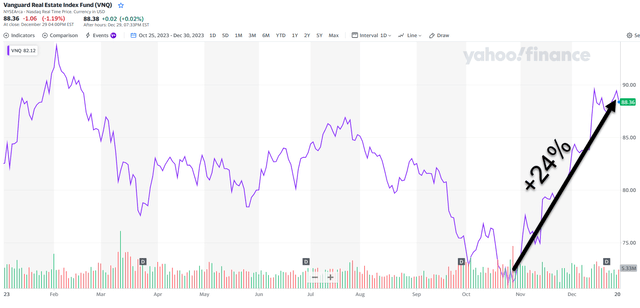

The last few weeks have been great for “most” of my REIT holding, thanks in large part to the first leg of the so-called REIT Rally, as I explained a few weeks ago,

Recent share price weakness in this sector has driven valuations on many of my favorite REITs down to levels where we’re seeing very attractive margins of safety.

I believe that the poor sentiment surrounding REITs today will allow investors to have their cake and eat it too when it comes to both passive income and strong capital appreciation over the coming years.”

Yahoo Finance

This year-end rally has allowed me to boost returns in my REIT portfolio, with names like:

- Digital Realty (DLR) +40%

- Simon Property Group (SPG) +33.4%

- STAG Industrial (STAG) +30%

- Prologis, Inc. (PLD) +24.4%

- Arbor Realty (ABR) +22%

- American Tower (AMT) +19%

In addition, I’m happy to have rebalanced certain REIT holdings in Q4-23 in which I was able to add more shares in:

- Realty Income (O)

- Agree Realty (ADC)

- VICI Properties (VICI)

- Safehold (SAFE)

I was even able to sell out Innovative Industrial (IIPR) – with a nice profit (+15%) – and Tanger (SKT) – with a nice gain of over 300%.

Most of my recommendations have worked out well in 2023, or in the case of Safehold (SAFE) or Highwoods Properties (HIW), I’m optimistic…

However, there’s one exception….

Yahoo Finance

Medical Properties Trust (NYSE:MPW)

MPW is a hospital RET that owns 441 properties (~44,000 beds) in 10 countries.

When I first began covering the company in 2012 MPW owned just 68 properties and assets of just over $2 billion. It’s also worth noting that MPW had a payout ratio at the time of 91%.

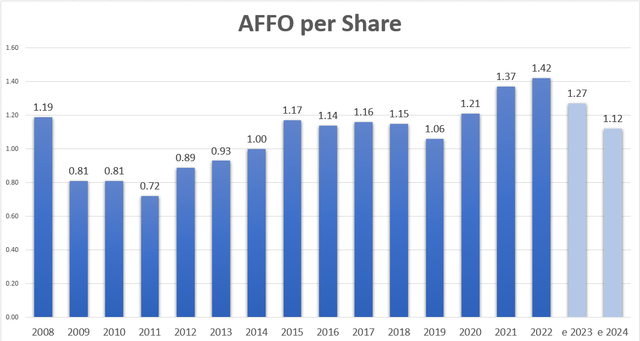

As you can see below, MPW has not maintained a reliable earnings history with decreases in 6 out of 16 years.

iREIT®

Most REITs saw negative growth during the Great Recession (like MPW), but the higher quality companies were able to claw back and generate consistent earnings and operating profits.

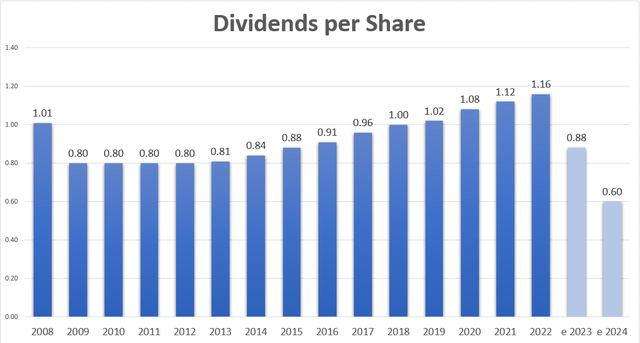

Meanwhile, as seen below, MPW was forced to cut its dividend in 2008 and the company did not grow it until a few years later (2013).

I was skeptical of the lack of dividend growth in 2014 citing “no compelling catalysts”, high payout ratio (100%), and junk-rated debt (‘BB’).

iREIT®

Back in May 2023, I pointed out that MPW was yielding 15.7% and I knew there was a high “probability of a dividend cut, somewhere between “even chance” (coin toss) and certain (100% probability).”

Then in August MPW announced it was cutting its dividend in half, “to strengthen its balance sheet and reduce its cost of capital.”

The company reduced the dividend from $.29 per share to $.15 per share, equating to an annual dividend payout of $.60 per share.

Clearly, management was behind the dividend cut, and unlike W. P. Carey (WPC), who recently cut its dividends, I don’t think many MPW investors were caught off guard.

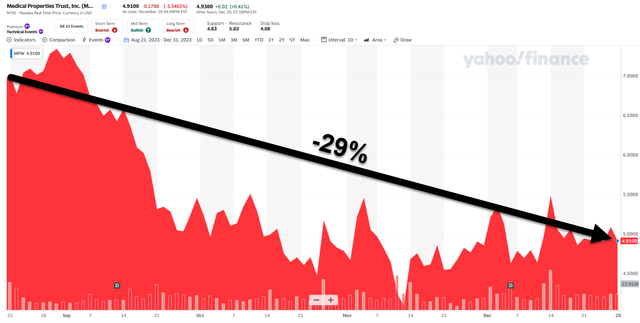

Yet, MPW shares are down another 29% after the company announced it was cutting its dividend:

Yahoo Finance

Many felt as though a dividend cut would give the company more flexibility to improve the balance sheet…

But Mr. Market did not perceive the cut as good news…

4 Reasons That I’m Not Buying

Prior to the dividend cut news, we have maintained a speculative buy on MPW, recognizing the high-risk rating and a wide range of potential outcomes.

Investors with above-average risk tolerance might see value in MPW, but I’ve opted to limit exposure and maintain strict diversification standards.

The first reason that I’m not buying more shares in MPW is because of the company’s high leverage levels.

Net debt/EBITDA was nearly 7x at Q3-23 and the company had $3.9 billion of debt maturing at 2.8% weighted average interest rate through 2026.

MPW’s existing 2028 bonds trade at nearly a 12% yield and the company has a junk credit rating (B+ negative / Ba2 negative).

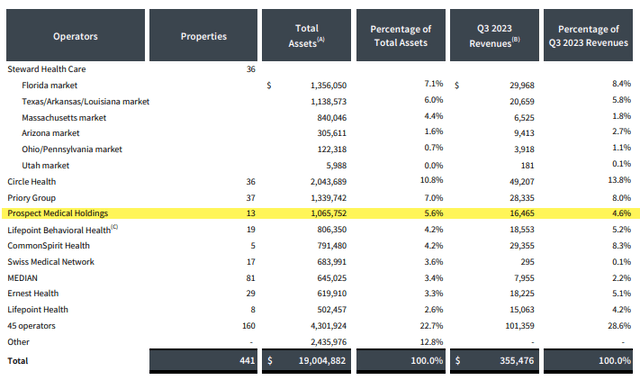

The second reason that I’m not buying more shares is because of its operator issues.

Around 5% of MPW’s revenue comes from Prospect, but the financial health of this operator is questionable.

In Connecticut, for example, MPW is under a sale leaseback with Prospect that could result in a monetization of the sale with Yale New Haven is finalized. However, this deal has been delayed for over a year and the “roadblock has proven to be challenging to navigate.”

The $75 million loan facility that MPW provided Prospect had $45 million drawn at the end of Q3-23 and $65 million by the time MPW reported Q3-23 results in late October.

MPW IR

Steward, MPW’s largest operator, representing 20% of total Q3-23 revenue via rent and loan investments, is also a riskier tenant that has been slow at times in meeting rent obligations.

Specifically, Steward paid a portion of September rent in early October and as of Q3-23 (10-Q filing) some of the rent was expected to be paid in mid-November.

Steward has made progress over the last several quarters by reducing expenses and on the latest Q3023 earnings call MPW’s Sr VO of Operations, Rosa Hooper said,

“Steward believes it’s making progress on its revenue cycle management and accounts payable backlog. With new technology and dedicated resources focused on enhancing claims quality, reducing initial denials and resolving denials more quickly, Steward is reporting improved efficiency of collections.”

MPW said that “Steward expects these improvements will result in an incremental $50 million of cash annually based on current volumes” and in Q3-23 “Steward was also able to successfully upsize their new ABL by $30 million.”

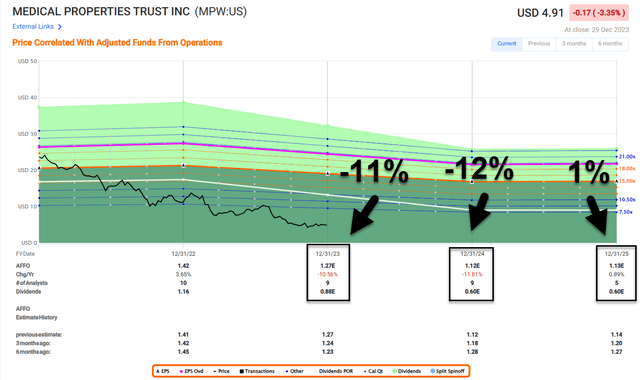

The third reason that I’m not buying is because of the lack of earnings growth over the next few years, primarily due to refinancing/de-leveraging dilution. Even if the operators pay rent, analysts are forecasting negative growth prospects, as shown below:

FAST Graphs

The fourth reason that I’m not buying more MPW is because I must stick with my blueprint, which is to always maintain responsible diversification and to only invest in companies that generate stable and predictable earnings (and dividends).

Despite the unchallenging valuation (3.9x 2023 AFFO, 4.1x FAD, 26% AFFO yield, 12.2% dividend yield), I’m not persuaded to put more capital to work given the unreliable fundamentals validated by the negative growth prospects.

While investors with above-average risk tolerance might see value in buying shares, I must maintain strict discipline.

What’s MPW Worth?

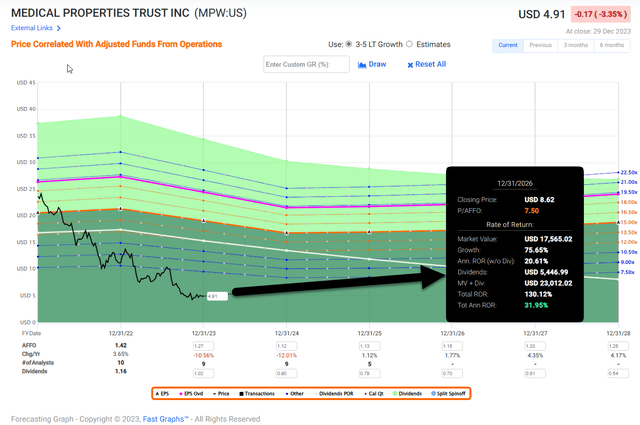

MPW is now trading at $4.91 per share with a dividend yield of 12.2%.

For new buyers, I consider the price “opportunistic” but as I said earlier, for investors with above-average risk tolerance.

The company has a lot more “wood to chop” and I believe shares could hit $6.00 in a year which could result in 30% annualized returns.

The company must continue to execute on asset recycling and “hope” that its cost of capital moves down in lockstep with interest rates in 2024.

I’ve debated long and hard about selling my shares and I’ve decided that I’ll hold on, given the fact that I have less than 2.5% exposure and that I expect to see MPW rally in line with other REITs in Q1-24 and Q2-24.

Similar to my recent sell with IIPR, if shares in MPW get anywhere close to my basis, I will most likely sell (the shares) to redeploy into stocks that generate sustainable and growing dividends.

FAST Graphs

To close, I’ll cite a few paragraphs from the Harvard Business Review and Beverly Lev, author of Winning Investors Over,

“The key for executives is not to ignore Wall Street but to be smarter in their dealings with it. Finance, economics, accounting, and management scholars, myself included, have for years studied the interactions between managers and markets.

We’ve discovered profound lessons about what investors do and don’t value. Much of this research has focused on U.S. companies and markets, simply because there are better data on them. But the lessons apply everywhere.

One of the most important lessons is that honesty does pay: Attempts to deceive investors by sugarcoating poor results or, worse, manipulating sales and earnings eventually lead to lower stock prices (and sometimes career-ending scandals) as investors wise up.

It’s this kind of behavior that critics of guidance and other aspects of the “earnings game” are presumably out to stop. But the best way to stop it, the evidence shows, is with more—not less—engagement with investors.”

The key lesson for me, as I reflect on my stake in MPW, is that I should have stayed laser-focused on the quality of MPW’s earnings stream.

I showed you earlier that the earnings history of the company has been choppy, dating back to its IPO.

The fact that the company did not grow its dividend for several years was a yellow flag (that I pointed out). and growth for the sake of growth is not a catalyst (growing AUM vs dividends per share).

I’ll take my lumps and “hope” shares can get me back somewhere close to even.

I’ll also commend the short sellers who were successful.

“Short sellers often signal serious operating and accounting problems that managers need to fix. Wide bid-ask spreads and a large variability in analysts’ forecasts both point to investor uncertainty about the future course of the business. And so on.”

A former business colleague once told me,

“I eat a lot of crow, and I’ve eaten so much of it that it tastes good.”

I would not go as far as saying that I’ve acquired good taste regarding MPW, but perhaps it’s because of my diversification instincts that I can speak openly with regard to my biggest loser in 2023.

Lesson Learned: Always focus on the quality of earnings which includes the overall safety of the balance sheet and the dividend.

Happy New Year!

Note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Read the full article here