The Bureau of Labor is set to release the Payroll report for December 2023 on Friday. Before the Payroll report, we will also get the new data on JOLTS job openings on Wednesday and the Weekly initial claims for unemployment on Thursday. Thus, this week will be very busy for investors, trying to gauge the labor market strength, and what it means for the economy, and the Fed.

The context

Broadly, the employment data this week needs to confirm that the disinflationary process is still in place, which will allow the Fed to cut interest rates as expected, but also to confirm that the US economy is not slipping into a recession.

The Fed has made a dovish pivot in December, signaling its intentions to start cutting interest rates this year, acknowledging that inflation is falling faster than expected, and yet suggesting the labor market is unlikely to weaken sufficiently to cause a recession – the Fed expect the unemployment rate to increase to 4.1% this year, from the current level of 3.7%. This is what many have described as a soft landing (hard landing would cause a sharp spike in the unemployment rate and a deep recession).

The Fed needs to see a continuous disinflationary process until inflation returns to the 2% target. The labor market plays an important part in the disinflationary process via wage growth, which directly affects service inflation. Wage growth is a function of labor supply and labor demand. Thus, the Fed needs to see a moderating wage growth, hopefully via the increased labor supply, as decreasing labor demand would signal a recession.

Most foresters have predicted a recession in 2023, and even the Fed was predicting a recession at a certain point last year. However, the recession has not arrived yet, specifically due to the resilient consumer spending, which is due to the strong labor market, and the labor market has been strong due to labor shortage. Specifically, the unemployment rate remained at a historically low level despite the aggressive monetary policy tightening, as employers held on to their employees due to the labor shortage.

The Fed now sees the labor market coming to a balance, which allows the Fed to normalize the policy rate without causing a recession – and that’s bullish for stocks. So, that’s the macro context.

What do we want to see?

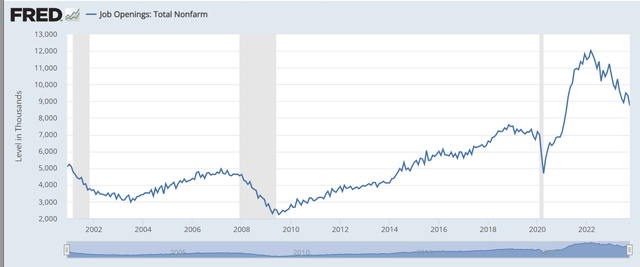

Once we get the data, first on Tuesday we want to get the confirmation of moderating labor demand, as proxied by the JOLTS Job Openings. The Job openings spiked after the pandemic, which caused the labor shortage and wage inflation. However, the trend in Job openings has been down – and this reflects a moderating labor demand.

The consensus is that the Job openings will slightly increase in December to 8.85M from 8.73M. Obviously, it would be positive to get a better-than-expected number, sub-8.73M. However, even with a slight uptick, the trend is still down. Ultimately, Job openings need to fall to pre-pandemic level of 7M, which is not too far from here.

FRED

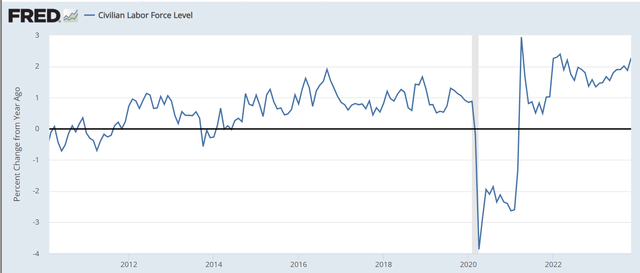

We also want to see an increase in labor supply, as proxied by the Labor Force growth. Currently, there are around 4M more participants in the labor force compared to the pre-pandemic level, and the labor force has been growing at around 2% annually, which is a very strong number. We want to see the labor force continue to grow at 2%, via higher participation rates and higher (legal) immigration. A higher labor supply will moderate the wage growth and contribute to the disinflationary process. Here is the chart showing an annual growth in the labor force.

FRED

Obviously, we don’t want to see a sharp increase in the unemployment rate, as this would signal a recession. The weekly claims for unemployment is the leading high-frequency labor market indicator – and this indicator has been suggesting that the labor market remains strong. We want to see the weekly claims to stay sub 250K, as the break above could signal a spike – and a recession. Here is the chart, weekly claims have been very low over the last 12 months, staying below 250K.

Trading Economics

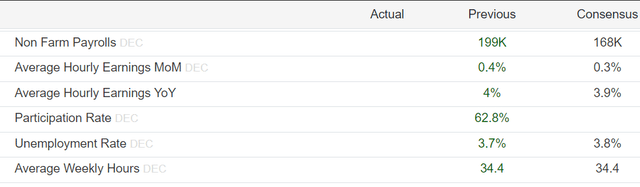

December payroll report consensus expectations

The market consensus is the payroll report on Friday will show a modestly weakening labor market with (only) 168K new jobs created, below October’s 199K number. The market would be happy with a number between 160K-180. Obviously, the market would not be happy with a number below 100K as this could suggest a fast-deteriorating labor market and a possible recession down the road. The market would also not be happy with the above 200K number, as this could impede the Fed’s plans to cut interest rates in March and cause a bond selloff. Based on the weekly claims, the labor market is still strong, and the risk is still to the upside.

The market consensus is also for a moderating wage growth at 0.3% mom and 3.9% yoy, which is consistent with the disinflationary process. Similarly, the market expects a slight uptick in the unemployment rate to 3.8%, which is positive as it leads to the Fed’s 4.1% target and confirms the Fed’s ability to normalize the policy rates.

Trading Economics

Implications

Overall, the market consensus calls for a modestly weakening labor market, which confirms the disinflationary process, and allows the Fed to cut interest rates in March. At the same time, the level of new jobs created supports a modestly growing economy and ultimately the “soft-landing” to 1.5% GDP growth in 2024, as expected by the Fed. Thus, if the data comes as expected, this would continue to support the soft-landing scenario, which is bullish for the stock market.

The stock market, as proxied by the S&P 500 (SP500) is currently overbought after the 2023 parabolic end-of-the-year rally, so investors could be looking for any excuse to sell stocks and take profits, which includes a reaction to the labor market data, even if the report is positive.

But the true reaction will be in the bond market, which is pricing an aggressive policy easing in 2024. The selloff in the bond market due to the “hot” labor market data, could trigger a deeper correction in the S&P 500, and especially in Nasdaq 100 (QQQ).

However, the big picture is positive, the current baseline outlook calls for the disinflationary process to continue, which will allow the Fed to cut as expected, which will cancel the expected recession. This is a bullish scenario for stocks.

The labor market data must continue to confirm this scenario, which is consistent with the market consensus. Thus, any potential technical dip or deeper correction in the stock market will be a buying opportunity – as long as the disinflationary process continues and the Fed cuts early and aggressively, as currently expected.

Read the full article here