International markets: two drawdowns and a miss from economists

Fellow Shareholders,

Despite a somewhat turbulent last four months in international markets, the international funds had acceptable performances on both an absolute and relative basis. Please see individual Fund letters for complete details.

In past commentary, I’ve often noted that macro events drive stocks’ upward or downward movements (e.g., the invasion of Ukraine). However, these events are often not linked to corporate fundamentals. At Oakmark, when macro events create a market frenzy, instead of being reactionary, we often revert to a “fundamentals of business value” frame of mind. Over the last two years, the international stock market has focused on two macro themes – European natural gas prices and interest rates. While distinct, each led to strikingly similar extreme 20% drawdowns in 2022 and 2023.

European natural gas prices

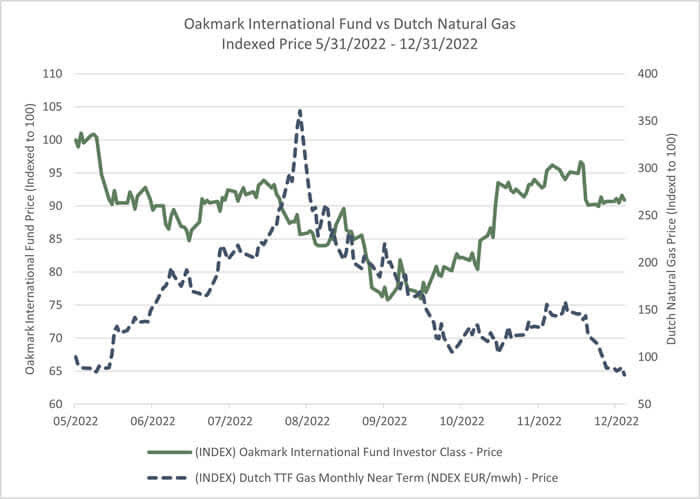

Following its invasion of Ukraine, Russia attempted to pressure the European Union into reducing its support of Ukraine by cutting off its natural gas supply. By September 2022, 90% of Russian gas piped to Germany, Austria, the Czech Republic, and Poland had stopped flowing. European natural gas prices soared to more than 10 times the levels at the beginning of 2021 (i.e., 22.32 EUR/MWh on 03/31/21). As a result of this “action,” European share prices plunged quickly and priced in an imminent deindustrialization of the European continent. Citizens and European corporations reacted by adapting remarkably to the new challenge by reducing their demand for natural gas and increasing their sources of supply. When visiting with our management teams during this time, we heard firsthand that corporate performance and cash flow generation remained resilient despite the macro events. Since others were wary, it provided us an attractive entry point into European-based companies (luxury goods, global industrials, consumer product companies, etc.) that were in actuality, global producers and operators. As we ended the year, this resilience became apparent to the market. Natural gas prices cratered. The draconian scenario failed to materialize, which sent European share prices sharply higher in the fourth quarter of 2022. Hopes of peaking inflation propelled European stocks to outperform other regions. The Oakmark International Fund rebounded 24% from September 29 through year end.

FactSet as of 12/31/22.

Dutch natural gas is the Europe-wide natural gas price benchmark.

Interest rates and positive economic data

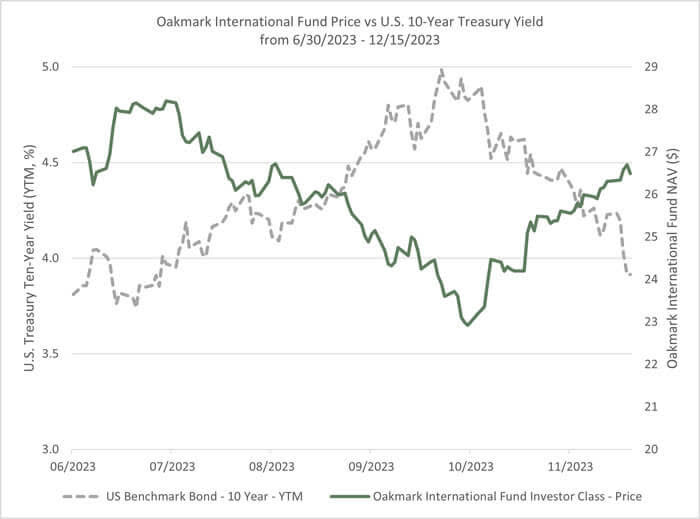

Since the global financial crisis, the “lower for longer” interest rate environment persisted, allowing forecasters to trendline more of the same, year after year. But in the summer of 2023, the long end of developed markets Treasury curves started to price at higher rates. Especially when economic data signaled strength, consensus abruptly switched to a “higher for longer” interest rate action. The thinking went that a stronger economy meant interest rates would stay higher for longer and higher bond yields would raise the cost of capital for companies and dent the consumers’ disposable income. After a 14% six-month rally to start 2023, European stocks fell 12% (exacerbated by a falling euro) between July 31 and October 27 (as defined as the MSCI Europe Index in USD). The Oakmark International Fund also retracted given our portfolio’s overweight to Europe and our exposure to two European stocks in particular – Worldline from France and Fresenius from Germany.

The Fund’s holdings in Fresenius Medical Care (FMS), a provider of dialysis care, and Fresenius SE (OTCPK:FSNUF), a shareholder in Fresenius Medical Care, declined after strong trial results for a GLP-1 drug showed signs of efficacy in treating kidney disease. As is often the case, the market looked to any stocks with exposure to dialysis and sold them all. In our analysis of its patient population, the ultimate impact of cash flows to Fresenius Medical Care was far less, if any at all, than the decline in its market capitalization. As for Worldline (OTCPK:WWLNF), an abrupt guidance cut partially associated with its German business reminded the market of a German payments company, Wirecard (OTC:WRCDF), which collapsed in one of Germany’s biggest corporate scandals three years ago. After speaking to competitors, senior management, and the lead independent director of the board, we were not able to find any illegality. Our due diligence gave us confidence that Fresenius Medical Care will right itself, execute its operational turnaround, and get back on the path of attractive organic growth and organic market share gains. In this instance, the new headwinds to growth did reduce our estimate of Worldline’s intrinsic value, but like Fresenius Medical Care, the share price declined more than the impact on fundamentals.

At the end of October, the narrative shifted once again as the 10-year U.S. Treasury bond reached 5%, its highest level since 2007. International and U.S. stocks started to look toward an increased likelihood of a soft landing. Avoiding a recession meant less risk of a credit event and declining inflation meant the Federal Reserve could pivot from being hawkish to dovish. A sharp decline in interest rates ensued and European stocks and the Oakmark International Fund climbed higher once again.

FactSet as of 12/31/23.

Looking back over the 15-month period starting September 30, 2022, the MSCI Europe Index is up over 44%, besting the S&P 500 (+36%) and equating to the NASDAQ (44%). Over this same time period, the Oakmark International Fund is up 46%. Why did the Fund’s NAV move so significantly on these two macro topics? It all has to do with price and valuation. Often, a hot concept is priced as such and a dull concept has little or no price. One must look at individual stock valuations to get to the answer, noting that the starting point of business valuation is of high importance. We believe it is a monumental investment error to simply put your money in those places that had a good macroeconomic run or impressive recent performance. Simply extrapolating the recent past can often lead investors to miss the dynamic nature of economic and market systems. Additionally, as exemplified above, these macro shocks to equity prices tend to have a very short-term impact on share prices as they often have little or no impact on corporate cash flow streams, the true determinant of business value and ultimately the price of equities.

While traders tend to focus on the short term, we believe that both our intensive research process and our focus on the long term help us find opportunities despite the pervasive theme of the time. When the market doesn’t separate the macro from the micro, there is an exploitable opportunity for long-term investors. We think the move in natural gas prices highlights the resilience of the European economy. There are numerous examples of European-based companies that are global operators selling at extremely depressed valuations because of the postal code of their corporate headquarters. We also believe the end of “lower forever” interest rates “should be extremely beneficial to banks and other financial institutions that have suffered slow earnings growth because of soft monetary policy.

Lastly, a tidbit on extrapolating from the past

Last year at this time, all we heard from the talking heads was a recession, recession, recession. In fact, a poll1 was published in late 2022 that said that 85% of economists believed there was a 100% chance of a recession in 2023. We were frequently challenged by clients asking how we could be overweight in stocks in industrials, consumer discretionary, etc., in this environment. Our response was that first, we need to consider the price we pay for businesses in which we include their end market exposures. Additionally, we questioned the conventional “wisdom” of the recession fear-mongering as we believed the global consumer was too strong, and that the private sector, individual, and financial sector balance sheets were all at safe levels. Yes, rising rates stifle economic activity, but real recessions are caused by falling incomes and high levels of indebtedness. Recall, that financial institutions globally rebuilt balance sheets at capital ratios to record levels post the global financial crisis, and the global consumer left the pandemic nearly fully employed and with high savings. There will be another recession someday, but the conditions weren’t ripe for one in 2023, despite what most economists predicted.

We continue to be grateful for the trust you, our clients, place in us and wish you a very happy 2024! And a special thanks to Client Portfolio Manager Danny Nicholas for creating this letter!

OPINION PIECE. PLEASE SEE ENDNOTES FOR IMPORTANT DISCLOSURES.

1Owen, Tyler. 2023. “How Were So Many Economists So Wrong About the Recession?.” Bloomberg. Bloomberg

The securities mentioned above comprise the following preliminary percentages of the Oakmark International Fund’s total net assets as of 12/31/2023: Fresenius 2.2%, Fresenius Medical Care 2.5%, and Worldline 1.3%. Portfolio holdings are subject to change without notice and are not intended as recommendations of individual stocks.

Access the full list of holdings for the Oakmark International Fund here.

The information, data, analyses, and opinions presented herein (including current investment themes, the portfolio managers’ research and investment process, and portfolio characteristics) are for informational purposes only and represent the investments and views of the portfolio managers and Harris Associates L.P. as of the date written and are subject to change and may change based on market and other conditions and without notice. This content is not a recommendation of or an offer to buy or sell a security and is not warranted to be correct, complete, or accurate.

Certain comments herein are based on current expectations and are considered “forward-looking statements.” These forward-looking statements reflect assumptions and analyses made by the portfolio managers and Harris Associates L.P. based on their experience and perception of historical trends, current conditions, expected future developments, and other factors they believe are relevant. Actual future results are subject to a number of investment and other risks and may prove to be different from expectations. Readers are cautioned not to place undue reliance on the forward-looking statements.

The MSCI Europe Index (NET) is a free float-adjusted, market capitalization-weighted index designed to represent the performance of large- and mid-cap stocks across 15 Developed Market countries in Europe. The index covers approximately 85% of the free float-adjusted market capitalization across the European Developed Markets equity universe. This benchmark calculates reinvested dividends net of withholding taxes. This index is unmanaged and investors cannot invest directly in this index.

On occasion, Harris may determine, based on its analysis of a particular multi-national issuer, that a country classification different from MSCI best reflects the issuer’s country of investment risk. In these instances, reports with country weights and performance attribution will differ from reports using MSCI classifications. Harris uses its own country classifications in its reporting processes, and these classifications are reflected in the included materials.

The S&P 500 Total Return Index is a float-adjusted, capitalization-weighted index of 500 U.S. large-capitalization stocks representing all major industries. It is a widely recognized index of broad, U.S. equity market performance. Returns reflect the reinvestment of dividends. This index is unmanaged and investors cannot invest directly in this index.

The NASDAQ Composite Index is a broad-based market-capitalization weighted index of all common type stocks on the NASDAQ Stock Market, including common stocks, American depositary receipts, ordinary shares, shares of beneficial interest or limited partnership interests, and tracking stocks. The index includes all NASDAQ-listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds (ETFs), or debentures. This index is unmanaged and investors cannot invest directly in this index.

The funds’ portfolios tend to be invested in a relatively small number of stocks. As a result, the appreciation or depreciation of any one security held by the Fund will have a greater impact on the Fund’s net asset value than it would if the Fund invested in a larger number of securities. Although that strategy has the potential to generate attractive returns over time, it also increases the Fund’s volatility.

Investing in foreign securities presents risks that in some ways may be greater than U.S. investments. Those risks include: currency fluctuation; different regulation, accounting standards, trading practices, and levels of available information; generally higher transaction costs; and political risks.

All information provided is as of 12/31/2023 unless otherwise specified.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here