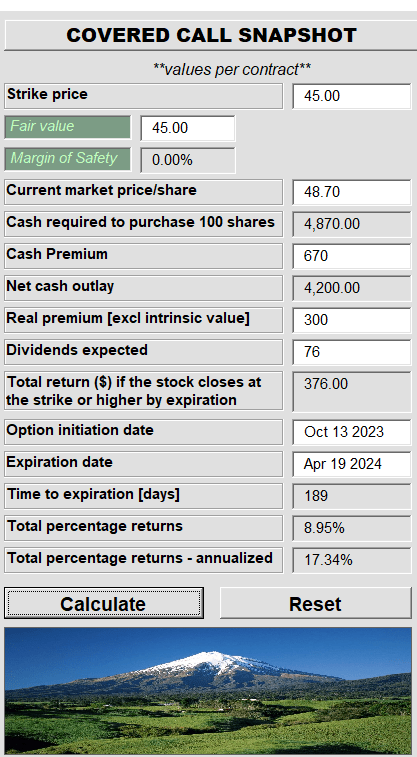

On our last coverage of Rexford Industrial Realty, Inc. (NYSE:REXR), we weighed the bull and bear cases and felt that one could make money over the longer run, though the returns likely would be poor. We suggested a $45 Covered Call for April 2024, as our preferred play on this to get a high yield with low risk.

17% returns are a good way to start to put your bid in.

Previous Article

We would not rule out even a $40 price at some point. At $48.72, we think you will still get positive albeit low returns 10 years out. There is just too much demand for these properties to get too negative down here, even with the high hurdle of interest rates. We rate the common shares as a Hold/Neutral.

Source: Getting Your 7% And 17% Fix

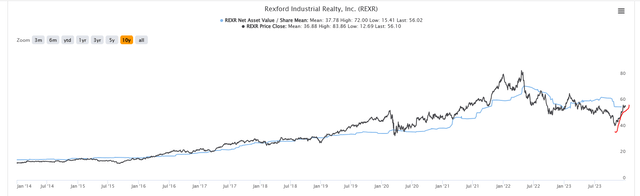

With the stock near $56.10, and having visited as low as $41.56, we can safely say that the REIT provided an above average dose of excitement. We update our valuation models after the Q3-2023 results and tell you how we played it.

Q3-2023

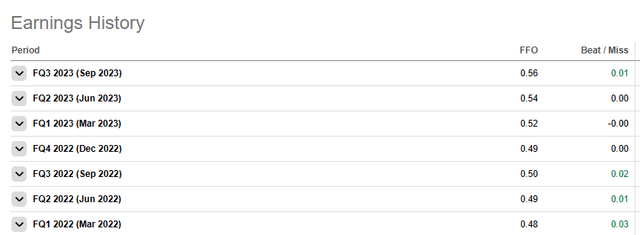

REXR provided predictable results for Q3-2023 with a one-cent a share beat on funds from operations (FFO). As you can see from the trend of the past seven quarters, REXR has been extremely consistent.

Seeking Alpha

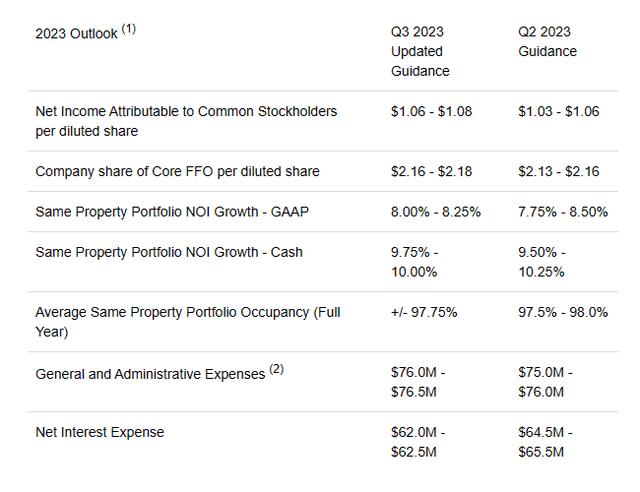

There are few things that analysts can even miss with this company. Management regularly provides updates on where market rents are relative to their own portfolio and crunching estimates on new leases is thus a breeze. Their own guidance on net operating income (NOI) and interest expense is also pretty much in the ballpark and the changes are small and generally positive. In Q3-2023, REXR upgraded all aspects of its 2023 outlook. GAAP net income and expected FFO were revised higher. These were powered by stronger same property NOI and slightly lower interest expense.

REXR Q3-2023 Press Release

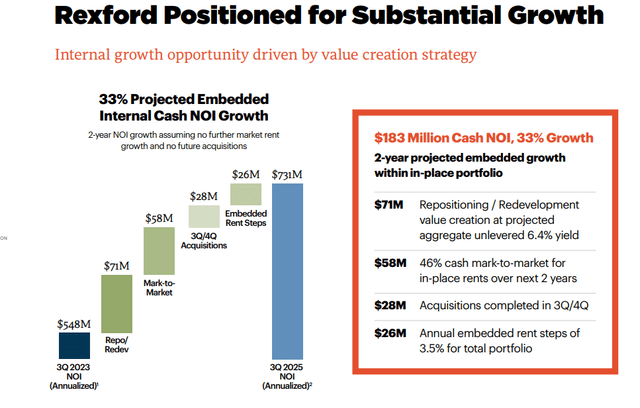

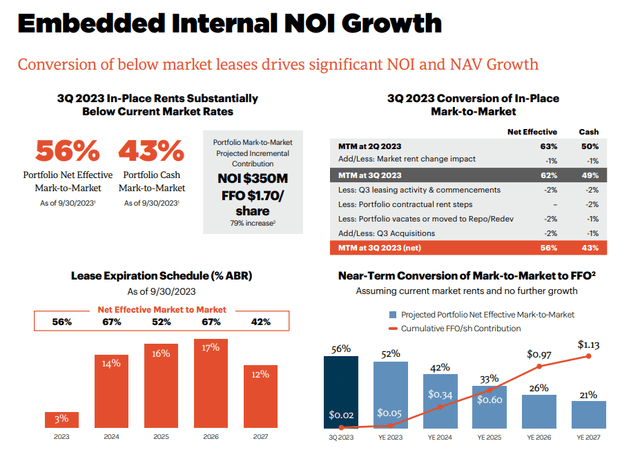

A slight shift on administrative expenses did not mess up the overall theme. REXR’s presentation was once again about the embedded value in its portfolio. To some extent it has to be as the REIT now has a close to $15 billion enterprise value. Its primary markets are pretty tight on supply and most purchases today would barely move the needle on its FFO. So the growth has to come from the rent increases over time and that is what REXR always talks about.

REXR Q3-2023 Presentation

With most REITs, even in the industrial space, this is relatively small. In REXR’s case, there is definitely some material resetting, assuming the supply-demand fundamentals don’t materially change over the next five years. This is expected to move NOI and FFO materially, assuming interest rates don’t reset far higher.

REXR Q3-2023 Presentation

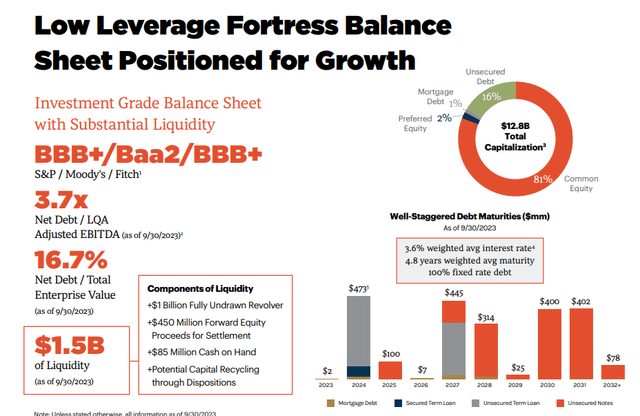

The balance sheet remains the best in the business with an otherwise unheard of 3.7X debt to EBITDA. REXR has some floating rate debt but that problem has been effectively neutralized using swaps. So effectively, all of its debt is fixed rate with a 4.8 year (as of September 30, 2023) weighted term.

REXR Q3-2023 Presentation

What is most striking about that is the rating agencies are still rating this in the “BBB+” arena. This probably stems from concentration risks (both property type and location) and a relatively shorter history compared to the eight “A” rated REITs. Nonetheless, in our view, the debt is heavily underrated compared to the fundamentals.

Valuation & Verdict

There is no one involved with this REIT that does not know about the mark to market opportunity. Even consensus estimates for 2027, pretty much are pricing it all-in.

TIKR

You are not going to move the stock on management’s 10 reiteration of these facts. What is worth considering though, is after all those rent increases flow through, REXR will be trading at 16-17X 2027 FFO. Of course, you can extrapolate the past and assume this growth will continue endlessly. And you can apply the 30-40X FFO multiples that it traded at during its earlier years, powered by ZIRP. That kind of logic will make it a buy for you, likely at almost any price.

We don’t see the story the same way. If nominal GDP rates remain high well into 2027-2030 timeframes, you can bet that Treasury yields will be relatively high as well. You are likely to see marked valuation compression in that case. We are also assuming zero impact from new supply and no real recession over this timeframe to get to that 16-17X 2027 FFO. That is certainly possible, but extremely unlikely. REXR has also rapidly bridged the gap between its price and consensus NAV estimates.

TIKR

We see the stock today as slightly overvalued for the risks in the market but continue to rate it a “hold”. We would move to a “Sell” rating over $65.00 per share. The last time we had a Sell on REXR was about two and half years ago and it played out in a volatile but ultimately, predictable manner.

Seeking Alpha

REXR has underperformed cash since then. For investors that followed our covered call idea, we would just hold that position until April 2024, when it should get called away for a nice, non-volatile and solid return.

Preferred Shares

REXR has two sets of preferred shares outstanding.

Rexford Industrial Realty, Inc. 5.875% PFD SER B (NYSE:REXR.PR.B) &

Rexford Industrial Realty, Inc. 5.625 CUM PFD C (NYSE:REXR.PR.C).

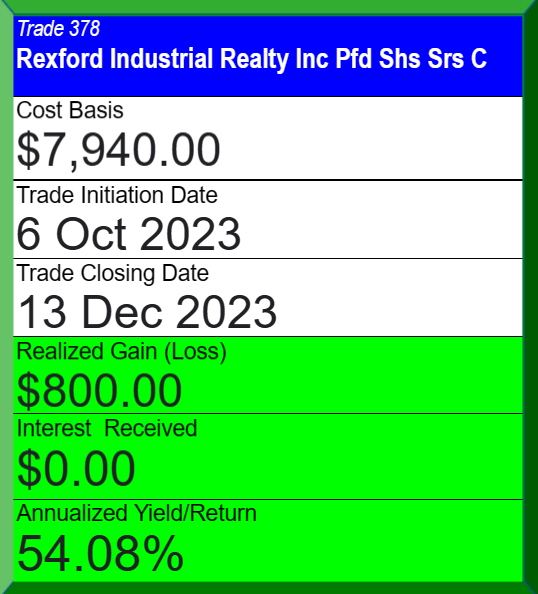

Both are probably the safest preferred shares you can get in the REIT space and on par with Spirit Realty Capital, Inc. 6% PFD SER A (SRC.PR.A). SRC.PR.A is only that safe as it is now becoming an obligation of Realty Income (O). We did buy REXR.PR.C in early October, but exited out in December. Probably too soon as the current market euphoria shows.

Conservative Income Portfolio, Trade 378

We are getting investment grade preferreds yielding as high as 8% currently (some with reset features and floor protections), so REXR.PR.C is a little less appealing with a 6.3% yield today. We need a minimum of 7% yield on this one to get involved. We continue to keep this on our watchlist and it probably gets there if the Fed does not deliver the six rate cuts.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Read the full article here