There’s an indication that the worst for Disney (NYSE:DIS) is likely behind it as its CEO Bob Iger is finally turning the business around. The latest relatively successful earnings results along with other recent developments point to the fact that Disney is on track to recovery and its streaming business could finally reach profitability next year. While some risks remain, the momentum that the company has going for it could likely help Disney’s shares to at least trade at the current levels in the foreseeable future.

Streaming Profitability In Sight?

Back in September, I said that Disney could be a value trap since the disappointing performance of the streaming business has negatively affected the company’s performance in recent quarters and pushed the shares to their 8-year lows. I’m happy to say that I’ve been wrong so far, as the latest earnings report for Q4 that was released last month pointed to the fact that the improvement of the company’s overall business could be on the horizon. In Q4, Disney managed to increase its revenues by 5.7% Y/Y to $21.24 billion, while its non-GAAP EPS of $0.82 was above the estimates by $0.11. What’s more, is that the growth of the experiences business has accelerated as its revenues during the period increased by 13% Y/Y to $8.16 billion.

At the same time, the entertainment business has finally managed to grow as well as its revenues in Q4 were up 2% Y/Y to $9.52 billion. In part it was possible thanks to the successful debuts of Disney’s new theatrical titles and in part thanks to the growth of the streaming business. In Q4 alone, Disney has managed to increase its subscriber count by nearly 7 million to 150.2 million subscribers, above the estimates of over 147 million subscribers. This could indicate that after losing nearly $11 billion since the launch of Disney+ in 2019, the company’s flagship streaming service is finally catching up momentum and could become profitable by the end of 2024. This could be achieved by the release of new content in the following quarters, the better marketing of the ad-supported plan of Disney+, and the implementation of stricter standards around account sharing in 2025. The latter has helped Disney’s competitor Netflix (NFLX) experience a rise in subscribers and revenues in the recent quarter.

All of those growth catalysts should help Disney keep the momentum going in the future and help the shares to rebound further from the 8-year lows. On top of that, a shift in strategy in 2024, along with the upcoming deal to sell the majority stake in its Indian operations could also ensure that the worst for Disney is finally behind it after years of struggles.

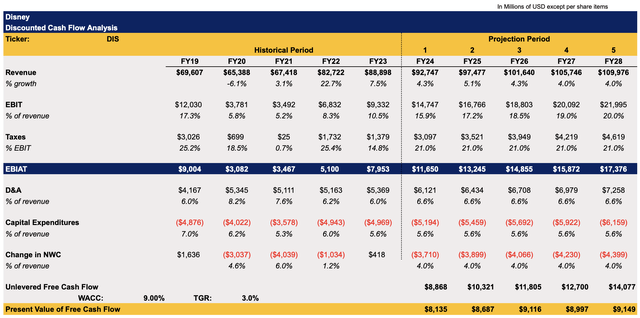

To figure out how big is Disney’s upside, I’ve created a DCF model that can be seen below. Most of the assumptions in the model for the following years are either close to the historical performance or in-line with the street estimates. The weighted average cost of capital in the model is 9%, while the terminal growth rate is 3%.

Disney’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

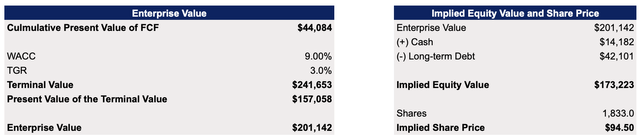

This model shows that Disney’s enterprise value is $201 billion, while its fair value is $94.50 per share, which represents an upside of ~5% from the current market price.

Disney’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

Major Risks To Consider

Despite all of the positive developments in recent months, there’s still no guarantee that Disney will be able to keep the momentum going in the following quarters. It’s important to understand that in order to keep any streaming service relevant there needs to be a constant supply of new and interesting content. While so far, Disney has been successful in producing such content in recent quarters – there’s always a risk that a weak release of a new movie or a series would result in a weaker growth of subscribers and kill the momentum that the company has currently going for it.

What’s more is that the future growth of Disney’s streaming business is in large dependent on the performance of the overall economy that has a direct impact on the streaming industry. Earlier this year it was reported that a quarter of adults in the United States have unsubscribed from streaming services as a result of a high inflation that has negatively affected the broader consumer confidence. While we’re currently in a disinflationary environment and on track to achieve a soft landing, there’s always a risk that inflation could once again get out of control and have a direct impact on the streaming industry in the future.

Another thing that needs to be mentioned is that even if we achieve a soft landing, the Federal Reserve could decide to keep the rates higher for longer and cut them later than we currently anticipate. If that’s going to be the case, then Disney’s interest payments could continue to rise in the foreseeable future. Just a year ago, Disney paid $434 million in interest expenses in Q4’22, while in Q4’23 the interest expenses reached $501 million. Therefore, it makes sense to believe that even if Disney is on the path to recovery, such a recovery is unlikely to be quick and straightforward.

The Bottom Line

There’s no denying that Disney is in a much better position now than even half a year ago. Despite all the risks that are associated with its business, the company has momentum going for it and if Disney+ continues to increase its user count and reaches profitability next year, then the shares could rally in the following quarters as they’re not overvalued at the current price. However, Disney had a history of overpromising and underdelivering in the past, so the improvement of the streaming business in the following quarters is not guaranteed at this stage. That’s why I stick with my HOLD rating for now.

Read the full article here