Like any other “trend” or noteworthy industry activity, there is a tendency for “all the players” to head in the same direction. But shareholders are paying management to find a deal or a low-cost way that the main crowd does not find. Crescent Energy (NYSE:CRGY) is a major consolidator that does not follow the crowd. Instead, this management is looking for sellers in areas where there is a lack of buyers. Shareholders can therefore expect that this management is unlikely to be caught in a bidding competition because there are always better deals that are not attracting attention. While many companies I follow are acquiring Permian acreage, this company management will only do that if the deal is comparable to deals management is finding elsewhere. That will not be happening often.

Eagle Ford

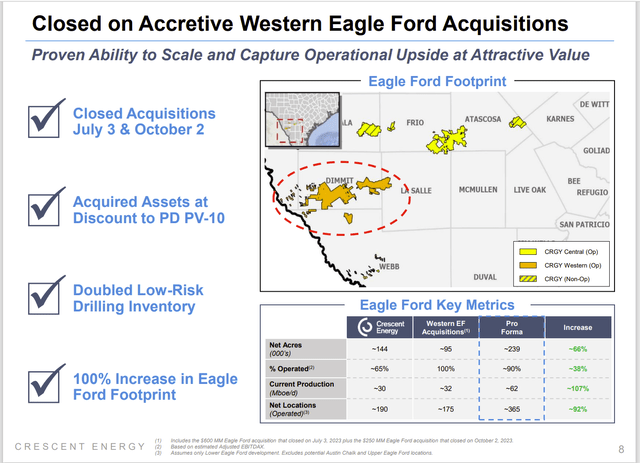

This management has long been building an attractive position in the Eagle Ford. The only other companies I follow doing this long term is Baytex Energy (BTE) and Silverbow (SBOW). The advantage of consolidating in the Eagle Ford is that few names are there. Therefore, the purchases prices are going to be much more reasonable than is the case in the Permian (where everyone “knows” that is the best acreage).

Crescent Energy Eagle Ford Acquisitions 2023 (Crescent energy Corporate Presentation Third Quarter 2023)

Management has been in no rush to acquire more properties. The result is that management has made accretive acquisitions and then expanded the advantages of the acquisitions by making operations more efficient. The continuing advance of technology is likely to increase that efficiency for some time to come.

The Eagle Ford operations usually ended up outperforming the Permian operators in the past (when talking about acquisitions) because the Permian often had takeaway capacity and other strained resources (like service companies and water issues).

The Eagle Ford is on the rainy side of Texas and therefore has access to more water while the Permian in located in a largely arid area. Therefore, water recycling is a big priority in the Permian as well completion can be held up due to a lack of water.

The takeaway constraint issue has long led to price discounting and big increases in transportation by using trucking. None of this was mentioned during the acquisitions in both basins. On the other hand, the Eagle Ford production often receives a premium to the benchmark price.

Improvements

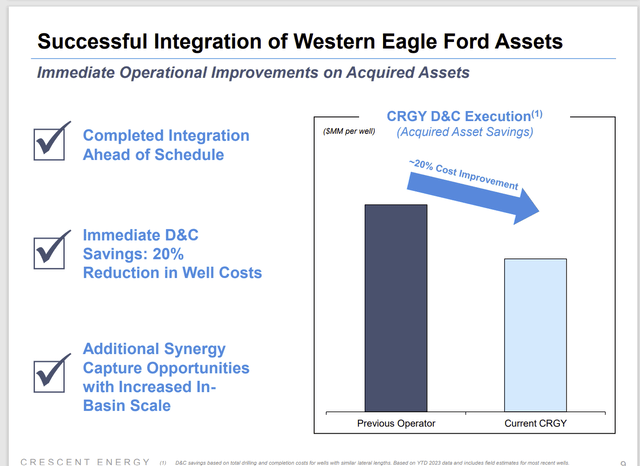

The operational improvements are showing up on both the cost side and the production side. This makes for a two-pronged strategy to drive down costs long-term.

Crescent Energy Operational Cost Savings (Crescent Energy Corporate Presentation Third Quarter 2023)

Management can drill cheaper wells as shown above right away. That does not automatically lower the cost of acquired production. But it does give any new wells a big cost advantage even as the production ages. Therefore, as new production replaces the acquired production, the average costs of production should decline over time. At the very least, the savings shown above should offset general inflation as well as service company inflation costs.

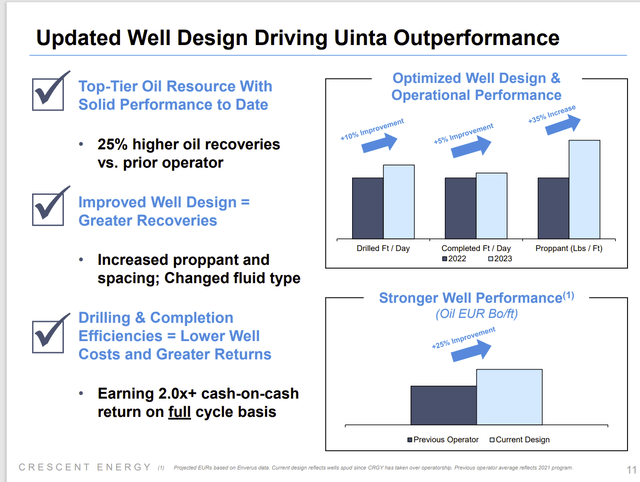

Crescent Energy Well Performance Improvement (Crescent Energy Corporate Presentation Third Quarter 2023)

The second way to reduce costs per barrel is to improve well performance. In this case, not only is management reducing drilling and completion costs, but they are also recovering more saleable product in the process.

This part of technology keeps advancing. Therefore, there is every chance that management will report continuing improvements in this area for some time to come. There is always a risk that technology will stop advancing “tomorrow”. But so far no one in the industry is betting on anything close to that outcome.

It should also be noted that a lot of managements are also planning on using carbon dioxide in a secondary recovery process to recover more oil when the time comes. There may also be tax credits available as this is likely to count as permanently storing carbon dioxide in the ground as part of the continuing “green revolution” drive to reduce carbon dioxide pollution.

Debt Ratings

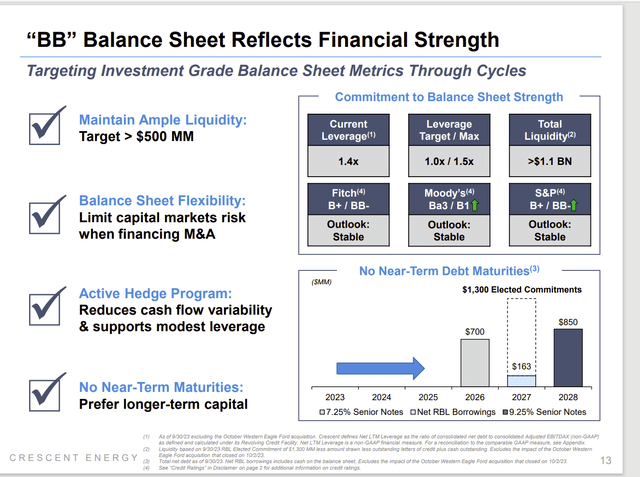

This has not been a public company for a very long period of time. Therefore, the debt ratings achieved so far are pretty good considering the lack of a track record as a public company as well as the rapid growth from acquisitions.

Crescent Energy Debt Ratings Summary And Debt Duration (Crescent Energy Corporate Presentation Third Quarter 2023)

This company often looks for “unnatural sellers”. This is different from acquisitions made by companies that specialize in energy and hence are familiar with the industry and keep up with latest practices until they sell the company.

This company will pursue bankrupt properties and banks (for example) that end up with repossessed properties in an effort to avoid “head-on” competition for properties and bidding wars. Back around 2020, this was a great strategy as there were no buyers (let alone buyers for specialized situations). It still appears to be a decent strategy although it would appear a lot of sellers have reduced their expectations in the hope of getting rid of long-held inventory.

As noted above, management has a just-below-investment grade rating. There is a wide-open bank line that further aids flexibility when shopping for deals. Management has also begun to sell bonds to the debt market to further improve liquidity.

Management will do acreage swaps to build contiguous holdings that are much more profitable to develop than is the case with scattered acreage. All of this plus KKR’s reputation for dealing with leveraged situations gives the company a major advantage when shopping for some of the larger deals in those “off-the-main-runway” locations that are still very profitable to have.

The Future

The major shareholders of this company are known for building and selling companies. But they only sell when they can get their price. Therefore, timing of a company sale is uncertain at best. Rarely do these shareholders sell their stock and the company remains public.

The company has access to the resources of KKR for the time that KKR manages this company. Those resources are considerable for a company of this size. KKR has a significant ownership interest in the company.

The other thing is that the company is structured so that selling owners can avoid paying taxes on any sales to this company as it acquires properties. That does mean that shares of stock will increase in the public arena from time to time as management shows in the latest presentation. Management has been periodically repurchasing stock as blocks of stock become public to support the stock price as shares go public from the private setup.

Summary

This company has gotten some excellent prices on properties it operates simply by avoiding the “hot spots”. Shareholders can continue to expect these bargain hunters to find some excellent acquisitions away from where everyone else is looking. This is actually what shareholders pay managements to do but many managements do not do it.

There is always the risk that a bargain comes with unexpected difficulties and therefore does not perform to expectations. But this management is very experienced in the industry. That experience should sharply reduce the risk.

The other consideration is that this is not a typical KKR adventure in that the financial leverage is low and guidance is for it to go lower. Many firms that tried financial leverage got severely “burned” in the 2015-2020 period as the boom times came to an end.

Now, it is an emphasis on technology advances with a “bet” to make those advances do what financial leverage used to do. Combine this idea with the finding bargains idea mentioned earlier and the major shareholders expect to do as well as they would have with financial leverage. Time will tell how this idea works and there is no assurance of success.

But the idea remains a strong buy with the idea that the major shareholders know what they are doing and will execute accordingly. Rarely do investors get to invest alongside major shareholders of this quality. While appreciation timing is uncertain. Usually, investors of this nature get involved when they can triple their money over five years to make up for the risk they are taking. The future looks good even if timing is uncertain.

Read the full article here