Thesis

The Vanguard Mega Cap Value ETF (NYSEARCA:MGV) is an equities exchange traded fund from the behemoth asset manager Vanguard. The fund has over $6 billion in assets under management, and aims to track the performance of a benchmark index that measures the investment return of the largest-capitalization value stocks in the United States. The respective index is the CRSP US Mega Cap Value Index, which provides for a diversified exposure to the largest value stocks in the U.S. market.

2023 has been the year of the tech mega-caps, with the sister fund Vanguard Mega Cap Index Fund (MGC) up over 28%. MGC is an expression of large growth mega-caps, and has been propelled forward by the outstanding performance of the ‘Magnificent 7’. MGV on the other hand has had a more muted performance, being up only 6.7% this year. Tech has outshined every other investment this year, but we feel 2024 will be different, with the baton passed to value equities.

What goes up, must come down

There is no doubt artificial intelligence will change many aspects of our lives, and it will help large tech companies with their profit generation, yet nothing can stay overvalued for too long:

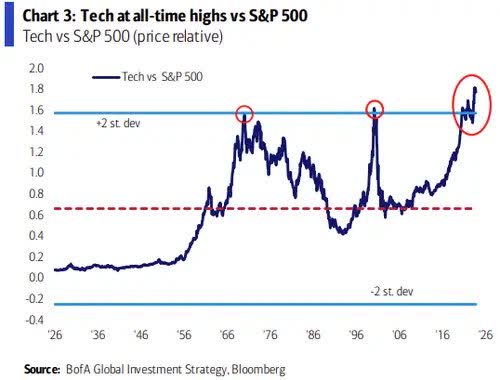

Tech vs S&P 500 (BofA)

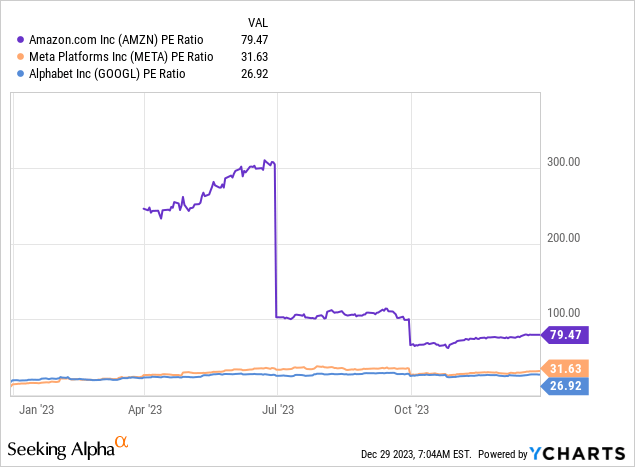

Over long periods of time, we always, always get mean reversion. The steeper the rise, the harder the fall. Tech is at an all-time high versus the S&P 500, and if history serves any lessons is that the future usually rhymes with the past. Have no doubt about it, the above chart will mean revert in the next years. We feel tech valuations are extremely stretched, and expectations are running high via extremely lofty P/E ratios:

While in an optimist scenario, tech mega caps will not crash, they will however fail to provide the same lofty returns going forward.

Large value companies are cheap

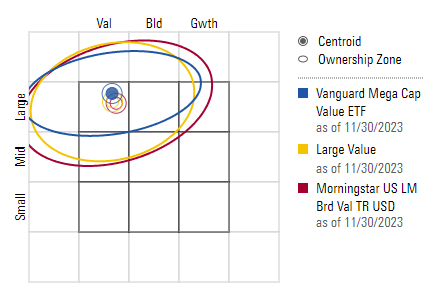

MGV falls in the Large Cap Value Morningstar box:

Morningstar Allocation (Morningstar)

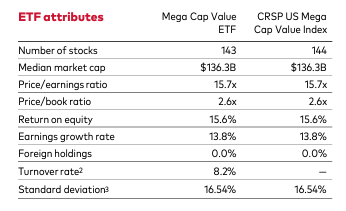

The median market cap for the ETF’s holdings is $136 billion, with an earnings growth rate of 13.8%:

Attributes (Fact Sheet)

The ‘Value’ box in the Morningstar universe references companies which exhibit more moderate or low growth when compared to the multiples exhibited by the ‘Growth’ sleeve. The earnings growth rate for MGC is 19% as a comparison point.

As opposed to tech mega-caps which have P/E ratios in the high 20s and 30s (some even higher than that), value mega-caps expose cheap entry points via a 15.7x P/E ratio. Entry points matter, and even if an asset is not as exciting as a growth stock. Buying equities at a low valuation ensures multiple expansion during a bull market. Remember the old adage ‘buy low, sell high’? We are of the opinion buying value large cap stocks here represents the ‘buy low’ portion of the respective phrase, while selling overvalued tech mega caps is the ‘sell high’ aspect.

A higher interest rate environment favors large caps

Higher interest rates take time to percolate to corporate’s balance sheets, but they eventually do. They translate into higher cost of funds for the companies’ debt, as well as a higher cost of opportunity for their projects. Initiatives that looked appealing from an IRR perspective at 0% rates are quite a different animal at 5% risk-free rates. Higher rates result in lower profitability for a company, all else equal. However, nothing is that simple, and the profile of a company’s balance sheet is very different from case to case, whilst not all industries are created equal.

Large cap companies are best positioned for today’s environment, with investment grade rating profiles and termed-out debt maturity profiles. Small and medium capitalization companies on the other hand have experienced significant trepidations:

Small cap stocks tend to feel the impact of changes in interest rates more than their large cap equivalents. Not only do small cap companies have a greater dependency on shorter term financing to help them survive but they tend to rely more heavily upon floating rate debt, strengthening the immediate impact of any increases in interest rates upon their profits.

Source: S&P

Eventually, small caps are set to outperform, but it is not time yet. We need to see a systemic and permanent shift lower in the cost of funds for that to occur. We expect that to be in 2025 and beyond. The next year will still experience high Fed Funds when compared to historic levels. That leaves us in the camp of favoring cheap value large caps, a sector which will provide an attractive risk/reward proposition going into 2024.

Analytics

- AUM: $6.3 billion.

- Sharpe Ratio: 0.57 (3Y).

- Std. Deviation: 15.2 (3Y).

- Yield: 2.5%.

- Premium/Discount to NAV: 0%.

- Z-Stat: n/a.

- Leverage Ratio: 0%.

- Effective Duration: n/a

- Expense Ratio: 0.07%

- Composition: US Large Cap Equities – Value

Historic Performance

MGV is a fund which has posted very robust long term results:

Total Return per Year (Morningstar)

Given its composition, the ETF underperforms during times of market exuberance, but excels during normalized economic cycles and during market sell-offs. The fund was down only -1.23% during a brutal 2022, while it posted an outsized result in 2019 when the Fed started lowering rates after its last monetary tightening cycle.

We expect the Fed to start lowering Fed Funds in mid-2024, and MGV to take advantage of its robust fundamentals in 2024 and 2025, with a very appealing valuation staring point.

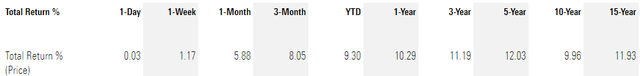

Long term annualized performance for the fund also stands-out, with the vehicle posting trailing 5- and 10-year returns in excess of 10%:

Returns (Morningstar)

The historic performance for the fund gives us the picture of a buy-and-hold vehicle, where retail investors are best served by finding attractive valuation entry points and then holding on to the investment. We think today’s environment presents that opportunity.

Conclusion

MGV is an equities ETF. The vehicle focuses on value large-cap names, and has posted only a modest 6.7% price return in 2023. We are of the opinion that we will see a change in 2024, with tech mega-caps passing the baton to value large cap equities, with tech exhibiting extremely stretched valuation metrics. MGV on the other hand has a low P/E ratio of only 15.7x, and brings to the table the solid balance sheet and funding profiles of large conglomerates. Higher rates will be a theme of 2024 as well when put into a historic context, and we think large caps are still set to outperform in this elevated interest rate environment. We like MGV for its components, stable funding profiles and low valuation entry point, and we feel capital will rotate into the new year from growth to value.

Read the full article here