Background

Interest rates are one of the most important factors affecting the economy and the outlook for equities. When interest rates rise, borrowing costs increase, which can reduce consumer spending and business investment, leading to lower economic growth. Conversely, when interest rates fall, borrowing costs decrease, which can stimulate consumer spending and business investment, leading to higher growth.

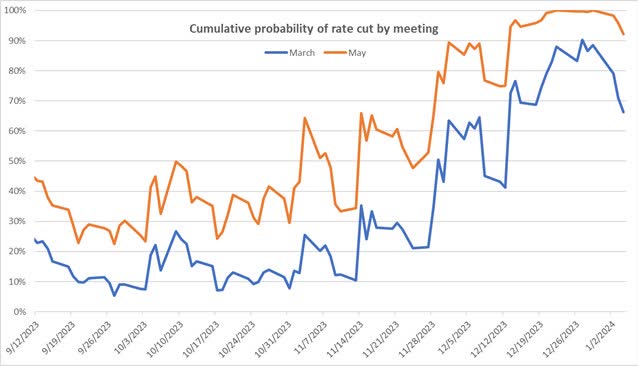

In an effort to bring inflation under control, in April 2022 the U.S. Federal Reserve embarked on a series of interest rate increases that proved to be one of the steepest in history, with rates moving from near zero in early 2022 to their current targeted range of 5.25-5.50% in less than eighteen months. With the FOMC now having kept rates unchanged for three meetings since a 25-basis point (bps) hike in July and inflation trending down toward the Fed’s 2% target, investors are increasingly of the mind that interest rates have peaked and are beginning to look forward to lower rates in the future. According to the CME’s FedWatch Tool, 30-day Fed fund futures are now pricing in more than a 60% chance of a 25 bps cut at the March 2024 FOMC meeting and above a 90% chance of a 25 bps cut by the May 2024 meeting.

Source: CME FedWatch Tool, Russell Investments

No longer higher for longer

As noted in our recent Active Management Insights report, managers through the first three quarters of the year had positioned equity portfolios for a higher for longer interest rate environment, believing the Federal Reserve would maintain rates at an elevated level for a prolonged period of time until inflation sustainably fell below the Fed’s 2% target. With inflation continuing to trend down, active managers are now repositioning portfolios for the changing environment.

Lower rates can affect equities through both direct and indirect channels. Direct effects include those that impact financing or operational aspects of the underlying business. All else equal, lower interest rates mean lower interest expense (and therefore higher profits) and can also make capital spending projects more attractive, increasing potential growth rates.

Indirect effects largely manifest via valuation multiples, both in absolute terms and relative to alternatives. Present value calculations for future earnings and cash flows for stocks are tied to assumptions about interest rates. When investors anticipate lower rates in the future, it increases the present value of future earnings and (likely) the multiple investors are willing to pay on current earnings. Lower rates also reduce the relative attractiveness of cash and fixed income investments compared to stocks, which may also result in higher warranted equity valuations.

Two camps: Soft landing and recession

Active equity manager outlooks broadly belong in two camps, with managers expecting either a benign soft landing and reacceleration of growth without inflation, or an interest rate-induced recession.

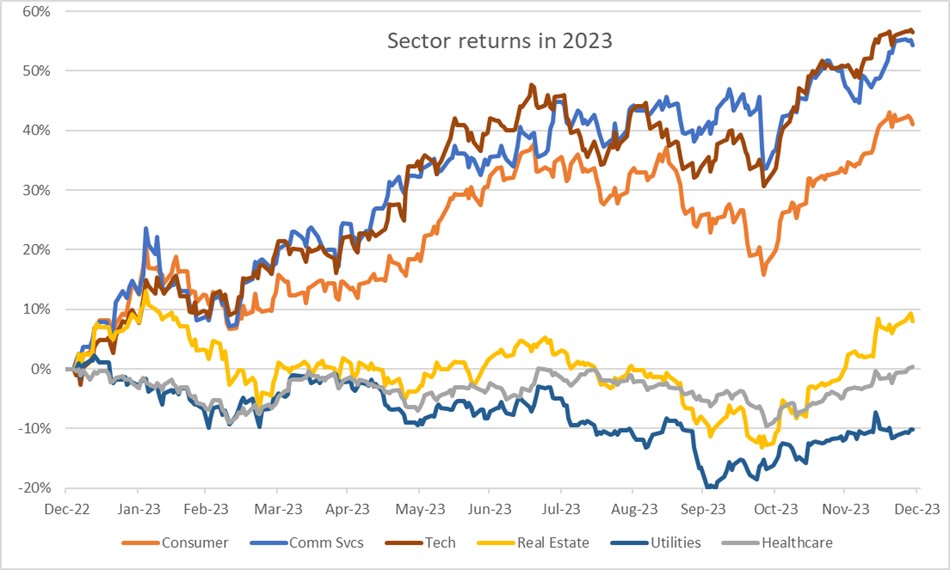

Managers that believe the economy will achieve a soft landing over the coming year expect a slowdown in growth in the near term (without the economy tipping into a recession) before a reacceleration of growth in the second half of 2024. Growth managers within this camp are adding to their high-conviction holdings in long-duration, higher-growth assets, particularly within information technology and communication services. More value-oriented managers are shifting their portfolios toward more cyclical and more highly leveraged companies as their concerns over refinancing risks and the business cycle recede.

The managers taking the opposing view believe an inverted yield curve and the recent decline in longer-term rates are best explained by an impending economic contraction and recession brought about the Fed’s rate hikes. Growth and core managers taking this view are positioning their portfolios toward more defensive, resilient growth within healthcare and consumer staples, while more value-oriented managers are adding to holdings in rate-sensitive defensive sectors such as utilities and real estate that underperformed the broader market for much of 2023.

Source: CME FedWatch Tool, Russell Investments

The bottom line

As evidenced by the significant volatility over the past two years, interest rates do not generally move in a linear or predictable way. They are influenced by a number of factors, including monetary policy, supply and demand, and, perhaps most significantly, market expectations. At Russell Investments, our equity manager selection process and portfolio management framework emphasize high active share and stock-specific risk, enabling clients to benefit from the unique insights of the underlying managers irrespective of the interest rate regime.

Disclosures

These views are subject to change at any time based upon market or other conditions and are current as of the date at the top of the page. The information, analysis, and opinions expressed herein are for general information only and are not intended to provide specific advice or recommendations for any individual or entity.

This material is not an offer, solicitation or recommendation to purchase any security.

Forecasting represents predictions of market prices and/or volume patterns utilizing varying analytical data. It is not representative of a projection of the stock market, or of any specific investment.

Nothing contained in this material is intended to constitute legal, tax, securities or investment advice, nor an opinion regarding the appropriateness of any investment. The general information contained in this publication should not be acted upon without obtaining specific legal, tax and investment advice from a licensed professional.

Please remember that all investments carry some level of risk, including the potential loss of principal invested. They do not typically grow at an even rate of return and may experience negative growth. As with any type of portfolio structuring, attempting to reduce risk and increase return could, at certain times, unintentionally reduce returns.

The information, analysis and opinions expressed herein are for general information only and are not intended to provide specific advice or recommendations for any individual entity.

Frank Russell Company is the owner of the Russell trademarks contained in this material and all trademark rights related to the Russell trademarks, which the members of the Russell Investments group of companies are permitted to use under license from Frank Russell Company. The members of the Russell Investments group of companies are not affiliated in any manner with Frank Russell Company or any entity operating under the “FTSE RUSSELL” brand.

The Russell logo is a trademark and service mark of Russell Investments.

This material is proprietary and may not be reproduced, transferred, or distributed in any form without prior written permission from Russell Investments. It is delivered on an “as is” basis without warranty.

CORP-12393

Original Post

Read the full article here