With 2023 generally being a good year for most individual stocks and the market in general, it is natural for investors to look to reduce their risks and exposure in 2024. ETFs are generally believed to be the middle-ground in staying invested while avoiding major risks. As I wrote earlier, I don’t always buy ETFs but when I do, I prefer Vanguard. Hence, this article looks at one of the popular Vanguard ETFs. Let us get into the details.

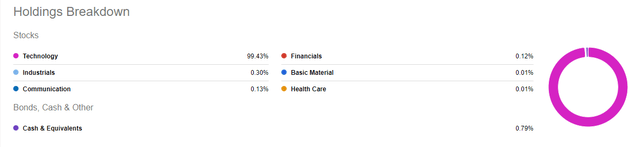

Vanguard Information Technology Index Fund ETF Shares (NYSEARCA:VGT), as the name indicates, is an ETF that tracks a basket of technology stocks. True to its name, 99.43% of its holdings fall under the technology sector with 5 other sectors (and a tiny bit of cash) making up the remaining .57%.

VGT Breakdown (Seekingalpha.com)

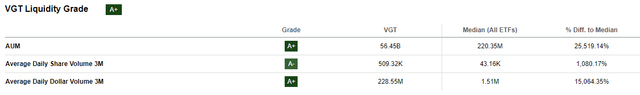

VGT has been on a great run over the last several years, as one can imagine, as technology stocks have dominated the overall market almost every year except 2022. As a result, VGT’s price has nearly tripled in the last 5 years. Undoubtedly, VGT has many nice attributes including but not limited to the revered Vanguard brand, low expense ratio, top liquidity grade, and exposure to some of the best and almost inevitable companies that are part of our day to day life globally.

VGT Liquidity (Seekingalpha.com)

But does that mean the EFT is a must own here? Let’s find out.

My biggest gripe with this ETF is that Apple Inc. (AAPL) and Microsoft Corporation (MSFT) form more than 43% of the holdings. Don’t get me wrong, I love both of these stocks and have owned them for many years. But this exposure defeats the generic purpose of an ETF, which is to diversify your holdings and spread, if not reduce, the risks.

A follow-up gripe is that Apple and Microsoft stocks are at present trading at an average forward multiple of 30 (33 for Microsoft and 27.50 for Apple) with an average expected earnings growth rate of 11% (14% for Microsoft and ~8% for Apple). That means, investors are paying a Price-Earnings/Growth [PEG] of nearly 3 for 43% of their VGT holdings. As a reminder, Growth At Reasonable Price [GARP] investors look for a PEG of <=1.

VGT Top 10 Holdings (Seekingalpha.com)

The next issue I see with VGT in its present state is that it is coming off an extremely strong year with nearly 50% gain. This does not necessarily make it a bad investment going forward but expectations should be tempered with big tech stocks. Even if it doesn’t end up being a rout that some analysts are predicting, it is natural that cyclical stocks with good valuation get a bid while the winners are at least trimmed, if not downright sold, in the new year with no immediate tax consequences to worry about.

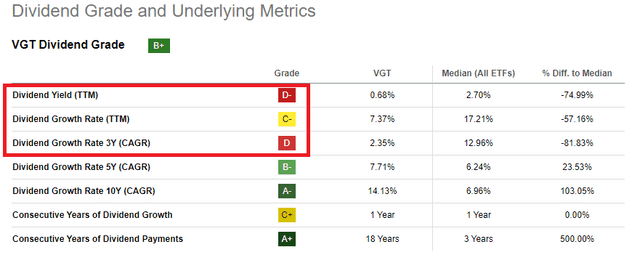

Another problem, although I may be barking up the wrong tree, is that VGT’s yield is laughably low. This is directly a consequence of the top 10 holdings as only Broadcom Inc. (AVGO) and Cisco Systems, Inc. (CSCO) have a current yield >=2%. And these two form just 5% of the total holdings. No wonder, VTG’s yield and dividend growth rates pale in comparison to its peers.

VGT Yield (Seekingalpha.com)

Finally, despite the 2 names making up 43% of the portfolio, VTG has a total of 318 holdings. That means, the other 316 holdings (except Apple and Microsoft) on average make up .18% each. This may indicate a problem with the fund’s selection criteria and its focus. Why expose yourself to 316 names when the average contribution is just .18%? In short, VGT comes across as way too diversified and way less diversified at the same time due to the dominance of its top 10 holdings.

Conclusion

Ultimately, the question we need to ask ourselves is why go to an expensive buffet only to consume two items primarily? We might as well go à la carte and avoid paying for items we don’t actually need nor like. Another point to consider is that VGT can still be a great holding for those with long-term horizon (say, at least a decade or two) as highlighted by Seeking Alpha analyst Diesel. Over that time period, the market usually adjusts for its excesses and while the individual names in VGT need not be the same after 10 years, the likelihood that technology continues driving, refining, and powering the economy is extremely high.

Overall, I rate VGT a Hold and suggest not adding new funds to this ETF at this moment.

Read the full article here