At a Glance

In my recent article, I explored Lexicon Pharmaceuticals’ (NASDAQ:LXRX) strategies and financial status. I emphasized Inpefa’s potential in heart failure treatment and Lexicon’s strong financials after Q2 2023 results. Lexicon now faces a crucial moment with the FDA’s green light for Inpefa, a unique heart failure drug. This launch is a key strategy in a market crowded with competitors like Eli Lilly’s (LLY) Jardiance.

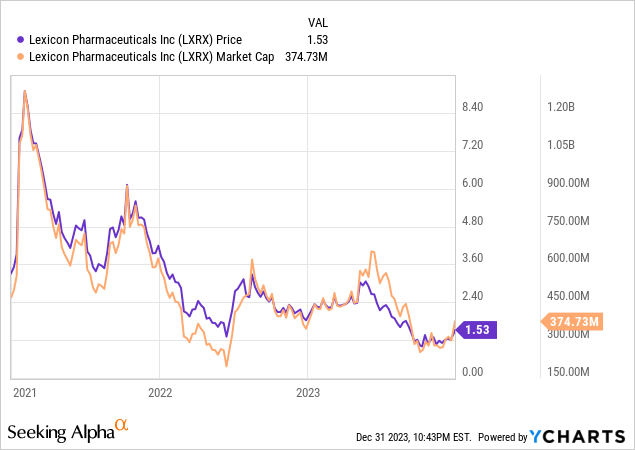

Financially, Lexicon is in a stable but complex situation. Its short-term outlook looks solid but rising marketing costs and high cash burn hint at future troubles. The market’s view of Lexicon is cautiously positive, with a mix of optimism and skepticism. This is seen in its stock trends and the high short interest from investors. This sets the scene for a deeper dive into Lexicon’s operations, market standing, and finances, suggesting a careful but insightful investment approach.

Inpefa’s Heartfelt Challenge: Outpacing Jardiance in the Race for HFpEF

Lexicon launched Inpefa, a unique dual SGLT1 and SGLT2 inhibitor, in June for heart failure treatment, including heart failure with preserved ejection fraction (HFpEF). This drug faces stiff competition, particularly from Jardiance, a similar medication marketed by Boehringer Ingelheim and Eli Lilly.

However, Lexicon’s marketing prowess remains questionable. Their prior product, Xermelo (later sold for $160 million), underperformed in the market, casting doubt on their ability to effectively promote Inpefa. The financial burden of marketing and potential funding needs poses additional challenges to Lexicon’s market position and value.

Jardiance directly competes with Inpefa. Belonging to the SGLT2 inhibitor class, it boasts an established market position, supported by comprehensive clinical data and strong marketing. This challenges Inpefa to distinguish itself. My research indicates that the potential additive benefits of SGLT1 inhibition in heart failure are merely hypothetical. For now, there is nothing clinically “special” about Inpefa relative to Jardiance. Subsequently, this comes down to Lexicon’s ability to market its newer, and relatively unknown, drug over a half-trillion-dollar powerhouse, Eli Lilly.

Investor confidence wavers due to uncertainties in Lexicon’s marketing skills and competition from drugs like Jardiance. A small success in the market could bring substantial gains for Inpefa, but the current uncertainties present a risky venture for Lexicon in the HFpEF treatment sector.

Q3 Performance

Lexicon’s latest earnings report shows a significant change. In Q3 2023, their revenue was just $0.2 million, a small figure due to the early stage of Inpefa’s market introduction. They cut research and development spending from $15.68 million to $10.56 million, a clear move to reduce costs. Yet, expenses in selling, general, and administrative areas rose sharply, from $7.30 million to $12.58 million, likely for Inpefa’s marketing. The net loss grew slightly, reaching $23.39 million, partly due to higher interest costs. More shares are now needed to calculate the net loss per share, increasing from 145,820 to 174,904, which affects shareholder value.

Financial Health

Looking at Lexicon’s balance sheet, they have $136.2 million in liquid assets, including $18.8 million in cash and $117.4 million in short-term investments. Their current liabilities are $18.4 million, giving them a current ratio of 7.4, showing they’re financially stable in the short term.

Over nine months, they spent $67.3 million in operations, averaging a monthly burn rate of $7.5 million. This rate implies they will have enough cash for around 18 months.

Considering their plans to sell up to $75 million in common stock, their financial situation seems secure for now. However, their long-term stability depends on managing their funds wisely and making progress in the competitive heart failure market.

Market Sentiment

According to Seeking Alpha data, LXRX’s market capitalization of $374.73 million, coupled with a substantial short interest of 22.47% and high shares short of 23.28 million, suggests a mix of market skepticism and potential volatility. The company’s growth prospects are noteworthy, with projected sales increasing from $3.80 million in 2023 to $90.11 million by 2025, indicating strong market confidence in its future performance. However, stock momentum has been negative compared to the S&P 500 over various timeframes, indicating underperformance and potential investor concerns.

Institutional ownership stands at 77.09%, with notable activity including an increase in positions by 57 holders (4,528,154 shares) and a decrease by 54 holders (7,124,158 shares). Key institutions like Artal Group S.A., Bvf Inc/Il, and Fmr Llc show significant holdings, with Millennium Management notably increasing its position by 47.513%. Insider trades over the past 12 months show strong positive net activity, with 29,004,883 more shares bought than sold, signaling insider confidence in the company’s prospects.

Considering these factors, LXRX’s market sentiment can be qualified as “adequate,” reflecting a balance between strong growth potential and current market doubts.

My Analysis and Recommendation

In summary, Lexicon Pharmaceuticals faces hurdles with its new heart failure drug, Inpefa. Past marketing struggles, notably with Xermelo, cast doubt on their competitive edge against drugs like Jardiance and Farxiga (another popular SGLT2 inhibitor). Inpefa’s unique SGLT1 inhibition is yet to prove superior. Eli Lilly is a well-known company with established relationships with prescribers. It is improbable that prescribers will favor or switch to Lexicon unless there is unambiguous proof of clinical differentiation.

Beyond Inpefa, Lexicon’s pipeline is limited to LX9211, a Phase 2 drug for a subset of neuropathic pain—a historically difficult indication to achieve.

Lexicon’s financials are shaky. Short-term, they’re stable, but high costs in marketing and admin, plus a quick cash burn, paint a worrisome long-term picture. Relying on new stock issues could hurt shareholder value.

The market sentiment is lukewarm. Significant short interest and lagging behind the S&P 500 highlight the risks. Yes, some big players hold stakes, but Lexicon’s entry into a competitive market is tough. As a result, I believe the revenue projections for Lexicon, cited earlier, are naively optimistic.

Investors should be cautious. “Sell” is the prudent call. Diversifying investments and watching companies with a solid market standing are wise. Keep an eye on Lexicon for any positive marketing or clinical updates. Reassess if things improve, but for now, the risks dominate.

Read the full article here