Introduction

Most of the ownership for Volvo Car Group (OTCPK:VLVOF) (OTCPK:VLVCY) is in China and much of their manufacturing is done there as well despite the fact that China only accounted for 170,091 out of 708,716 units sold in 2023 or 24%. Furthermore, China only accounted for 3,281 battery electric vehicle (“BEV”) units in 2023 which were just 2.9% of Volvo Car Group’s 113,491 global BEV units. A mere 12,075 Volvo Car Group plug-in hybrid vehicles (“PHEVs”) were sold in China in 2023 which was just 7.9% of their 152,561 global PHEV units. Per my November 1st article, the new EX30 BEV is intriguing and it may help bolster BEV sales in China but we are still in the early innings with this new model. The C40 BEV and XC40 BEV are generation 1 whereas the EX30 BEV is generation 2. Eventually they’ll have generation 3 BEVs with mega casting for the rear floor and it may take the gen 3 vehicles to gain BEV market share in China.

My thesis is that Volvo Car Group is being careful with their BEV market share in China. They’re not willing to jump into a price fight and they’re being patient with their BEV share in that region until they have the right models for that market.

The Numbers

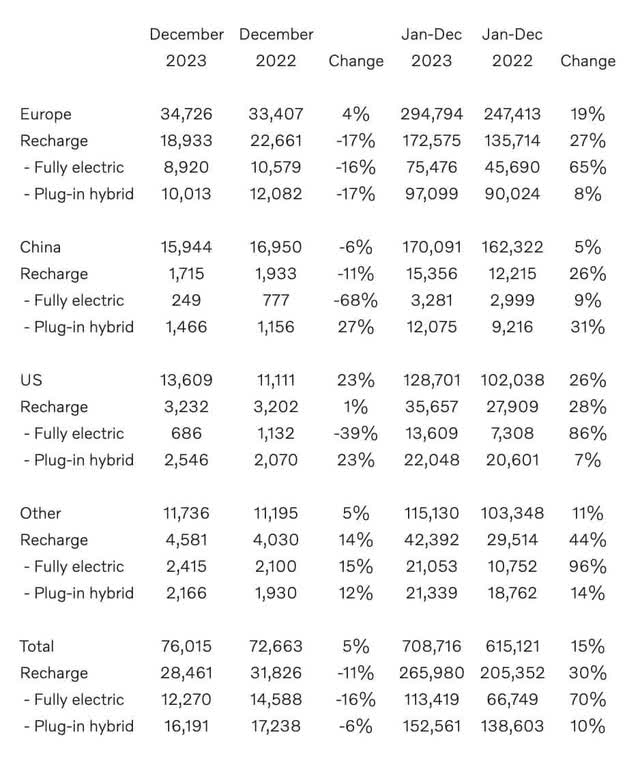

Again, Volvo Car Group sold 113,419 BEVs in 2023 which was up nearly 70% from 66,749 in 2022. They also sold 152,561 PHEVs such that the recharge subtotal was 265,980 units. Additionally, they sold 442,736 ICE units, bringing the overall total to 708,716 units:

Volvo 2023 units (Volvo Car Group 2023 announcement)

On a relative basis, the BEV units in China above are underwhelming and this was discussed in a December 2023 Automotive News Europe interview. CEO Jim Rowan said they don’t want to use excessive discounts in order to gain market share (emphasis added):

If you look at China’s hypercompetitive EV space, right now we only have the XC40 and C40. To compete we would have to discount. We have a nice portfolio of mild hybrids and plug-in hybrids that is really popular with customers in China. In addition, we are trying to fill in some white space with products that are fully designed to be BEVs. The EX30 will help us with our BEV transition. The EM90 at the top end of the EV market brings us some premium-ness. The EX90 will do the same. So, you have the EX90, EM90 and EX30 that will all be better positioned to avoid being in China’s mass market price fight.

CEO Rowan went on to say they don’t need a price fight with older models. Instead, they can be circumspect with their China BEV share and do more when they have the right models with the proper economics:

We have a nice lineup of products so we don’t need to jump into the price fight at this point in time. We won’t take market share for the sake of market share on BEVs until we get the products that make sense for us to do that.

Valuation

Per the December interview above, CEO Rowan said Geely Holding Group recently sold some of their Volvo Car Group shares, reducing their ownership from about 82% to about 78%. Geely Holding Group knows more about Volvo Car Group’s valuation than we do so I don’t see Volvo Car Group as a buy anymore with Geely Holding Group selling. On the other hand, Rivian (RIVN) delivered just 50,122 BEVs in 2023 and they have a higher market cap than Volvo Car Group. Also, Volvo Car Group is doing well with BEVs and PHEVs outside of China relative to giants like BYD (OTCPK:BYDDY) and Geely Auto Group (OTCPK:GELYY) which is part of Geely Holding Group.

Volvo Car Group sold 538,625 vehicles outside China in 2023 including 110,138 BEVs and 140,486 PHEVs. Meanwhile, the CPCA says BYD exported 242,765 BEVs and PHEVs from China during the year while Geely exported 274,101 vehicles including BEVs, PHEVs and ICE (emphasis added):

In 2023, the export performance of national passenger car companies was excellent, including 923,931 Chery Automobiles, 685,018 SAIC passenger cars, 344,078 Tesla China vehicles, 274,101 Geely Automobiles, 267,756 Great Wall Motors, 242,765 BYD Automobiles, and 198,578 Changan Automobiles.

We don’t yet have the 2023 financials but we do have the unit numbers. 2023 was a record year for BEV units, PHEV units and overall units as they were up 70%, 10% and 15%, respectively, over 2022. We know Geely Car Group sold 80,629 BEVs through the first three quarters so they sold 32,790 BEVs in 4Q23. Looking at earlier quarterly results by comparison, they sold about 30,000 BEVs in 1Q23, 29,000 in 2Q23 and 21,000 in 3Q23.

I think of Volvo Car Group as a hold right now.

Forward-looking investors should keep an eye on EX30 BEV units in 1Q24.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here