At a Glance

Delving into Moderna’s (NASDAQ:MRNA) trajectory, my earlier analysis shed light on its eclectic project range. This spectrum spans from oncology to infectious diseases, with notable breakthroughs in RSV and flu vaccines. Moderna has since leaped forward, especially with mRNA-1083. This vaccine, both innovative and dual-purpose, targets COVID-19 and flu. It’s now in Phase 3, with approval expected in 2025.

However, it’s not all smooth sailing. The past year saw revenue dip and operational expenses climb. Still, Moderna’s financial health stays resilient, boasting $12.8 billion in liquid assets. Yet, investors should stay alert. They face hurdles like Pfizer’s (PFE) rival vaccine and the crucial need for sharp financial stewardship to ensure growth.

Despite these challenges, the market seems to undervalue Moderna. It overlooks the long-term growth driven by its rich pipeline. This oversight is particularly acute in the realms of cancer treatment and infectious disease control. These areas, brimming with potential, are likely to be key drivers of Moderna’s future revenue surge.

Moderna’s Double Defense: A Shot at Conquering Flu and COVID Together

As a nurse working at the bedside, I have been donning a lot of isolation gowns, gloves, and masks lately. This winter, COVID-19 and influenza are on the rise, with many vulnerable people infected and experiencing symptoms. This underscores the need for more effective and convenient immunizations. Moderna’s mRNA-1083 vaccine takes a huge step forward by targeting both influenza and COVID-19.

mRNA-1083’s Phase 1/2 trials revealed solid results. Their findings demonstrated significant immune responses to both viruses, as well as a safety and reactogenicity profile equivalent to existing immunizations.

The trial data for mRNA-1083 revealed impressive hemagglutination inhibition antibody levels, rivaling or surpassing those elicited by approved quadrivalent flu vaccines. Similarly, the vaccine generated SARS-CoV-2 neutralizing antibodies at levels comparable to those from the Spikevax bivalent booster. Notably, adverse reactions were generally mild or moderate, aligning with those observed in standalone vaccine trials.

mRNA-1083 is now in Phase 3, with approval expected in 2025. This dual-action immunization allows for speedier administration and increased patient compliance, potentially reducing the annual burden that these viruses place on individuals and healthcare systems. Because COVID-19 is likely to be a seasonal problem, similar to influenza, I believe a combination vaccine might be a highly lucrative investment, and if Moderna’s pandemic efforts from years ago are any indication, they are well-positioned for success.

Furthermore, the huge commercial potential of this vaccine is demonstrated by Moderna’s prediction that sales of respiratory products will reach between $8 and $15 billion by 2027. That, in my opinion, is not a naive estimate. A combination vaccine could more than double their current market share. As Moderna observes,

The global influenza market volume is approximately 500-600 million doses annually with approximately 150 million doses administered in the United States. Moderna estimates the U.S. fall 2023 COVID-19 market size as likely to be 50 to 100 million doses, depending on vaccination rates. Over time, the Company anticipates the COVID-19 market will approach the influenza market in the U.S. given the burden of disease.

Moderna

Q3 Performance

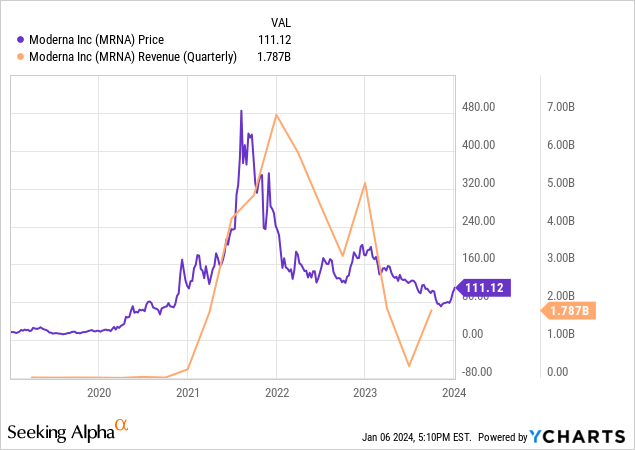

For the quarter ending September 30, 2023, Moderna revealed a significant Y/Y decrease in revenue, with net product sales dropping from $3,120 million to $1,757 million due to a decrease in demand for their COVID vaccine. Operational costs, particularly in the cost of sales, increased to $2,241 million, leading to a net loss of $3,630 million, a significant drop from the previous year’s profit of $1,043 million. Share dilution has been moderate, with basic weighted average common shares receding from 390 million to 381 million.

Financial Health

Moderna’s total liquid assets are $12.8 billion, consisting of $2.9 billion in cash and equivalents and $9.9 billion in investments. The company has $5.9 billion in liabilities, divided between $4.4 billion in current and $1.5 billion in non-current. The current ratio is 2.46, indicating a solid liquidity position.

However, Moderna experienced a net cash depletion of $3.7 billion in operating activities over the nine months ending September 30, 2023. This negatively impacts the company’s financial runway, with an estimated (historical) cash runway of 31 months.

Moderna’s cash reserves and long cash runway suggest minimal need for additional financing within the next year, assuming a consistent cash burn rate and no major unexpected expenses or revenue slumps. However, the company’s long-term financial health is uncertain due to significant cash burn and the potential need for strategic financial stewardship for sustainability.

Market Sentiment

According to Seeking Alpha, Moderna’s market capitalization is pegged at $42.37 billion, marking a major presence in the biotech landscape. However, growth prospects appear limited, with sales expected to drop from $6.42B in 2023 to $4.45B in 2024, then rebound to $5.57B in 2025. This sales volatility points to fluctuations in revenue streams. In terms of stock performance, (MRNA) has trailed behind SPY, dipping 35.96% over the last year, against SPY’s 23.35% uptick. This underperformance reflects a lack of investor confidence. On the other hand, investors may benefit from zooming out and considering the long-term story.

The stock’s short interest stands at 6.36%, with 21.88 million shares short, signaling moderate investor skepticism. Institutional ownership is high at 64.21%, but a shift in new (2,051,730 shares) versus sold-out positions (3,680,455 shares) suggests a gradual retreat from the stock. Key players like Baillie Gifford & Co. and Blackrock display varied adjustments in their holdings. Insider trading patterns show a discernible negative trend, with significant net sales over the past year (-2,346,233 shares), possibly hinting at internal doubts regarding Moderna’s future trajectory. Thus, the market sentiment surrounding Moderna can be characterized as fragile.

My Analysis and Recommendation

Investors are drawn to Moderna’s stock because it is both appealing and risky. mRNA-1083, a vaccine that combats both COVID-19 and influenza. This innovation represents Moderna’s prowess. It is critical for investors because it suggests a reversal in the near-term revenue trend. Currently, the market appears to be underestimating the significance and immediacy of this catalyst. As COVID-19 becomes an endemic, similar to the flu, demand for a combination vaccine is expected to rise. Here, Moderna stands poised to exploit.

Beyond COVID-19, Moderna’s mRNA technology shines. Their pipeline, replete with potential cancer therapies and other infectious disease remedies, foretells consistent growth. Such diversification bolsters the firm’s outlook, reaching past pandemic-centric vaccines.

Pfizer’s comparable vaccine, which is slightly ahead in development, is poised to capture a significant market share. This competition may limit Moderna’s market penetration and revenue growth. Furthermore, Moderna’s finances are currently being strained by significant R&D expenditures. Investors should keep a close eye on these. Any clinical setbacks could have a significant impact on the stock.

Investors’ strategy? Diversify holdings, explore hedging options. Vigilance in tracking clinical trials and vaccine market shifts is key for informed decisions.

In conclusion, despite fiscal challenges and Pfizer’s shadow, Moderna’s vibrant pipeline and anticipated approval for mRNA-1083 mark it as a viable long-term biotech investment. The company’s solid fiscal footing, underscored by ample cash reserves, reinforces this view. Amid stock fluctuations and clinical unknowns, Moderna remains a “Strong Buy” for forward-looking investors. The pandemic-induced revenues only scratched the surface of Moderna’s medical potential. Although revenues have declined since the pandemic, the technology remains, and patient investors may be rewarded in due course.

Read the full article here