Dear readers/followers,

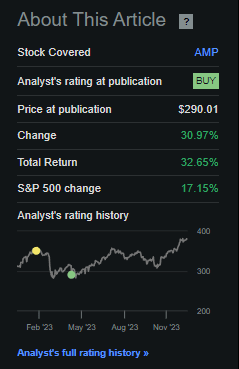

I’ve been covering Ameriprise Financial (NYSE:AMP) stock for some time. The company has been a very solid pick, and since I gave my last “BUY” recommendation back in April of 2023, meaning almost 9 months back, the company has outperformed the S&P 500 by quite a bit. You can find that last article here, and read my thesis before going into this update if you like.

Seeking Alpha RoR (Seeking Alpha)

Ever since first investing in Ameriprise Financial several years ago when this company, believe it or not, was significantly undervalued, I’ve been impressed by AMP’s ability to hit targets and generally perform at a very high level.

In fact, you can go back to my original recommendation during COVID-19, and find that my original position has a RoR of over 200% from what I used to be. Only a small portion of my investment is actually left at that cost basis because I, unfortunately, rotated part of my position at one point when I believed AMP had gone too high.

This proved to be wrong – and in this article, I’ll show you why, despite everything, AMP may rise even higher. The downside risk of course is that the company could decline, but there is some upside here that suggests we could see even better returns.

Let’s see what we have here.

Ameriprise Financial – The company is, despite everything, not at a premium

So one of the first things that investors assume, given the sheer returns that AMP has given us, is that the company is somehow trading at a significant or outsized premium. But while the company has certainly moved in the right direction for the past few years, the sheer earnings growth that we’ve been able to see really means that the company isn’t trading at as high a premium as you might think.

And I’m never shy as to when I was “wrong” either. While I reinvested the capital I sold at excellent returns, even outperforming AMP which means that it wasn’t a “wrong” choice for me, my definition of acting “incorrectly” in the context of the market is: Selling when the company continues to outperform the market.

AMP has done exactly that.

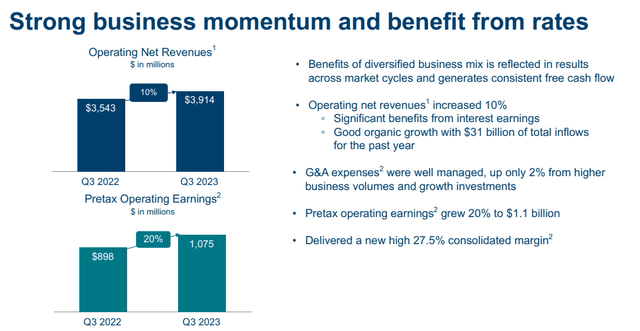

3Q23, which is the last quarter we have for AMP, also does exactly nothing to diminish this. This is because the company saw 24% EPS growth for the YoY period, which demonstrates not only the resilience of the company’s longer-term trends but also the strength of the diversified business model that AMP follows.

Also, AMP grew, despite trends in asset management across the world, its AUM by $1.2T, which is a double-digit YoY improvement during a time when most asset management arms are either growing far less or even not growing at all.

You might expect the company, like some, to see an increase in expenses – and it’s true, expenses did rise – but only by 2%, which is far less than many of the other companies I have been looking at here. AMP manages also to give among the best RoEs in the segment, at 50%, with a consolidated margin of 27.5%.

AMP is, as far as things go, a class leader, and its success also means that capital is being returned to shareholders at an accelerated rate, at over $650M with a combination of dividends and other sources during the quarter.

AMP has a strong balance sheet with continued available capital of $1.4B in excess, $1.9B available, and a very solid investment portfolio that’s on track to, overall and on the company level, deliver 80% of operating earnings to shareholders during this fiscal.

It shouldn’t be a secret that while I did make a profit with the alternative investments for my original AMP stake, I do regret selling it and not using other capital to invest. AMP is a “too good” company to sell at any but the most overvalued and insane valuations and the company has not been at such a level for many, many years.

The strong business momentum is in fact continuing, and this latest quarter only proves it.

AMP IR (AMP IR)

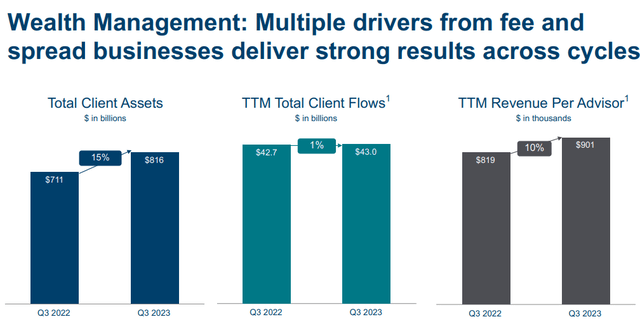

Even the wealth management arm, which again saw considerable downside in many of Europe’s largest firms, grew significantly during the quarter, showing once again the confidence and quality of AMP’s asset managers and their work.

AMP IR (AMP IR)

While the company’s clients, especially in AWM, continue to move to cash, this does not mean a net negative to AMP. The company’s cash balances, including MMF’s, are up 35% YOY and 4% sequentially – so AMP isn’t immune to having its mix move to the somewhat lower-margin segments, but the company still manages to squeeze a considerable amount of profit here, as evidenced by its 26% wealth management earnings growth.

The one area where we see similar-to-market trends here is AUM flows, which do remain challenged as they do across the market – but only at a TTM total flow rate of negative 2.3% – they’re worse in other companies.

You may ask how I can defend first being so positive on a quality company like this, only to then sell, only to then go positive again when AMP is actually higher than it was when I went to “HOLD”.

While not seeking in any way to defend my mistake, I will say that the underlying trends, forecasts, and fundamentals were very supportive of an overvalued assumption back in 2021 and parts of 2022, only to then showcase incredible resilience and earnings growth. I was far from alone in “going” hold. Most other analysts I follow or people who do similar work to me saw very similar trends, in fact, between the period of 2021-2023 YTD, where they went from considering the company overvalued in 2021, only to then switch around later. (Source: S&P Global, Morningstar, FactSet).

I seek to learn from this mistake and not repeat it, as I continue trying to slowly build exposure here to what I consider to be an absolutely superb Asset manager/custody bank.

Ameriprise remains A-rated, and the by far biggest hindrance to a sort of “take-my-money”-mentality here aside from the company’s valuation, which we’ll get to, is the poor yield offered by AMP. When I invested large in AMP, I did so at more than 3% yield.

That 3% is now 1.42% – and it’s not set to grow considerably at all.

Let’s look at what drives the upside, downside, and risk to this company here.

Risks & Upside to Ameriprise Financial

I’m going to increase my price target for AMP in this article, to reflect the higher upside I see here, but that does not mean in any way that Ameriprise comes without risk.

Ameriprise, without exaggeration, has transformed itself into a superb investment manager, with over $1.2T AUM and managing over 10,000 advisors. Through the sale of its P&C insurance business, particularly home and auto, it has significantly de-risked its income and sales mix. This was further added to by moving out of fixed annuities, which once was something that AMP was actually known for. More de-risking there as well.

However, while this is de-risking in one sense, a focus on wealth, asset management and the company’s current sales mix has made this company far harder to evaluate and put a valuation to than it was before. Also, while it has moved out of P&C (auto & Home) which certainly de-risks, a focus on AM and WM also opens the company up to the possibilities of redemptions, another risk worth mentioning. And this has actually happened as the company has focused more and more on this business.

While AMP has the undeniable scale to make this work, I believe in a general compression of fees and costs for wealth and asset managers. It’s a shrinking world, where more and more people can do as well themselves or with general funds where they don’t need advisors.

AMP has, in one way of seeing it, exchanged one risk for another.

However, this needs to be weighed against the company’s building of an asset management business that is incredibly well-protected and mixed with its M&A of Columbia, essentially doubling the business, as well as the BMO EMEA business, giving it a global footprint.

AMP, while riskier in some ways than before, is now also “better” than before, and this is how I justify a higher share price as we move forward.

Ameriprise Financial Valuation

In my last article I gave AMP $335/share. I’m bumping this up, and moving to the long-term for this company, but I want to be clear that this is not my first financial sector investment at this time, nor is it one that I can consider a “HOLD” here.

AMP currently trades at almost 13x P/E, which is high for a financial. It’s especially high for one that has less than 1.5% where I can get over 7-8% from a Scandinavian bank.

And those banks are, to me, just as risk-free as AMP is.

So I want more “cheese” here.

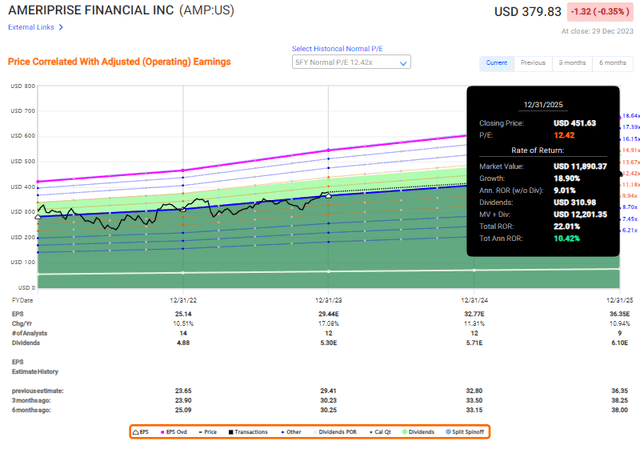

Assuming a high earnings growth rate of 8-9% – the forecast of 11% annually works, but it does come at a 16-20% negative miss ratio with a 10% margin of error, – we get an upside of 10.4% per year here, to a 12.4x forward valuation and a share price of $451/share.

You’ll recall that my minimum target for investing is an annualized RoR of 15%. I don’t get that here – and I would, if the yield was higher.

The company currently trades at just south of $380/share.

F.A.S.T Graphs AMP upside (F.A.S.T Graphs)

Ameriprise doesn’t, as of this point in time, fulfill all of the demands I put on a company like this. I want better returns, and while I am increasing my share price target to $355/share, this really represents the absolutely highest target that I would accept for this company, still being able to make a decent profit even if things go a bit south.

If the company in fact did trade lower than 12.5x, as it has historically at times, your RoR can go below double digits rather easily.

That’s not a situation I want to be in.

For that reason, I give you the following updated thesis for AMP – and while it represents a rating change, I will remain ready to scoop up shares if the company dips below $355/share.

Thesis

My thesis for Ameriprise Financial, Inc. is the following:

- This is an excellent company provided you can buy AMP at a conservative 11.5X-12.5 2024E midpoint P/E – the annualized RoR at such a scenario is over 12-15%, and this would be buy-worthy.

- However, the company has recently moved up quite a bit and now trades at almost $380/share, which is a bit on the high side for me personally.

- I move my PT up for AMP to a $355/share for the 2024-2025E period, and at that price, I believe you’ll make around 10-15% per year.

- I now consider AMP a “HOLD”, here moving my rating down a notch.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

I won’t call AMP “cheap” here, but I believe you can make a profit at the right price – just not here. I now consider it a “HOLD”.

Read the full article here