Utility closed end funds are seen as the ultimate bastion of income and stability. You get the benefits of a stable sector and the upside of leverage. What’s not to like? Well there is a laundry list of things that can go wrong with Utility CEFs and anyone following our work over the last year has seen these fleshed out in various articles. Today, we are going to compare two popular funds and tell you what you need to look at before diving in into one.

The Two Funds

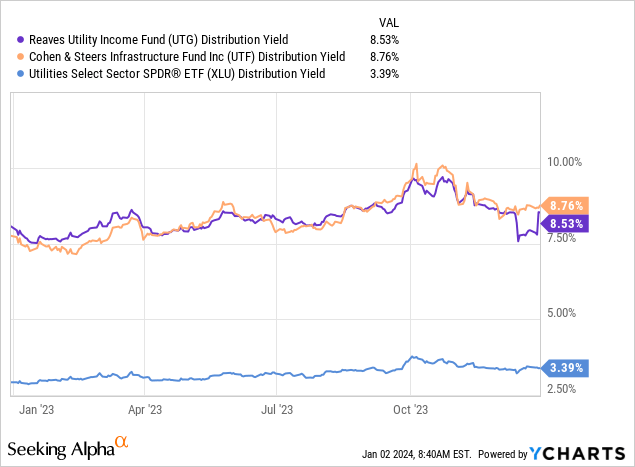

Reaves Utility Income Trust (NYSE:UTG) and Cohen & Steers Infrastructure Fund (NYSE:UTF) are large sized CEFs. Both have market capitalizations around $2 billion each. Only about 15 funds have market capitalizations larger than these two in the entire CEF Connect Database. While their names suggest that they are radically different, they both tend to favor one sector (no bonus points for guessing which one at this point) over all else. For the rest of their holdings, they tend to favor utility-like companies like telecoms and pipelines. Both dole out very generous yields and these are yields you simply cannot get by buying vanilla utility ETFs.

We next go over three factors that investors must weigh on, before hitting the ask.

Performance

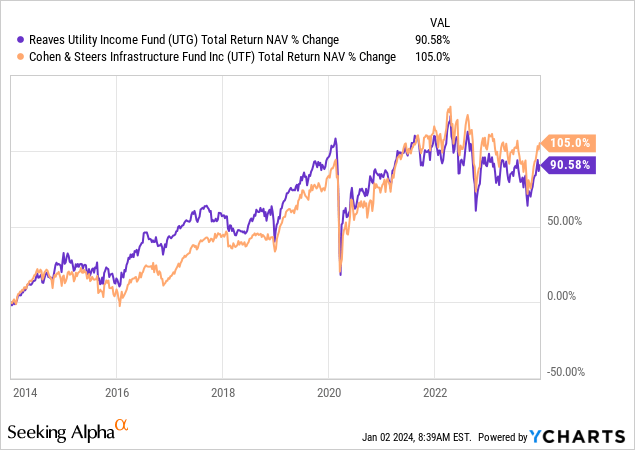

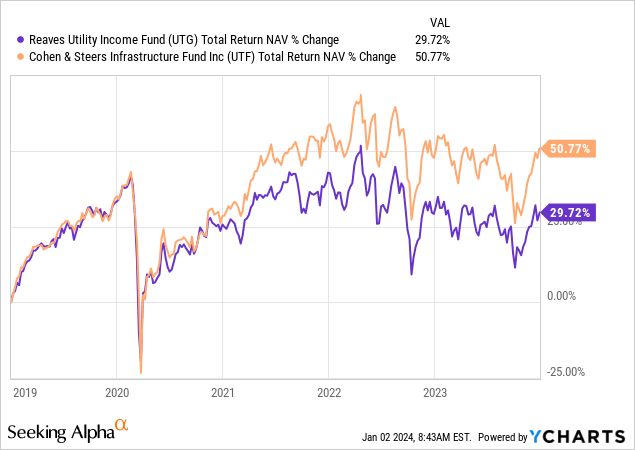

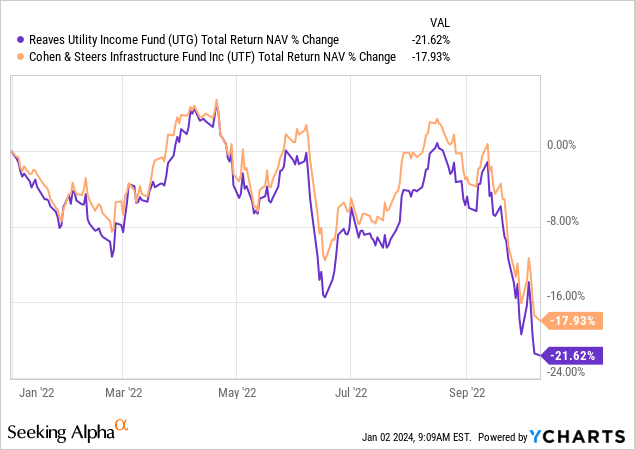

Over the last decade, UTF has beaten UTG on a NAV performance basis. The amounts are material at this point, though it was close at times, and UTG actually had the lead going into the COVID-19 crash.

What has been interesting here is the consistency of performance from UTF during some shorter timeframes. Here is the 3 year comparison.

And here is the 5-year comparison.

All other things being equal, you want the more consistent fund. In fact, you might even give a little off total performance for that consistency. A fund which exhibits a lower beta will be one that more people will stick with even at the depths of despair in a bear market. While we are no fans of performance chasing, UTF has shown the ability to deliver returns with more consistency, and that is a win.

Leverage

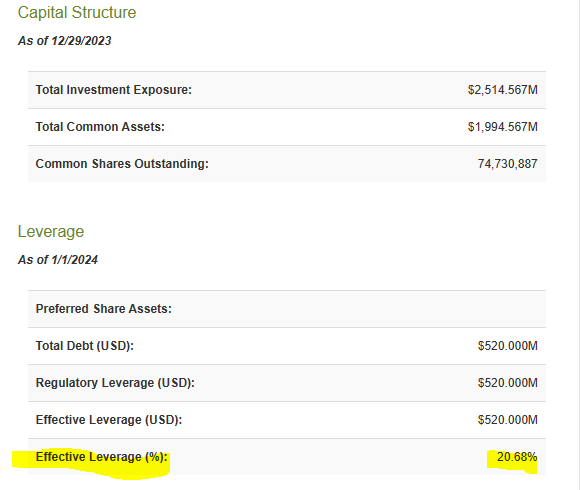

A key reason that we have generally shied away from CEFs common units (one major exception) in the past years is the leverage. We are just not comfortable employing leverage or with funds employing leverage. Here, we must note that the underlying companies themselves have “let themselves go” and dialed up debt levels. This is thanks to ZIRP which made CFOs and CEOs believe that nothing bad would ever happen if they went a couple of extra turns. Whether investors buy our extreme take or not, it is crucial to examine leverage levels when comparing two funds. Here we see that UTG has been a bit more sensible.

CEF Connect-UTG

UTF is on the higher end.

CEF Connect-UTF

What is quite fascinating here to us is that UTF has still done better on a NAV basis when you look at peak drawdowns within the 2022 bear market.

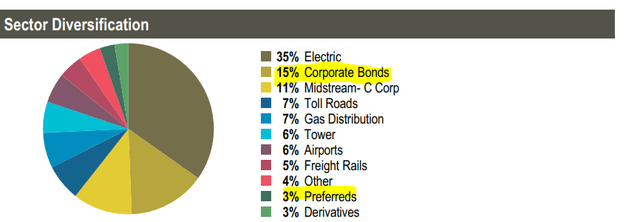

UTF has compensated for its higher leverage by holding a smattering of corporate bonds and preferred shares.

UTF Fact Sheet

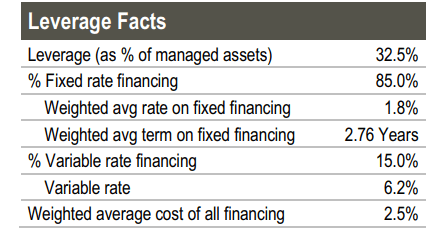

It also holds generally a slightly lower beta set of investments, and that has worked in its favor. UTF’s leverage costs are also primarily fixed-rate and are coming at a very low costs today.

UTF Fact Sheet

UTG is in a world of hurt on its interest rate payments on a relative basis.

For the year ended October 31, 2023, the average amount borrowed under the Credit Agreement was $517,643,836, at a weighted average rate of 5.42%. As of October 31, 2023, the amount of outstanding borrowings was $520,000,000, the interest rate was 5.99% and the value of pledged collateral was $ $1,040,000,020.

Source: UTG Annual report

We are considering this as a tie, as UTG’s overall lower leverage is offset by UTF’s mitigating actions. One must also not give UTF too much credit here as they might have to roll that debt into a far higher rate in 2 years.

Pricing

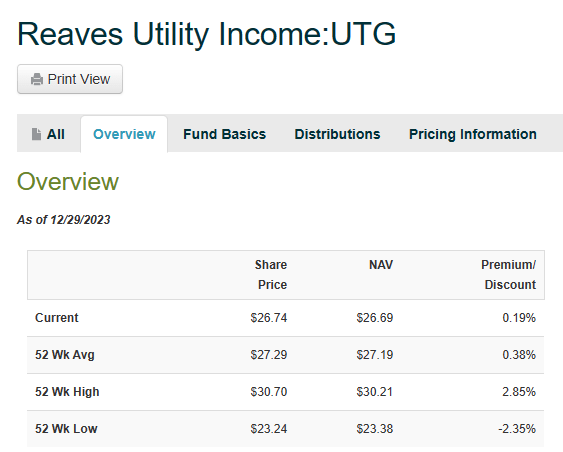

One of the biggest sources of alpha for a trader is the pricing movement in CEFs. While the NAV returns follow their own path, prices sometimes, take a rather different route. All too often the herd completely ignores the pricing distortions and the changes in premium or discount. Mean reversion here can be quite a free gift. In the case of UTG and UTF too, we can see a rather interesting setup. Based on what you have read above, with one clear win for UTF on performance and one tie, you would think people would be bidding up UTF. You would be wrong.

UTG trades right near its NAV.

CEF Connect-UTG

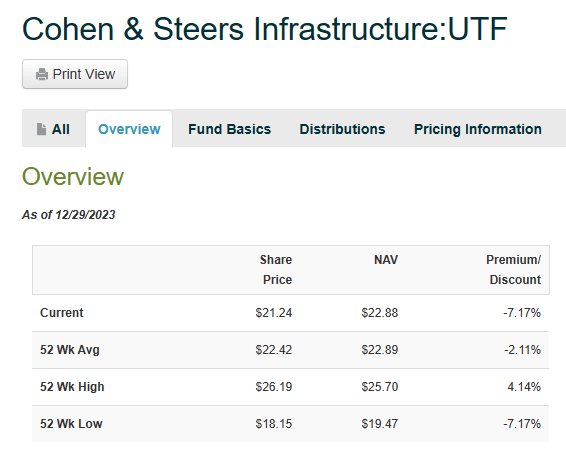

While investors are happy to part ways with UTF at an 8% discount.

CEF Connect-UTF

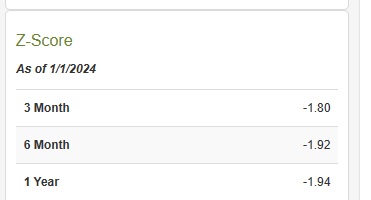

This also shows up as a highly negative Z-score, which shows UTF is cheap relative to its own pricing.

CEF Connect-UTF

If we plot this “spread” between the funds, we can see that UTF has become cheaper relative to UTG in the past. But there really should be no reason why UTF should have this pricing advantage.

Verdict

While not the setup on UTF’s favor that we got in early 2020, this one is not too bad. The 7.35% discount spread likely gives you a 2.5% annual alpha for the next 3 years. At a minimum we expect both to trade at the same discount to premium to NAVs, though we cannot rule out that UTG will likely move to a big discount versus UTF moving over NAV. At present, we rate both at a “hold”. We don’t see the need to chase these funds when we are getting quality 8% preferred shares for purchase. But if we had to buy one today, no question, we would go with UTF.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Read the full article here