SCHD Overview

I’ve covered hundreds of different funds over the last few years and I can confidently say that Schwab U.S. Dividend Equity ETF (NYSEARCA:SCHD) is one of the highest quality dividend focused ETFs that are available to investors. I put this guide together to give you all the information you will need to help you make an informed decision on whether or not SCHD fits within your portfolio. SCHD is managed by Schwab ETFs and has an inception dating back to 2011. The ETF has a very affordable expense ratio of 0.06% with assets under management of more than $70B, making it one of the most competitive ETFs from a cost perspective.

SCHD aims to match the performance of the Dow Jones U.S. Dividend 100 Index, which is designed to measure the performance of high dividend yielding stocks. The index contains companies that have historically maintained a consistent track record of paying dividends to shareholders and have favorable fundamentals and metrics, such as earnings growth, dividend payout ratio, and dividend growth.

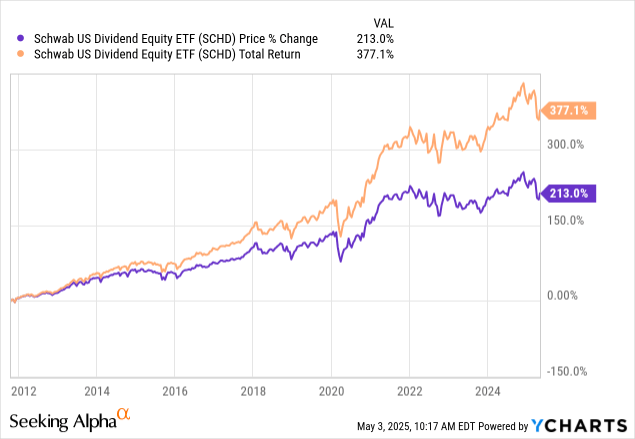

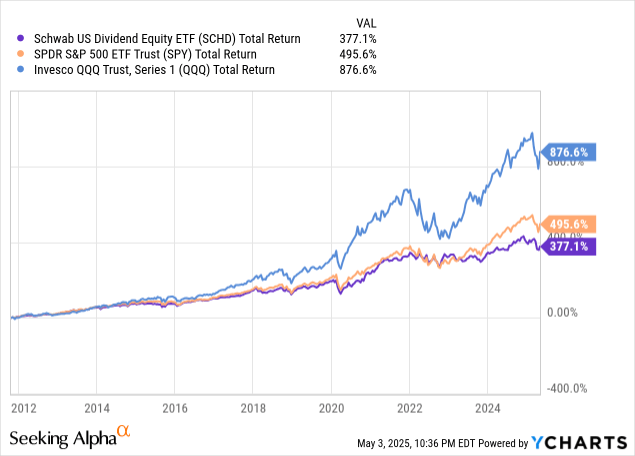

As a result of the ETF’s criteria, SCHD is able to offer a starting dividend yield of 4%. Dividends are paid out on a quarterly basis, and the dividend growth has historically led to attractive total returns. Looking back at the performance since inception, we can see how SCHD’s price has increased by 213%. When including dividends paid out during the same time frame, the total return jumps up above 377%. I think these are very solid returns for a little over a decade worth of performance history.

Data by YCharts

Who Is SCHD For?

So who is an ETF like SCHD built for? SCHD is built specifically for the investors that value consistent, reliable, and growing income within a portfolio. Life has a habit of getting increasingly expensive; rents increase, property taxes rise, the cost of groceries is higher, and fast food doesn’t have the same affordable appeal it once had. For these reasons, there are many investors, such as myself, that want their investments to create a growing stream of income as a safety buffer.

SCHD’s dividends are also tax-efficient, meaning that the ETF can be utilized within regular taxable brokerage accounts, which are a lot more accessible than tax-advantaged accounts like a 401K or IRA. The ability to create a supplemental form of income with a high-quality ETF like SCHD means that investors can significantly increase their financial foundation. Income reduction, job loss, and growing inflation all become less of an issue when you have an ETF that has averaged double-digit dividend growth.

The ETF’s requirements and emphasis around the inclusion of dividends means that SCHD excludes exposure to the rapid moving growth companies. You will not see companies like Tesla (TSLA), Amazon (AMZN) or Netflix (NFLX) as part of the ETF. Therefore, SCHD is best utilized as a tax-efficient income vehicle and investors need to understand that this is not a ‘one-stop-shop’. Since these rapid growth companies are excluded, there should be no expectation that SCHD can stay on par with the returns of traditional indexes like the S&P 500 or Nasdaq 100.

Despite this, I believe that an ETF like SCHD can be efficiently utilized in a variety of ways for different types of investors. Therefore, investors should strongly consider whether or not SCHD fits their specific investing objectives and goals.

If you are a younger investor in your 20s, 30s, or 40s, I believe that SCHD is best suited as an accompanying position within an already diversified portfolio of assets. Since you are a younger investor with a lot more years ahead of you on your investing journey, you are probably better off focusing on trying to maximize your total return with ETFs that track an index. I don’t think that you should sacrifice total return for income if you don’t need to. You can certainly still initiate a position in a fund like SCHD, but try to do so without compromising your total return. Hence, why I state that SCHD should be an accompanying position and piece of the pie.

However, there is a benefit to initiating a position in SCHD earlier in your life. The longer you maintain a position, the longer you can let the compound effect of the dividend growth work in your favor. If you don’t need the income right now, you can reinvest the dividends and snowball your dividend income more rapidly over time.

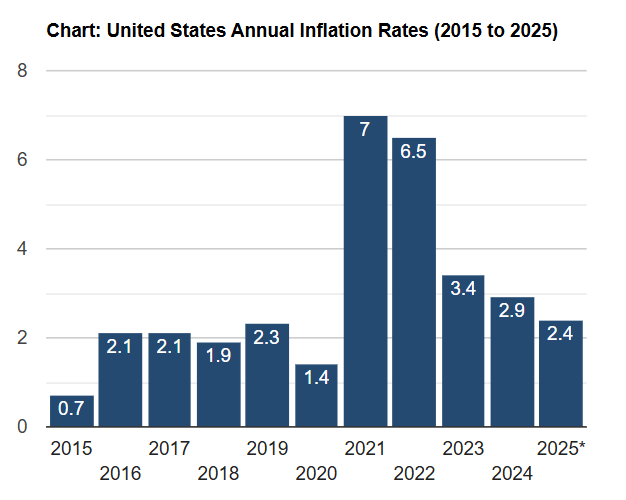

US Inflation Calculator

On the other end of the spectrum, I believe that SCHD is most suitable for investors that are nearing or at retirement age. When you make the shift to retire, and you no longer collect an active income, it’s extremely valuable to have a supplemental stream of income alongside traditional social security. SCHD is great for retired investors because the dividend growth has significantly outpaced the average inflation rate over the last decade. Looking at the table above, we can see how inflation averaged approximately ~3% of the last decade. So let’s now dive into SCHD’s strategy and how the ETF is able to consistently increase its dividends year over year.

Fund Strategy

The ETF has a few criteria that stocks must have in order to be included within the ETF. These are designed to ensure that SCHD always maintains exposure to high-quality companies that can consistently contribute to the dividend growth experienced. The criteria that holdings must meet are:

- A stock must have sustained at least ten years of consecutive years of dividend payments.

- Have a minimum market-cap of $500M with solid liquidity metrics. So a company cannot have too much debt.

- After the first two points are met, SCHD sorts the selections from the highest dividend yield.

- SCHD then filters down by cash flow to debt ratio, return on equity, dividend yield, and 5-year dividend growth rate.

- No single stock can account for more than 4% of the index.

- No single sector can account for more than 25% of the index.

- SCHD reconstitutes its holdings annually, usually around March. ‘Reconstitute’ simply means to run through this process again and select the most updated stocks that fit these criteria. This ensures that SCHD is always maintaining exposure to the highest quality holdings, since things can change rapidly in the markets.

- SCHD rebalances its holdings quarterly. ‘Rebalance’ means that SCHD adjusts the weight in each holding so that they reflect the rules laid out in points 5 and 6 above.

I think that these rules and criteria that SCHD sets for its holdings makes the ETF very unique. Instead of focusing on speculative investments that could prove to be profitable for shareholders, SCHD focuses on companies that are currently profitable and have a long, consistent track record of such. The underlying strategy is most suitable for investors that want to focus on businesses that have strong core fundamentals.

What makes SCHD a great ETF is also related to the fact that the selection criteria usually has some other positive traits associated. For instance, a business with strong free cash flow and low debt may have some kind of moat that makes the business difficult for competitors to replicate. Additionally, the criteria used can also leave the ETF with exposure to businesses that have strong pricing power or brand loyalty.

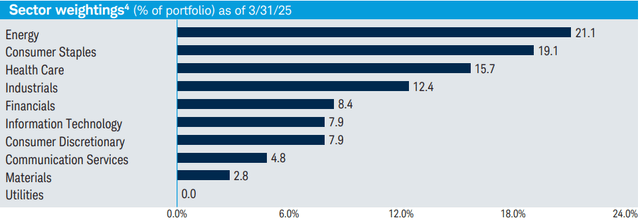

Following these rules, SCHD recently reconstituted its holdings this past March. We can see that exposure to Energy companies now makes up the largest bulk of the ETF at 21.1%. This makes sense when we think about the necessity of energy companies; they offer services that are essential to our daily lives, which means they typically have more consistent and predictable cash flows every quarter.

This is followed by exposure to Consumer Staples and Health Care companies, accounting for 19.1% and 15.7% of assets, respectively. Similarly, both of these industries offer products that are necessities and that people tend to purchase and consume throughout all economic cycles.

SCHD Fact Sheet

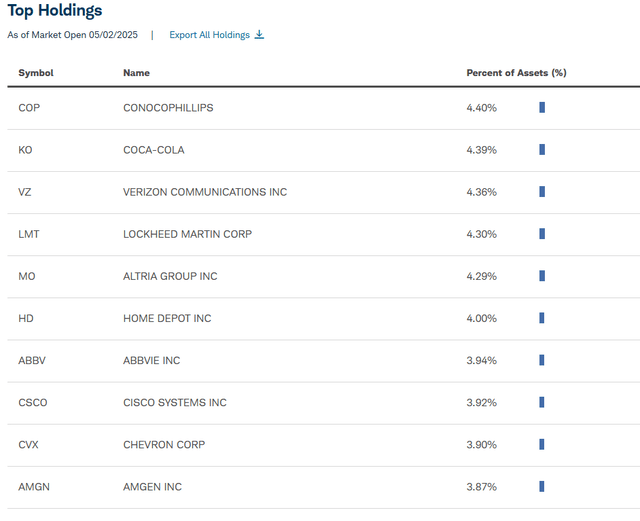

There are approximately 101 different holdings within SCHD. When looking at the top holdings, ConocoPhillips (COP) is the largest position at 4.4% of assets. This is followed by varying weights to other well-known companies like Coca-Cola (KO), Verizon (VZ), and Lockheed Martin (LMT) just to name a few. When looking at all the holdings, SCHD maintains an interesting blend between established dividend legends and newer dividend growers that have shorter histories but more aggressive growth profiles. Just to demonstrate this, I listed some notable characteristics of SCHD’s holdings that stand out to me.

- ConocoPhillips: Has a low payout ratio of 40.15% and an excellent dividend CAGR (compound annual growth rate) of 16.37% over the last three-year period.

- Altria Group (MO): Offers a higher starting dividend yield of 6.8% and has earned the title of dividend king by raising its dividends for over 55 consecutive years without disruption.

- Home Depot (HD): Has only increased dividends for 15 consecutive years but has maintained a dividend CAGR of 10.15% over the last five years.

Schwab Asset Management

Keep in mind that the ETF rebalances its holdings every quarter. So depending on when you read this article, the holdings can potentially look a lot different. I personally believe that the quarterly rebalances should be interpreted as a good thing so that it always keeps a larger allocation towards the companies that best match their criteria.

To demonstrate the effectiveness of SCHD’s selection process, I wanted to show the ETF’s results through a variety of different market conditions. This will help instill confidence that SCHD can provide attractive total returns, even when the underlying holdings are rebalanced and reconstituted going forward. The beautiful part about SCHD’s long operating history is that we have several different time frames, market conditions, and catalysts for reference.

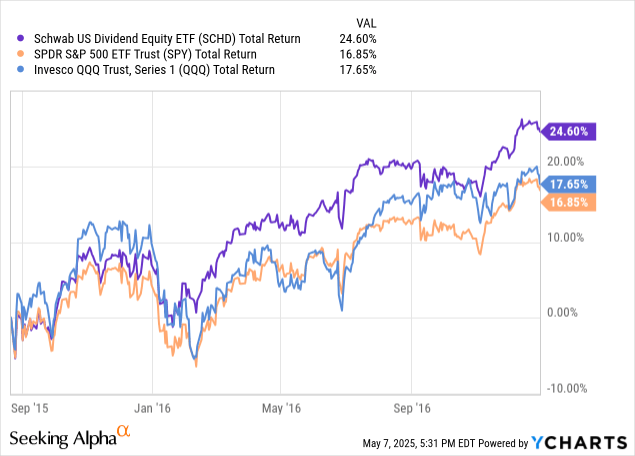

Looking back over the last decade, market indices declined between 2015 and 2016 due to several global events. Most notably, the Brexit vote took place in 2016, but this was also accompanied by a period where Greece experienced a debt default, the US was experiencing quantitative easing, and there was also a fall in petroleum prices. In the US, indices experienced a sharp drop in August 2015. Looking at the graph below, we can see how SCHD’s strategy proved to be more resilient and offered a superior recovery from the initial drop throughout the end of 2016 when compared against traditional index-tracking ETFs like SPDR S&P 500 ETF (SPY) or Invesco QQQ Trust (QQQ).

Data by YCharts

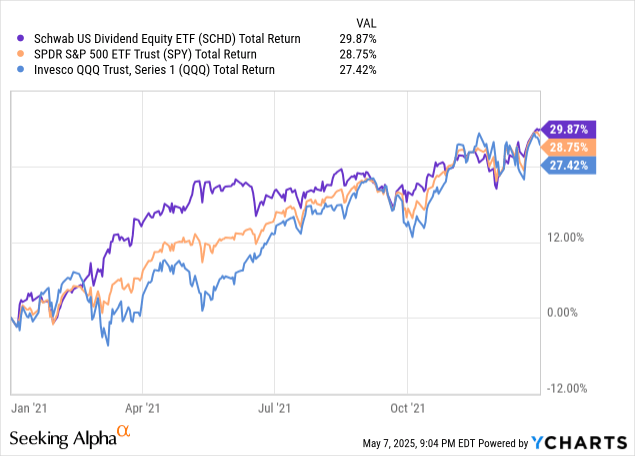

After the pandemic happened in 2020, the Fed cut interest rates to near zero levels in an effort to provide some stimulus to the economy. This caused markets to rapidly increase over the course of 2021. Cheap debt made it extremely affordable for companies to use debt capital to finance growth initiatives like acquisitions, product research and development, or even fund more aggressive marketing campaigns. Since SCHD’s strategy also focuses on attractive return on equity metrics, the ETF’s holdings were able to successfully navigate a low-interest rate environment and outperform its traditional ETF counterparts, as seen below.

Data by YCharts

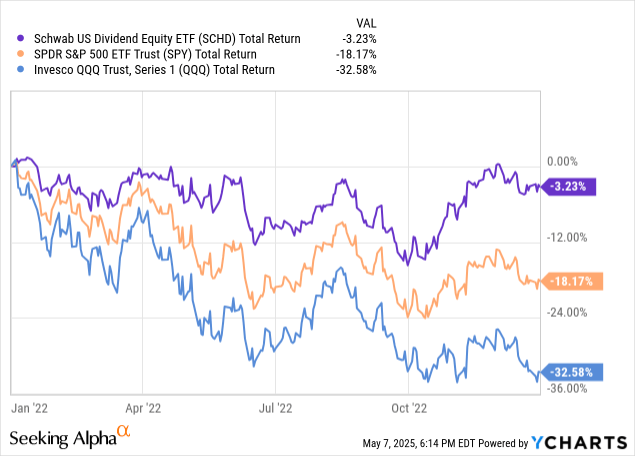

Following the pandemic, the economy suffered from record high inflationary data throughout 2022. In an effort to combat this, the Fed aggressively hiked interest rates to decade-high levels. Market indexes declined in reaction to this, since a higher interest rate directly translates to a higher cost of borrowing. This made it difficult for many companies to increase earnings because a higher cost of debt negatively impacts operating margins and causes businesses to shift their focus to capital efficiency rather than growth. However, SCHD focuses on companies that have strong free cash flows with low debt burdens and strong liquidity metrics. Therefore, SCHD’s holdings were less affected by higher rates, causing SCHD to outperform market indexes.

Data by YCharts

The conclusion is that SCHD’s underlying strategy leaves the ETF comprised of many companies that are more likely to demonstrate resilience during market downturns. The focus on companies with better liquidity metrics means that these holdings are less likely to experience a high level of volatility, and the ETF can thrive in both extremes of the interest rate spectrum. SCHD’s strategy also means that it can outperform during periods where market uncertainty is high, since the underlying holdings have more consistent streams of income.

Risk & Vulnerability

Although SCHD takes a smart approach to its selection process, you may have noticed that there is a relatively small allocation to the Technology sector. Technology only accounts for a little under 8% of total assets at the moment. I manually went through all of SCHD’s holdings and was able to identify the following technology positions and their respective percentage of net assets.

- Cisco Systems (CSCO) – 3.92%

- Texas Instrument (TXN) – 3.49%

- Skyworks Solutions (SWKS) – 0.44%.

Only three holdings make up all of SCHD’s technology exposure. So, despite companies like Microsoft (MSFT) and Apple (AAPL) paying dividends, they do not meet the fund’s criteria for inclusion. The smaller technology allocation does make sense fundamentally, since technology companies aren’t usually known for their emphasis on dividend growth. Technology companies generally opt to reinvest their earnings back into the business as a way to grow earnings more rapidly. Once again, the holdings can always change over time, but I anticipate this being a consistent vulnerability of the fund.

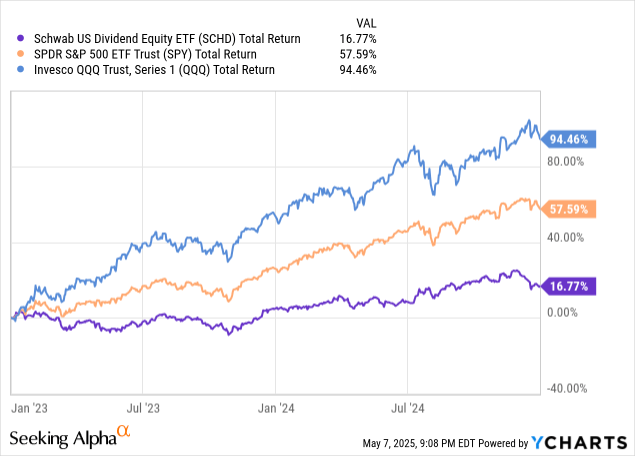

The lower technology exposure could technically help with SCHD’s price stability, but it leaves the ETF vulnerable to underperformance during bull markets. While your goal with SCHD shouldn’t necessarily be to keep up with the S&P 500, it’s good to get a point of reference of the sort of underperformance that we are talking about. Just to visualize this, I pulled a total return comparison of SCHD against traditional index-tracking ETFs like SPY and QQQ. We can see how SCHD underperformed these ETFs since its inception.

Data by YCharts

Dissecting this underperformance further, we can see how SCHD can also outperform traditional index-tracking ETFs. Over the course of 2023 and 2024 there were some large strides throughout the tech sector. For instance, Nvidia (NVDA) experienced massive earnings growth from its artificial intelligence innovations. This sparked a lot of optimism around any company that was working on any sort of AI-based product or service.

This caused the sector to experience massive growth, with many of the Mag 7 companies seeing double-digit growth. This was also followed by Bitcoin (BTC-USD) hitting the $100,000 milestone at the end of 2024. As you can see below, this caused the QQQ to run up over 94% while SPY increased by nearly 58% over 2023 and 2024. Since SCHD lacks meaningful tech exposure, the ETF is unlikely to see these large price increases. SCHD is more likely to continue to provide an attractive total return that puts a larger emphasis on income generation, rather than these sorts of secular growth trends.

Data by YCharts

However, I don’t necessarily think these periods of underperformance should be viewed completely as a downside. Don’t forget that the main priority for SCHD is to provide a stream of growing income over time. The ETF has still managed to do exactly that, despite its shortcomings during bull markets.

This circles back to the point I made earlier about how SCHD would be best utilized as an accompanying fund if you are a younger investor. Assuming that technology continues to lead market growth over the next decade, investors need to be aware of the risk that SCHD is likely to continue underperforming these traditional ETFs.

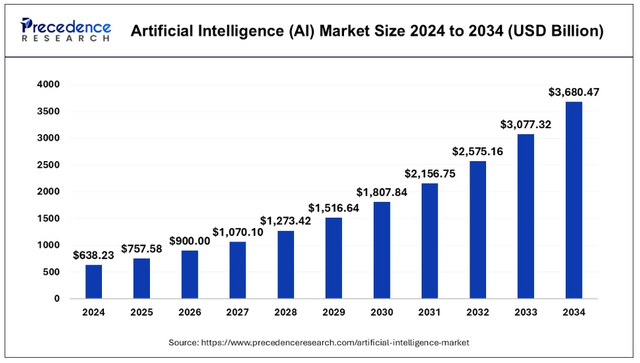

With so many different catalysts within the tech market, it’s a shame that SCHD isn’t able to put a greater weight on the sector. The growth of the Artificial Intelligence market can be one of the largest drivers for growth right now, and I just don’t see SCHD capitalizing on this growth with its current positions. For instance, Precedence Research estimates that the size of the AI market can increase at a CAGR of 19.20% through 2034!

Precedence Research

However, this isn’t to say that the ETF’s holdings cannot adjust over time. There are still plenty of large cap companies working on different AI technology that SCHD can eventually include as part of the fund in a future reconstitution. For instance, Microsoft, Apple, and Broadcom (AVGO) are all dividend paying technology companies that are working on expanding their innovations and product offerings that utilize AI tech.

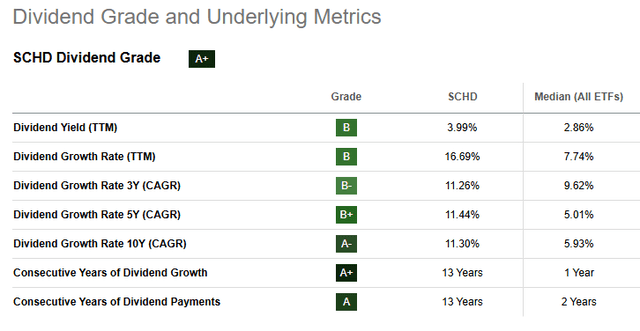

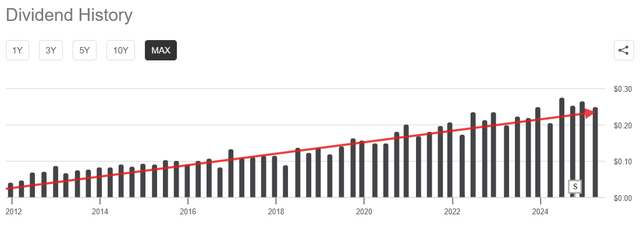

Benefit: Dividend Growth

The main benefit of SCHD is the superior track record of dividend growth demonstrated. Since the underlying strategy puts an emphasis on companies with strong financials to support dividend raises, SCHD has been able to average a double-digit growth rate in its raises. For instance, SCHD has been able to increase its dividend at a CAGR of 11.30% over the last decade! Even on smaller time frames of three or five years, SCHD has been able to maintain this double-digit growth! This is why SCHD earns an A+ rating with regard to its dividend grade.

SCHD Dividend Metrics (Seeking Alpha)

SCHD distributes its payments out on a quarterly basis, and the amounts tend to vary every quarter. Despite the varying payout amounts, we can see the clear uptrend over time, which reinforces the efficiency of the ETF’s strategy. What’s so special about this dividend growth is that the income received is tax-efficient.

According to the dividend reporting for 2024, 100% of the dividends received from SCHD were classified as qualified dividend income. Therefore, the ETF can be efficiently utilized outside of traditional tax-advantaged retirement accounts. This increases the appeal and flexibility for investors that may want to hold SCHD within a regular brokerage account for better liquidity and access.

Seeking Alpha

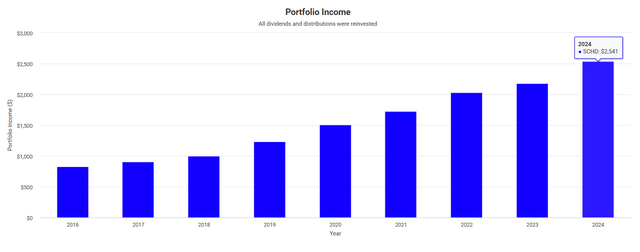

So how does this translate in real time? To demonstrate the strength of the dividend growth, I ran a back test of an initial investment of $25,000 at the start of 2016. The graph below represents the income received in each year, with the assumption that no additional capital was ever invested following the initial $25k. However, it does assume that all dividends received were reinvested back into SCHD to accumulate more shares. By simply remaining invested and reinvesting dividends, an investor would’ve been able to more than triple their dividend income.

2016 Dividend Income: $825

2024 Dividend Income: $2,541

SCHD Dividends Reinvested (Portfolio Visualizer)

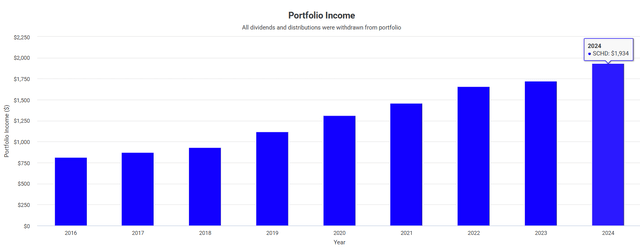

Even in a scenario where an investor chooses not to reinvest their dividends back into SCHD, the dividend income received would’ve more than doubled over the same time frame. This scenario is more realistic for retired investors that are aiming to live off of the dividend income that their portfolio produces. The dividend growth has historically outpaced inflation, and I anticipate this to continue over the next decade.

2016 Dividend Income: $816

2024 Dividend Income: $1,934

SCHD Dividends Not Reinvested (Portfolio Visualizer)

Of course, these numbers aren’t exact and only represent a back test of the data we have available. Looking forward, we can only assume that SCHD will be able to maintain the same level of dividend growth over the next decade. Following the reshuffling, I feel optimistic about SCHD’s future growth potential when assessing the financial health of the top holdings. For instance, SCHD’s top holding is ConocoPhillips and the company has a reasonably low dividend payout that is accompanied by an A+ profitability grade. The company has excellent margins and cash on hand to support future raises. With results like this, I have confidence in SCHD’s stock selection going forward.

Schwab U.S. Dividend Equity ETF Vs. Other Dividend Focused ETFs

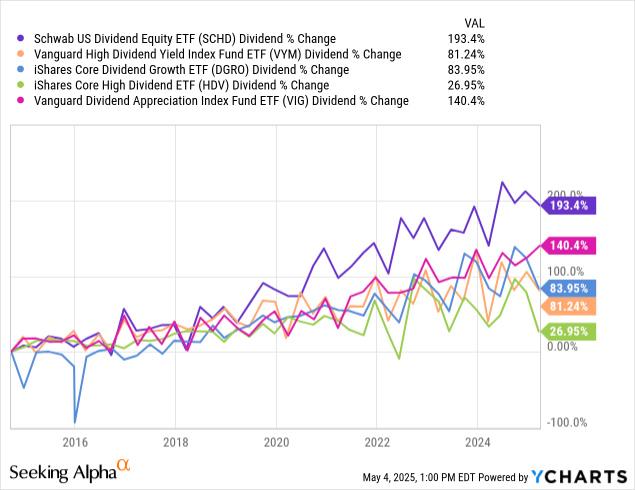

There are numerous dividend ETFs for investors to choose from, and it can be difficult to determine which is best. The answer to this question is highly dependent on an individual’s specific goal and priority, as many of the dividend focused ETFs have varying underlying strategies and selection processes. I believe that some peer funds include:

- Vanguard High Dividend Yield Index Fund ETF (VYM)

- iShares Core Dividend Growth ETF (DGRO)

- iShares Core High Dividend ETF (HDV)

- Vanguard Dividend Appreciation Index Fund (VIG)

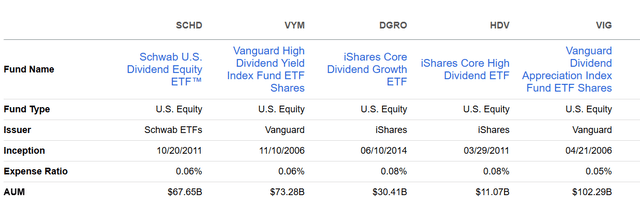

As each of these alternative ETF names implies, there is a specific focus on either dividend growth or a high dividend yield. I view SCHD as the middle of the road approach that provides excellent dividend growth, provides attractive capital appreciation, and offers a competitive starting yield. These alternatives lean in the direction of one of these traits, rather than offering a blend of all like SCHD does. Just for reference, here are some metrics for each of these peers.

SCHD Peers (Seeking Alpha)

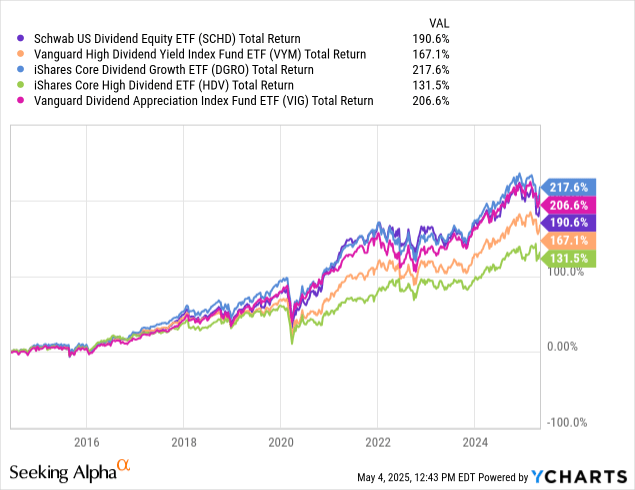

In terms of expense ratio and length of operating history, SCHD is pretty competitive with these peers. However, SCHD isn’t the best performer in terms of total return. We can see that SCHD is outperformed by both DGRO and VIG over the last decade. This isn’t surprising though, since DGRO and VIG both have looser criteria for its stock selection process.

For instance, DGRO and VIG don’t require their holdings to have paid out dividends for 10 consecutive years. As a result, both of these peers have a much higher technology allocation as part of their portfolio of holdings and allows them to hold companies like Microsoft (MSFT), Apple (AAPL), Broadcom (AVGO).

Data by YCharts

Conversely, ETFs like VYM and HDV put an emphasis on stocks that offer a higher starting dividend yield. Higher yielding assets typically appreciate at much slower rates than dividend growers, causing these two funds to be the worst performers of the bunch. However, it can be difficult to make a case for VYM and HDV since their starting dividend yields are 2.9% and 3.5% respectively, which are both lower than SCHD’s starting dividend yield of 4%.

The fact that SCHD has a lower total return is not the focus here. The important thing to remember is that SCHD, an ETF you would choose if you seek superior dividend growth. Looking at a comparison of the dividend growth below, we can see that SCHD has outperformed all of the alternative choices mentioned.

Data by YCharts

So once again, SCHD is the clear winner from a dividend growth standpoint. This is exactly what the fund is designed to do, so I am happy with these results. It’s important for investors to consider all of these choices and understand that a focus on dividend growth may not yield the highest total return but that’s okay.

Takeaway

In conclusion, SCHD is a world-class dividend growth ETF that has proven the efficiency of its strategy. Investors that want to put an emphasis on a growing stream of reliable dividend income can feel confident in SCHD, as the ETF has averaged a double-digit growth rate for over a decade. Although SCHD lacks meaningful technology exposure, the fund is still very competitive amongst peers with its total return potential. The ETF has a low expense ratio that also makes it a very cost-efficient option over the long term.

The fund has a vigorous selection process that aims to provide diversified exposure to companies with strong financial metrics that can support future dividend raises. The dividend raises have outpaced inflation, making it a great choice for retired investors seeking a reliable source of supplemental income. The dividends are also classified as qualified dividend income, which means that SCHD can be efficiently utilized inside a regular taxable brokerage account.

This article answers these three main questions about SCHD:

- What makes SCHD stand out among dividend ETFs?

- How can investors most effectively use SCHD within their portfolios?

- Under what circumstances does SCHD outperform or underperform the market?

Editor’s note: This article is intended to provide a general overview of the ETF for education purposes only and, unlike other articles on Seeking Alpha, does not offer an investment opinion about the ETF.

Read the full article here