Oil prices took a hit for several reasons in the final couple of months of 2023. First, the US EIA reserves have increased. Second, the US shale oil producers have gotten quite active. Moreover, everyone is worried about the Fed and that it might hike the interest rates. All is true. But the most irrational fear of the oil markets is OPEC+, in my view. The alliance has recently decided to decrease the oil production volumes. But the markets reacted quite negatively. There are some bullish political factors for oil. So, let me analyze the whole picture.

Shale oil in the US

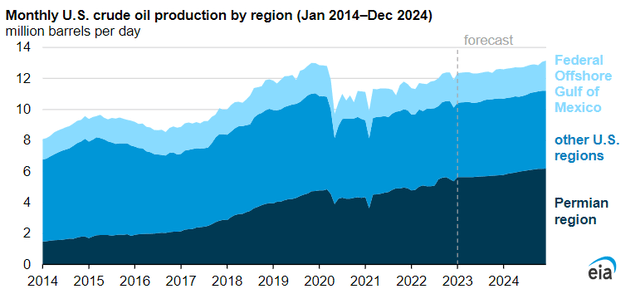

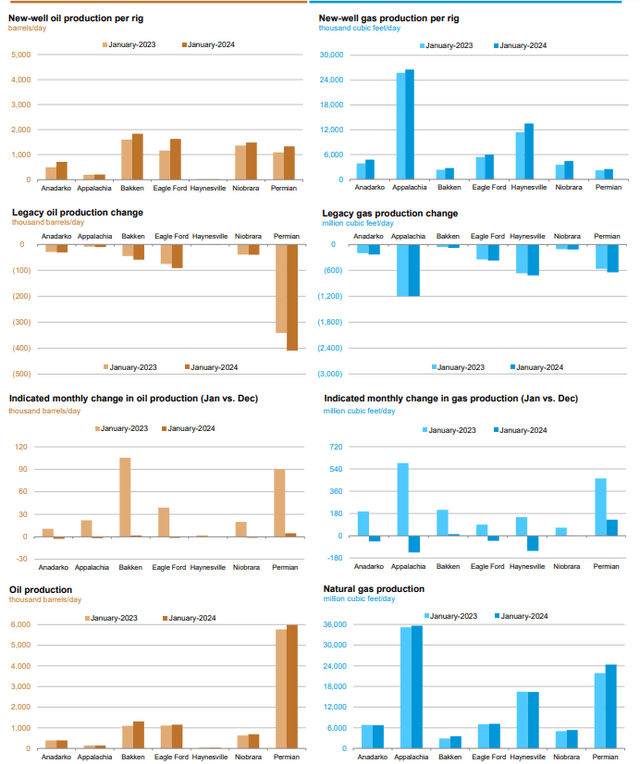

Shale oil production in the US is said to be hitting record highs. The diagram below is dated as of 25 January 2023. It clearly predicted quite a significant rise between the beginning of 2023 and the start of 2024.

EIA

According to the December 2023 report, however, the total US oil production has remained almost in line with the January 2023 volumes.

EIA

But the truth is, according to the EIA, that the US was accountable for 80% of the rising global oil supply this year. And its production is set to grow by 850,000 barrels per day, much faster than analysts had anticipated. American crude oil production reached a fresh all-time high of 13.2 million barrels per day in September 2023. Indeed, shale oil production reserves have plenty of spare capacity. Experts even say that only falling commodity prices can put a halt to increasing US production. On the surface this might mean that the oil prices will be held artificially down thanks to US shale producers. But this is not as simple as that.

High interest rates

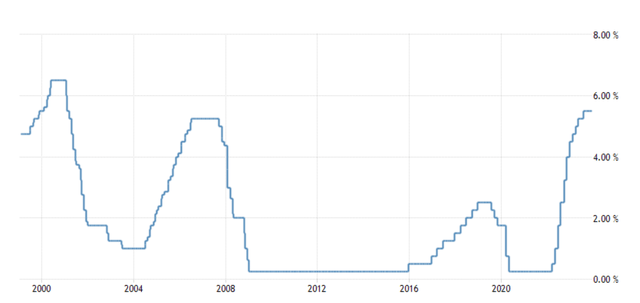

The interest rates are near multi-year highs. In fact, these have even exceeded the 2007 levels. Higher interest rates mean tight monetary conditions and are therefore daunting for the economy.

Trading Economics

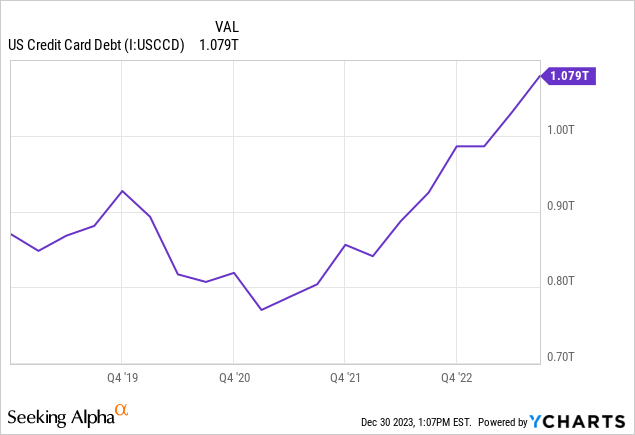

Much of the consumer demand in the US economy relies on debt. That is why the debt levels have been rising for a while. This is particularly true of the credit card liabilities that exceeded $1 trillion in August 2023.

If the situation with the rising interest rates continues for a while, I believe the US will enter a full-scale recession. Obviously, it is in no-one’s best interests. So, everyone expects the Fed to ease. Apart from the Fed, other central banks are also predicted to ease their monetary policies. Among them are the Bank of China and the ECB. If that happens on time, there will be a soft landing of the global economy in my opinion. But uncertainty remains.

Macroeconomic factors

Unemployment, declining PMI activity, lower sales and lower inflation readings can all make the Fed change course sooner rather than later. But Jerome Powell has mentioned many times before that his 2% inflation target remains his top priority.

Trading Economics

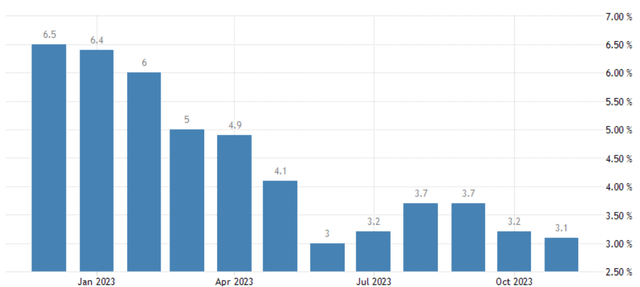

After May 2023 the CPI has declined substantially. This can be easily seen from the diagram below. But still, you might argue that 3.1% is not good enough for the Fed, given the 2% target. At the same time, the Fed seems to be taking the “wait and see” approach. So, no rate hikes are expected in the next couple of months. Moreover, sometime later the Fed can in fact start easing.

That is why many market players and analysts expect the Fed to manage the “soft landing” of the US economy. Obviously, this will be bullish for most commodity markets, most notably oil. However, there is also a risk of any unforeseen events. The Covid-19 pandemic was such an event that provoked a sharp but short recession. Anything similar can actually happen now.

Why might oil prices increase?

OPEC+ is one of the factors to keep the oil prices afloat. But US shale oil producers are slowly taking the OPEC+’s share of the market. But there are other factors, mostly political ones that truly matter.

To start with, the conflict between Israel and Hamas is not over yet. For example, Iran deployed a warship to the Red Sea after the US Navy killed Houthis trying to commandeer a commercial vessel. War is still raging in central and southern Gaza after Israel announced it pulled some troops from the ground invasion. So, the point I am making is that the whole situation is not over yet. As announced by Israel’s military, the country’s government is preparing for fighting in the strip to last throughout 2024. There is also a risk Iran would enter a full-scale war to protect the Houthis and Gaza, which will be quite bullish for the oil prices.

Then, there is a potential war between Venezuela and Guyana. Just a quick reminder that tensions flared in a territorial dispute between Venezuela and Guyana, with Caracas launching a major military exercise near the contested, oil-rich Essequibo region.

We do not know what will happen in the future. But these upside risks to oil remain.

Risks

The first and foremost risk is that of a recession. Even oil production glut is not a big problem because there is no need to produce lots of oil when the prices are not high enough. So, even US shale producers are not a big risk, not to mention the OPEC+ countries that are interested in maintaining higher prices for longer. The biggest risk is that there would be no “soft landing” for the global economy. In other words, the Fed and other central banks fail to react on time to changing market conditions, the macroeconomic indicators deteriorate and the oil prices crash. In my view, this is the only visible risk to oil.

How can investors benefit?

In my view, it is not the best idea to select individual companies. There is a lot of research work to do. Not to mention there are plenty of individual corporate risks, for example, balance sheet data, income statements, the management, etc. Futures and options target quite short time periods, typically several months and therefore pose multiple risks because it is often hard to get the timing right. That is why I recommend oil bulls to buy commodity ETFs. And it is often the best to buy the largest one because of the high trading volumes, low fees and reliable companies the ETF encompasses.

The largest oil ETF is Energy Select Sector SPDR Fund (NYSEARCA:XLE). I wrote about this ETF several times in my previous articles. Exxon Mobil (XOM), and Chevron (CVX) are some of the largest US oil companies and these companies are all part of the index. These are profitable and also pay high dividends. XLE’s annual expense ratio is only 0.10%. Moreover, all of XLE’s businesses have high credit ratings, which makes this ETF a relatively low-risk buy.

Sector SPDRs

Conclusion

There is no point of thinking the oil prices do not have any upside potential in my opinion. US shale producers’ output was quite high in 2023. But the demand for oil as well as oil production depend on the macroeconomic indicators and most importantly the Fed’s policies. Among the bullish factors for oil are the tensions around Gaza and the conflict between Guyana and Venezuela as well as the “soft landing” for the global economy.

Read the full article here