It feels like just yesterday when I could close my eyes, throw a dart at the dart board, and land on a deeply undervalued tech stock. Tech stocks had been crushed unusually hard heading into 2023, leading them to trade at incredibly attractive valuations in spite of their strong long term secular growth outlooks. That made tech stocks a great asymmetric bet. Times have changed. Tech stocks have recovered their losses and now appear to be trading at aggressive valuations once again. The best secular growth stories are often hampered by rich valuations. Meanwhile, conventional value stocks may face balance sheet risk in light of the higher interest rate environment. While it is difficult to possess anywhere near the kind of conviction I had last year, I can offer two top picks for the year, one growth stock hiding in plain sight, and another value stock offering an outsized yield.

This Time Isn’t Different

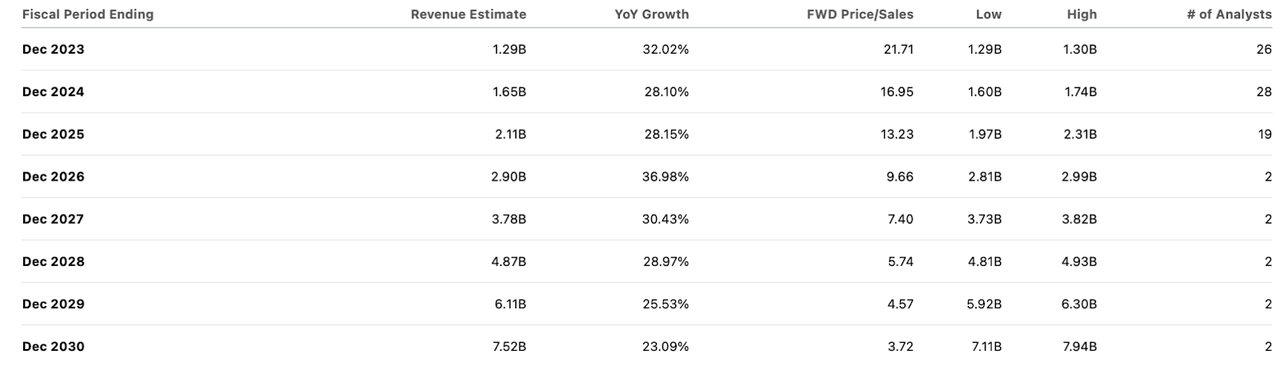

Growth stocks have staged a recovery for the ages. After seeing valuations swing from ultra-bullish to ultra-bearish in 2022, tech stocks soared in 2023. That may have caught some bystanders off-guard given that revenue growth rates had slowed post-pandemic. But many tech companies offset the decelerating top-line growth with aggressive improvements in operating margin, showing cost discipline that Wall Street apparently did not believe they were capable of. While many tech stocks are still well below all time highs, valuations are still nonetheless looking aggressive. Consider the stock of Cloudflare (NET), a high quality name which saw its stock trading at just under 22x sales as of recent trading. Consensus estimates also look aggressive, expecting the firm to sustain 25% to 30% revenue growth for many years with no hint of deceleration.

Seeking Alpha

Based on 20% top-line growth, 30% long term net margins, and a 1.5x price to earnings growth ratio (‘PEG ratio’), I could see fair value hovering at around 9x sales. That means that the stock is pricing in many years of growth even using the aggressive consensus estimates. Meanwhile, the company is still a ways off generating real GAAP profits – what happens if consensus estimates prove too aggressive? I don’t want to be around to find out.

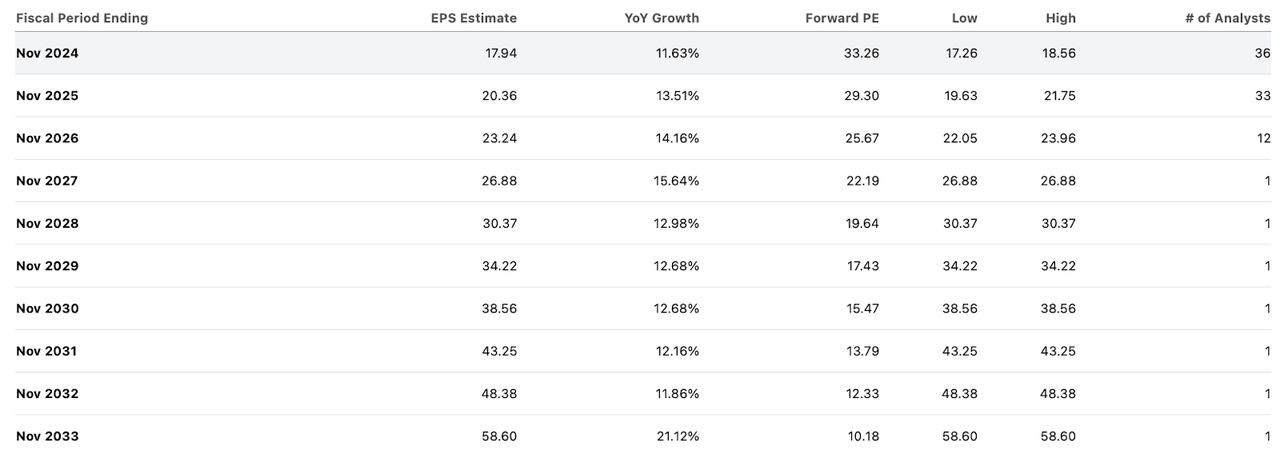

Think this is an issue just with unprofitable tech stocks? Think again. Take a look at the stock of Adobe (ADBE), which was trading at well over 30x forwarded earnings. Here, consensus estimates also look aggressive, calling for double-digit top-line growth for a decade and even faster bottom-line growth on top of that.

Seeking Alpha

The stock will likely see some multiple compression as growth rates come down. Based on a 22x earnings multiple in 2033, the stock might trade at $1,289 per share in 2033, implying just around 8% compounded annual return upside over the next 10 years (or around 10% to 11% inclusive of the earnings yield). That kind of prospective return might be enough to beat the broader market only slightly, but I am not comfortable with the aggressive assumptions underlying it.

Growth investors may be tempted to loosen their valuation hurdles, which would theoretically “solve” the above issues. I caution against making such an adjustment given that interest rates remain somewhat high and also the 2022 tech stock crash is only one year removed. I am guilty of making that mistake in 2021 in my search for “alpha” and I paid dearly for it – I can only hope that these cautionary words can help others avoid the same mistake today.

Top Growth Pick

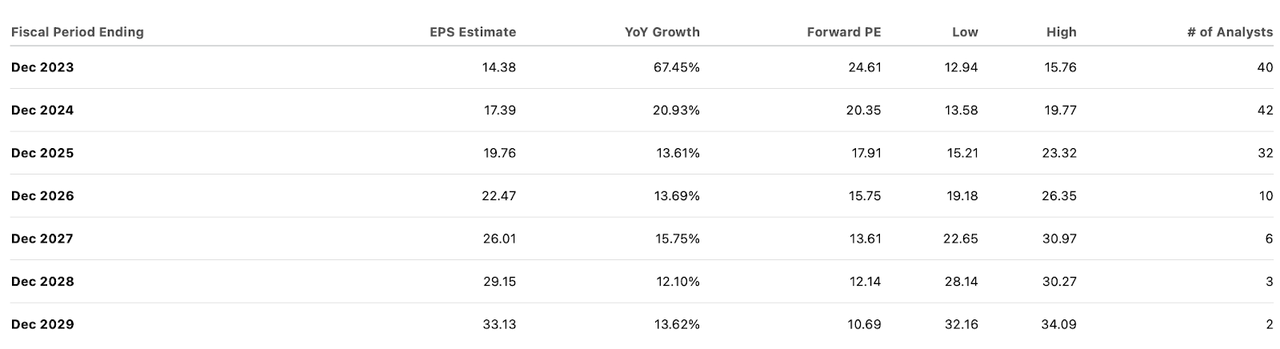

Not all growth stocks are overvalued. Meta Platforms (META) has returned a stunning 280% from the lows, but the stock today looks as sure a bet as ever.

Seeking Alpha

The company has reignited top-line growth due to moving past tough post-pandemic comparables as well as strong execution on integrating artificial intelligence into content feed generation. Artificial intelligence appears to have helped META move past the iOS data privacy changes that initially caused the stock’s collapse in late 2021 and early 2022. The company is also showing solid growth in its user base, showing that it can exist alongside the fast-growing TikTok. The company has over $40 billion in net cash and is actually a lot cheaper than it looks – Reality Labs losses make up nearly 30% of overall operating profits. If Wall Street were to eventually value Reality Labs at $0 instead of the negative implied value on a P/E basis, then the stock could experience a substantial re-rating from that alone. With management proving their commitment to profitability with their “year of efficiency,” I expect solid operating leverage moving forward. Management has also appeared more shareholder friendly than ever, showing a solid commitment to their share repurchase program. META stock is the perfect package but advertising revenues remain undoubtedly exposed to a potential recession.

Top Value Pick

It seems obvious to me that growth stocks on the whole are looking frothy, but that does not necessarily mean that it is easy to find high conviction ideas in the value space either. The big rally in the overall market (IVV) has positively affected value stocks as well, with the result being that the most obvious “bargains” may have certain balance sheet issues.

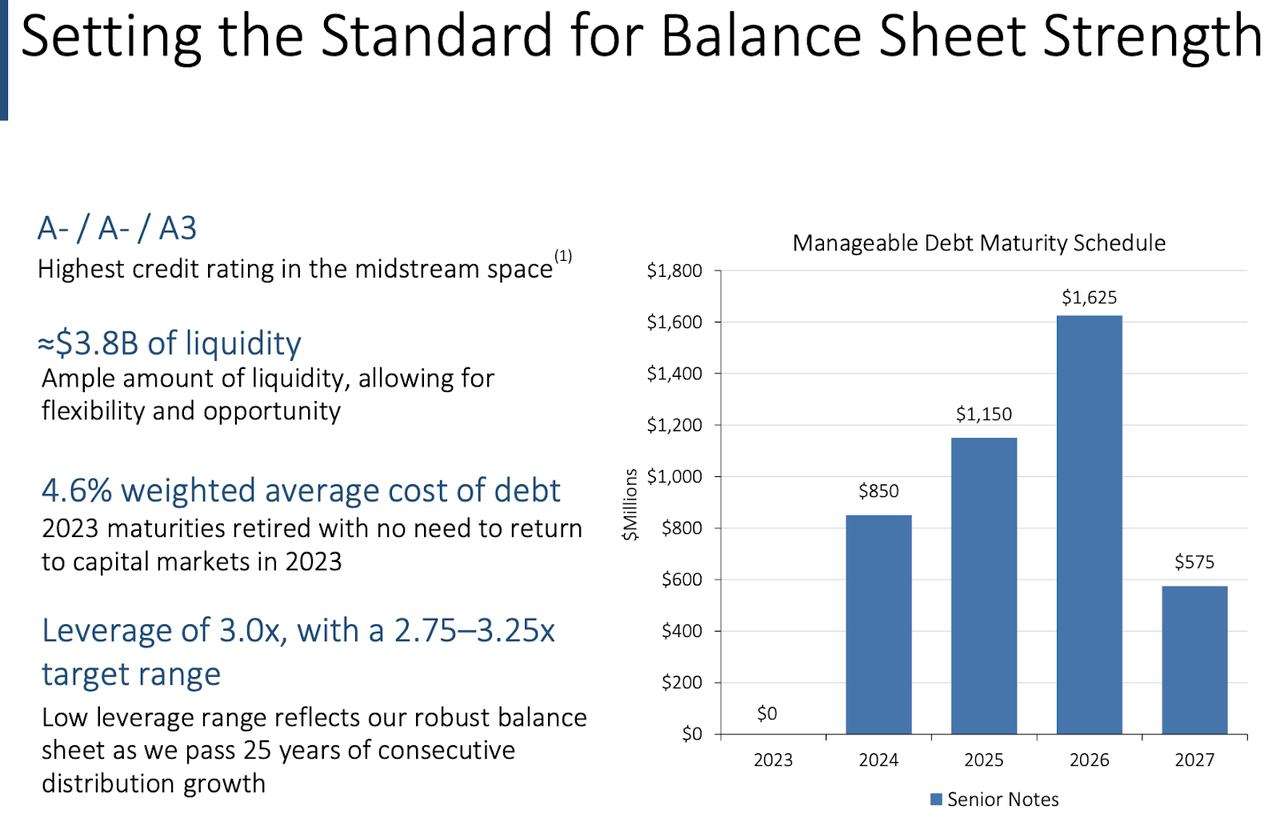

My top value pick is Enterprise Products Partners (EPD). I should first note that the company issues a K-1 tax form and may complicate the tax filing process (though there are certain tax deferred advantages to help offset that hassle). With that out of the way, EPD is one of the largest midstream operators (meaning that it transports products like natural gas liquids through its pipeline infrastructure). The energy sector as a whole remains somewhat unloved due to potential tail-end risk, but there are two reasons why EPD stands out among the rest. First, the company maintains one of the strongest balance sheets in the sector, with leverage standing at just around 3x debt to EBITDA and the upcoming maturity schedule being more than manageable. This means that the company may face less interest rate headwinds than peers.

2023 Q3 Presentation

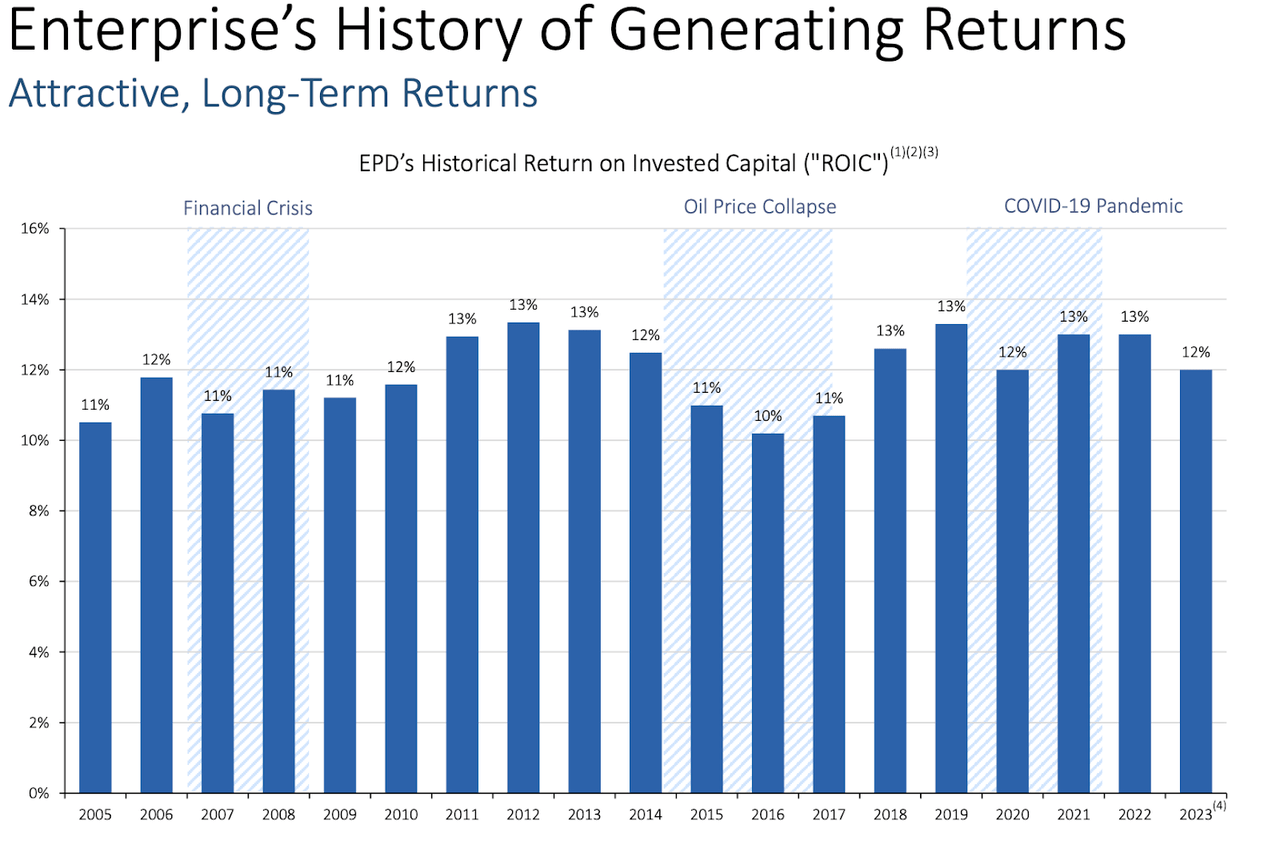

That low leverage is due to both management’s conservative leaning as well as their ability to generate solid returns on invested capital. EPD has a long history of extracting value from their growth projects, something that is surprisingly unique in the midstream space.

2023 Q3 Presentation

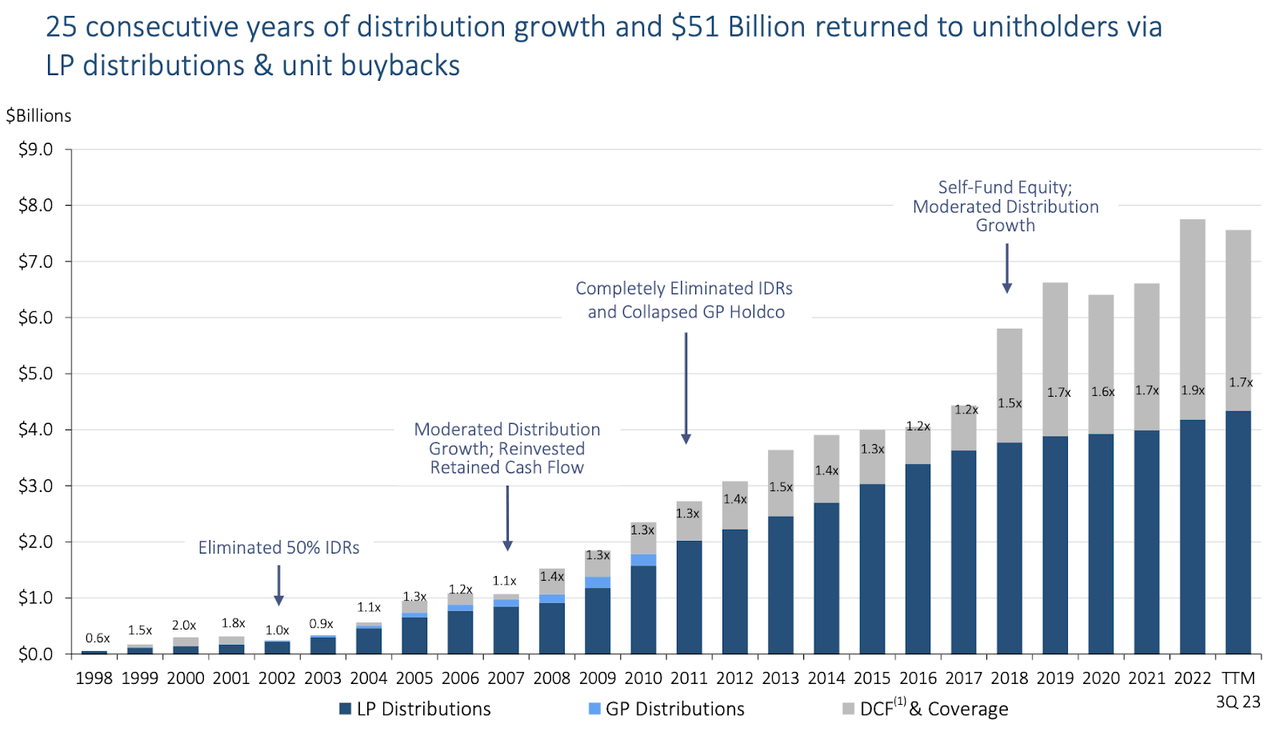

EPD is one of the few midstream operators to transition to a fully self-sustaining business model, meaning that it is able to fund both distributions and growth CapEx out of internally generated cash flow alone.

2023 Q3 Presentation

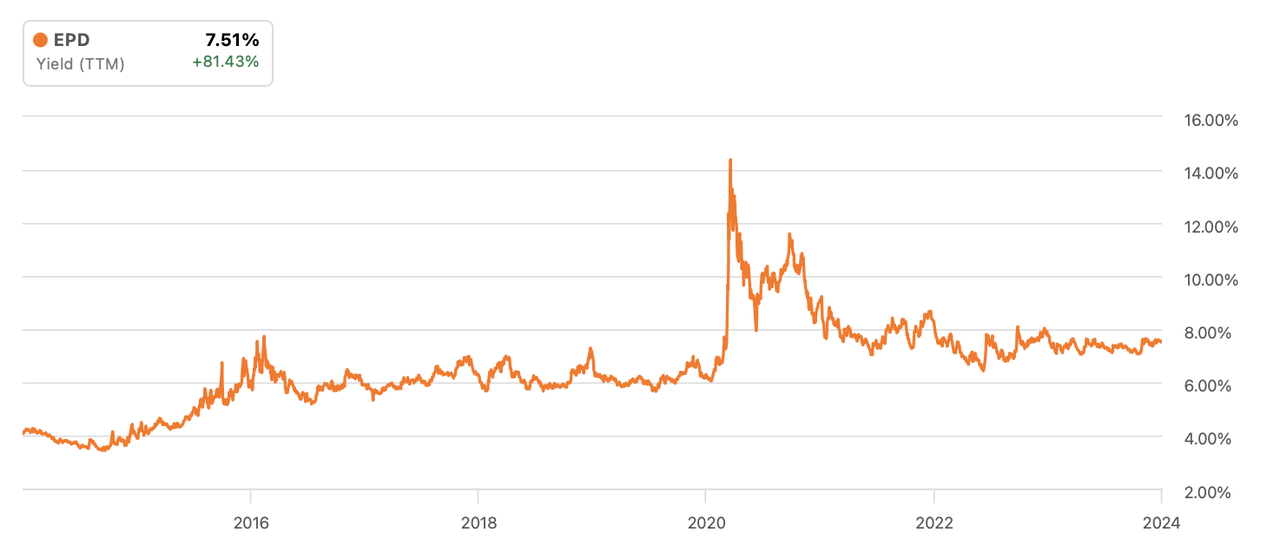

In spite of the top tier financial metrics, EPD trades at a 7.5% distribution yield. EPD trades at an unusual discount to c-corp peers like Enbridge (ENB) and TC Energy (TRP) on an EV/EBITDA basis, which appears to be due to the aforementioned K-1 tax form. It was just several years ago that EPD was trading at yields around 6% and less.

Seeking Alpha

Between projections for around 3% to 5% growth and the 7.5% distribution yield, EPD appears poised to deliver double-digit returns all while paying a generous yield. If EPD can get some respect for the rent-like consistency of its revenue stream, then the prospective return potential can increase even further. EPD appears to be one of the few stocks offering compelling valuations (7.5% yield, 10x EV/EBITDA multiple) against a low risk profile (conservative debt position and contracted revenue stream) – again, investors need to make themselves comfortable with the K-1 tax form.

Conclusion

I remain bullish on stocks overall, though tech and growth stocks are looking frothy. This makes it difficult to find high quality growth stocks that are still trading at buyable valuations, while value stocks may retain balance sheet risk. Meta Platforms and Enterprise Products Partners are two names that strike a balance between compelling value and risk, while operating at opposite ends of the growth/value spectrum. I look forward to a new 2024 year and encourage readers to share their thoughts and picks below.

Read the full article here