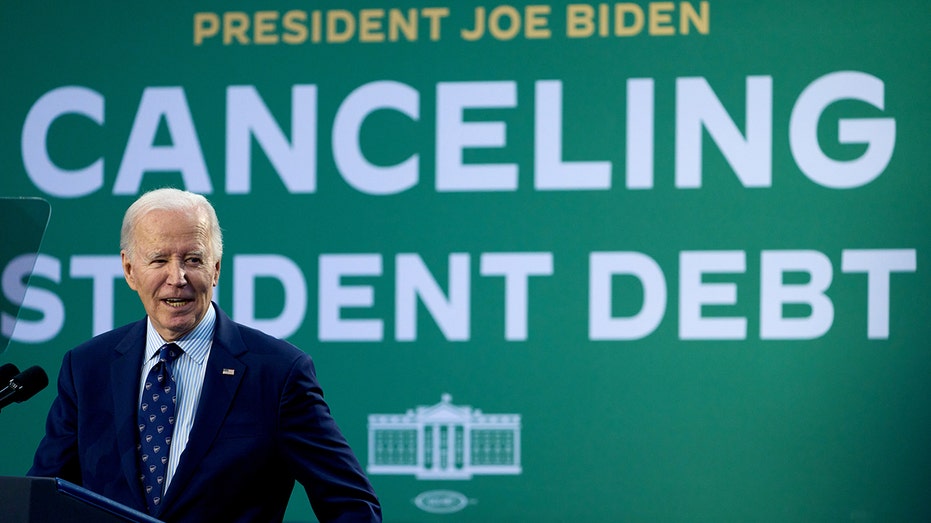

A federal judge in Missouri on Thursday temporarily blocked President Biden’s student loan handout just one day after a judge in Georgia had permitted the plan to move forward.

U.S. District Judge Matthew Schelp snatched the win from the Biden administration in response to a request from six Republican state attorneys general who have challenged the White House’s effort.

Schelp, an appointee of Republican former President Trump, issued a preliminary injunction blocking the Biden administration from “mass canceling” student loans and waiving principal or interest under the plan pending the outcome of the states’ lawsuit.

The ruling came down after U.S. District Judge Randal Hall transferred the litigation from Georgia and removed the state from the case after finding it would not experience any legal harm under Biden’s handout plan.

FEDERAL JUDGE HANDS BIDEN WIN AS REPUBLICANS CHALLENGE STUDENT LOAN BAILOUT

The Republican-led states assert the Department of Education has overstepped its authority by proposing a regulation to cancel student loan debt without an act of Congress. The White House counters that the president has used his authority under existing law to ensure borrowers who meet certain qualifications can experience relief from debt accrued in pursuit of higher education.

Two previous efforts by Biden to fulfill a campaign promise to assist student loan borrowers were defeated in court. His third proposal would hand out $73 billion in student loan debt held by an estimated 27.6 million borrowers.

In addition to Georgia and Missouri, Republican attorneys general in Alabama, Arkansas, Florida, North Dakota and Ohio are party to the lawsuit challenging the policy. Hall in September had issued a temporary restraining order blocking the Department of Education from finalizing a rule to implement Biden’s plan, but that order expired on Oct. 3.

Schelp on Thursday said he agreed with Hall that the loan bailout should be halted until courts have weighed in on its legality.

FEDERAL JUDGE BLOCKS REVAMPED BIDEN STUDENT LOAN HANDOUT, LATEST LEGAL SETBACK FOR THE ADMINISTRATION

“Allowing Defendants to eliminate the student loan debt at issue here would prevent this Court, the U.S. Court of Appeals, and the Supreme Court from reviewing this matter on the backend, allowing Defendants’ actions to evade review,” Schelp wrote, according to Reuters.

Missouri state Attorney General Andrew Bailey celebrated Schelp’s decision on X, calling it a “huge win for transparency, the rule of law, and for every American who won’t have to foot the bill for someone else’s Ivy League debt.”

“My team is 9-0 with [President Biden] and [Vice President Kamala Harris] in court on this issue,” Bailey wrote. “At what point does this become a constitutional crisis?”

A Department of Education spokesperson said the department is “extremely disappointed” by Schelp’s ruling.

“This lawsuit was brought by Republican elected officials who made clear they will stop at nothing to prevent millions of their own constituents from getting breathing room on their student loans,” the spokesperson said. “We will continue to vigorously defend these proposals in court. We will not stop fighting to fix the broken student loan system and provide support and relief to borrowers across the country.”

GOP-LED STATES SUE BIDEN ADMINISTRATION OVER STUDENT DEBT RELIEF PLAN

The Biden administration’s proposal would bail out borrowers who owe more than they first borrowed due to accrued interest; individuals who have been in repayment for at least 20 to 25 years, depending on their circumstances; and borrowers who were eligible for student loan forgiveness under previous programs but who never applied.

The Justice Department had argued that since the Department of Education had not yet finalized the rule, there was no agency action for the judge to review in this case. The Republican-led states insisted that the Biden administration was preparing to immediately cancel student loan debt once the rule became final before the action could be challenged in court.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

The attorneys general said such action would occur in the run-up to the Nov. 5 presidential election pitting Democratic candidate Kamala Harris, who is vice president under Biden, against Republican rival Trump, and that the administration would seek political credit for the policy.

Reuters contributed to this report.

Read the full article here