I covered ServiceNow (NYSE:NOW) last January, concluding that the stock should reach $150B market cap over the next handful of years. Less than one year later, the stock is just about there.

This is yet another case study of the irrationality of the market herd. In July of 2022, sentiment on ServiceNow was extremely negative, as CEO Bill McDermott expressed concern in “macro crosswinds” and “elongated sales cycles”. What has ServiceNow done since? In April of this year, it slightly reduced its long term guidance from $16B+ in revenue by 2026 to $15B+. The long term revenue trajectory should be the most important input for investors assessing the business’ value. This should have been a negative revelation, yet the stock has soared as ServiceNow has outperformed near term expectations, raising current year guidance throughout the year.

Fundamentals

ServiceNow is an easy business to get excited about. ServiceNow’s early leaders determined the platform was far more useful beyond being a traditional IT help desk. ServiceNow is an entire workflow solution, meaning it can transfer information from one party to another in a variety of applications. In addition to IT service management, this includes managing IT operations and assets, employee requests, and customer requests. ServiceNow seems to perpetually discover new avenues where its platform can be useful, which gives investors more confidence in our year growth and performance.

ServiceNow has blasted past the organic revenue growth trajectories of behemoths like Salesforce (CRM), Adobe (ADBE), and Oracle (ORCL) by continuing to penetrate the world’s best enterprise and government customers. ServiceNow had its best quarter ever for new government deals:

From an industry perspective, this was the best US Federal quarter in ServiceNow’s history. NNACV was up over 75% year-over-year. US Federal agencies are standardizing on a single platform with a core set of end-to-end solutions. We had 19 federal deals over 1 million, including three deals over 10 million.

Our top deal in the quarter, the United States Air Force was the third largest deal in the company’s history.

It’s easy to be suspicious of CEOs like Bill McDermott that talk a big game, McDermott has repeatedly testified that his dream of making ServiceNow the defining enterprise software company of this century, but thus far, execution has been about as good as it gets.

McDermott has continually expressed customer centricity as the reason for ServiceNow’s success. McDermott shared a colorful antidote at a recent investor conference of an experience running a retail business as a teenager:

I had built a video game room on the side of the delicatessen and I let the kids in 40 at a time. And to really amplify the importance of treating your customer well at the end of a long day, one of the young people said to me, Bill, when we want to have good food, be treated with respect and play video games, we come to your store and when we want to steal stuff, we go to 7-Eleven. It’s all about the customer, man.

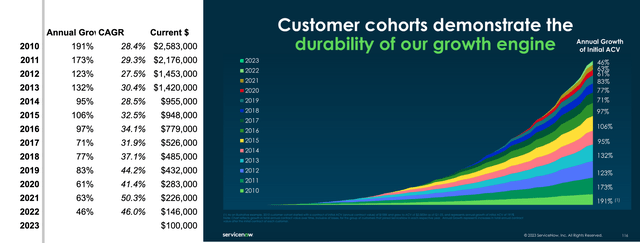

The numbers back up McDermott’s claims. As an example, in this chart shared at Investor Day each year, ServiceNow’s customer cohort from 2010 is spending over 25x this year than they spent their first year as a customer:

Author / ServiceNow Investor Day Presentation

It’s hard not to like ServiceNow’s fundamentals, it’s even harder not to like its charismatic CEO. Sentiment ebbs and flows, the principles of valuation do not.

Valuation:

ServiceNow (along with the broader market) is just beginning to crest to new highs following the November 2021 peak and subsequent rate-driven sell-off.

As software valuations compressed in 2022, the debate over whether or not to classify stock-based compensation as an expense raged. It’s become clearer that it should indeed be expensed, even if not a cash outflow. Here’s why:

During the years ended December 31, 2022 and 2021, we issued a total of 2.7 million shares and 3.2 million shares, respectively, from stock option exercises, vesting of RSUs, net of employee payroll taxes and purchases from ESPP.

If we average out ServiceNow’s stock price at the end of each quarter in 2022, we reach a price of about $592/share. Multiply this by 2.7 million shares issued, and this equals nearly $1.6B, or just slightly above the $1.4B stock-based compensation expense added back to free cash flow.

This is real value that has been transferred from shareholders to employees. In previous assessments, I may have been a bit too generous, valuing the business. This seemed to matter when valuations were falling, but investors have decided to turn a blind eye as prices have risen again.

ServiceNow trades at a steep multiple of 54x this year’s FCF, 91x if excluding stock-based compensation. This compares to 80x and 216x at the peak of 2021, respectively. This is fuel for the bulls, the argument that multiples have significantly compressed at the same valuation because of significant growth.

Sticking To Principles:

It’s easy to get drawn into ServiceNow’s spectacular narrative and want to own the stock. But when the sky starts falling, as it periodically does in the financial markets, the sole source of conviction becomes very simple math.

The bulk of ServiceNow’s value is locked up in distant future earnings. The fundamentals and management team are elite, but the possibility of a long period of underperformance after a huge rally is notable. New investors should consider waiting for a better entry point. It’s very difficult to rate such a high quality businesses as a sell, but the valuation is stretched enough the investors should begin to consider the limits on their own risk tolerances if multiples continue to expand.

Read the full article here