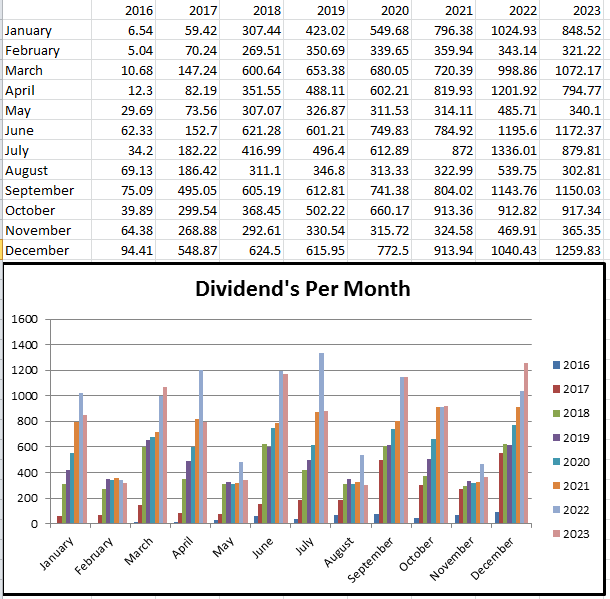

December 2023 Passive Income Update

- 3 sources of passive income

- $1,259.83 from dividends

- 18 stock/units dripped in December

- Trailing 12-Month Portfolio Return 5.51%

S&P 500 12-Month Total Return +23.53% for December 2023

S&P/TSX Composite Index 12-Month +11.34% January 2, 2024

Who would have thought 2023 would be bringing those kinds of returns? Absolutely crazy. Some of my accounts outperformed, but when you include Algonquin (AQN, AQNU, AQN:CA), it brings it way down. Let’s see what 2024 brings, will the magnificent 7 continue to carry the market? Time will tell.

Alright, Let’s Get To Our December 2023 Passive Income

Raises/Cuts

I don’t think we got any raises this month, but other than Aecon (OTCPK:AEGXF, ARE:CA), I’m pretty sure every company in our portfolio raised its dividend this year.

Total Added Income from Dividend Raises in 2023 – $194.96

A lower raise overall for the year. Bryan Adams may say it best that the Algonquin dividend “cuts like a knife.” Without it, we would have been near $500, and with 10k in forward income at the end of the year, we would be close to a 5% dividend growth rate. Although we started 2023 with $8,350.93 forward income, so I guess it would be higher. Don’t know how you would calculate that. Average the start and finish numbers?

December 2023 Dividend Income

12 companies paid us this month.

| Stocks | December 2022 Income | December 2023 Income |

|---|---|---|

| Stanley Black & Decker (SWK) | 21.60 | sold |

| Franco-Nevada (FNV, FNV:CA) | 5.22 | sold |

| JNJ (JNJ) | 75.71 | 79.73 |

| Home Depot (HD, HD:CA) | 19.00 | 60.61 |

| Lockheed Martin (LMT) | 66.00 USD | 78.75 |

| Microsoft (MSFT) | 28.56 | 30.75 |

| Alimentation Couche-Tard (ATD:CA, OTCPK:ANCTF) | 23.80 | 36.93 |

| Canadian National Railway (CNI, CNR:CA) | 79.84 | 93.22 |

| Brookfield Asset Management (BAM, BAM:CA) | 0 | 24.40 |

| Allied Properties (OTC:APYRF, AP.UN:CA) | 0 | 42.00 (2 Drips) |

| Brookfield Renewable (BEP, BEP.UN:CA) | 118.44 (3 Drips) | 155.85 (4 Drips) |

| Suncor Energy (SU, SU:CA) | 213.72 (5 Drips) | 234.35 (5 Drips) |

| Fortis (FTS, FTS:CA) | 128.82 (2 Drips) | 139.24 (2 Drips) |

| Enbridge (ENB, ENB:CA) | 259.72 (3 Drips) | 284 (5 Drips) |

| Totals | 1,040.43 | 1,259.83 |

18 stocks/units Dripped in December.

To say that I was impressed tabulating this month’s income would probably be an understatement. This was a solid increase compared to the $1,150.03 in September. I really like how the portfolio has morphed over the years into better-quality companies.

This month was our first payment by Allied Properties. While I wouldn’t put it under the wide moat quality companies, it has already done very well for us in the month-and-a-half we have had it. Will it continue like this? Who knows, but that special dividend is coming our way in January. Plus that Costco (COST) special dividend! Sweet.

Our Drips (Dividend Reinvestment Program) added $44.84 to our forward income.

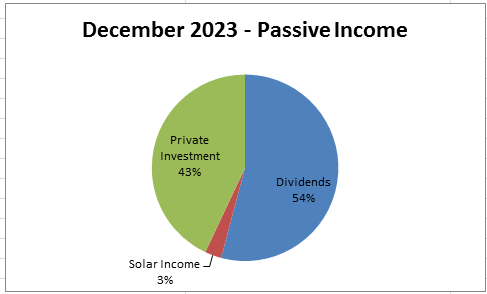

Other Income

Private Investment Payment – $1000.00

1k a month, very nice!

Solar Panel Income

In November (we always get paid a month later), our solar panel system generated 248 kWh. Since we bring in a fixed rate of 28.8 cents per kilowatt hour, Hydro One (OTCPK:HRNNF, H:CA) deposited $66.69 into our chequing account this month.

Last November, the system generated $61.96, so we came out slightly ahead. It will be interesting to see what December’s solar will look like in this climate.

Total Income for 2023 – $2,106.67

System Installed January 2018

Total System Cost ——–$32,396.46

Total Income Received ——–$14,278.96

_____________________________________________

Amount to Break even —- $ —18,117.5

Last year’s solar income was 2,287.07, so we are seeing a pretty decent decline in earnings. I know my tree is getting bigger, but is this the factor? I dunno. Maybe I gotta go up there and squeeze those panels clean again.

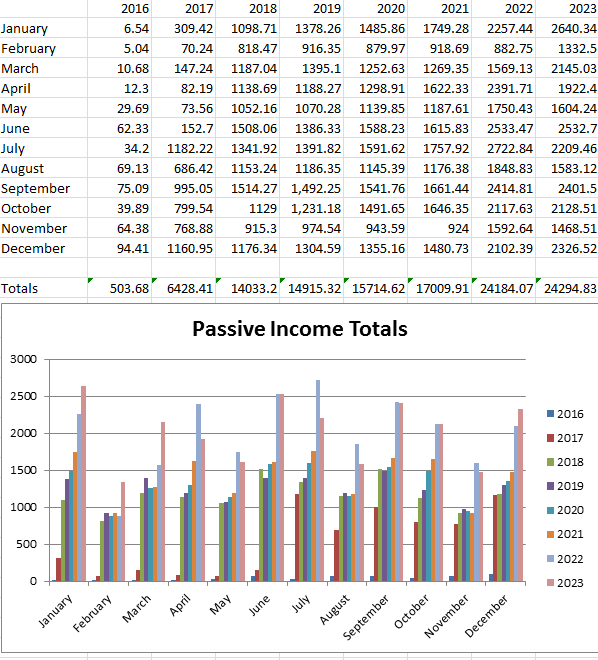

Total December 2023 Passive Income – $2,326.52

December 2022 Passive Income – $2,102.39

$224.13 increase year over year or a 10.66% growth rate. Hey, that ain’t bad at all. We are back to some growth after selling over 100k of stock last October.

While it was a good move to deleverage, some of those sales are up and some down. One thing that stands out is my rant about the world. Here we are a year later and things don’t seem that bad about the things I was going on about. Maybe the mass immigration, the upcoming US election, and the current wars may be different this time. It does point out how there is always horrible news and politics.

Totals For 2023

Dividends Year To Date Total – $9,424.32

Other Passive Income Year to date – $14,870.51

Total Passive Income for 2023 – $24,294.83

Year End Goal – $26,000 (93.44%)

Below the goal, but that’s alright. Last year, we brought in $24,184.07. So really not a massive jump, if you just look at the numbers. But the thing is we collected all those dividends from the 100k we sold last year. The sales lost us about 4k in dividend income and here we are.

8 years of investing from 0 to almost 25k per year. We see the growth and spikes in the chart above and with the power of 3, that will only grow faster. Drips, Dividend Raises, and New Capital.

December Stock Purchases

Couche-Tard – (OTCPK:ANCTF, ATD:CA),

A great company that has treated us very well. The stock price is up nicely and the 20% plus yearly dividend raises aren’t bad either. We added another 17 shares at a cost basis of $76.46 per share.

This adds $11.90 to our forward dividends.

Nutrien – (NTR, NTR:CA)

Our basic materials sector is one of our lowest sectors and this position is a small one of ours as well. While it is technically not a wide moat company, it pretty much is. Unfortunately, the business is highly cyclical and here we are, close to 52-week lows. The good thing is I know the world will always need food, and we need fertilizer to maximize those crops. That’s Nutrien’s bread and butter. Another good thing, Nutrien likes to buy back stock and I’m pretty sure they will be taking advantage of these current prices in that regard.

- December 31, 2018 shares outstanding – 608.54 million

- October 21, 2023 shares outstanding – 494.55 million

RBC says Nutrien is undervalued and currently gives them a fair value of $99.75 per share. If we were to pop up to that price, that’s a 25.16% return, not including that dividend.

We added 13 more shares at $76.19 per share. This adds $27.56 to our forward dividends.

Overall, we added $39.46 in forward income this month.

Total added forward dividend income from purchases in 2023 – $1,608.14

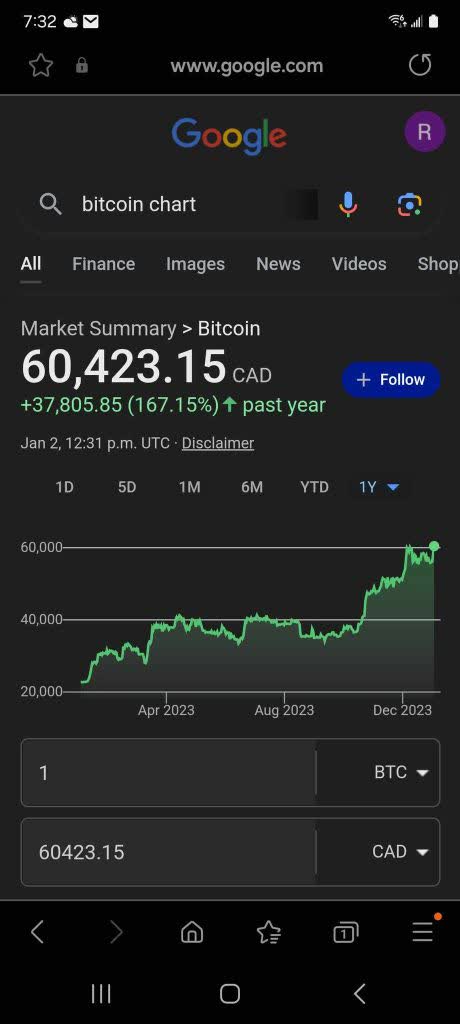

Bitcoin

To say Bitcoin (BTC-USD) has had a good year would probably be an understatement. Wow! 167.17%.

Financial Goals Update

Charities

- We continue our monthly donation to The Nature Conservancy of Canada of $85.

ETF Monthly Minimum Purchase of $250

- This month, we added 0 more units of XAW ETF (XAW:CA, XAW.U:CA).

- Questrade is great because it offers free ETF trades and cheaper stock trading options than most Canadian brokers. $250.00 a month would kill us if we needed to pay high trading fees.

We didn’t buy XAW this month.

December 2023 Passive Income Conclusion

I’m happy with the progress we have made in 2023. Let’s hope the market retracts a bit as we are still in the accumulation phase and some of these P/Es are just crazy. Wish you all nothing but the best in 2024! How did you do this year? Any goals for 2024?

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here