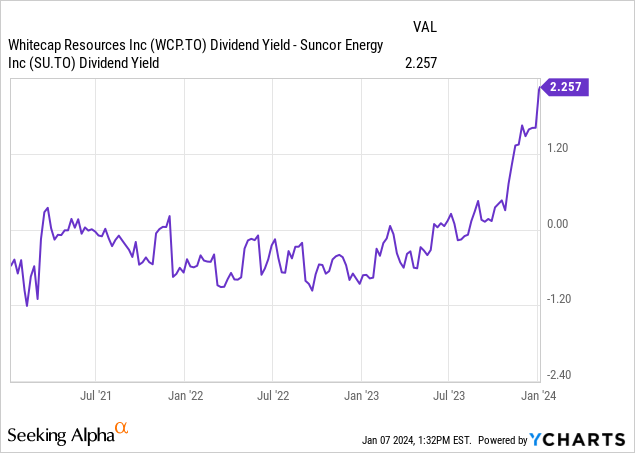

Relative valuation is an important tool, even when you believe in the potential of the asset class. Combining that with the macro outlook is why we leaned a bit heavily (some might argue too heavily) on Suncor Energy Inc. (NYSE:SU), (TSX:SU:CA), versus Whitecap Resources Inc. (TSX:WCP:CA). That was a long time ago and we have not revisited this since then.

Seeking Alpha

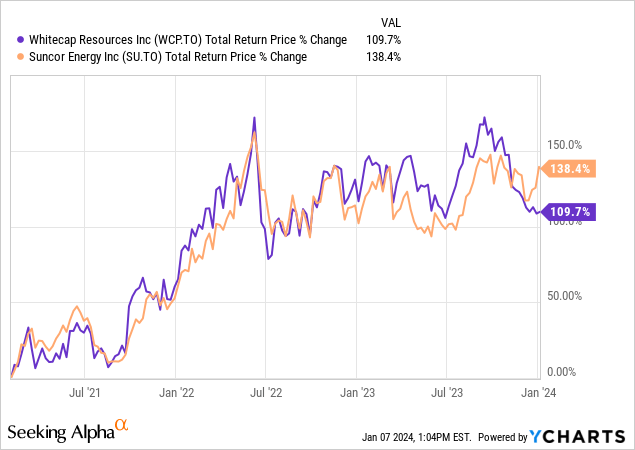

The thesis did not pan out even close to how we envisioned it. Yes, Suncor won out here if we go by total returns since then. It gave you 138.4% versus 109.7%.

While 30% alpha over three years is great, the two basically tracked each other all the way through. Whitecap was actually ahead until recently. We go over the merits of investing in both today and tell you why we think Whitecap would be our choice today.

1) Valuation

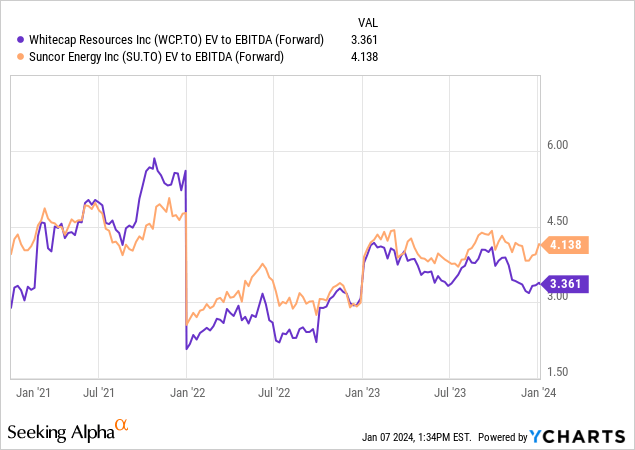

If you look at the valuations here based on 2024 estimates, Whitecap has an edge. With an estimated $2.80 in cash flow per share, Whitecap is trading at just a 3.2X cash flow multiple. Suncor is not remotely expensive here either. With $10 of cash flow at $75 oil, Suncor is trading at close to 4.5X. You could look at it as both of them being really cheap, or you could look at it as Suncor being far more expensive (50%). Even on a debt-adjusted basis, Whitecap appears to be opening up an unusual gap relative to Suncor.

So Whitecap has messed around with acquisitions in the past three years, but we are actually getting enough of a spread (0.8X EV to EBITDA multiple is a lot) to lean towards Whitecap.

2) Natural Gas Exposure

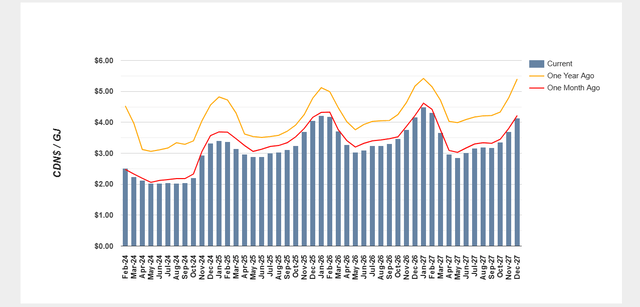

Suncor’s production is essentially zero percent natural gas. Whitecap is at 37%. The estimates that we gave above, price this in. For all of 2023, we kept our direct Natural Gas exposure in the Canadian market to essentially zero. Prices were high and companies had not hedged enough. 2024 and 2025 strips have been killed.

AECO

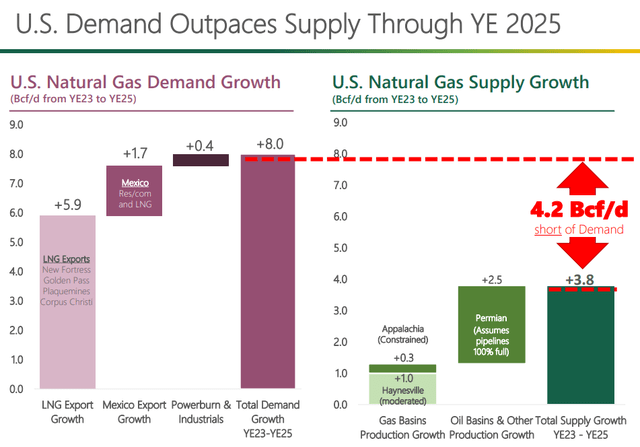

The summer months look awful for 2024 and won’t even cover operating costs. So Suncor obviously looks great from that standpoint, and we have about as close to a “hand over fist” exposure to that company as one can get. It was instrumental in our portfolio delivering solid results over the last three years. But that is the past. Current cash flow and EBITDA estimates include really poor pricing for Natural Gas for Whitecap. There is an avalanche of demand coming through by year-end 2025 (see slide from Antero Resources Corporation (AR) presentation below) and outside 2023-2024 warm winters repeating, we think Natural Gas prices will need to at least double to clear the market.

Antero Resources

So here we are adding some Natural Gas exposure, mainly via companies that have a good deal of liquid production to tide them over if we are wrong. Whitecap with 37% Natural Gas, fits that perfectly.

3) A Solid Dividend Differential

Whitecap delivered on its promise of increasing shareholder payouts after its XTO acquisition.

Upon closing of the XTO acquisition on August 31, 2022, we had established net debt targets of $1.8 billion and $1.3 billion. On achieving these targets, we committed to increasing our dividend to $0.58 per share and $0.73 per share (annualized), respectively. In January 2023, we achieved our first net debt milestone of $1.8 billion and increased our monthly dividend to $0.0483 per share. We now expect to achieve our $1.3 billion net debt milestone on or before September 30, 2023, and our Board of Directors has approved a 26% increase to our monthly dividend to $0.0608 per share, effective with the October 2023 dividend, payable in November 2023. This equates to an annual dividend of $0.73 per share, up from $0.36 per share prior to the XTO acquisition.

Since September 2022, we have reduced our net debt by approximately $900 million and returned over $400 million to shareholders through dividends plus share buybacks.

Our net debt target of $1.3 billion is important to us as it represents a Debt/EBITDA ratio of 1.0x at our stress-tested commodity price assumptions of US$50/bbl WTI and $3.00/GJ AECO and is currently 0.6x at current strip prices. It is also an important milestone for our shareholders as we will now return 75% of free funds flow back to shareholders. Capital returns to shareholders will be comprised of the increased annual dividend of $0.73 per share and will be supplemented with share buybacks and/or special dividends.

Source: Whitecap website

Suncor is on a similar path, though there have been some delays thanks to the purchase of TotalEnergies SE’s (TTE) Fort Hills’ share. The combination of where Whitecap is at today, alongside the recent price differential has created an interesting dynamic.

Whitecap now yields more than 2.25% over Suncor.

You are getting quality management on both sides here but for investors relying on dividends, the 2.25% is hard to overlook.

Verdict

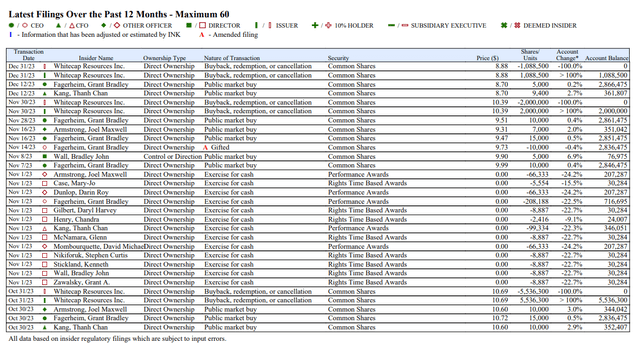

We like them both. We have a big position in Suncor and a tiny residual one in Whitecap. We are going to be buying a lot more Whitecap in the days ahead, assuming this valuation differential stays the same or increases. It is always nice to see insiders line up in the same direction as us (though it is never a requirement). Multiple Whitecap insiders are salivating at the recent prices and stepping in to buy. So that gives you a fourth (bonus!) reason.

Insider Ink

We think they are right and Whitecap should outperform Suncor from here over the next 12-24 months.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here