I expect Qualcomm (NASDAQ:QCOM) to be a big winner in 2024, as the company is exceptionally well-positioned to capture emerging growth in AI-powered application in Edge computing. In fact, Qualcomm’s management anticipates that first use-cases of device-powered AI applications (e.g., on smartphones), may surface as early as 2024, with a subsequent exponential surge in growth. Meanwhile, Qualcomm’s automotive continues to leverage the structural growth tailwind coming from smart mobility.

I view Qualcomm’s EV multiple of <13x 2024 EBIT as a clear buying opportunity. On the backdrop of both valuation upside and accelerating commercial momentum, I give QCOM shares a “Strong Buy” rating with a $174 target price.

For context, Qualcomm stock has outperformed the broad U.S. equities market in 2023. For the trailing twelve months, QCOM shares are up about 28%, compared to a gain of approximately 23% for the S&P 500 (SP500).

Seeking Alpha

AI To Drive An Emerging Growth Thesis …

Qualcomm’s strategic positioning is posied to leverage AI applications at the Edge, not just with best-in-class performance but also with a unique ability to deliver these capabilities at remarkably low power consumption. This low-power feature is crucial, especially as AI models run persistently and pervasively on battery-powered devices, like mobile phones. In that context, Qualcomm’s leadership is quite differentiated from Nvidia’s position, which is more pronounced in Cloud-based AI solutions. Specifically, I point out the Edge environment leverages local information for real-time actions. This form of computing passes the limitations of Cloud-based AI due to latency constraints.

Qualcomm management has voiced expectations that first use-cases of device-powerd AI will emerge already in 2024, followed by likely exponential growth thereafter. This is important for QCOM investors, because AI-powered use-cases on devices are anticipated to drive a potential replacement cycle in the smartphone market. Unlike network upgrades like 5G, this replacement cycle will be more consumer-driven, and recurring. Although Qualcomm refrains from including AI replacement tailwinds in its market assumptions, management has suggested that AI-enabled smartphones will likely command higher Average Selling Prices compared to non-AI enabled smartphones, which could significantly impact pricing power for Qualcomm.

Moreover, AI may also supercharge Qualcomm’s ambition in spatial computing. In 2022, Qualcomm has launched chips to power Meta Platform’s PRO virtual reality headsets. After an initial celebration, market sentiment about this partnership has faded; but, bullish expectations may pick-up again as AI drives more demand for headsets. In that context, Qualcomm CEO commented:

We are seeing gen AI coming into VR. We see an incredible potential [for augmented reality and mixed reality glasses], especially as you use audio and large language models as an interface. We have been very bullish about spatial computing being the new computing platform, and we see a lot of promising developments coming: we see what Meta is doing, we see what is happening on the Android ecosystem with Google and Samsung. We are just at the beginning.

Discussing Qualcomm’s VR/ AR ambition, it’s also interesting to point out that the chip-designer has recently announced the XR2+ Gen 2 chip, a product that is expected to be competitive with an announcement that both Samsung (OTCPK:SSNLF) and Google (GOOG) (GOOGL) have plans to employ the Snapdragon XR2+ Gen 2 in their forthcoming mixed reality devices.

… While Automotive Is Well-Positioned To Capture Structural Tailwinds

While Qualcomm’s AI ambitions are promising, the company also stands on the brink of a structural growth opportunity within the automotive industry. Specifically, I point out that Qualcomm has cemented its position as an industry leader in vehicle connectivity and has made significant strides in researching and developing relevant technologies: Qualcomm has pushed to specialize in developing advanced digital cockpit technologies, integrating infotainment systems, driver assistance, and vehicle control interfaces for improved user experiences and safety features. Additionally, Qualcomm is exploring wireless charging solutions for electric vehicles. Moreover, Qualcomm also holds an interest ADAS functionalities, leveraging sensors, cameras, and processors to enable collision avoidance and adaptive cruise control. Lastly, Qualcomm’s emerging strength with AI is poised to help the company in automotive, as the company may likely build products around predictive maintenance, contextual awareness, and intelligent navigation systems.

On a short-/ mid-term perspective, I am bullish on Qualcomm’s automotive opportunity heading into 2024, despite acknowledging macro pressures affecting the broader automotive semiconductor supplier ecosystem. On that note, it is also important to point out that Qualcomm’s exposure is diversified across multiple OEMs and geographic regions, reducing dependence on idiosyncratic challenges of customers. Moreover, Qualcomm’s automotive business remains drivetrain agnostic, providing insulation against concerns about fluctuations in electric vehicle (EV) demand. This neutrality allows Qualcomm to cater to various drivetrain technologies, ensuring its relevance regardless of the propulsion systems dominating the market.

With Q4 reporting, Qualcomm reaffirmed its projections, stating that Automotive revenue is set to surpass $4 billion by the end of fiscal year 2026 and exceed $9 billion by the end of fiscal year 2031.

Valuation Update: Set TP At $174

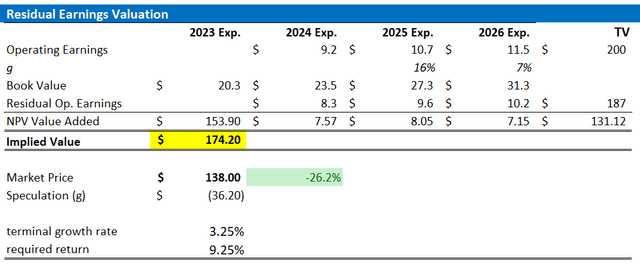

Based on an overall supportive Q3 report, robust guidance, and a gradually improving macro-economic backdrop going into 2024, I am updating my EPS projections for Qualcomm. According to my estimates, it is likely that QCOM’s EPS for FY 2024 could range between $9 and $9.4. My projections for FY 2025 and FY 2026 see EPS of approximately $10.7 and $11.5 respectively. Notably, my estimates quite closely align with the consensus EPS, showing a margin of approximately +/-10%, based on Refinitiv data. Moreover, although I maintaining a 3.25% terminal growth rate (about 100 basis points above historical long-term nominal GDP growth to reflect a structural growth market in AI/ semiconductor), I lower my cost of equity requirement by about 75 basis points, mostly as a reflection of the expectations for rate cuts (which lower the cost of capital). As a result of these adjusted inputs, my fair estimated share price for Qualcomm now stands at $174.

Analyst Consensus; Company Financials; Author’s Calculations

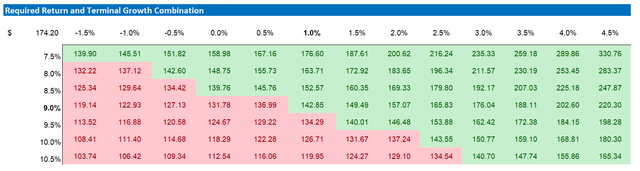

Below is also the sensitivity table, which tests different assumptions for cost of equity (row) as well as terminal growth rate (column).

Analyst Consensus; Company Financials; Author’s Calculations

A Note On Risks

Investing in Qualcomm, like investing in any assets, also comes with risks: Particularly, heightened competition poses a potential concern, with major tech giants like Intel and Apple (in-house chip development) vying for market share in the smartphone semiconductor industry. Moreover, competitive landscape includes challenges from Qualcomm’s partners, such as Samsung and Huawei, potentially impacting market position and revenue streams. Moreover, uncertainties surround the pace of adoption for 5G technology and the deployment of new telecom infrastructure globally. In that context, delays in widespread 5G adoption or regulatory hurdles in key markets might affect Qualcomm’s revenue projections. Furthermore, the company’s ventures into emerging technologies like AI, VR, IoT, and automotive may face uncertainties regarding market acceptance and profitability, adding another layer of risk.

Investor Takeaway

Qualcomm is poised to capture emerging growth in 2024, as the first AI use-cases are coming to Edge computing. As another growth driver, Qualcomm’s automotive continues to leverage the structural tailwind coming from smart mobility. I view Qualcomm’s EV multiple of <13x 2024 EBIT as a clear buying opportunity. On the backdrop of both valuation upside and accelerating commercial momentum, I upgrade QCOM shares to a “Strong Buy” rating with a $174 target price

Read the full article here