The Worst Of The Bunch

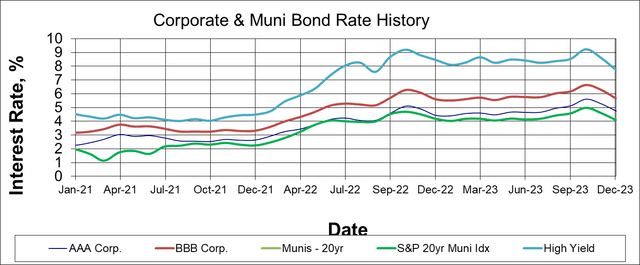

The PIMCO Dynamic Income Opportunities Fund (NYSE:PDO) debuted on 1/29/2021 and is now the second newest of PIMCO’s 11 taxable fixed income closed end funds. This was an unfortunate time to come public, at the end of a benign interest rate environment just before the steepest rate hiking cycle since the 1970’s.

Author Spreadsheet

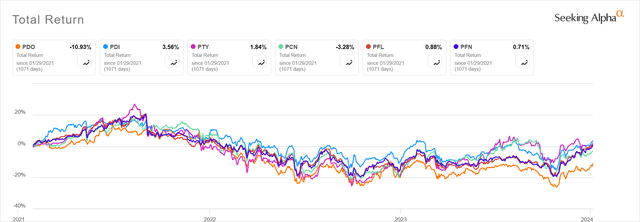

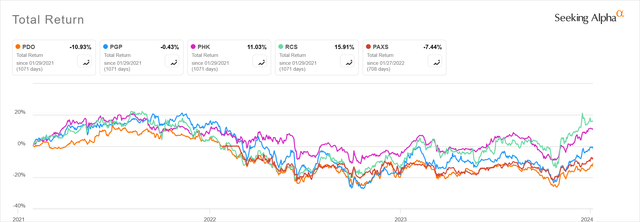

One would have expected leveraged closed end bond funds to struggle in this environment, but PDO managed to perform dead last of the 11. (PAXS is shown from its inception date on 1/31/22. PDX is not shown on the chart as it greatly outperformed the others due to its energy industry focus for most of its existence.)

Seeking Alpha Seeking Alpha

As you can see, PDO’s underperformance was significant and persisted for most of the life of the fund. Despite its short life, the fund is the third largest of the PIMCO taxable CEF family and has been heavily covered here on Seeking Alpha. Most analysts got it wrong with 2/3 of the articles through February 2023 rated Buy or better (including mine from April 2022.) Since then, sentiment has soured with less than 1/3 of the articles rated Buy.

Of course, what really matters to investors is not where the fund has been, but where it is going. It’s possible that the interest rate environment has turned since late October 2023 when the 10-year Treasury yield (US10Y) touched 5% on an intraday basis. Some of the factors that hurt PDO since its inception may now be beneficial. Unfortunately, there are some misconceptions about which factors are important that often get repeated in these articles and in the comment section. It is necessary to take a look at the data to clear up some of these.

The Database

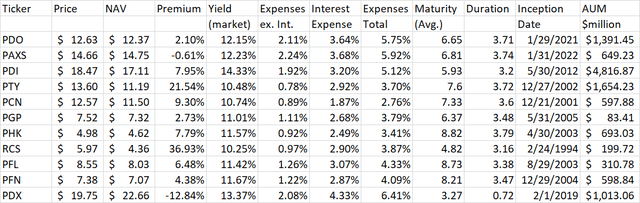

It’s rare in these CEF articles to look at data for an entire fund family. Even PIMCO itself makes you look at each fund page individually to collect this data. I’ve compiled this data for use in this article and I am presenting it here for reference. First, here are some basic fund facts. Pricing and yield data is from 1/5/2024. Other data is from 11/30/2023 which is the latest available from PIMCO.

Author Spreadsheet (Data Source: PIMCO)

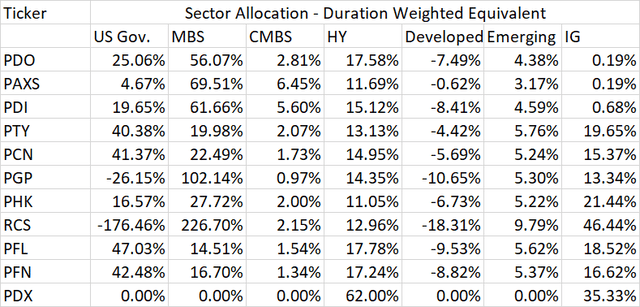

Next up are the fund holdings. All data are as of 11/30/23. Rather than show the actual holdings by market value, I am showing the duration weighted equivalent concentrations as calculated by PIMCO, which take into account the impact of swaps, repos, and derivatives used for hedging and leverage. For simplicity, I left off a few smaller categories which include mostly munis, short duration investments, and others.

Author Spreadsheet (Data Source: PIMCO)

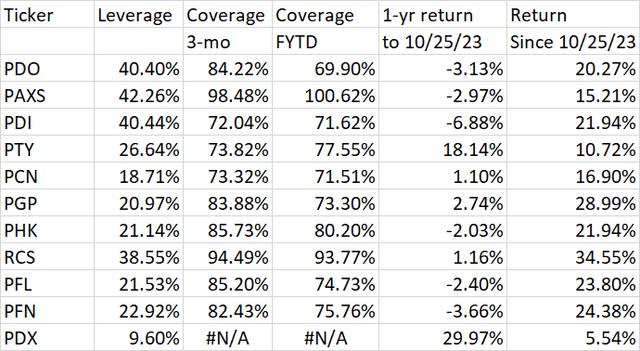

Finally, here are some data on leverage, distribution coverage (both through 11/30/23), and performance (last column through 1/5/24).

Author Spreadsheet (Data Sources: PIMCO, Seeking Alpha)

Let’s dig a little deeper and see which of these metrics matter and which don’t.

Ignore The Premium

I mention this first because it’s often mentioned by both authors and commenters as a reason to buy a fund or prefer it over another. In reality, the ranking of each fund’s premium compared to the others does not seem to change much over time. The absolute levels do change. Premiums are usually higher when the funds are performing well and lower when they are doing poorly. Nevertheless, there are some funds, like PTY and RCS, that always seem to have a higher premium than the others. The possible exception to this is after a dividend cut, but within a year or so, the high premiums come right back. On the other hand, a fund like PDO has maintained one of the lowest premiums in the group since inception. Some people attribute this to the fact that this fund has a designated termination date (2033), but I don’t grant much credence to that theory. A lot can happen in the fixed income markets over a decade, and there are much more immediate factors impacting the fund’s premium than its eventual possible liquidation. The liquidation may not even happen as a voting process exists to extend the termination date and even make the fund perpetual if desired.

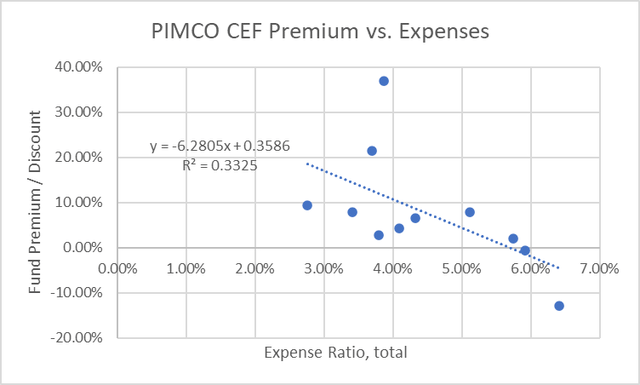

Looking at the above data, there does appear to be a weak correlation between a fund’s expense ratio and its premium. This is a negative for PDO, which has one of the higher expense ratios.

Author Spreadsheet

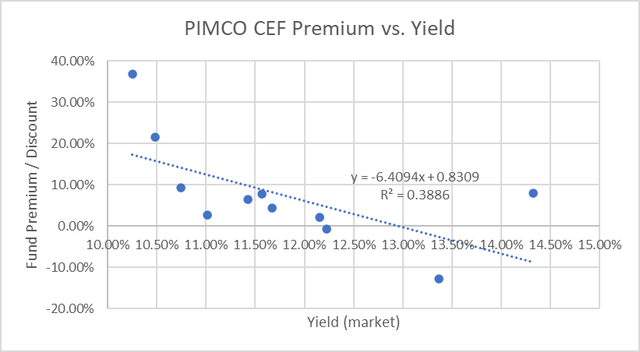

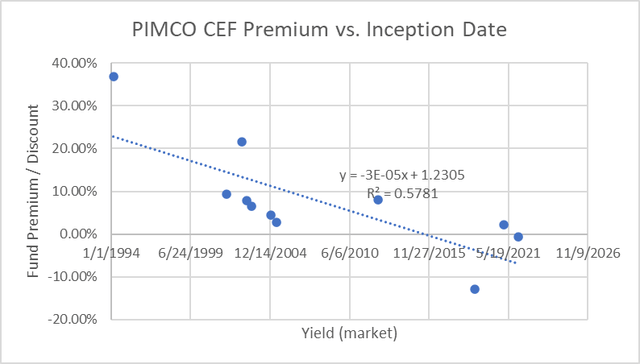

In the past, I have suggested that a fund’s premium may also be influenced by its yield relative to similar funds. This was based on a strong positive correlation I saw in the Nuveen municipal CEF space. Within the PIMCO taxable family however, the correlation is weaker and runs in the opposite direction with higher yielding funds having lower premiums.

Author Spreadsheet

In fact, the best correlation I found with fund premiums was something completely unexpected – the age of the fund, with the older ones having the higher premiums. This could be due to investors preferring the more established funds, or it could be just a coincidence with no causation at all.

Author Spreadsheet

Either way, the low premium is not a good reason to own PDO, despite the intuitive appeal of a bargain to value investors.

Leverage – A Dull Double-Edged Sword

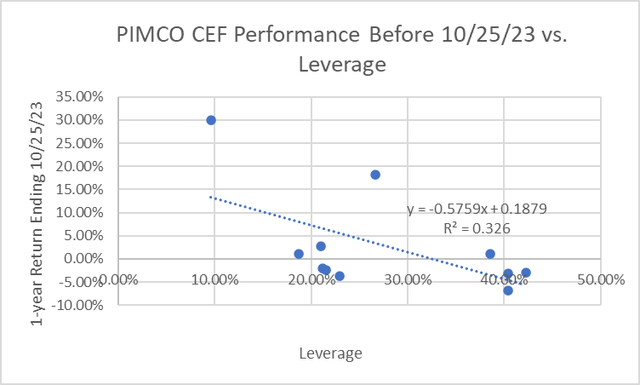

I am guilty of using the cliche of leveraged being a double-edged sword in other articles, though I am not the first or last to do so. Intuitively, it makes sense. In a flat or inverted yield curve environment, the cost of leverage is high relative to the income earned by the fund’s holdings. This should be a negative for high-leverage funds like PDO. (also PDI, PAXS, and RCS) If the yield curve is steepening and the cost of leverage is dropping relative to the income from the fund holdings, these funds should benefit.

In the year leading up to the October 2023 interest rate peak, we did see a negative correlation between leverage and performance, but it was weak.

Seeking Alpha

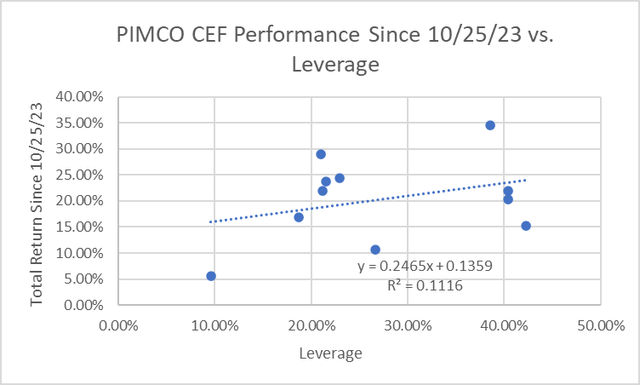

Since the interest rate peak, we should have seen leverage start to become a benefit. It has, but the correlation is even weaker.

Author Spreadsheet

To be fair, long rates have fallen more than short rates since October, so the cost of leverage may not yet have come down much. The positive fund performance could just be from better mark to market of the long maturity holdings. We may need to see actual Fed Funds rate cuts and the yield curve turning positive before the higher-levered funds like PDO see a significant benefit.

Distribution Coverage – Check Back Next Month

It makes sense that we should prefer funds that can cover their distributions with investment income rather than returned capital. Return of capital lowers the asset base on which the fund can earn more income. Funds can raise capital by selling new shares, but this is less dilutive for funds that sell at a high premium to NAV, unlike PDO.

PDO had good distribution coverage during its first two years, even paying a large special distribution at the end of 2022. PAXS, just wrapping up its second year of existence, also has near 100% distribution coverage. Since the special dividend, PDO coverage has deteriorated. The fund now has the lowest coverage in the group for the fiscal year to date (7/1/23-11/30/23). The good news is that coverage seems to be improving, at least in the short term. PDO moved back to the middle of the pack on a 3-month basis. Even better, PDO did not issue a Section 19a notice in December which it would have done if the distribution was not covered by investment income. Several other funds did still issue a 19a notice last month.

Distribution coverage can vary considerably from month to month depending on maturities and asset sales, especially at PIMCO, where swaps and currency hedges can also affect results. When we see the UNII report for December, I expect to see an improvement for PDO, providing some reassurance that a dividend cut is not imminent.

Pay Attention To Holdings

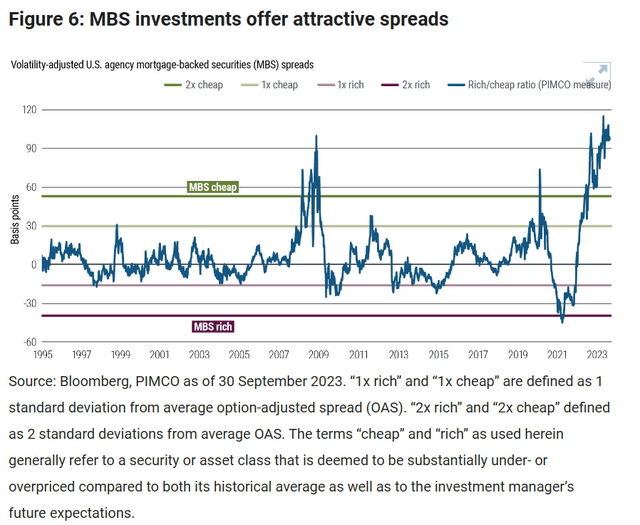

After seeing so many weak correlations, it is nice to find something fundamental that drives fund performance, specifically the fund’s holdings categories. PIMCO happens to be bullish on mortgage-backed securities, noting in their 2024 outlook that MBS spreads have widened even beyond where they were in the housing crisis.

PIMCO

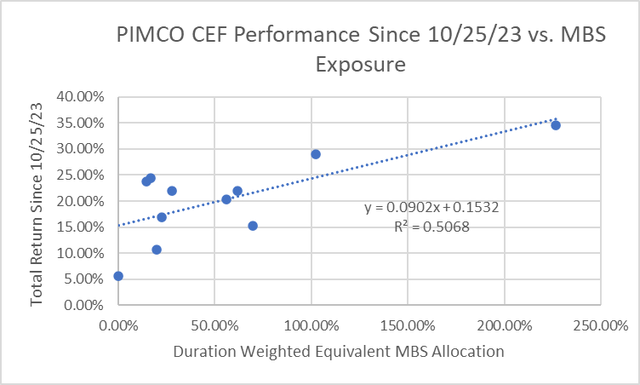

If the soft landing scenario holds, MBS should perform well. Interest rates should come down enough to allow some price appreciation, but not so much to create prepayment risk. Avoiding a serious recession also minimizes default risk. PIMCO has high exposure to MBS in several of its funds, including PDO, PDI, PAXS, PGP, and RCS. Since October, there is a positive correlation between MBS exposure and fund performance.

Author Spreadsheet

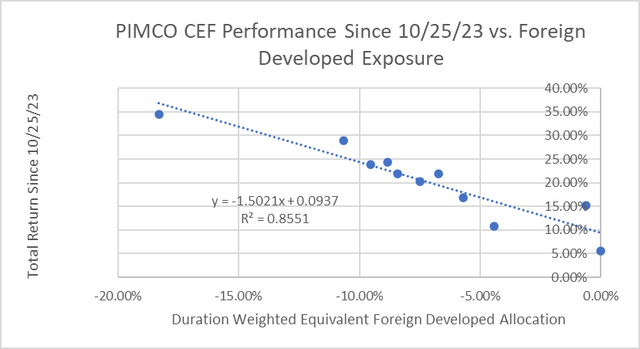

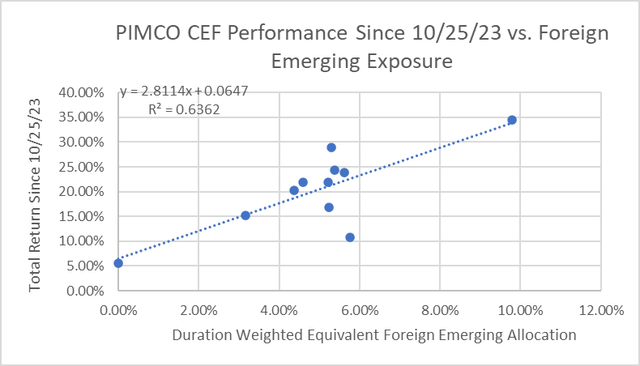

PIMCO also appears to be making a call on foreign bonds, differentiating between developed and developing markets. Each fund is effectively short developed market bonds and slightly long emerging market bonds. PDO has about an average short position in developing, but its emerging market long position is a bit below average. Fund performance since October has correlated pretty well with exposure to these categories.

Author Spreadsheet Author Spreadsheet

On the corporate credit side, the funds (except for PDX) all have high yield exposure between 11% and 18%, with PDO at the high end. Exposure to investment grade is more variable, with PDO (along with PDI and PAXS) having almost none, while others have as much or more than they have in high yield. This positioning probably hurt PDO from inception through 2022 when high yield spreads widened, but they have been narrowing for the past year. PDO can benefit in a soft landing scenario where high yield spreads stay narrow, but performance would be negatively impacted if they widen.

Conclusion

Many people, including myself, were too optimistic about PDO after its inception in 2021. Its low premium and good distribution coverage sounded great in theory but did not help the fund outperform its peers. Since interest rates hit a peak in October 2023, PDO has returned 20.3%, but that’s right around average for the group. In a soft landing scenario, the fund’s leverage and exposure to MBS and high yield credit should allow it to at least continue to keep pace with the group. If interest rates go back up or a recession happens, PDO will go right back to being an underperformer. Unfortunately, the high expense ratio, even before interest expense, is a permanent headwind. I’m hanging on to PDO, consistent with my economic outlook, but would strongly consider swapping it for a lower risk fund when an economic downturn looks imminent.

Read the full article here