By Naveen Jayasundaram, Elisa Mazen, Mary Jane McQuillen & Adam Meyers

Achieving Sustainability Ambitions at Scale

Public Equities Amplifying Positive Impact

Large companies with complex global operations may sometimes present challenges for sustainability-minded investors. In some cases, because a larger company’s business is more complex than smaller, pure play companies focused on one particular sustainability need (addressing unmet medical needs or enabling renewable energy, for example), its sustainability contributions might be misunderstood or overlooked. Yet some well-known companies can have lesser known sustainability strengths, and these may be all the more impactful due to their large scale. The importance of scale represents a key tenet of ClearBridge’s approach to ESG integration, as companies can make a positive impact simply because of their global reach, their deep supply chains and the depth of their involvement in the communities in which they operate.

A mega cap company like Amazon (AMZN) is a complex and very large company that may seem difficult to own in sustainable portfolios, as investors might be concerned about its overall carbon footprint and environmental impact, as well as working conditions, given the size and speed of the workforce. Amazon has drastically improved its capital allocation and profitability since 2022 under new CEO Andy Jassy; much of this has been driven by ongoing efforts at margin improvement through retail regionalization, scaling its advertising business and improving costs. Complementing these fundamental and governance improvements is Amazon’s growth as company for which sustainable improvements strengthen the business case, with potential for positive change that benefits multiple stakeholders (employees, customers and shareholders).

Since 2019, ClearBridge’s sector analysts have been engaging Amazon on the most material and relevant activities that could pose risk to the company in terms of operations and societal impact. These areas include climate change and climate targets; labor topics such as worker health and safety and unionization; packaging and materials; responsible AI; and disclosure. During our multiyear engagements, Amazon has agreed to disclose more data around each of these issues. In addition, Amazon reaches out to us throughout the year (and vice versa) to consult us on its sustainability progress and goals. Our most recent engagement, in September 2024, was on climate strategy and covered science-based targets, last-miles-driven, renewables and EV investments and AI power needs.

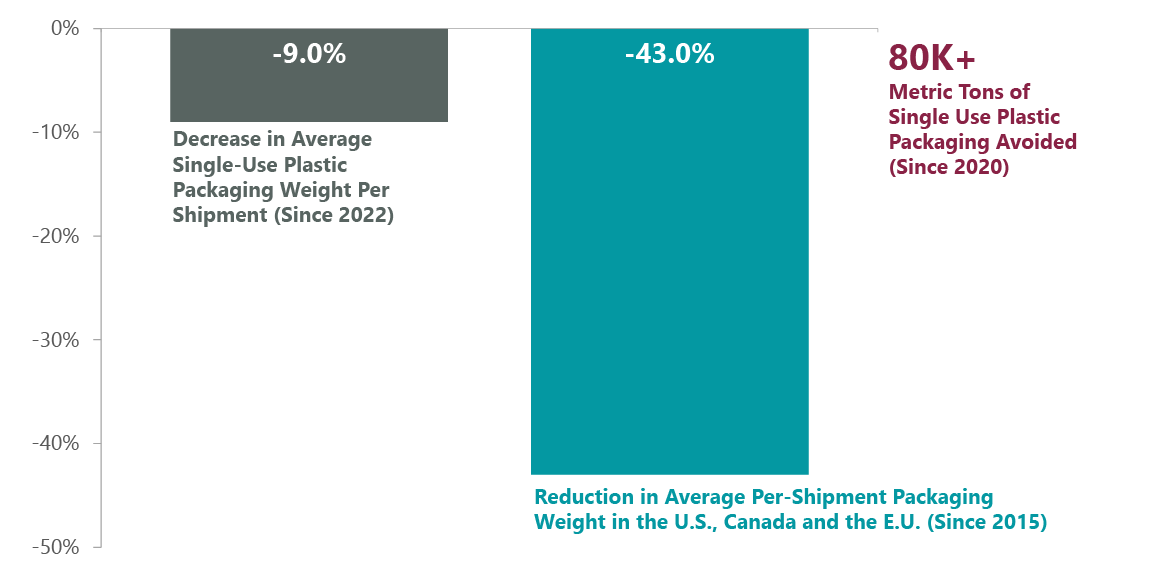

Sustainability disclosures are significant for shareholders as they help benefit the bottom line over the long term, and Amazon’s progress on several sustainability initiatives, such as reducing and innovating on packaging materials and increasing their circularity, are meaningful considering the scale of its operations. Amazon is the second-largest private employer in the U.S., with over 1.5 million employees: increasing wages, providing immediate family benefits and free tuition, and focusing on worker safety at these volumes positively impacts their many employees. The company delivers over 600 million packages per year with less materials and filling. It uses machine learning algorithms to determine the most efficient packaging for each order and so it can minimize empty space in boxes and optimize shipments to require less space in vehicles, reducing the number of vehicles on the road (Exhibit 1). AWS, meanwhile, is the largest cloud provider in the world, and is designing the latest protocols on addressing responsible AI. We believe progress made on these sustainability topics will have a material positive impact.

Exhibit 1: Amazon Reductions in Single-Use Plastic and Packaging Weight

Source: “How Amazon is improving packaging and boosting sustainability,” Oct. 2024, Amazon.

More Than a New Coat of Paint

As the world’s largest paint and coating company, Sherwin-Williams (SHW) may suffer from negative sustainability perceptions due to their paint products being derivatives of petrochemicals like propylene. The industry has, however, been increasingly replacing hydrocarbon-based solvents with water-based ones, which have no harmful volatile organic compounds (VOCs) — in particular architectural paints, which are two-thirds of Sherwin-Williams’s business. Some waterborne solvent products made by Sherwin-Williams and others include air-purifying and sanitizing paints that reduce VOC levels from sources such as carpeting, cabinetry and fabrics in addition to fighting bacteria.

Sherwin-Williams further distinguishes itself with a sustainability-forward salesforce that helps its customers become more efficient. It stands out as an engaged supplier to its customers, providing education and recommendations on best practices using its products that can help its customers overcome labor shortages with paints that require fewer passes, for example, and use less material. In a recent engagement with the company, we also learned how it supports new accounts (small business owners) with consulting resources such as the digital infrastructure, invoices and accounting basics needed for new contracting businesses to succeed long term.

In terms of how to recycle or properly dispose of excess paint, Sherwin Williams volunteers many of its stores across the U.S. as drop-off locations for unwanted or leftover paint through its partnership with PaintCare, a nonprofit organization.

While the company’s execution on its stated sustainability goals such as carbon emission reductions has been slower than might be hoped, we recognize such large goals take time. Upgrading LED lighting kits for all paint store color displays, investing in renewable energy to power its facilities and growing its paint recycling program are positive signposts for Sherwin-Williams, as its recently appointed CEO — a woman (only 6% of CEOs at the companies in the S&P 500 are women),1 — continues to foster a winning culture of product innovation and service excellence with positive environmental and social impacts.

Change Should Start with Industry Leaders

Modern clothing manufacturing and retail is often considered riddled with environmental and social problems such as resources use, waste, pollution, overwhelmed landfills, child labor and unfair labor practices. However, a clothing manufacturer leader like Inditex (OTCPK:IDEXY) is actually an agent of change and improvement in a problematic industry. We believe change should start with industry leaders rather than with fringe or marginal players, and ClearBridge is following how a clothing behemoth like Spain-based Inditex, best known for its Zara brand, is using its leadership to improve its ESG rankings among its peers and benefit the entire industry.

Examples of Inditex’s environmental leadership include its use of sustainable fibers with low impact on the environment, its innovation in next-generation fibers and its use of recycling. Among its short-term goals are 100% responsibly sourced linen (it reached 100% for cotton in 2023) and a 25% reduction in water use by 2025. For 2030 it aims to improve biodiversity across 5 million hectares, reduce emissions by 50% across total product life from design to recycling (and by 90% by 2040), and move to 100% fibers with low impact on the environment.

Social leadership is equally important: Inditex is dedicated to remedying the poor social image of the industry with a comprehensive audit of all external suppliers. This will affect millions of people. The company is already a recognized leader for its internal human resources credentials for talent development, diversity and engagement of its 170,000 employees. It is now turning its focus outward on the entire ecosystem for responsible clothing manufacturing. Its “Workers at the Centre” program for supply chain management involves due diligence on all 1,700 suppliers, inspecting human rights, living wages, respect, and health and safety. It has spoken with 1.5 million people so far with the goal to reach 3 million people by 2025. Monitoring visits improved from 540 in 2022 to 820 in 2023.

While these improvements are laudable, we recognize there is still a lot of progress to be made, and some commitments could be made more credible with more detail provided on how they’ll be met. Yet given the extreme fragmentation of the fashion industry, we believe Inditex’s scale and forceful implementation of better sourcing and manufacturing should have an amplified positive impact on the whole industry’s supply chain.

Naveen Jayasundaram, Director, Senior Research Analyst for Media and Internet

Elisa Mazen, Managing Director, Head of Global Growth, Portfolio Manager

Mary Jane McQuillen. Head of ESG, Portfolio Manager

Adam Meyers, Director, Senior Research Analyst for Energy/Basic Materials

|

1https://research.com/careers/female-ceos-of-the-sp-500 Past performance is no guarantee of future results. Copyright © 2024 ClearBridge Investments. All opinions and data included in this commentary are as of the publication date and are subject to change. The opinions and views expressed herein are of the author and may differ from other portfolio managers or the firm as a whole, and are not intended to be a forecast of future events, a guarantee of future results or investment advice. This information should not be used as the sole basis to make any investment decision. The statistics have been obtained from sources believed to be reliable, but the accuracy and completeness of this information cannot be guaranteed. Neither ClearBridge Investments, LLC nor its information providers are responsible for any damages or losses arising from any use of this information. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here