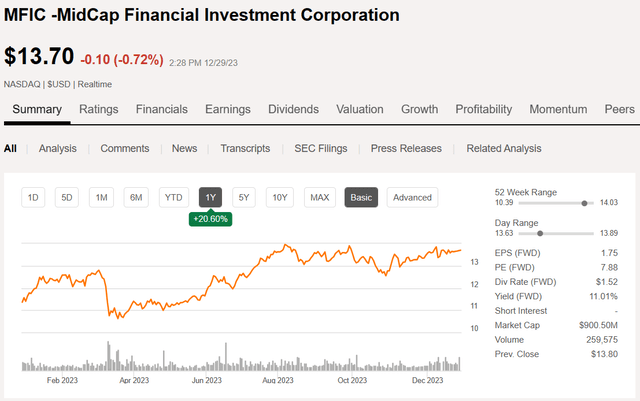

Another one that I do not currently own that is in the top 20 and trades at a discount of -9% is MidCap Financial (MFIC). MFIC yields 11% and has a market cap of about $900M. Recently in the news due to the pending merger with two CEFs – AIF and AFT, MFIC should be a candidate to consider for outperforming in 2024. According to the press release:

Combined Company Will Have Approximately $3.4 Billion of Total Investments and $1.4 Billion of Net Assets

Under the terms of the merger agreements, MFIC will be the surviving entity and will continue to operate as a BDC and trade on the NASDAQ Global Select Exchange under the ticker symbol “MFIC.” MFIC’s investment strategy will continue to focus on first lien floating rate loans to middle market companies, primarily sourced by MidCap Financial, a leading middle market lender.

The best time to have bought MFIC this year was back in March when the price dropped along with many other BDCs as shown in the price chart.

Seeking Alpha

If you are a more conservative investor and believe that the credit markets will have more defaults next year, then ARCC and MAIN might be more your cup of tea with their longer history, bigger market cap, and higher credit quality. I am also interested in the income generated by BDCs more than the capital appreciation, and those two BDCs are also lower yielding than the ones that I own, which is another factor to consider.

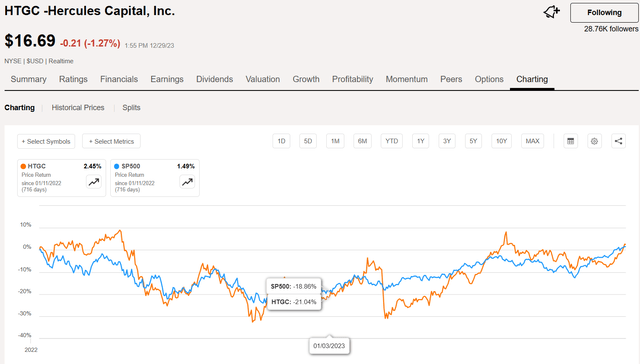

Another popular BDC which has a long history, is internally managed, is larger in size with a market cap of about $2.5B and made the list of top 20 outperformers in 2023 is Hercules Capital (HTGC). However, HTGC also trades at a very high premium of more than 54% (like MAIN) so could be due for a big price drop on any market correction. Currently, HTGC has mixed reviews with several Buy and a couple of Hold recommendations from other SA analysts. I like HTGC and even wrote a Buy recommendation in January 2022. But the venture capital market dried up in 2022 and the first half of 2023 which seriously impacted the performance of HTGC until things started getting better in November. The price performance of HTGC has mostly followed the broader market since January 2022 as shown in this chart of the price during that period.

Seeking Alpha

Like CSWC, I would put HTGC on my watch list for any big price drop during a market correction. But I would not recommend starting a new position now with the big runup in price over the past couple of months. There are other factors to consider such as the credit quality of the portfolios and the target markets that each BDC addresses as well as leverage and debt levels. And there also needs to be consideration of your own investment objectives such as income versus capital appreciation and how much risk you are willing to accept. The higher the risk, in general, the higher the reward but also more downside risk if the economy takes a sudden downturn.

In this article I am attempting to explain my rationale for the BDCs that I am currently invested in, and those that I would put on my watch list to add if there is another opportunity like the one that we had back in March after the bank failures. That was a good time to add several BDC positions because the prices of nearly all of them dropped along with other financial stocks due to the banking scare. But the prospects for many of those BDCs improved as a result of the banking crisis as they took up the slack.

This article does not attempt to identify the “best” BDCs for the future but is more of a review of how they did over the past year. Past performance is no guarantee of future results, but it can be used to help weed out those that may be worth watching. Based on this review, I will be adding BCSF and MFIC to my personal list to review further and may decide to initiate positions in one or both. I may also add CSWC and/or HTGC back to my portfolio if we get a good opportunity due to a broader market correction or another bank scare. I welcome your comments below.

Read the full article here