Introduction

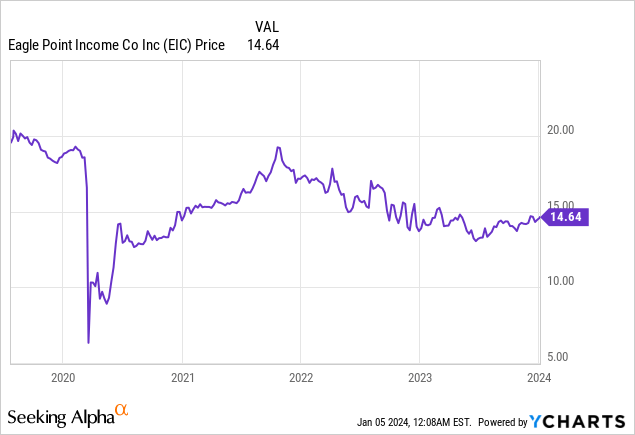

Eagle Point Income (NYSE:EIC) is an investment company focusing on the BB tranches of CLO debt. And just like in my previous article, I’d like to refer you to Steven Bavaria’s articles which often provide excellent reads as he is very capable in explaining CLO tranches and the implications in layman’s terms.

I am slowly going overweight in the 2026 term preferred shares

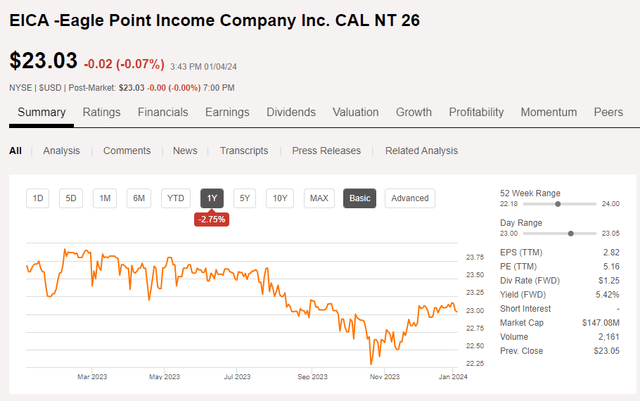

Before diving into the financial details of the company, I would like to explain why I’m so attracted to the two series of preferred share issued by Eagle Point Income. A few months ago, I started to purchase the Series A preferred shares, which are trading with (NYSE:EICA) as ticker symbol. Those preferred shares have a mandatory repayment date in October 2026 and can be called from October 30th this year on.

Seeking Alpha

EICA offers a 5% preferred dividend yield, and it is paying the $1.25 in annualized payments per preferred share in twelve equal monthly payments of just over $0.104 per month. These preferred shares can be called at any given moment at their principal value of $25, but what makes this issue even more attractive is the fact EIC has to redeem these preferred shares by October 30, 2026. This means we should look at these preferred share using the same perspective as a bond investment. Not only because it has an end date but also because the preferred shares are listed as a liability on the balance sheet and not as equity, exactly because there is a mandatory redemption date. This also means that at the current share price, the yield to maturity is approximately 8%.

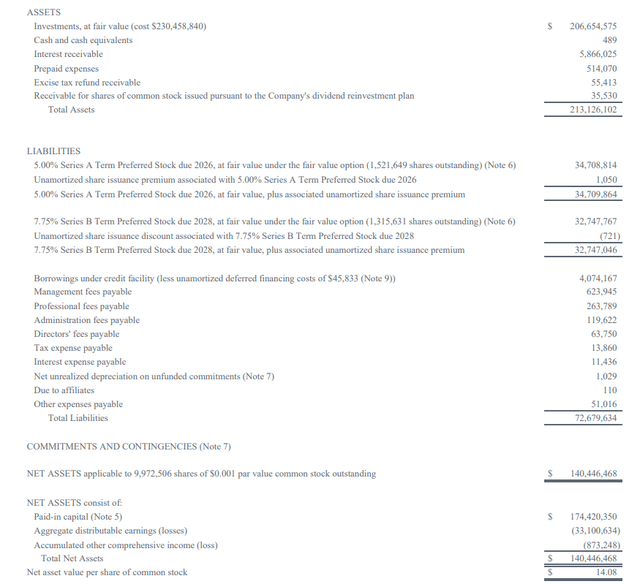

ECI Investor Relations

As you can see in the image above, you can see the total amount of liabilities as of the end of September came in at $72.7M of which $67.5M consists of the preferred shares. Note: the total preferred share related liability is based on the market prices. As you can see in the image above, there are 1.52 million shares of EICA outstanding, while there are also almost 1.32M shares of the more recent (NYSE:EICB) issue. On a combined basis, repaying all preferred debt would cost the company just under $71M. And as the image above shows, there’s only $4.1M in bank debt that’s senior to the preferred shares.

This preferred share also enjoys the 200% minimum asset coverage level, which adds an interesting layer of protection. As of the end of September, the total amount of assets came in at $213M, while the net assets on the balance sheet were approximately $208M. As there is just $67.5M in principal value in preferred shares outstanding, the asset coverage level exceeded 300%, so Eagle Point’s preferred shares are pretty safe given this required coverage level. I’m not too worried about this coverage ratio, as EIC has been issuing new shares at a premium to its NAV using its at the market offering program.

The Eagle Point Q3 and 9M results remain very encouraging

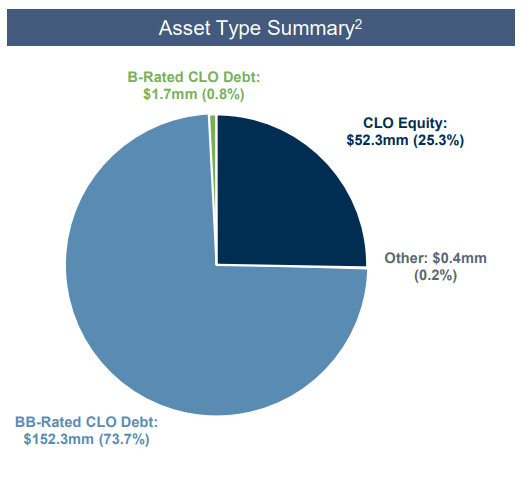

At the end of September, EIC was still predominantly focusing on BB-rated CLO debt, which accounted for almost 75% of the portfolio. There was a little bit of lower quality B-rated debt, while the equity tranches of CLO offerings accounted for just over a quarter of the total assets. 100% of the BB CLO debt exposure has a floating rate feature.

ECI Investor Relations

As I already discussed the safety net provided by the minimum required 200% asset coverage ratio for the preferred shares, it is obviously an equally important question to check up on how well the monthly preferred dividends are covered.

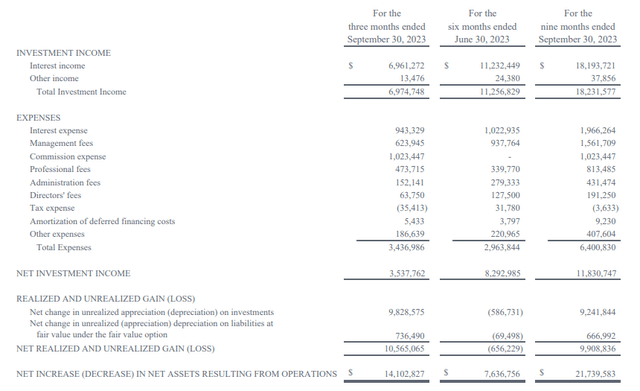

As you can see below, Eagle Point reported a total investment income of almost $7M during the third quarter, which was almost entirely generated by the interest income. The total amount of expenses was $3.4M, resulting in a net investment income of $3.5M.

ECI Investor Relations

EIC also reported a total net realized and unrealized gain of $10.6M on its investment portfolio, which resulted in a net profit of $14.1M. Great news, but let’s break this down. First of all, I am excluding the realized and unrealized gains on the investments, as I would like to see Eagle Point’s ability to cover all its expenses without the fluctuations in the fair value of the investment portfolio.

The monthly payments of $0.104 per EICA share are costing the company approximately $160,000 per month, or $0.48M for the quarter. EICB was only issued during the third quarter but using the current share count of 1.315M and knowing the monthly payment of $0.1614, we can budget the monthly payments to the EICB shareholders at $212,000 and the quarterly payments at $0.64M. This means Eagle Point Income will need just over $1.1M per quarter to cover the preferred dividend payments. We know the net investment income is $3.5M, and we also know this would have exceeded $4.6M excluding the preferred dividend payments. This means Eagle Point Income needs just about 24% of its adjusted net investment income (defined as interest income minus the operating expenses but excluding the preferred dividend payments) to cover the preferred dividend payments. And that’s fine.

Investment thesis

I have a long position in the common shares of Eagle Point Income, but the majority of my exposure to the company comes from my position in EICA, the 2026 term preferred stock. I like the required 200% asset coverage ratio, and the 8% yield to maturity in 2026 is appealing. I am also planning to initiate a long position in the EICB 2028 term preferred to improve the duration in my portfolio, but I am in no rush.

Read the full article here