By Paul Wightman

At a Glance

- While some hydrotreated vegetable oils or renewable diesel are produced from rapeseed oil, biofuels remain a key source of demand

- The launch of European Rapeseed Oil futures marks a significant transformation for a market that has traditionally relied on liquidity in a physical forward market

The European rapeseed oil market is one of the largest vegetable oil markets in the world, playing a crucial role in food, feed and bioenergy.

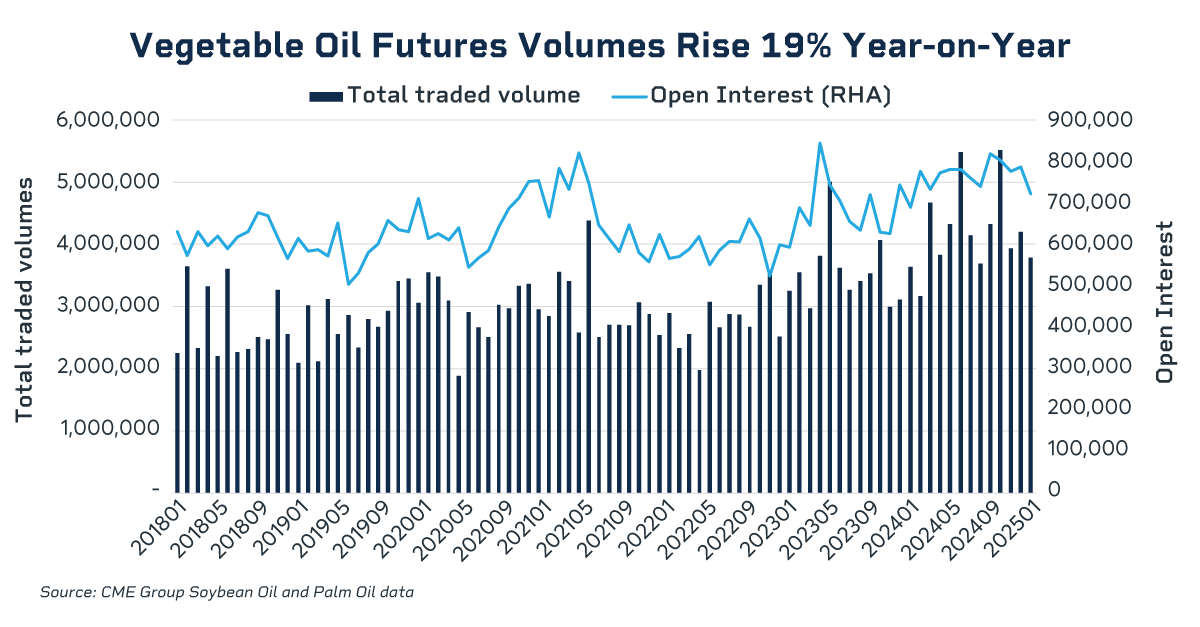

Vegetable oil-based derivatives volumes have been rising, in part due to the growing importance of bioenergy markets such as biomass-based diesel and ethanol used in transportation, as well as biogas used for heating and electricity generation.

In this sphere, the biggest futures and options market is for soybean oil, which is traded globally as one of the leading benchmarks for the vegetable oil sector. However, European rapeseed oil has been gaining ground amid rising demand for road transport biodiesel, with demand particularly high during the colder months due to its superior performance compared to other feedstocks.

The growing embrace of bioenergy has seen demand rise across the vegetable oil sector and has been beneficial to products like Soybean Oil, Palm Oil and Used Cooking Oil futures, a trend that looks set to continue – vegetable oil demand for sustainable aviation fuels remains relatively strong according to data provider Argus Media, and total vegetable oil-based futures volume in the 12 months to March 2025 reached 4.254 million contracts per month, up 19% from 3.58 million contracts per month in the prior 12-month period.

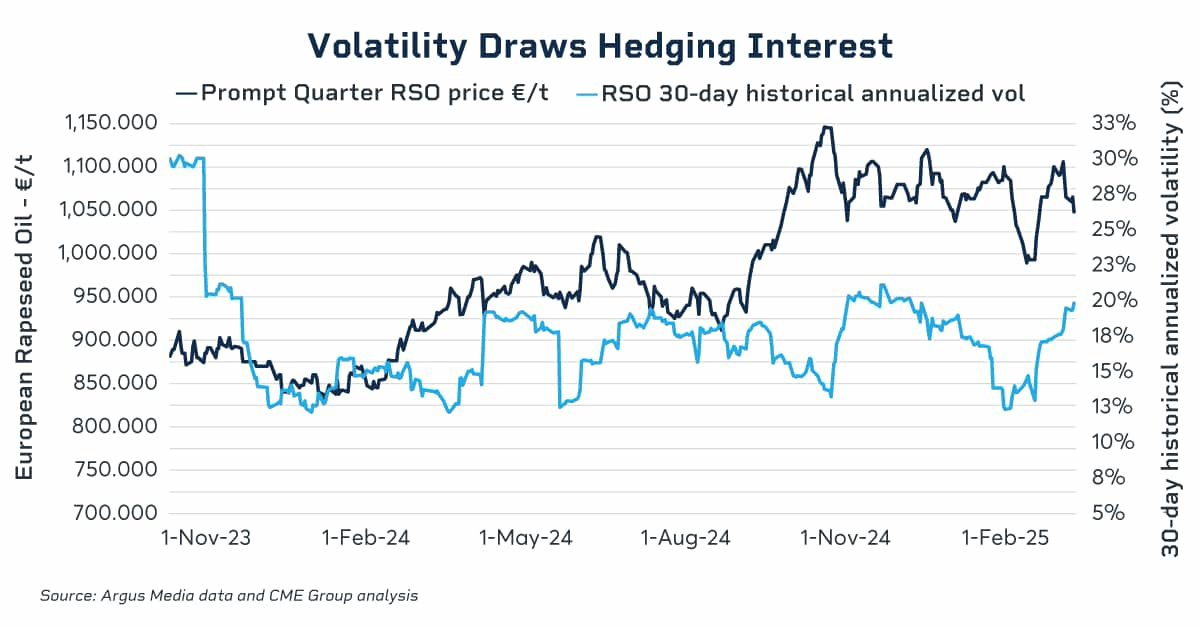

Rising Volatility in European Rapeseed Oil

Hedging against the price volatility in the rapeseed oil market has become an increasingly common trade in recent years. The chart below shows that the price of rapeseed oil has been rising for the past 15–18 months, which can be attributed to the demand for biofuels. While volatility appears to be falling from levels seen in the early part of 2023, the 30-day historical annualized volatility has traded between 14% and 21% since the final quarter of 2023 as more firms enter the market to hedge against the underlying commodity cost.

With the addition of European Rapeseed Oil futures to CME Group’s suite of vegetable oil-based derivatives contracts, market participants now have a tool that allows them to hedge against market volatility, especially during a time when shifting trade policies are reshaping the global flow of commodities.

Rising Demand for Biofuels in Europe

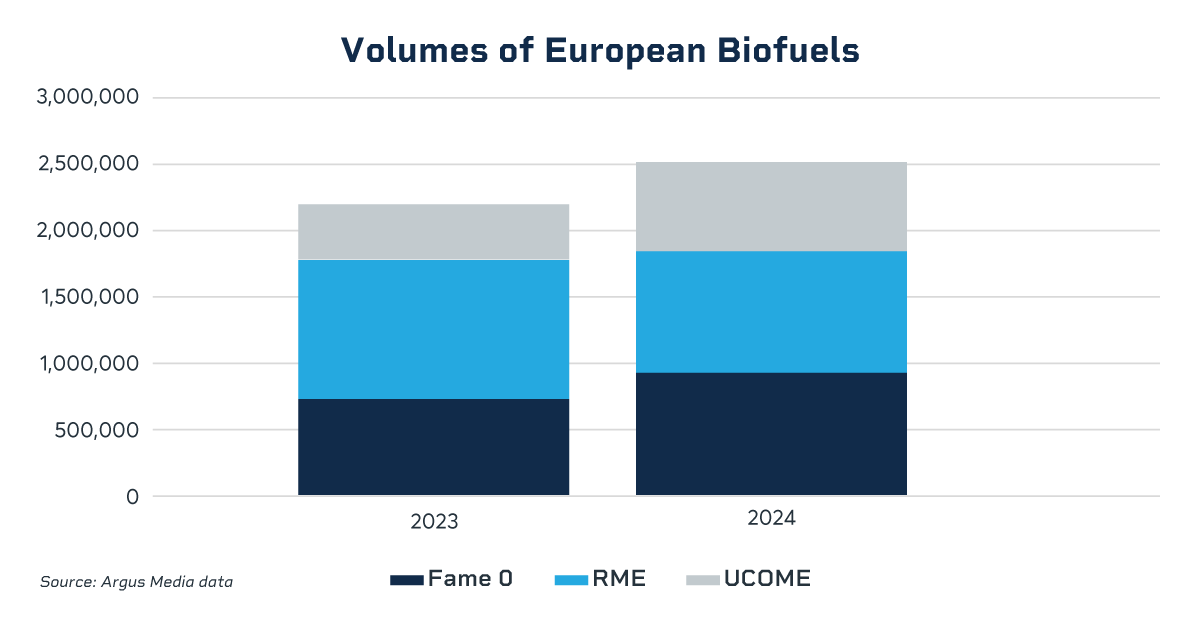

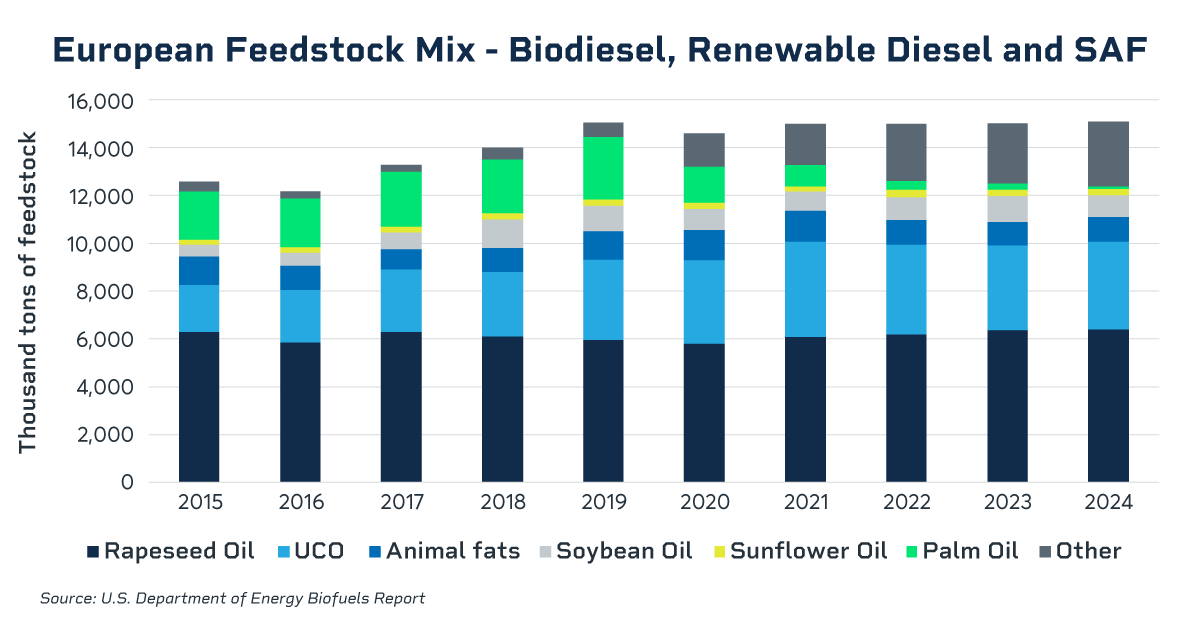

Among European biofuels, rapeseed oil remains the dominant feedstock, accounting for around 50% of the total biomass-based diesel in 2024. Strong demand for rapeseed oil comes partly from demand for biofuels such as rapeseed oil methyl ester, one of the leading biofuel markets in Europe.

A range of feedstocks are used in the biofuels sector, and advanced feedstocks such as used cooking oil (UCO) have gained ground against traditional crop-based biofuels in recent years due to their higher greenhouse gas-savings credentials.

However, concerns persist about shortages in the sector, in part due to the continued volatility in the supply chains from countries like China, a significant global exporter of UCO. The volatile supply chains are largely caused by a mismatch between demand and available supply combined with some quality issues for European buyers, though quality issues are being addressed by more comprehensive regulation as the trade flows continue to develop. The volume of rapeseed oil being used in the biofuels sector is around 6.5-million tons based on latest data for 2024.

Rapeseed – A Dual Purpose Feedstock

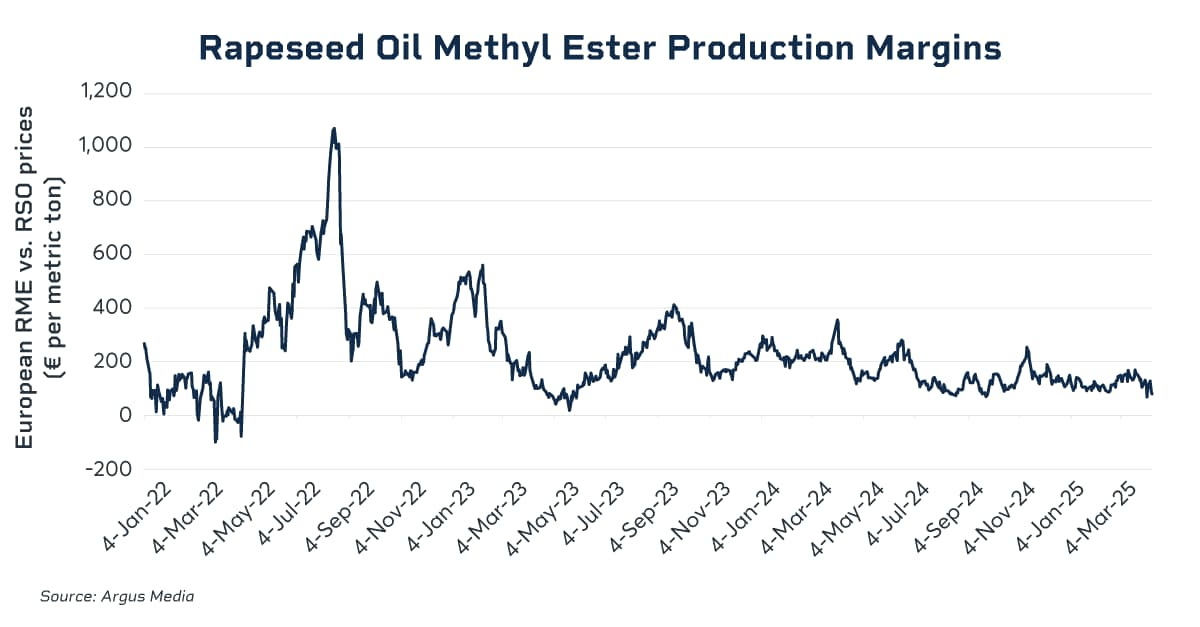

In the biofuels sector, traders closely monitor the relationship between rapeseed oil and biodiesel fuel Rapeseed Methyl Ester (RME) as this partly determines the production margin for biodiesel producers.

The spread between the cash price of Argus RME and Argus rapeseed oil has been weakening since the fourth quarter of 2023, in part due to the relatively strong demand for rapeseed oil as a feedstock for energy markets coupled with its use as an animal feed. Since the final quarter of 2023 the spread between the cash price of RME and rapeseed oil has weakened from around €400 to just below €100 per metric ton in mid-April 2025, according to data from Argus Media.

As risks persist in the market, European Rapeseed Oil futures offer market participants a way to manage this uncertainty and are a valuable addition to the well-established futures and options markets for U.S. Soybean Oil and Malaysian Palm Oil.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here