Introduction

As a BDC investor I’m constantly on the hunt for others in the sector who I think have the potential to become great long-term investments. Whenever I look to invest in any company, my goal is to look at different metrics to see if they fit the buy-and-hold criteria I typically look for when investing. Business Development Companies are still considered to be risky, but in my opinion are stronger now than they’ve ever been. Better management teams & defensively positioned portfolios make them holdings not just for the short-term, but for the future as well.

One BDC that recently came on my radar is Fidus Investment (NASDAQ:FDUS). Their name came up a few times in my article comments so I felt compelled to do an analysis on them. My initial thought was they reminded me a bit of another favorite and holding of mine in the sector (BIZD), Capital Southwest (CSWC). The company seems to have all the makings of a superstar. In this article, I get into why I think Fidus Investment could be a standout in the sector and why they may make a great long-term holding for income investors.

Who Is FDUS?

Fidus Investment is a business development company who specializes in leveraged buyouts, refinancings, strategic acquisitions, growth capital, business expansion, and debt investments. Unlike many other BDCs, they do not invest in turnarounds or financially distressed companies.

This is why some prefer not to invest in the sector. Because most loan to financially distressed companies, this can be a turn-off for investors. Another difference is FDUS makes investments in warrants and sometimes takes a minority equity stake in the companies they choose to invest in. Warrants are similar to options and may be considered risky but can yield high returns.

Investopedia

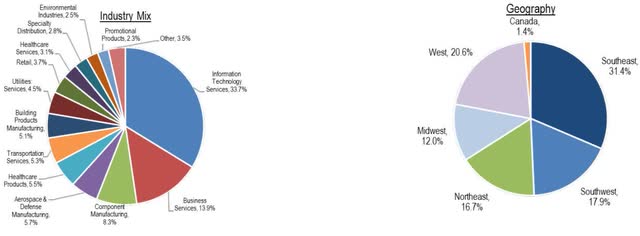

Warrants, similar to options, come in both calls or puts varieties. This is one way some BDCs are able to reward shareholders with very high returns. Something else that set FDUS apart is that it has a much higher concentration in the information technology sector than other peers at nearly 34%.

FDUS Q3 investor presentation

This is in comparison to peers Ares Capital (ARCC) who has 23.2% invested in the software & services industry, and Capital Southwest’s portfolio where this makes up just 3%. Furthermore, FDUS is also geographically diversified with most of their investments in the Southeast & Southwest. Having a large amount of concentration in the IT sector means FDUS is defensively positioned and likely to deliver consistent & stable cash flows.

When looking into BDCs I typically like those who have a longer track record, preferably those who were around before the Great Financial Crisis. Seeing how companies did during turbulent times can give you a great look into not just their financial distress during that time, but a look at the management team as well.

Several BDCs faced a tough time during the 2008-2009 recession but then again so did a lot of others businesses. I prefer those who did. Think about this. If you have a friend who wanted you to invest in their business that just opened 6 months ago what would be your reaction? Now what about someone who’s been in business for the past 20 years?

The person who’s been in business for two decades through not only the GFC but the 2020 pandemic as well. And while that doesn’t necessarily mean they’re the better business, that does gives them experience during economic downturns. And even if they faced financial distress, they likely learned from it. Same concept I look for when researching companies/businesses.

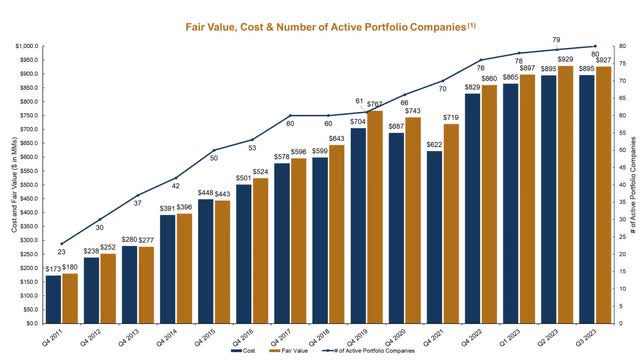

FDUS IPO’d in 2011 so they’ve got some time under their belt. Not as much as other peers like ARCC or CSWC but enough to assess their track record and obtain a picture. Since 2011, the BDC has grown its portfolio from 23 companies to 80. Additionally, a majority of their debt investments are in first/second-lien loans at 67.3%.

FDUS investor presentation

Strong Dividend Growth & Returns

The thing that impressed me the most about FDUS was their dividend growth. In 2023, the company paid out plenty of extra income in the form of special dividends, rewarding its shareholders. Furthermore, they raised the base dividend nearly 5% and the supplemental more than 42% from $0.19 to $0.27. In Q3 the BDC paid out a total of $0.72 in dividends. In the last 3 years FDUS has had a DGR of 43.33%. This is in comparison to CSWC’s 39.02%.

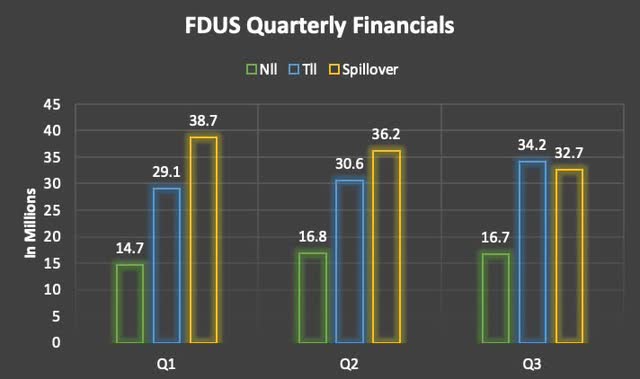

During Q3 earnings in November FDUS continued to grow its financials quarter-over-quarter. In the chart below you can see net investment income & total investment income both grew by double-digits. Additionally, the BDC continued to carry-over extra income and in Q3 had $32.7 million or $1.15 in spill-over income.

Author creation

The company also continued on its path to growth with two new investments worth $80.3 million during the quarter. One was in a leading provider of software for auto dealerships and the other a leading regional provider of medical equipment to hospice agencies & sub-acute care facilities.

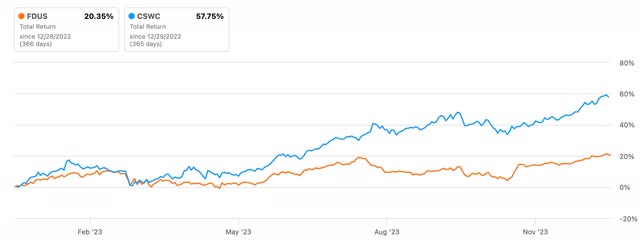

In the chart below I compare FDUS to one of my favorites in the sector, CSWC. The latter has outperformed most of its peers when it comes to total returns. They’ve even outperformed Fidus over the past year. You can see CSWC doubles FDUS’ 20.35%.

Seeking Alpha

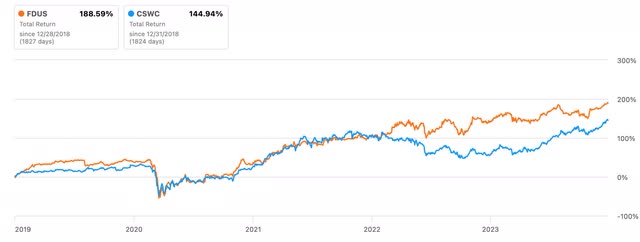

But looking over a 3-year period you can see the former outperforms CSWC by a sizable margin.

Seeking Alpha

Here they also outperform CSWC by more than 40% over a 5-year period.

Seeking Alpha

Below you can see as you look further out, CSWC more than doubles FDUS’ total return percentage at more than 366% compared to nearly 169% over a 10-year period. But this still impressive considering this is more than a 16% annual return and more than the S&P’s typical annual return.

Seeking Alpha

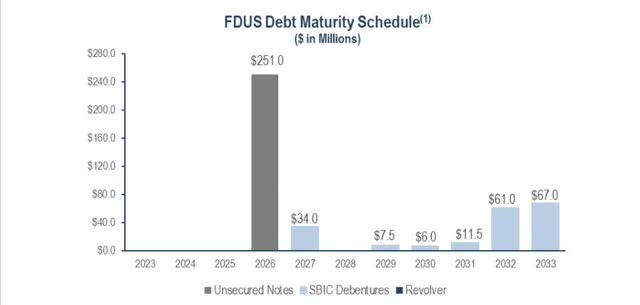

Well-Laddered Debt

FDUS also has an impressive balance sheet to go along with the growing portfolio and dividends. The BDC has no debt maturing until 2026 in which rates are expected to be significantly lower by then. And even then, they have very little maturing in the coming years after the $251 million due in the next two years. All of their debt had a weighted-average interest rate of 4.1%. Furthermore, they had $100 million in available borrowings under the revolving credit facility and $80.3 million in cash.

FDUS investor presentation

2024 BDCs Will Continue To Reward Shareholders

Recently I wrote an article titled “Don’t give up on BDCs in 2024.” With three rate cuts expected in the coming year some may be worried about the sector. While I do expect to see some of their prices retract once this starts, the higher-quality ones will still continue to pay out extra income in the form of specials & supplementals.

Reason is because many of them have enjoyed spill-over income and will likely carry this over into the new year. With growing portfolios and out-earning their dividend, many can and will likely use the extra to continue rewarding shareholders. So, because rates are expected to decline, BDC income will still be up.

FDUS’ management addressed this during their latest Q3 earnings call. Their CEO stated that they plan to continue paying out 100% of their excess earnings going forward. And as they do so, I expect their share price, like many of their peers to continue to reflect this and trade above their NAVs.

And I also see their management teams taking advantage by issuing shares and raising capital while prices remain elevated. FDUS recently issued 3.2 million shares at an average price of $19.54 raising net proceeds of $61.5 million. So, 2023 has been a great year and 2024 & beyond looks promising.

Risks & Valuation

FDUS has done a great job of keeping a tab on their non-accruals. While peers like TriplePoint Venture Growth (TPVG) have seen theirs rise significantly as a result of the high interest rate environment. I discussed this in a recent article. Fidus’ percentage has been very manageable. At the end of Q3 non-accruals accounted for only 1.3% of their portfolio at fair value. This was 1.2% at the end of 2022 so the company has done a good job at keeping this percentage low. It also speaks to their quality and financial strength of their portfolio companies.

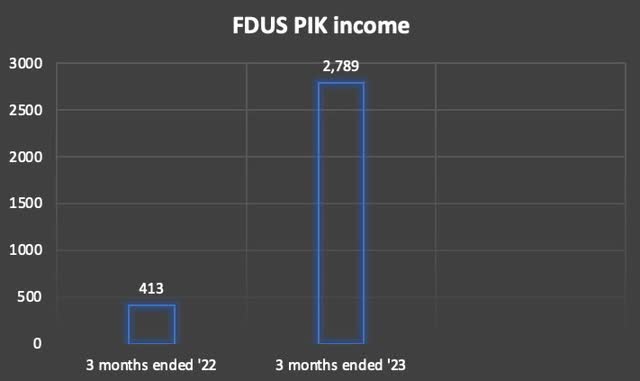

But one thing has that increased since 2022 was their PIK interest income. This more than doubled from 2022. And while this doesn’t necessarily mean there are portfolio concerns, it is something to keep an eye on going forward.

Author creation

Furthermore, the stock is currently trading at a premium to its NAV of $19.28. At a price of $19.67 at the time of writing the BDC offers little upside to its price target of less than $21. And although I expect the price to trade near here for the foreseeable future, I would advise investors to wait for a price drop before adding or starting a position.

Conclusion

FDUS has all the makings of a future superstar in the sector. Additionally, they have performed well in 2023 and I expect this to continue as they reward shareholders with extra income in 2024. They also have been growing their portfolio steadily and have a strong balance sheet with well-laddered debt maturities. However, with rates expected to decline I do see the price dropping in the foreseeable future.

Additionally, PIK income has risen significantly in the past year, but management has done a good job of keeping non-accruals below the KBW BDC average. Despite their performances over the past 3 & 5 years I think the BDC still has some proving to do going forward. Because of their rise in PIK income and valuation above NAV, I currently rate the stock a hold.

Read the full article here