Energy Transfer (NYSE:ET) is a large and diversified midstream energy company. The company handles both the transportation and storage of a variety of energy related commodities from crude oil to natural gas liquids (NGLs). Upon reviewing the financials, I believe there are three excellent income options related to investing in the company. These options are an investment in common shares, an investment in the Series E preferred shares, or the sale of cash secured put options against the common shares.

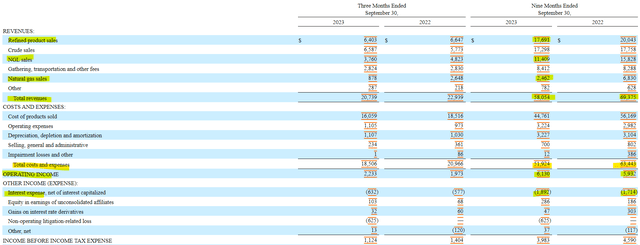

Energy Transfer’s income statement leads off with an alarming trend in revenue. For the first three quarters of 2023, Energy Transfer’s revenue dropped by more than $11 billion or 16% compared to the same period last year. While this drop is undoubtedly related to the volatility of the energy markets, Energy Transfer’s cost of goods sold dropped commensurate with the drop in revenue. Thanks to a combination of lower selling, general, and administrative expenses along with no impairment costs, operating income came in at $6.1 billion, which is $200 million higher than last year.

SEC 10-Q

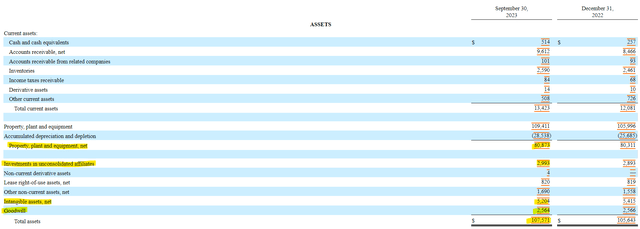

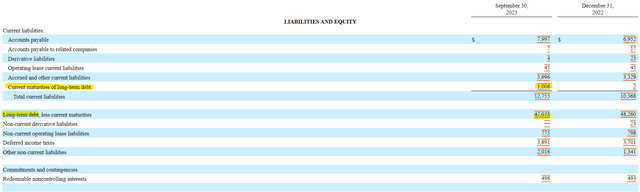

Energy Transfer’s balance sheet is pretty cut and dry. The company’s assets mostly consist of property, plant, and equipment. Long term debt has remained stable at $48 billion during 2023, with $1 billion coming due within the next 12 months (listed as a current maturity). Shareholder equity has remained stable at $40.5 billion and with a market cap of $43 billion, the shares are trading at relatively close to book value.

SEC 10-Q SEC 10-Q

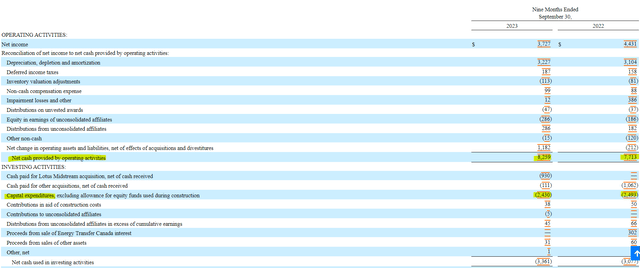

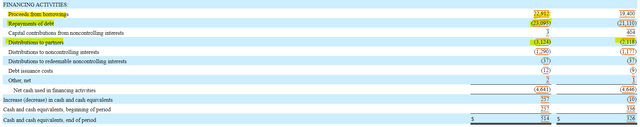

The cash flow statement shows how the company’s cash management has made the 9% dividend yield sustainable. In the first nine months of 2023, operating cash flow rose to $8.25 billion from $7.7 billion last year, despite the drop in revenue. After considering the $2.4 billion in capital expenditures, the company has $5.8 billion in free cash flow. The free cash flow is more than sufficient to cover the $3.1 billion in distributions to shareholders and the $1.3 billion in distributions to noncontrolling interests. Energy Transfer generates enough cash to cover capital expenditures, pay dividends, and reduce debt, which is all positive for shareholders.

SEC 10-Q SEC 10-Q

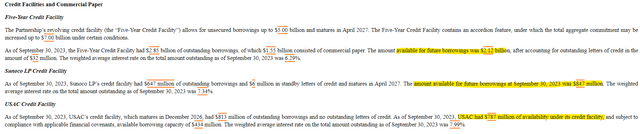

While commodity prices can create obvious headwinds for the business, investors should also be mindful of interest rate risk. With $1 billion of debt coming due in the next 12 months, Energy Transfer is facing the possibility of higher interest expenses and lower earnings if it opts to refinance that debt. It is important to note that the company has over $2 billion in liquidity available under its current credit facility. Energy Transfer is not facing any liquidity hurdles in the near term that may threaten its dividend.

SEC 10-Q

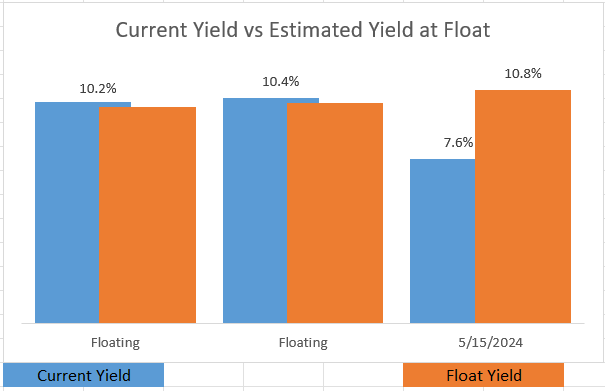

If investors are looking for an alternative to the common shares, they may want to consider the Series E preferred stock (ET.PE). These shares are currently trading at a 7.6% dividend yield, which is below the floating rates of the other two issuances, but they are scheduled to float in May at a forward yield projection of 10.8%, if short-term interest rates remain at the same levels. The Series E is also the only of the three issuances currently trading below par, which means a positive yield to call and no call risk. The common share dividends must be eliminated for the preferred dividends to be touched, but investors should be mindful that a drop in short-term interest rates will affect the dividends paid by the Series E shares, with a floor level being approximately 5.2% of the current price.

Pricing as of 12/29/2023

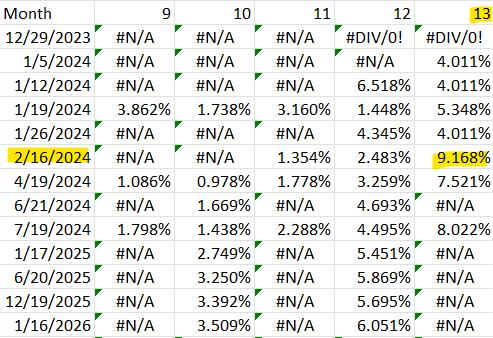

The last option is the one I’ve chosen, which is to sell cash secured put options. Selling put options generates income, although if share prices fall below the strike price of the contract, I may be forced to buy shares from the contract holder at the strike price. But, since I am comfortable owning shares at the current price of nearly $14, I am willing to own shares at a cost of $13 per share between now and February 16th.

Therefore, I decided to sell cash secured puts by setting aside the cash to purchase a block of shares at the strike price of $13 per share and collecting a premium. Based on the expiration date of February 16th, I am earning an annualized return of over 9% if the option expires worthless. I am also earning 5% interest on my secured cash through my brokerage firm (Fidelity). While this strategy represents a very short-term gain, selling put options over and over in shares like Energy Transfer can lead to income generation that outpaces the dividend. If the share price drops and I am assigned the shares, I expect to receive a dividend at a yield of 9.6% ($1.25/$13).

Yahoo Finance as of 12/29/23

Energy Transfer’s resiliency and cash flow generation in the face of volatility in the energy markets make it a great income candidate for investors. While buying the common shares outright can lead to good returns through the company’s dividend, preferred shares and the sale of put options present unique income opportunities as well. Investors will need to look at the pros and cons of each style before deciding how to proceed.

Read the full article here