Summary

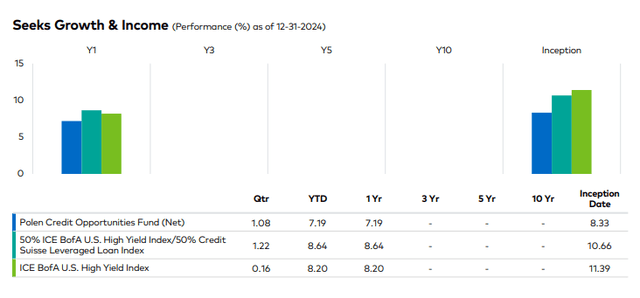

- Over the fourth quarter of 2024, the Polen Credit Opportunities Fund (the “Fund”) returned 1.08% versus the 1.22% return of the 50% ICE BofA U.S High Yield Index / 50% Credit Suisse Leveraged Loan Index and the 0.16% return of the ICE BofA U.S. High Yield Index (the “Index”)

- Below-investment-grade credit experienced mixed results in the fourth quarter, driven by rising yields and widening spreads. Leveraged loans delivered a positive return and outperformed high- yield bonds, which posted a more modest gain.

- Baffinland Iron Mines Corporation and Asurion, LLC were the top contributors to total returns during the quarter, while Specialty Steel and Dexko Global detracted the most significantly.

- Polen Capital did not make any meaningful changes to fund positioning in the fourth quarter. However, we initiated a position in T BAILEY, INC., a leading provider of industrial-sized tanks, casings, pipe, and penstock.

- As we enter 2025, our primary concerns today include a monetary policy mistake, a weaker consumer, larger fiscal deficits, and growing geopolitical risks.

- In our view, remaining patient and not overreaching for yield will leave our Fund well positioned to take advantage of compelling opportunities as the cycle ages.

|

Theperformancedataquotedrepresentspastperformanceanddoesnotguaranteefutureresults.Current performance may be lower or higher. Periods over one-year are annualized. Performance figures are presented gross and net of fees, and have been calculated after the deduction of all transaction costs and commissions, and include the reinvestment of all income. The commentary is not intended as a guarantee of profitable outcomes. Any forward-looking statements are based on certain expectations and assumptions that are susceptible to changes in circumstances. Opinions and views expressed constitute the judgment of Polen Capital as of the date herein, may involve assumptions and estimates which are not guaranteed and are subject to change. All company-specific information has been sourced from company financials as of the relevant period discussed. |

Market Commentary

During the quarter, the overall environment was favorable for risk assets. To the delight of investors, the Federal Reserve (the “Fed”) delivered two rate cuts, and market sentiment improved following the outcome of the U.S. presidential election. As a result, high yield spreads reached their tightest levels since 2007. However, toward year end, the Fed’s hawkish tone—prompted by stronger- than-expected economic activity and inflation readings—pushed U.S. Treasury yields higher and spreads wider. Despite this, in Q4, the ICE BofA U.S. High Yield Index managed to produce a gain of 0.16%. Once again, high yield returns were led by bonds rated CCC and below, which generated a gain of 2.45%. Meanwhile, B- rated issues also eked out a modest gain of 0.34%, but BB-rated bonds incurred a loss of -0.50%, as higher yields more than offset the modest spread tightening experienced by this cohort during the quarter.

Further, in Q4, the top performing sectors were transportation, telecommunications, and media, while the biggest laggards were the utility, real estate, and healthcare sectors. For the full year 2024, the high yield bond index delivered a total return of 8.20%.

Expectations for a “higher for longer” rate environment sustained strong investor appetite for floating rate leveraged loans. Several months of inflows and CLO origination supported a robust bid for leveraged loans

As of this writing, more than 60% of the loan market is priced above par. In Q4 2024, the Credit Suisse Leveraged Loan Index gained 2.29%, finishing the year with a total return of 9.05%— outperforming its fixed rate peers for the third time in four years. During the quarter, B-rated loans in the index outperformed their BB-rated and CCC-rated counterparts, each producing gains of 2.53%, 2.21%, and 0.25%, respectively. Among loans in Q4 2024, metals/minerals, media/telecommunications, and retail emerged as the best performing sectors.

Turning to new issuance activity, Q4 2024 saw diverging trends between high yield bonds and leveraged loans. While high yield bond issuance slowed, activity in the loan primary market surged. Following strong activity in Q3 2024, high yield bond issuance fell during the quarter, producing the lowest quarterly total of the year. Although refinancing activity remained the largest use of proceeds, Merger & Acquisition-driven issuance as a percentage of total activity increased for the second consecutive quarter.

Notably, 2024 primary market issuance for high yield bonds exceeded the combined totals of the preceding two years.

For leveraged loans, new issuance reached record-breaking levels. Q4 2024 was the most active quarter of the year, with December marking the busiest single month on record. To provide context, 2024’s loan primary market activity totaled $1.3 trillion, smashing the previous all-time high of $973.9 billion set in 2017. However, despite the impressive gross total, approximately 88% of this activity was used to refinance or reprice existing debt, leaving net new issuance at relatively low levels.

Finally, while bifurcated default activity persists, it remains in aggregate under control. According to J.P. Morgan data, at the end of Q4 the trailing twelve-month default rates for high yield bonds and leveraged loans (including distressed exchanges) were 1.47% and 4.49%, respectively, representing the widest gap between the two markets since 2000. Excluding distressed exchanges and liability management exercises (LMEs), default rates declined to 0.36% and 1.52%, respectively. This data underscores the prevalence of distressed exchanges and LMEs, particularly in the leveraged loan market. This divergence is likely to persist as elevated rates continue to put pressure on fundamentals among loan issuers.

Portfolio Performance & Attribution

During the fourth quarter, the Polen Credit Opportunities Fund returned 1.08% versus the 1.22% return of the 50% ICE BofA U.S. High Yield Index / 50% Credit Suisse Leveraged Loan Index and the 0.16% return of the ICE BofA U.S. High Yield Index. During the fourth quarter, U.S. Treasury yields rose. Given the Fund’s shorter duration relative to the Index, the duration effect for the quarter was positive. However, in aggregate, the Fund’s reorganized equity positions detracted from relative returns.

Attribution by rating shows that the security selection effect was positive and driven primarily by the Fund’s CCC-rated and B- rated loans. This positive effect as partially offset by the negative effect produced by the Fund’s CCC1-rated high yield bond holdings, which lagged those of the benchmark. Turning attention to sector attribution, the sector allocation effect was positive.

This positive effect was driven by the Fund’s overweight to high yield bonds in the basic industry and capital goods sectors.

Conversely, the sector security selection effect was positive. The Funds high yield bond holdings in the basic industry sector, as well as its loan holdings in the services & retail and healthcare sectors, outperformed those of the Index, contributing to relative performance. However, these positive effects were partially offset by the negative effect produced by the Fund’s bond holdings in the capital goods sectors, which lagged those of the Index.

Notable issuers that contributed to, or detracted from, the Fund’s total return for the quarter are set forth below.

Top Contributors

Baffinland Iron Mines Corporation, based on Baffin Island in Nunavut, Canada, is a low-cost producer operating one of the world’s highest-grade iron ore mines. The performance of the company’s 8.75% First Lien Notes due July 2026, held by the Fund, was bolstered by positive developments during the quarter regarding the company’s planned expansion. The proposed project, expected to begin in early 2026, aims to roughly triple the mine’s ore output and will require external capital for funding as well as the refinancing of the existing Notes. In Q4, the company announced progress in meeting its goals and timeline for the expansion, driving positive price movement in the notes.

Asurion, a leading provider of cell phone protection plans, partners with mobile carriers to offer these services on an outsourced basis. The company dominates the market both domestically and in Japan, serving as the exclusive provider of phone insurance for two of the three major U.S. wireless carriers. Asurion’s scale creates a significant competitive moat in the mobile device protection space. Wireless carriers benefit from outsourcing these plans, as they generate additional revenue, lower costs, and reduce customer churn. With mobile phones playing a vital role in consumers’ daily lives, protection plans are widely regarded as essential. These characteristics, combined with the company’s recurring, subscription-driven revenue, extremely low capital intensity, and ability to retain and grow its subscriber base, give Polen comfort with respect to the ability of the business to generate free cash flow on a sustainable basis. During the quarter, the price of the SOFR+5.25% Second Lien Term Loan due 2029 held in the Fund increased following strong earnings.

Largest Detractors

Specialty Steel is one of North America’s leading independent producers of specialty steel products, specifically cold-drawn specialty bars and seamless tubes. The company operates a low commodity price risk business model by sourcing steel from its mill suppliers, processing it, and delivering products tailored to customers’ specifications in terms of size, shape, and quantity. In Q4, Specialty Steel’s private equity position, held in the Fund and internally valued by Polen, detracted from total returns.

Consequently, the price of the SOFR +10% Holdco Notes—also held in the Fund and internally valued by Polen—remained at par, with coupon income providing a positive contribution to performance. However, this gain was outweighed by the decline in the value of the equity position. Specialty Steel has demonstrated stable operating performance and strong cash generation, which reduced absolute debt levels and further supported de-leveraging efforts. We are optimistic on the company’s fiscal year 2025 outlook based on improved backlog trends and recent strength in the oil and gas markets. The Fund continues to maintain its positions in this issuer.

Dexko Global, a Michigan-based manufacturer of trailer axles, chassis, suspensions, and components for markets such as industrial trailers, RVs, and utility vehicles, generates 60% of its revenue in North America and 40% internationally. The company’s strong free cash flow, and excellent management team.

6.625% Senior Notes due 2029 were a top detractor to returns this quarter. The company’s 2024 year-to-date results fell short of expectations due to weakness in global RV and industrial trailer markets. Despite near-term challenges, Polen remains optimistic given Dexko’s leading market position, high barriers to entry,

Portfolio Positioning & Activity

In Q4 2024, Polen did not make any meaningful changes to the Fund’s positioning. However, we did increase positions in certain existing holdings. Further, we executed relative value sales in positions that had rallied during the quarter.

In Q4, we initiated a position in T BAILEY, INC., a leading provider of above-ground industrial tanks, casings, marine pontoons, penstocks, pressure vessels, and custom steel solutions in the Pacific Northwest. Founded in 1991, the company is known for its exceptional project management, quality, and safety. Polen made a direct loan to T BAILEY to support its acquisition by Saothair Capital, a middle-market private equity firm. The loan, issued at a modest original issue discount, yields SOFR + 7%. We view this investment as offering an attractive risk-reward profile, supported by a low loan-to-value ratio, strong asset coverage, robust free cash flow, and capable management.

Outlook

Our view is that the significant rally in equities and leveraged credit during the past two years reflects market participants’ growing belief that the Fed can orchestrate a soft landing.

However, the market’s confidence in this outcome could be disrupted if the Trump administration attempts to remove the Fed chairman prior to the end of his current term in 2026.

Regardless, for now market participants seem to have shifted their attention away from inflationary risks to concerns about the consumer and the economy. However, economic indicators continue to be supportive of markets.

As we enter 2025, our primary concerns today include a monetary policy mistake, a weaker consumer, larger fiscal deficits, and growing geopolitical risks. While the new administration may facilitate business-friendly deregulation and enact tax cuts, the implementation of certain trade policies such as tariffs could have a less favorable impact on the overall U.S. and global economy.

With that in mind, as of now, markets seem complacent.

That said, we anticipate a decline in refinancings alongside an increase in net new issuance of high yield bonds and loans, driven by a resurgence in M&A activity amidst a more accommodating regulatory landscape and lower yields. While repricing and refinancing will certainly not vanish, their proportionate share of new issuance should fall.

Within the private equity space, sponsors are likely to pursue exits from portfolio investments due to prolonged holding periods resulting from a slowdown in deal-making in recent years. Many sponsors had heavily leveraged their acquisitions during a low- interest-rate environment but rising rates and falling valuation multiples have now complicated the monetization of these investments. As limited partners grow impatient for returns as their funds’ investment periods end, we expect sponsors to initiate monetization efforts. Despite restrictive monetary policy, a shift toward lower yields is anticipated, supporting these initiatives.

We believe that we are reaching the top of the cycle for the broader high yield and leveraged loan markets. Though spreads are tight, as a long-only fixed income manager, we must nonetheless manage our client portfolios through the cycle.

As a result, today, we are being more cautious and are willing to sacrifice yield for safety. Safety for us means investing in competitively advantaged businesses that generate sustainable free cash flow and offer a reasonable margin of safety. In our view, remaining patient and not overreaching for yield will leave our portfolios well positioned to take advantage of compelling opportunities as the cycle ages.

Sincerely,

Ben Santonelli and John Sherman

| Disclosures

Holdings are subject to change. The top holdings, as well as other data, are as of the period indicated and should not be considered a recommendation to purchase, hold, or sell any particular security. There is no assurance that any of the securities noted will remain in the Fund at the time you receive this fact sheet. It should not be assumed that any of the holdings discussed were or will prove to be profitable or that the investment recommendations or decisions we make in the future will be profitable. A list of all securities held in this Fund in the prior year is available upon request. This material must be preceded or accompanied by a prospectus, available at PolenCapital.com. Please read it carefully before investing. The Polen Credit Opportunities Fund is not suitable for all investors. Investors should consider the investment objectives, risks, chares, and expenses of the Polen Credit Opportunities Fund carefully before investing. A prospectus with this and other information about the Fund may be obtained by calling 1-888-678- 6024 or visiting the Materials tab. It should be read carefully before investing. All performance is calculated in U.S. Dollars. Risks: It is possible to lose money on an investment in the Fund. Fixed income investments are subject to interest rate risk; as interest rates rise, their value will decline. Lower-rated securities are subject to additional credit and default risks. Investments in bank loans, which are made by banks or other financial intermediaries to borrowers, will depend primarily upon the creditworthiness of the borrower for payment of principal and interest. Trading in Rule 144A securities may be less active than trading in publicly traded securities. Investments with low trading volumes may be difficult to sell at quoted market prices. No assurance can be given that any fund will achieve its objective or avoid losses. Interval fund investing involves risk, including possible loss of principal. The Fund is non-diversified, which means that a large portion of the Fund’s assets may be invested in one or few companies or sectors. The Fund could fluctuate in value more than a diversified fund. Fund Risk: The Fund is recently organized. There can be no assurance that the Fund will reach or maintain a sufficient asset size to effectively implement its investment strategy. Illiquidity of Shares: The Fund is designed for long-term investors and not as a trading vehicle. An investment in the Shares, unlike an investment in a traditional listed closed-end fund, should be considered illiquid. The Shares are appropriate only for investors who are seeking an investment in less liquid portfolio investments within an illiquid fund. The Polen Credit Opportunities Fund is not suitable for all investors. The Polen Credit Opportunities Fund is distributed by Foreside Funds Distributors LLC., not affiliated with Polen Capital Management. When calculating the credit quality breakdown, the manager selects the middle rating of the agencies when all three agencies rate a security. The manager will use the lower of the two ratings if only two agencies rate a security and will use one rating if that is all that is provided. Securities that are not rated by all three agencies are reflected as such. Indices: ICE BofA U.S. High Yield Index: The ICE BofA U.S. High Yield Index tracks the performance of U.S. dollar denominated below investment grade corporate debt publicly issued in the U.S. domestic market. The index data referenced herein is the property of ICE Data Indices, LLC, its affiliates (“ICE Data”) and/or its Third Party Suppliers and has been licensed for use by Polen Capital Credit, LLC . ICE Data and its Third-Party Suppliers accept no liability in connection with its use. Please contact Polen Capital Credit for a full copy of the applicable disclaimer. Credit Suisse Leveraged Loan Index The Credit Suisse Leveraged Loan Index (CS Leveraged Loan Index) is designed to mirror the investable universe of USD institutional leveraged loans, including U.S. and international borrowers. 50% ICE BofA U.S High Yield Index / 50% Credit Suisse Leveraged Loan Index: The 50% ICE BofA U.S High Yield Index / 50% Credit Suisse Leveraged Loan Index is a blended benchmark comprised of equal allocations of the ICE BofA U.S. High Yield Index and Credit Suisse Leveraged Loan Index Definitions: Alpha: Alpha is the measure of the difference between a portfolio’s actual returns and its expected performance, given its level of risk as measured by beta. SOFR: The Secured Overnight Financing Rate (SOFR) is a broad measure of the cost of borrowing cash overnight collateralized by Treasury securities. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here